Investing

Applied Optoelectronics Is Up 32% in July, But Short Sellers Expect It to Crash

Published:

Last Updated:

Key Points

the major indices continue to set all-time highs, small-cap companies are finally joining the party. Since July 1, the Russell 2000, which tracks the smallest 2,000 stocks in the Russell Index, has risen nearly 11%. But a handful of individual, small-cap companies have far outpaced those gains. One of those companies is Applied Optoelectronics Inc. (NASDAQ: AAOI), which has seen its shares jump 35% since the start of the month.

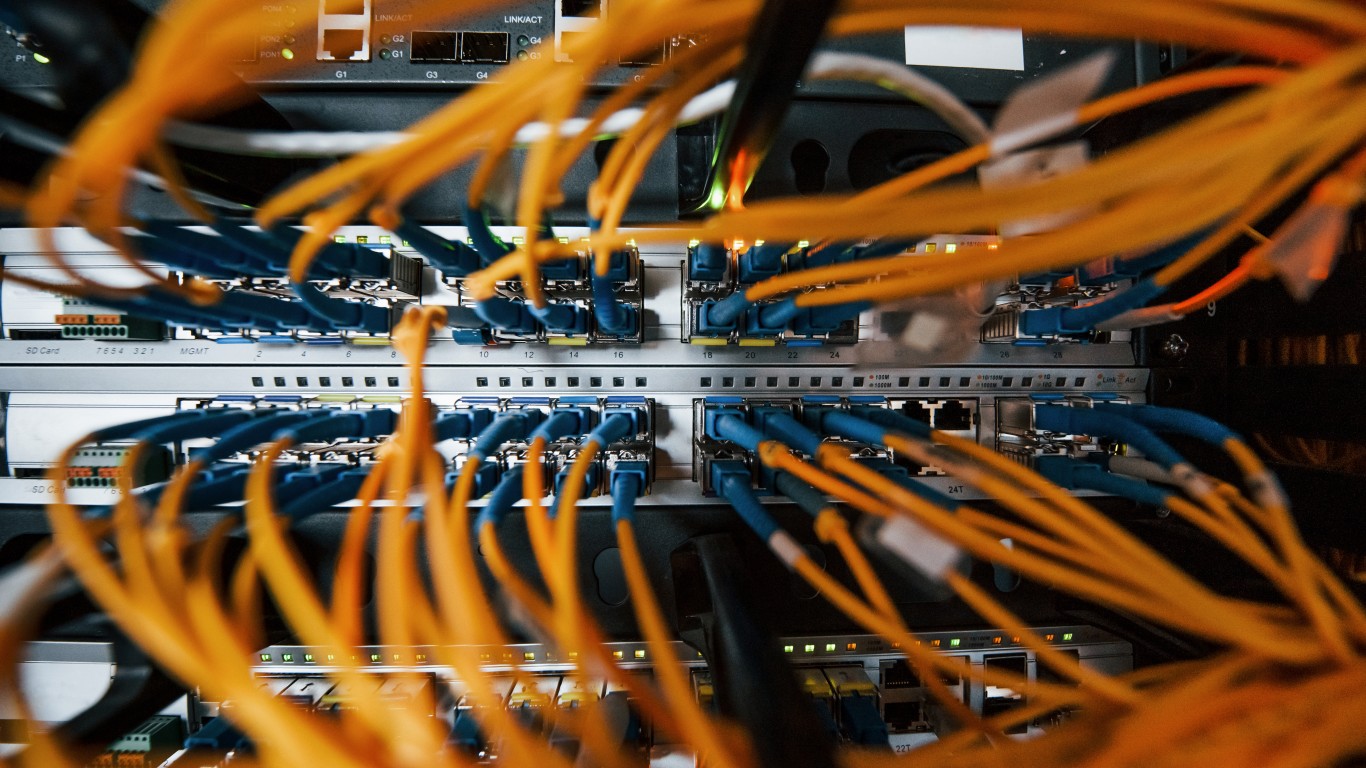

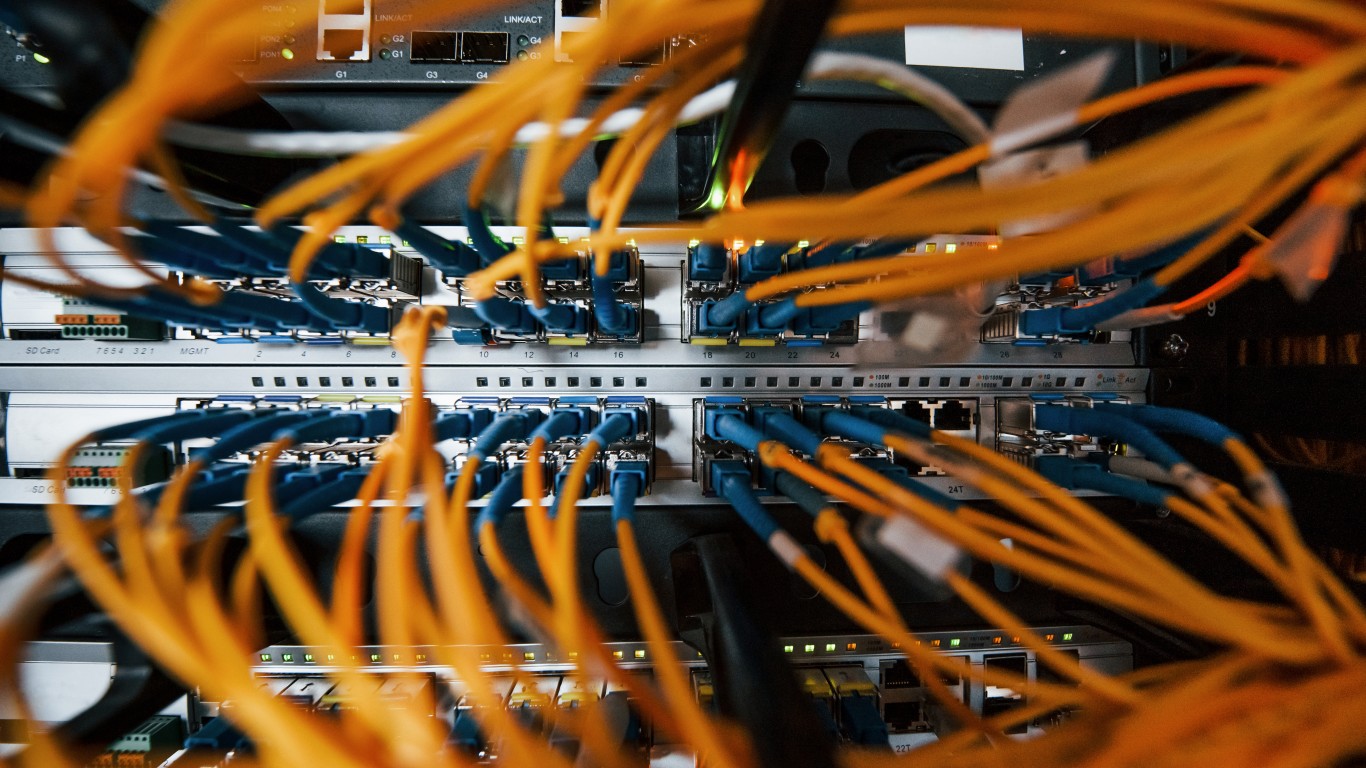

The company, founded in 1997, is a leading developer and manufacturer of advanced optical products, many of which serve as the building blocks for broadband fiber access networks around the globe. AAOI has risen 23.28% over the past year and 569.33% over the past two years. But despite its share appreciation, the stock is recently become the target of Wall Street shorts.

According to Nasdaq.com, as of the June 28, 2024 settlement date, 10.31 million shares of Applied Optoelectronics have been sold short, which is roughly 26.5% of the company’s 38.91 million shares outstanding. That coupled with 4.8 days to cover has seen a resulted in skepticism about AAOI’s share appreciation moving forward.

The Wall Street Journal‘s most recent one-year median price target is now just $16, with a high-end price target of $18 and a low-end price target of $12. Shares of AAOI are currently trading for $10.92. Even though the median one-year price target from the Journal‘s analysts represents 46.5%% upside potential, the revised estimate for the third quarter of 2024 is based on a forecast of -13 cents in earnings.

If those negative earnings expectations hold true, it will mean that Applied Optoelectronics has only been able to produce positive earnings per share once in the past nine quarters dating back to the second quarter of 2022. Revenues have been similarly disappointing, with the company only beating forecasts once since the first quarter of 2022.

Meanwhile, Applied Optoelectronics continues to bleed money. Based on its trailing 12 months of financial data, the company has seen free cash flow of -$17.46 million, a figure that has for the most part held steady since earnings were reported during the final quarter of 2022.

Icing the cake, over the past 12 months, insider trading have favored sellers over buyers 58 to 26, with a total of 996,598 shares having been offloaded during that period. With a price-to-earnings (P/E) ratio of -15.24 in 2023, estimates for 2024’s P/E ratio stand at -49.54.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.