24/7 Wall Street Insights

- Exchange Traded Funds offer a stock market type platform to invest in various indexes.

- VT and BND are ETF examples of index market platforms for the global equity and fixed income markets.

- For investors seeking dividends, click here for a free report on two high dividend stocks

The gains made in the stock market since 2016 have left many people with a problem. There are some who were late to the game and hope the market will continue on the same trajectory. However, not every stock still can soar like Nvidia (NASDAQ: NVDA). Others are concerned that the current market is another dot com bubble ready to burst. There is a small majority who have witnessed the gains of the Dow Jones Industrial Average and S&P 500, which would have been more than satisfactory. Mutual Funds offer diversification and a way to invest in an index on a prorated basis. Exchange Traded Funds (ETF) also offer these features, with some differences.

ETFs vs. Mutual Funds – A VHS vs Betamax Rivalry?

Once upon a time, there were no such things as streaming video and Blu-Ray discs. During the 1980s until roughly 2000, home video was still on analog video tape. The two competing formats were VHS and Betamax. They functioned essentially in a similar fashion mechanically, although they differed in terms of overall image quality, total running times, audio quality, and other factors. Overall, the format differences were more a matter of convenience than of anything major indicating an obvious superiority. ETFs and Mutual Funds are in a similar boat.

Exchange Traded Funds and Mutual Funds have a number of similarities. Here are the primary ones:

- ETFs and Mutual Funds are both accumulated pools of individual stocks, bonds, derivatives contracts or whatever securities represent the sector of interest.

- ETFs and Mutual Funds both offer a prorated interest in the total fund’s assets, which are diversified and risk mitigated.

- ETFs and Closed-end Mutual Funds both trade on NYSE or NASDAQ at a market bid/ask price based on a fixed number of shares.

Their differences are more distinct – these apply to Open-Ended Mutual Funds::

- Mutual Funds have minimum investment amounts. One can buy a single ETF share, just like a stock

- The par value for a single bond is $1,000, An ETF share that tracks bonds can be purchased for considerably less.

- Mutual Funds trade for the NAV price for the entire day and more shares are added with additional inflows. ETFs trade at a live bid/ask market price, which can vary within seconds.

- The majority of ETFs are passively managed and pegged to an index. Mutual Funds are usually actively managed, which is correspondingly costlier.

- Mutual Funds have varying loads, and early redemption fees, which are factored into their costs. Smaller ETF costs are often the result of a premium to NAV, broker commissions, and market maker bid/ask spreads.

- Mutual Funds are taxed differently (usually higher) than ETFs with regard to capital gains.

Vanguard Total World Stock Index ETF

ETF: Vanguard Total World Stock Index ETF (NYSE: VT)

Yield: 2.05%

Shares for $5,000: 44.39

Fees: 0.10% (expense ratio)

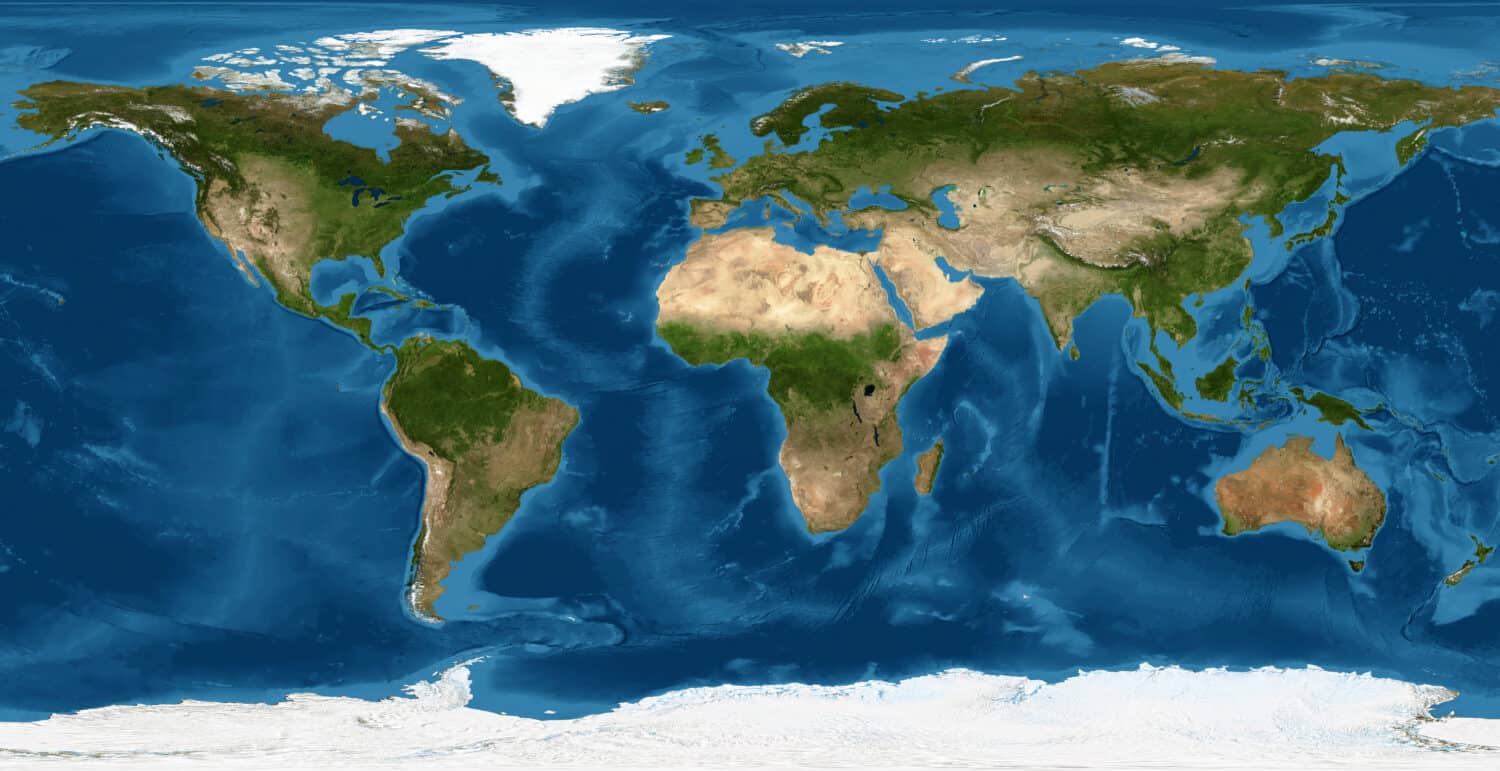

The world is a huge place, and every industrialized nation on the planet has a stock exchange. There are countless stocks with upside potential and some international exposure for a stock portfolio can mitigate against domestic market problem downturns.

The Vanguard Total World Stock Index ETF tracks the FTSE Global All Cap Index, which covers both well-established and still-developing markets. With $48 billion AUM, Vanguard Total World Stock Index ETF replicates the FTSE Global All Cap Index, albeit on a much smaller scale.

From geographic perspective, the portfolio’s stock selection is allocated accordingly:

- North America: 64.50%

- Europe: 15.60%

- Pacific Rim: 10%

- Emerging Markets: 9.70%

- Middle East: 0.20%

The North American market’s strength is still a primary driver. Among the top 10 largest holdings in Vanguard Total World Stock Index ETF, 9 of them are the same as the top largest companies also in the S&P 500. The one exception is #10, Taiwan Semiconductor Manufacturing, albeit the Taipei stock, which is 2330, not the ADR.

Over a 10 year span at the time of this writing, Vanguard Total World Stock Index ETF has appreciated from 63.09 to 112.63.

Vanguard Total Bond Market Index Fund

ETF: Vanguard Total Bond Market Index Fund (NYSE: BND)

Yield: 3.37%

Shares for $5,000: 69.38

Fees: 0.03%

There’s a Wall Street saying: “People who want to make money buy stocks. People who want to keep their money buy bonds.” With roughly 80% of capital markets wealth chasing fixed-income securities vs. 20% for equities, this would appear to be a truism.

Buying bonds is unquestionably more expensive than buying stocks. The par value of a bond is $1,000 and accumulating any meaningful bloc of bonds will generally cost at least 5 figures. One way to obtain a fixed income portfolio with diversification features on a smaller budget is through a mutual fund or ETF.

The Vanguard Total Bond Market Index Fund is an intermediate bond fund that serves almost as a de facto index. Its $318.5 billion AUM is allocated among 11,194 different bond issues with an average 5.1% yield to maturity and 8.4 year maturity. It compares its performance to the Bloomberg US Aggregate Bond Index and Spliced US Bloomberg Aggregate Float Adjusted Index as its benchmarks.

As the fund holds a broad range of stocks, a look at the ratings allocations shows:

- Government: 67.40%

- AAA: 3.60%

- AA: 3.10%

- A: 12.50%

- BBB: 13.30%

- Unrated: 0.10%

The top 10 largest holdings in the fund’s portfolio are all Fannie Mae (Federal National Mortgage Association) and Ginny Mae (Government National Mortgage Association) issues, which are in-line with its majority government bond holdings.

iShares Russell 2000 ETF

ETF: iShares Russell 2000 ETF (NYSE: IWM)

Yield: 1.26%

Shares for $5,000: 24.64

Fees: 0.19%

Small-cap stocks have long been attractive to the more adventurous investor due to their higher volatility but correspondingly higher upside potential. With lower profiles than large cap stocks, the small-caps often are under the radar of the more popular analysts. As a result, there is always the equivalent of finding buried treasure in being an early investor in what could be the next Nvidia.

The Russell 2000 Index is a small cap index that contains the lower portion of Russell 3000 small and mid-cap stocks. Created by Frank Russell in 1984, it is monitored and maintained by London Stock Exchange Group subsidiary FTSE Russell.

Designed by NY asset management company BlackRock, iShares Russell 2000 ETF replicates the Russell 2000 in its stock portfolio allocations. Its $60 billion AUM is spread across 2,032 different stocks. The top 10 largest holdings are as follows:

| Insmed Inc. | 0.42% |

| FTAI Aviation Ltd. |

0,42% |

| Abercrombie & Fitch | 0.36% |

| Fabrinet |

0.36% |

| Sprouts Farmers Market Inc. |

0.34% |

| Vaxcyte Inc. |

0.33% |

| Applied Industrial Technologies |

0.30% |

| Fluor Corp. |

0.30% |

| Healthequity Inc. | 0.30% |

| SPS Commerce Inc. |

0.28% |

In a 10 year span, iShares Russell 2000 ETF has gone from a price of 119.82 to 202.89 as of the time of this writing.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.