Investing

Forget Nvidia: This Stock Is the Next Millionaire Maker

Published:

Last Updated:

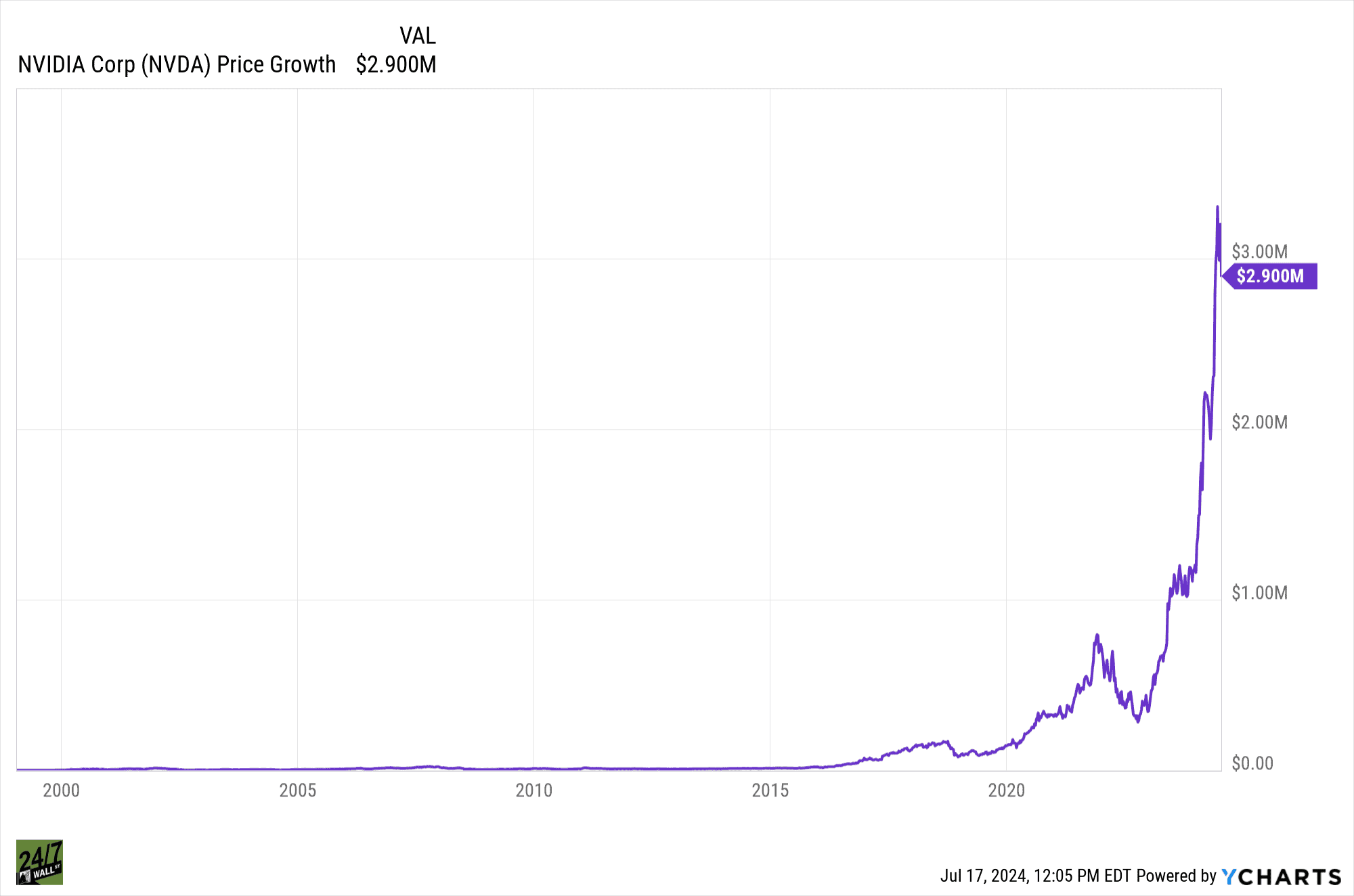

The semiconductor industry is the backbone of modern technology, powering everything from smartphones to supercomputers. For years, NVIDIA (NASDAQ: NVDA) has reigned supreme as the dominant force in graphics processing units (GPUs), capturing the imagination of investors and gamers alike. $1,000 invested in NVIDIA at IPO would be worth $274,997.38 today.

However, a seismic shift may be underway.

Advanced Micro Devices (NASDAQ: AMD) has emerged from NVIDIA’s shadow. With a relentless focus on innovation and a commitment to delivering exceptional performance, AMD is starting to gain traction in several high-growth markets. It’s this traction that makes the company a compelling investment opportunity for those who are okay with risk.

AMD’s aggressive pursuit of market share in gaming, data centers, and artificial intelligence (AI) is driving its resurgence. We’ll take a deeper look at what this looks like, delving into the company’s performance and future prospects.

Key Points to Know:

AMD has positioned itself well in several high-growth markets, driving its recent growth. Let’s take a look at what these markets are:

The gaming industry is experiencing explosive growth. PC gaming is becoming more and more popular, and esports are beginning to get off the ground in many places. AMD has capitalized on this trend with its powerful and affordable Radeon graphics cards.

The company focuses on delivering great performance at a competitive price point. This goal resonates with many gamers, leading to the rise in popularity of AMD’s graphics cards. Despite NVIDIA’s long-time lead, AMD is starting to gain a significant market share.

The demand for data center infrastructure is skyrocketing as businesses and organizations increasingly rely on cloud computing and big data analytics. AMD’s processors have become a compelling alternative to traditional CPUs. AMD advertises that its processors have superior performance, energy efficiency, and scalability.

And it seems that the advertising is right. More and more cloud service providers and computing centers are turning to AMD for their processing needs. Thanks to the exponential increase in data that needs processing, data centers are expected to grow at an annual rate of 10%. That leaves the door wide open for AMD to gain a significant market share.

AI seems to be everywhere these days. It’s not surprising that more and more industries are starting to implement AI heavily into their current offerings. AMD is also actively investing in AI technologies, developing products that can handle the unique requirements of running AI. The company’s GPUs and CPUs offer a strong starting point and are already utilized by many companies to run AI applications.

As the AI market continues to expand, AMD may take a good portion of this growth.

While AMD already has a decent market share of the industries above, this company also has several advantages that make us hopeful for its future. It’s a combination of technological innovation and relentless focus:

AMD is set to grow exponentially thanks to these factors, making it a very impressive investment.

Of course, the numbers are important, too. Luckily, AMD has performed very well so far in 2024. Its revenue has surged to $5.5 billion, reflecting a 2% year-over-year increase. Notably, the Data Center segment emerged as a standout performer, with revenue soaring 80% year-over-year, driven by the ramp-up of MI300 AI accelerator shipments and the widespread adoption of EPYC processors.

The gross margin expanded to 47%, showing AMD’s capability to streamline its cost structure and gain value in the market. On a non-GAAP basis, the gross margin reached an impressive 52%. Although the company reported a net income of $123 million, when adjusted for non-GAAP measures, the net income stood at a more substantial $1 billion.

All of this information shows us that AMD’s financial performance is supported by the growing demand for GPUs and CPUs. The company’s ability to capitalize on the AI boom can be a serious driver of its financial success.

Of course, it’s also important to remember that the semiconductor industry is cyclical and subject to serious fluctuations. Things tend to move fast in the tech industry, making predictions even harder.

No investment is without risk, and that includes AMD. While AMD has demonstrated strong financials recently and has significant growth potential, there are many risks to keep in mind:

Luckily, AMD can do a lot to mitigate some of this risk. As we’ve seen, AMD has many revenue streams. If one industry doesn’t work out, it wouldn’t be a game-over for this company. That’s great news since it prevents the company from fluctuating quite as much due to a drop in one industry.

AMD has also already proved that they can innovate and regularly come out with new products. They aren’t a company that has sat still in the past, and it’s likely they’ll continue pushing the bar in the future!

We also like AMD’s current financial situation. They have ample cash reserves that give them some wiggle room and help them invest when they can.

Still, you shouldn’t invest in AMD if you’re completely risk-averse. Investing in any single company is risky. (ETFs are much less risky if you’re looking for a very diversified option.) Investing in a “potential” company is even more risky.

While you’re looking into it, consider our brand-new “The Next NVIDIA” report, which is completely free and dives more into AI winners.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.