24/7 Insights

- QuantumScape Corp. (NYSE: QS) trades near a 52-week low.

- SoundHound AI Inc. (NASDAQ: SOUN) is a potential take-out candidate and trades near $4.

- United Microelectronics Corp. (NYSE: UMC) trades under $10 and also offers a hefty dividend.

- Grab a copy of our brand-new “The Next NVIDIA” report to discover more stocks that could dominate a coming breakthrough in AI.

For younger investors or those on a tight budget, investing to generate solid stock market gains can be daunting because many top technology stocks trade anywhere from $25 to over $100 per share and more. Realizing any significant return on investment can be challenging with a small investing capital base of $1,000.

We screened our 24/7 Wall St. database of tech stocks, looking for solid, lower-priced stocks that pay and that investors can purchase to start generating positive returns.

Three top companies hit our screens, and all are valuable ideas for investors looking to grab the three smartest tech stocks to buy with $1,000 right now. All have Buy ratings at major Wall Street firms and have huge potential upside.

QuantumScape

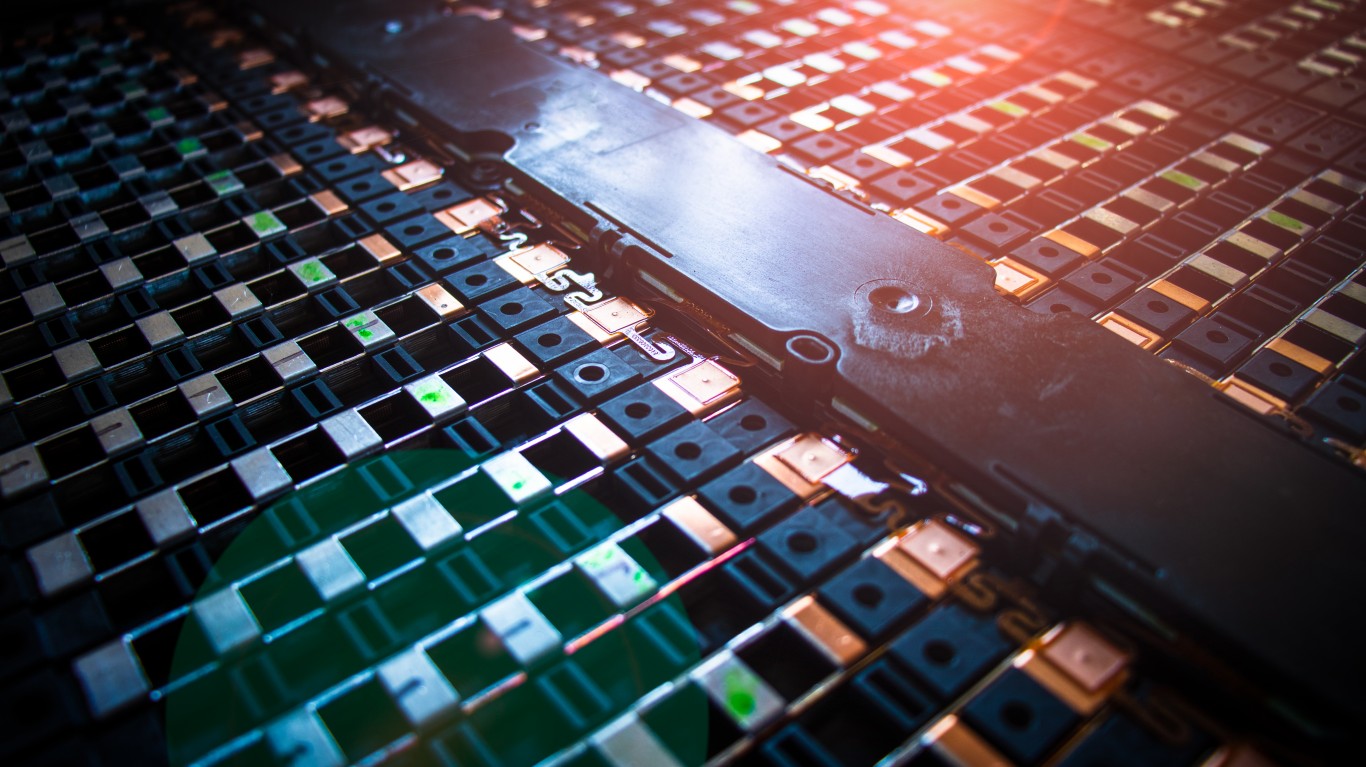

Trading just above a 52-week low, this tech stock has been rumored to be a takeover candidate in the EV arena. QuantumScape Corp. (NYSE: QS) is a research and development stage company, focuses on the development and commercialization of solid-state lithium-metal batteries for electric vehicles and other applications.

The company’s next-generation solid-state lithium-metal battery technology is designed to enable greater energy density, faster charging, and enhanced safety to support the transition away from legacy energy sources toward a lower carbon future.

QuantumScape developed the industry’s first anode-less cell design, which delivers high energy density while lowering material costs and simplifying manufacturing.

The company’s innovative battery cell technology can store energy more efficiently and reliably than today’s lithium-ion batteries.

SoundHound AI

Revenue surged for this tech stock in the first quarter and could be poised for a repeat in the second quarter. SoundHound AI Inc. (NASDAQ: SOUN) develops independent voice artificial intelligence (AI) solutions that enable businesses across automotive, TV, Internet of Things, and customer service industries to deliver high-quality conversational experiences to their customers.

Its products include Houndify platform that offers a suite of Houndify tools to help brands build conversational voice assistants, such as:

- Application Programming Interfaces (API) for text and voice queries, support for custom commands

- Extensive library of content domains

- Inclusive software development kit platforms

- Collaboration capabilities, diagnostic tools, and built-in analytics

- SoundHound Chat AI integrates with knowledge domains, pulling real-time data like weather, sports, stocks, flight status, and restaurants; and

- SoundHound Smart Answering is built to offer customer establishments custom AI-powered voice assistant

The company’s products also include:

- CaiNET software that uses machine learning to enhance how domains work together to handle queries

- CaiLAN software that arbitrates responses so users get answers from the right domain

- Dynamic Interaction a real-time, multimodal customer service interface

- Smart Ordering which offers an easy-to-understand voice assistant for restaurants

- Employee Assist; automatic speech recognition; natural language understanding; wake words; custom domains; text-to-speech; and embedded voice solutions

Goldman Sachs Loves 5 Warren Buffett Dividend Stocks

United Microelectronics

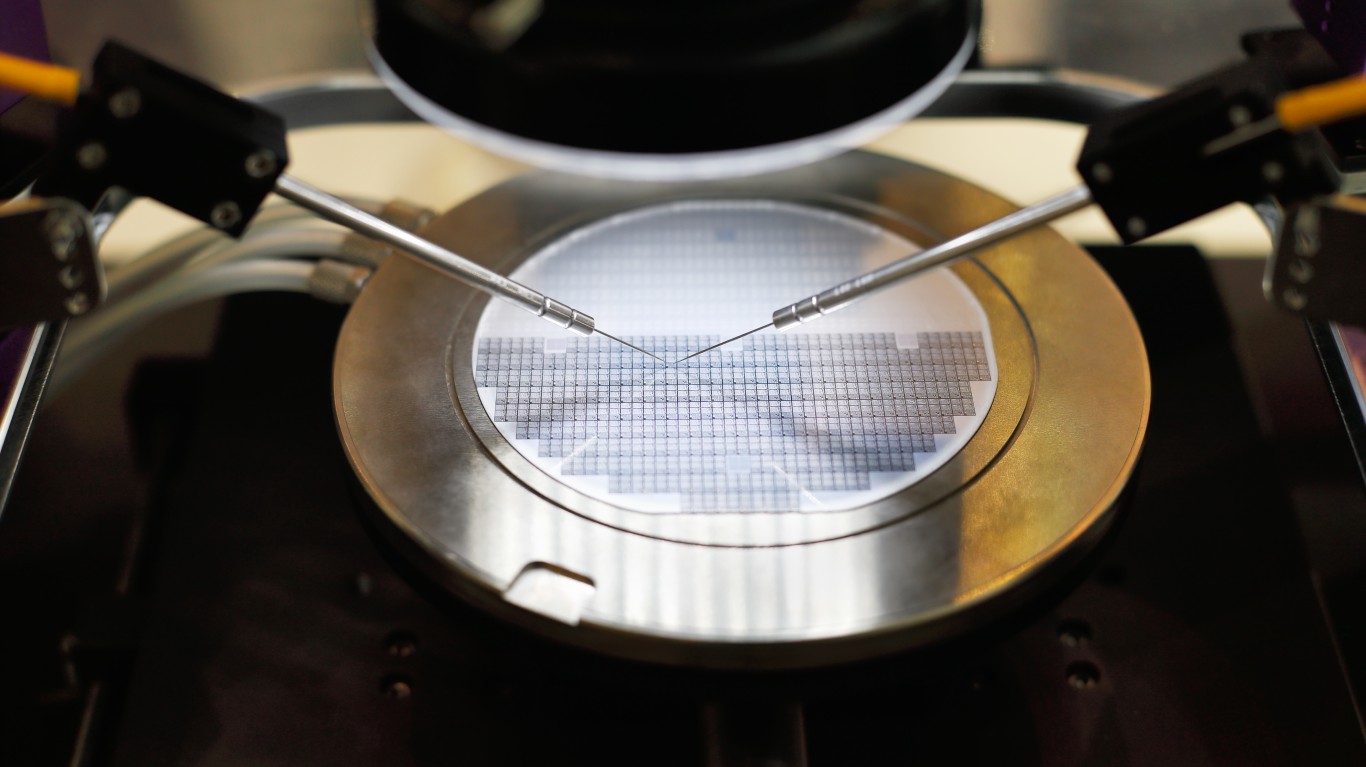

This Taiwanese semiconductor company offers massive total return potential with a 5.29% dividend and trades below $10. United Microelectronics Corp. (NYSE: UMC) operates as a semiconductor wafer foundry in:

- Taiwan

- China

- Hong Kong

- Japan

- Korea

- the United States

- Europe

- Elsewhere

The company provides circuit design, mask tooling, wafer fabrication, and assembly and testing services. It serves fabless design companies and integrated device manufacturers.

United Microelectronics recently announced the availability of its 22 nanometer embedded high voltage (eHV) technology platform, the most advanced display driver IC foundry solution in the market to power premium displays for smartphones and other mobile devices.

With unmatched power efficiency and reduced die size, the new platform, 22eHV, enables mobile device manufacturers to enhance battery life of their products while offering superior visual experiences.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.