24/7 Wall Street Insights

- Since their launch, the single most universal complaint of mobile devices has been insufficient battery life.

- Among the various new technologies to address that problem, lithium-silicon has shown the most promise to date, theoretically averaging nearly 90X larger charge capacity.

- A slew of analysts are bullish on Enovix for a number of reasons that justify it being 24/7 Wall Street’s Single Best Stock to Buy under $20 for July.

- For investors seeking dividends, click herefor a free report on two high dividend stocks.

Longer Battery Power: The Never Ending Quest

Since the introduction of mobile phones, the phrase,“my cell phone died” is now so globally ubiquitous that it has become a punchline, a tv and film plot device, and an iPhone auto reply text phrase. The world’s dependence on smartphones has exploded in the 21st century, and additional smart devices have added to the demand for longer lasting batteries.

Apple (NASDAQ: AAPL)led the trend towards forced obsolescence of iPhones by eliminating customer replaceable batteries. This practice, later adopted as well for Android phones, forces customers to upgrade after the batteries have met the end of their respective lifespans. Nevertheless, the R&D for extended life batteries continues, with the demand continuing to grow.

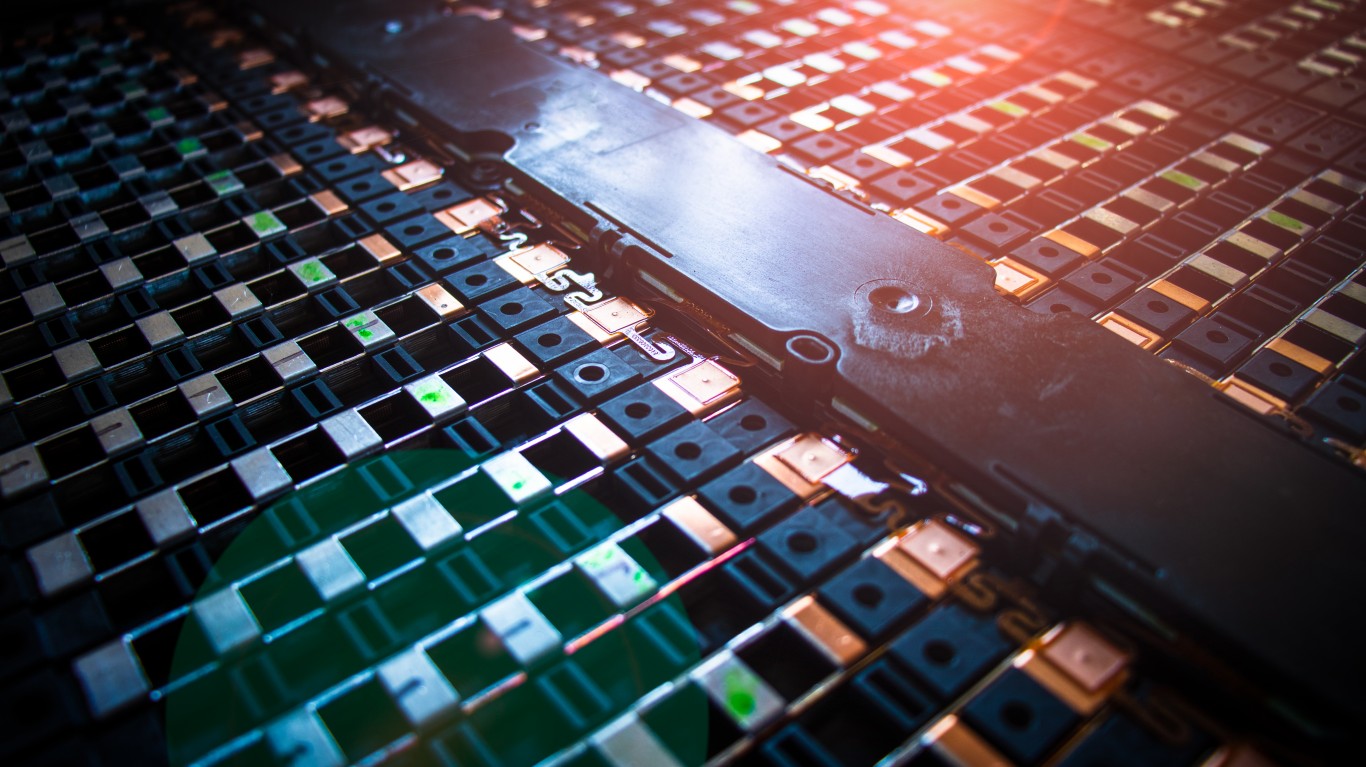

Fremont, CA based Enovix Corporation is a pioneering leader in the field of lithium-silicon battery technology. While graphite anodes have a maximum theoretical charge capacity of 372 mAh/g (milli-Ampere hours per gram mass), silicon can potentially hold a charge capacity of 3600 mAh/g. The obstacle until Enovix made its breakthrough for commercialization in 2021, was how to successfully combine the silicon with lithium. While there are now several lithium-silicon battery companies competing with Enovix in different sectors at this time, Enovix has batteries that address the entire spectrum of application demand, from wearables to military vehicles.

3D the Key?

Enovix launched in 2007. It was founded by Dr. Harrold Rust, Ashok Lahiri, Robert Spotnitz, and Murali Ramasubramaniam. In order to address the lithium and silicon anode obstacle, the Enovix team designed a 3D cell architecture to increase energy density and extend cycle life.

Enovix went public via SPAC merger in 2021 with Rodgers Silicon Valley Acquisition Corp. T.J. Rodgers, former CEO of Cypress Semiconductors,was named executive chairman. The deal raised $400 million to kickstart commercial battery manufacturing, marketing, and sales.

Current Enovix CEO Raj Talluri was interviewedin The Technology Letter, where he explained the main problems between using lithium with graphite and with silicon:

“There’s only so much lithium you can put into the graphite because of the structure of the graphite itself,” explains Talluri. The reliance on graphite anodes has stunted the field, he argues. “Lithium-ion batteries have only improved a few percentage points a year for the last few decades,” he says. “The interesting thing about silicon is, it actually can take somewhere between six and ten times more lithium than graphite,” says Talluri. “And the reason for that, is, lithium doesn’t just sit in the holes in silicon: it actually combines with it molecularly, it forms lithiated silicon.” Despite high absorption, silicon has an efficient release of lithium to the cathode in the drain process, when used to power things. “It gives it back, it gives quite a bit back,” says Talluri.

The main problem, according to Talluri, was silicon’s propensity towards physical expansion. To ust try to substitute silicon for graphite in conventional lithium-ion batteries would lead to the batteries blowing up the back of the phones. Enovix solved the problem with a 3D architecture that involves slicing the anodes and cathodes into tiny strips to create layers of mini batteries.

Resembling a Napoleon layer cake of anode and cathode layers, the 3D structure can be turned on its side, so that the pressure of engorged silicon can be reduced from 1.7 tons per square inch to two hundred pounds in a typical smartphone-sized battery. That amount of pressure can be clamped to prevent blowing out the back of the phone.

A former Micron Technology and Qualcomm executive, Talluri’s work in designing increasingly powerful chips for Internet of Things and A.I. led him to the realization that the chips would be useless if they could not receive sufficient battery power to accomplish the tasks they were trying to accomplish. The Enovix approach intrigued him, and Executive Chairman TJ Rodgers poached Talluri for the CEO position after a management shakeup in 2023 that saw co-founders Rust and Lahiri depart the company.

Enovix’s Cheerleaders and Institutions

Enovix has coverage from a number of analysts, who are unanimously bullish. The analysts list, and their recommendations, include:

- Canaccord Genuity Group – buy

- William Blair – outperform

- Cantor Fitzgerald – overweight

- B. Riley – strong buy

- J.P. Morgan Chase – overweight

Institutional ownership in Enovix owns roughly half of the outstanding shares. Some of the larger players include:

- Vanguard Group (7.70%)

- BlackRock (5.77%)

- Electron Capital Partners, LLC (3.31%)

- Geode Capital Management LLC (1.85%)

- State Street Corp. (1.85%)

New institutional reported buyers of Enovix stock as of July, 2024:

- GAMMA Investing LLC

- Beacon Capital Management LLC

- Able Wealth Management LLC

- Quest Partners LLC

- Voisard Asset Management Group

Why They’re Excited

As the proverbial “first one to jump into the pool” of the lithium-silicon battery technology arena, Enovix has a significant head start over its competitors. As a result, Enovix makes batteries for the full spectrum of current applications as well as future ones:

- Wearables and Internet of Things

- Smartphones and larger IoT devices

- Portable power for military and industrial use

- Laptops and Tablets

- Medical Devices

- Electric Vehicles

Additional R&D has led to Enovix innovations that pre-emptively ameliorate potential problems.

- BrakeFlow– This is an intra-cell system to prevent a thermal runaway fiery chain reaction in the event of a battery’s physical damage or puncture. This safety measure is meant to prevent accidental house fires associated with lithium battery charging.

- Enovix Routejade Technology– Due to the microscopic 3D design of Enovix battery cathode and anode layering, batteries can be customized into a wide range of different shapes and sizes. Routejade is an encapsulation technology that mitigates the odds of internal short circuits and electrode misalignment issues.

Enovix has a new plant in Penang, Malaysia set to debut in August. Dubbed “Fab2”, the factory is anticipated tohouse up to four high-volume production lines capable of producing tens of millions of high-performance batteries for consumer electronics devices such as smartphones, IoT devices, and laptops.

24/7 Wall Street has covered Enovix in the past. The ubiquitous need for longer and more reliable batteries is indisputable. Enovix’s recent sales announcements and new production facilities will certainly not only help the company do its part to feed this demand, but its commensurate revenues should justify it being 24/7 Wall Street’s Single Best Stock to Buy Under $20 selection for July.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.