24/7 Wall Street Insights

- Video gaming is now a $200 billion+ global industry that is larger than the film, tv and music industries combined.

- China headquartered NetEase, Inc. (NASDAQ: NTES) is the 4th largest internet and video game company in the world by revenue.

- 90% of Gen Z and 94% of Gen Alpha identify as gamers, which means video gaming will continue to dominate entertainment for at least the next decade or two. Not only are its proprietary games finding fans around the planet, but NetEase also serves as a major China conduit for games from Microsoft’s Blizzard and other western game companies.

- 24/7 Wall Street has a free report to read on what may be “the next Nvidia” if you click here.

Video Games Rule The Entertainment World

Video games have become universally popular. The technical sophistication of video games and computer generated imaging have equaled, and in some instances, surpassed its rivals in Hollywood. And just like with the film and music industries, internationalization has led to local innovations and creations that have garnered acclaim around the world. Korea’s BTS in music, Hong Kong’s Ip Man film biographies, and NetEase’s multiplayer games, such as its Marvel Duel, Marvel Super War, Diablo Immortal, and its Westward Journey series.

Founded in 1997 by entrepreneur (William) Ding Lei, Hangzhou, China based NetEase has emerged as a leading video game producer, 2nd in China after TenCent (OTC: TCEHY), and #4 worldwide after Sony Interactive, TenCent, and Microsoft, by revenue. The rise of competitive esports gaming and the global nature of popular game titles has fueled bullish revenue and earnings projections for its stock. 24/7 Wall Street has published a number of articles on its coverage of NetEase over the past few years. The following details underscore the reasons why 24/7 Wall Street has selected NetEase as its Single Best Stock to Buy under $100 for July.

Jack of Many Trades

NetEase is best known for its catalog of video games, but its actual business is more like an online conglomerate with some off the wall divisions. These include, but are not limited, to:

- While NetEase publishes its games for PC and mobile devices, its internet connectivity for multiplayer games through game portals, e-commerce, emails, etc. is the foundation of its revenue generation.

- With a count of 940 million as of 2018, NetEase is closing in on 1 billion users, thanks to its free email services, the largest in all of China, and comparable to Google’s gmail.

- NetEase e-commerce and advertising services, which provided year over year increased margins for overall 2023 year end financials, are also revenue drivers

- Youdao, an intelligent learning subsidiary, is showing strong growth, and will accelerate further with the proliferation of AI. Youdao already provides a dictionary, translation features, STEAM courses, adult and vocational courses, digitization solutions, and smart devices.

- NetEase Pay is an online and mobile payment system to top off game credit cards.

- Yanxuan is NetEase’s private label consumer lifestyle brand.

- Cloud Music, which is essentially China’s version of Spotify, is China’s leading online music streaming service.

- Pig Farming – Although not tech related, pig farming is a very crucial business within China. This is due to African swine fever, which impacted China with a loss of nearly 28 million metric tons of pork production between 2018-2021, thus causing prices to more than double. The Chinese government offered subsidies and incentives to replenish Chinese domestic pork supply. As a result, NetEase owns 3 pig farms as of 2019.

Partnership Gateway To China

In a similar way that the hit Korean tv series Squid Game used the Netflix streaming network to build a huge international following, video game companies have been forming joint venture partnership arrangements with NetEase and TenCent to market its games, characters and other intellectual property for Chinese and affiliate Southeast Asian markets, some of which which are strictly regulated.

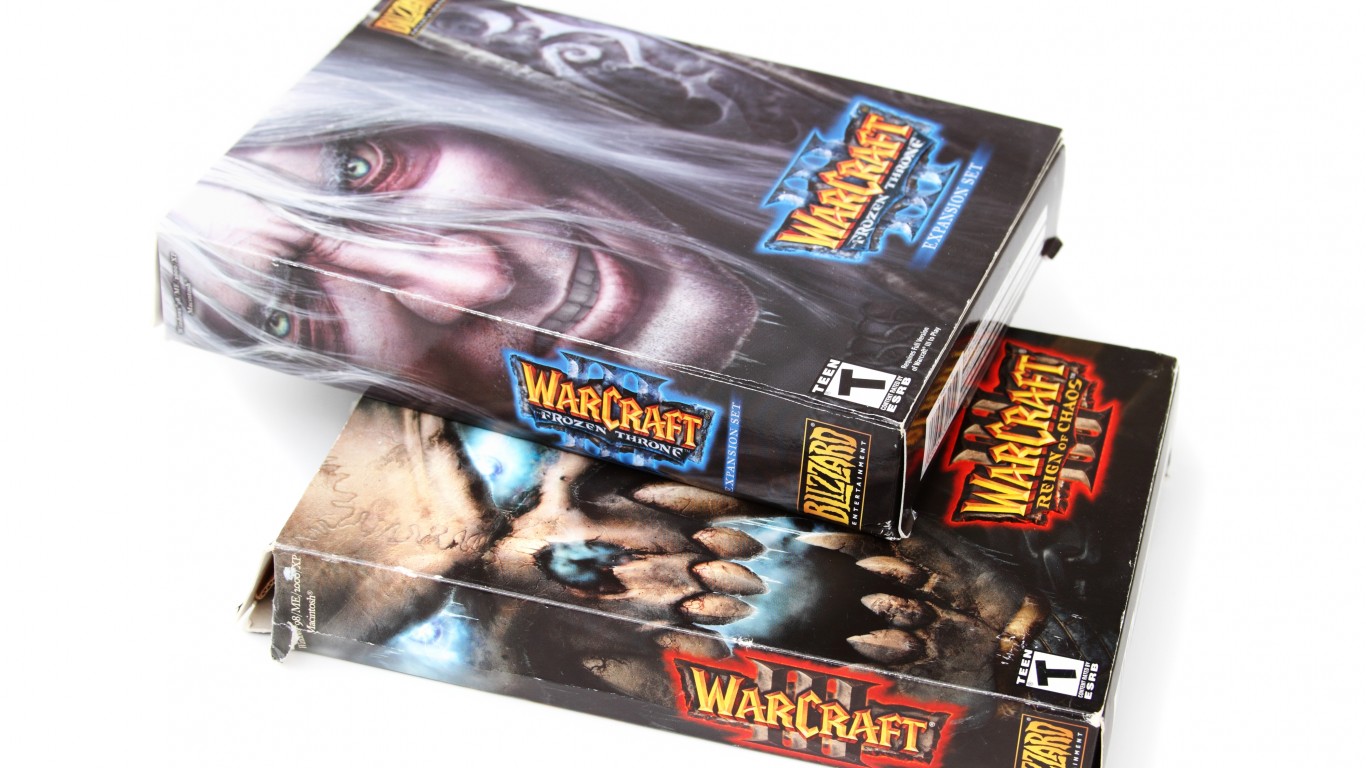

Blizzard Entertainment, which was acquired by Microsoft in Q4 2023, has had a licensing deal with NetEase since 2008 for publishing its games in the Chinese market. Although they had a dispute in early 2023, a renewed contract was inked in April, 2024. As a result Chinese fans can once again play the past and latest iterations of the following best-selling Blizzard games:

- World of Warcraft

- Overwatch

- Overwatch 2

- Hearthstone

- Diablo Immortal

- Starcraft II

- …..and others.

Warner Brothers – as its Harry Potter: Magic Awakened game was created by third party Zen Studios, Warner Bros. Games licensed it to NetEase for the China and Taiwan markets.

Other gaming companies from Japan, France, Canada, UK, S. Korea, Spain, and multiple US companies have development deals with or direct investment from NetEase. These companies do specialized CGI and other coding work and have contributed to many popular games, such as Halo, Killer 7, Detroit: Become Human, and Minecraft, among others.

NetEase Games for the Global Market

NetEase’s reputation was enhanced by its marketing success with Blizzard’s offerings. Its internal video game development expertise led to some of its JV games and other content from the arrangement also being marketed in the west.

Marvel Entertainment – In 2019, Marvel Entertainment signed a deal with NetEase “to create original entertainment content based on internationally beloved Marvel stories. Joint products including games, television series and comic books featuring Marvel characters will be developed for users in China and beyond.”

NetEase subsequently created the multiplayer games, Marvel Super War and Marvel Duel, and the forthcoming Marvel Rivals, which will also be available for XBOX and Playstation platforms.

Warner Brothers – Warner Bros. Interactive Games has developed several of its film and tv properties for video games in collaboration with NetEase for global release:

- The Lord of the Rings: Rise to War – Based on the Oscar winning Peter Jackson film trilogy version of J.R.R. Tolkien’s epic novels, The Lord of the Rings: Rise to War was a mobile strategy game that recreated Tolkien’s Middle Earth fictional world.

- Tom and Jerry – The beloved children’s animated characters were faithfully recreated in the original 2-D style, while players could select Tom (cat) or Jerry (mouse) for multiplayer battles in exotic new settings, such as a weightless space station, a cruise ship, or in a medieval kingdom.

Who Is Bullish on NetEase and Why?

Bank of America came out with a bullish buy forecast for NetEase recently for Q3 2024. It cited some strong financial aspects of the company, such as:

- Potential robust growth from Cloud Music and Youdao.

- Excitement over forthcoming release of the Marvel Rivals and Once Human games.

- NetEase is holding $6 billion cash vs. only $60 million in debt.

- NetEase has an additional $12.4 billion in time deposits, which will become cash in under 12 months.

From a regulatory perspective, NetEase, along with TenCent and Alibaba (NYSE: BABA) were slammed by the CCP’s 8 month freeze on video game licenses in 2021. Since then, the Chinese government has steadily increased its rate of license issuance, with 104 new video game licenses in June, 2024 alone.

Additionally, market guru Ray Dalio has remarked that China’s gamer population is estimated to reach 730 million by 2027, and a report on video gaming found that Chinese domestic market spend on video games is a staggering 31%.

NetEase has 11 “strong buy” or “buy” ratings at the time of this writing. The highest projected 12-month price target is $145.

NetEase is one of the leading companies in the world for video game entertainment. The growth of video gaming is indisputable, and it continues to outpace other entertainment platforms. The future ubiquity of AI will inevitably continue to fuel video game growth. Therefore, 24/7 Wall Street has selected NetEase as its Single Best Stock to Buy Under $100 for July.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.