Investing

Top Wall Street Bank Loves 5 High-Yield Dividend Stocks for Second Half of 2024

Published:

24/7 Insights

The artificial intelligence rally over the past year and a half, led by the so-called Magnificent 7, has been remarkable if you owned those stocks. However, most of the S&P 500 is treading water and will not likely catch up to the hype-driven AI stocks soon.

One thing remains certain: with storm clouds gathering on the horizon, the election right around the corner, and the risk of an escalating conflict in the Middle East, many Wall Street strategists are cautious. Many predict modest single-digit gains for the remainder of 2024 but also warn that a significant 20% or more sell-off could be possible.

With the second half of 2024 now underway after a sizzling first half that saw the S&P 500 up a whopping 17.5%, many of the top Wall Street banks are out with their top ideas for the year’s second half. We screened Truist Financial’s “Best Opportunities for Alpha Generation” for the second half of 2024 and found five top high-yield dividend-paying stocks that have big total return potential. Investors should also take a look at these two incredible dividend stocks.

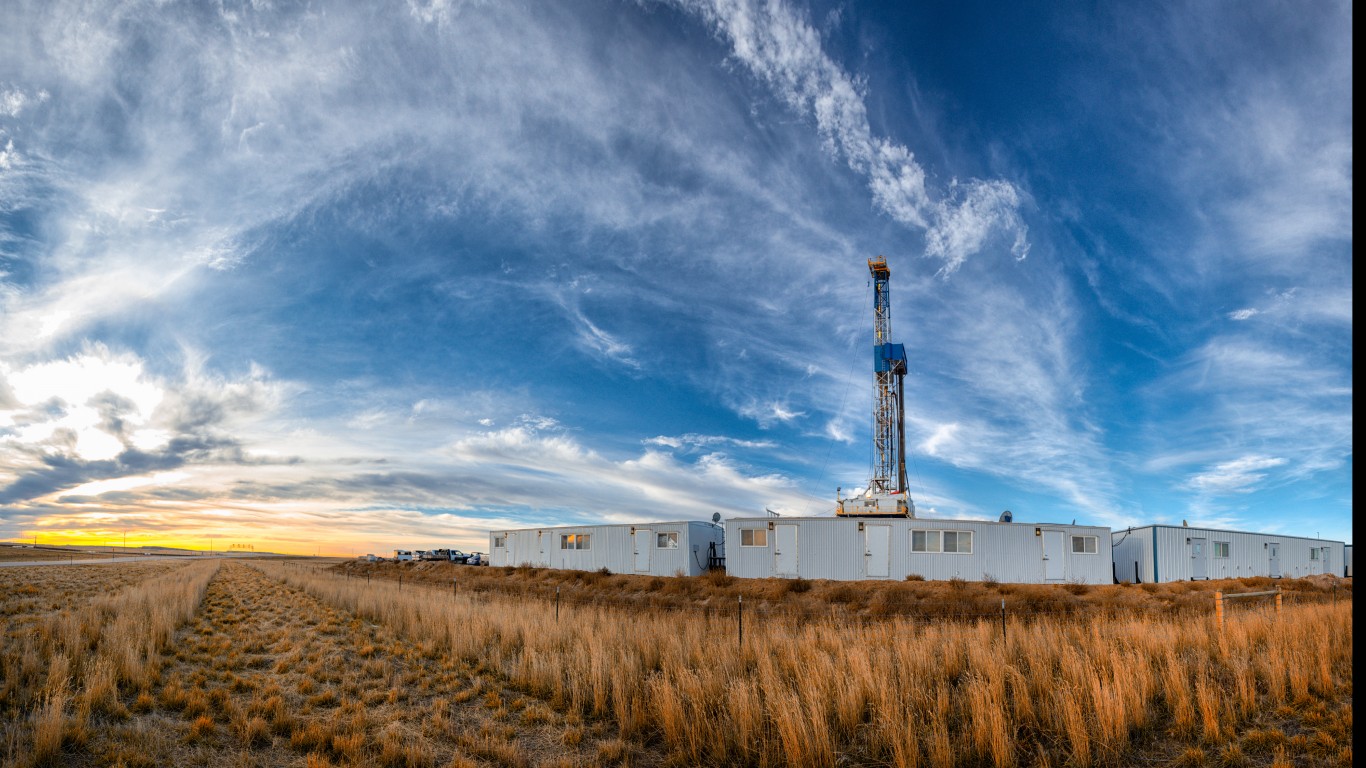

Trading at a dirt cheap 4.96 times estimated 2025 earnings with an 8.63% dividend, this company could be a total return gem for 2024. Civitas Resources Inc. (NYSE: CIVI) is an exploration and production company focused on the acquisition, development, and production of oil and natural gas in the Rocky Mountain region, primarily in the Wattenberg Field of the Denver-Julesburg Basin of Colorado.

Last October, Civitas signed an agreement with Vencer Energy to acquire oil-producing assets in the Midland Basin of West Texas for a total consideration of approximately $2.1 billion, subject to customary terms, conditions, and closing price adjustments. The Acquisition closed in January.

With the Vencer acquisition successfully closed, and following the $4.7 billion acquisition of Tap Rock Resources and Hibernia Energy III, Civitas has solidified its position in a big way with $6.8 billion in Permian Basin deals.

While off the radar, this company offers investors a rich 6.50% dividend and solid total return potential. Gaming and Leisure Properties Inc. (NASDAQ: GLPI) acquires, finances, and owns real estate property to be leased to gaming operators in triple-net lease arrangements.

In a triple net lease arrangement, the tenant is responsible for all facility maintenance, insurance required in connection with the leased properties and the business conducted on the leased properties, taxes levied on or concerning the leased properties, and all utilities and other services necessary or appropriate for the leased properties and the business conducted on the leased properties.

In a significant move, Gaming and Leisure Properties acquired the real estate assets of Tioga Downs Casino Resort for $175 million in February of this year. This strategic acquisition was followed by a 30-year master lease agreement, further solidifying the company’s position. Moreover, the company’s revenues for the first quarter were up 5.8% year-over-year, indicating a positive growth trajectory.

Trading just below a 52-week high, Highwood Properties Inc. (NYSE: HIW) is a publicly traded, fully integrated office real estate investment trust that pays a stellar 7.71% dividend and has huge upside potential. In addition, stock looks very close to breaking out to big upside.

The company owns, develops, acquires, leases, and manages properties primarily in the best business districts (BBDs) of:

Highwoods Properties’ biggest customers include the U.S. government, financial services firms, industrial supply retailers, and health care companies.

We have covered this stock since it traded in the single digits, and it is an outstanding dividend small-cap value idea yielding a solid 4.07%. Northern Oil and Gas Inc. (NYSE: NOG) is an independent energy company, engaged in the acquisition, exploration, exploitation, development, and production of crude oil and natural gas properties in the United States.

One of Northern Oil and Gas’ key strengths lies in its diversified interests. The company holds significant stakes in the Williston Basin, the Appalachian Basin, and the Permian Basin in the United States.

In late June Northern Oil and Gas announced that it has entered into a definitive agreement to acquire a 20% undivided stake in the XCL Assets in partnership with SM Energy Company for a purchase price, net to the company, of $510.0 million in cash, subject to customary closing adjustments.

The acquired assets are located primarily in Uintah and Duchesne Counties, Utah, and include approximately 9,300 net acres and 97.6 underwritten net undeveloped locations, normalized for 10,000-foot laterals.

This very popular REIT offers shareholders a hefty 4.4% dividend. Ryman Hospitality Properties Inc. (NYSE: RHP) is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences.

The company’s holdings include five of the top seven largest non-gaming convention center hotels in the United States based on total indoor meeting space:

The company also owns the JW Marriott San Antonio Hill Country Resort & Spa and two ancillary hotels adjacent to its Gaylord Hotels properties. Marriott International manages the company’s hotel portfolio, which includes a combined total of 11,414 rooms and more than 3 million square feet of indoor and outdoor meeting space in top convention and leisure destinations across the country.

Ryman Hospitality also owns a 70% controlling ownership interest in Opry Entertainment Group (OEG), which is composed of entities owning a growing collection of iconic and emerging country music brands, including:

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.