24/7 Wall Street Insights

- Cutting edge innovations and new energy prospects on the geopolitical front have prompted bullish recommendations from numerous analysts for this stock.

- Its latest prognoses and news has earned it 24/7 Wall Street’s pick for Single Best Stock to Buy Under $25 for July.

- 24/7 Wall Street has a free report to read on what may be “the next Nvidia” if you click here.

Moving Energy Across the Nation

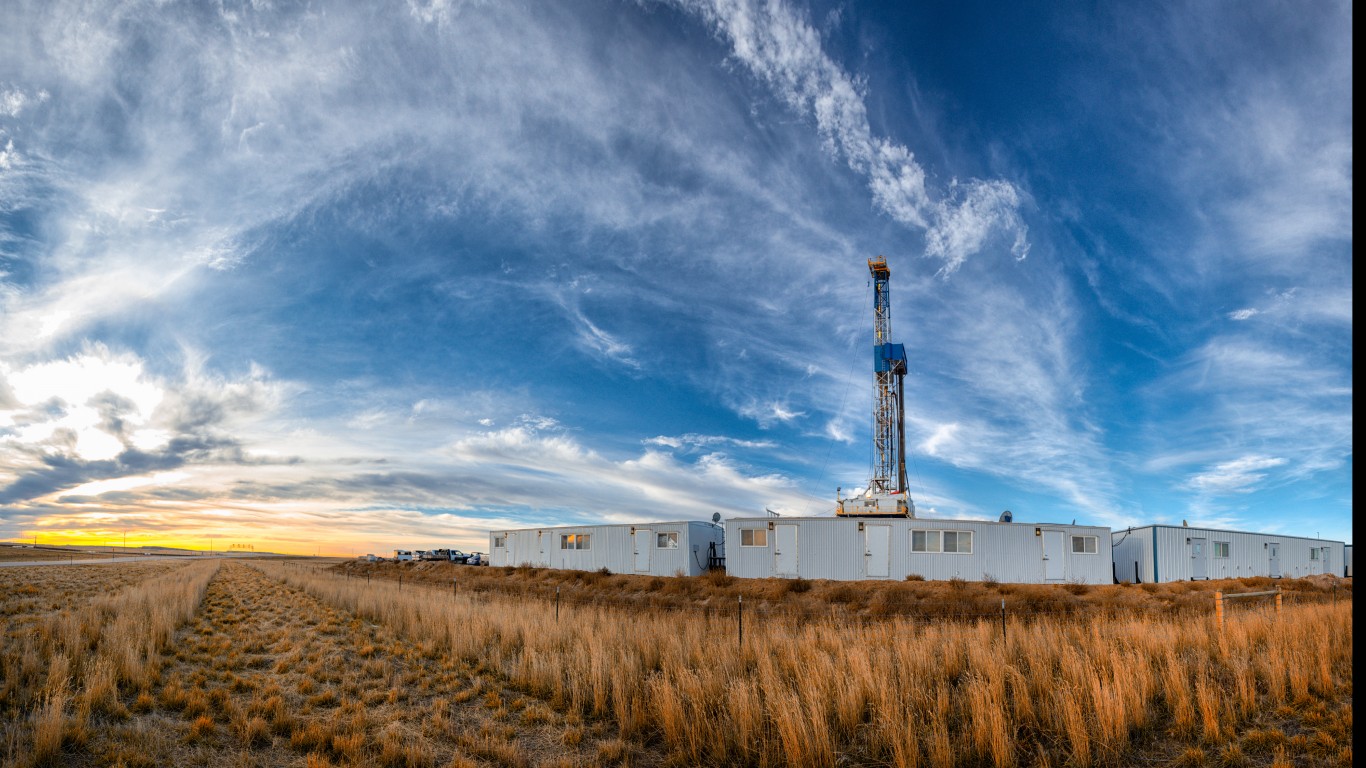

Even with the current administration’s push towards electric vehicles, the Strategic Petroleum Reserve has apparently been steadily rebuilding. Over the past year the SPR has increased by roughly 26 million barrels. In spite of Green Energy rhetoric, this action underscores the critical need for oil and natural gas as reliable and critical energy sources for the country.

Dallas, Texas based Energy Transfer (NYSE: ET) has built a solid business for itself in the past 28 years by providing storage and transport of crude oil, natural gas, natural gas associated liquids (NGL), and refined products. At the start of 2024, Energy Transfer was the third largest US midstream company by market cap size. Its supply chain network spans Texas, New Mexico, West Virginia, Pennsylvania, Ohio, Oklahoma, Arkansas, Kansas, Montana, North Dakota, Wyoming, and Louisiana. With over 125,000 miles of continental US infrastructure under its auspices, Energy Transfer’s business structure and forward thinking strategy situates it very advantageously going forward.Energy Transfer is a Limited Partnership with several wholly owned divisions, and large institutional ownership stakes in to other publicly trading companies:

- Sunoco LP (NYSE: SUN) – 100% interest in incentive distribution rights and 21% interest in the general partnership.

- Sunoco Logistics Partners Operations LP – 100%

- USA Compression Partners (NYSE: USAC) – 39.4% general partnership interest.

- Lake Charles LNG – 100%

- LNG Export Project – 100%

“Building The Perfect Beast”

Starting with 200 miles of natural gas pipeline in East Texas back in 1996, Energy Transfer has strategically expanded its pipeline, storage and port connection facilities to serve 12 different states across 125,000 miles of infrastructure. A look back at its history demonstrates how this behemoth was assembled with every building block, since going public:

- In 2004, Energy Transfer acquired the Tufco Pipeline system, which connects to the Barnett Shale natural gas fields in Texas. It is one of the largest in the US.

- In 2005 Energy Transfer acquired the Houston Pipeline system.

- 2006 saw Energy Transfer obtain the Transwestern Pipeline in New Mexico.

- The next 4 years saw Energy Transfer expanding construction on their pipeline network. This includes addition of the Paris and Carthage loop pipelines, Southeast Bossier, Fayetteville, and Tiger pipelines.

- The list goes on with mergers and acquisitions just about every year…

The Bulls Love Energy Transfer

Energy Transfer is covered by a total of 19 Wall Street analysts. The average recommendation is “strong buy”. With 0 “sell” or “hold” ratings, the top 10 most recent “strong buy” and “buy” ratings come from:

- Barclays

- JP Morgan Chase

- Mizuho Securities

- Morgan Stanley

- Wells Fargo

- Bank of America

- UBS

- Goldman Sachs

- Stifel, Nicolaus

- RBC Capital

Substance Over Style

The bullish analyst sentiment for Energy Transfer is justified by a number of developments and trends, but below are three areas that have generated enthusiasm: 1) Favorable Market Trends; 2) Projects In-Progress; and 3) Supplying the AI Market

Favorable Market Trends

As green energy failures mount, the pendulum is swinging back towards oil and gas, which will greatly benefit the midstream industry as a whole in these areas:

- Stronger Pipeline Demand: As oil prices once again exceed $80 per barrel, explorers and producers will likely ramp up upstream activities. More new products will increase demand for crude transportation pipelines of midstream players.

- Stabilized Fee-Based Revenues: Long term shipping contracts will mitigate storage and pipeline fee volatility. This will allow analysts’ forecast and revenue estimates to be more reliable, which will bolster their track records.

- Increasingly Attractive Yields: Yields from midstream MLPs generally pay higher yielding dividends than their affiliates in the overall energy sector. The increased supply will boost midstream stock dividend payouts, again bolstering the analysts’ prognostications and track records.

Projects In Progress

Energy Transfer has (5) projects already in-progress that will substantially boost its bottom line and market share:

- Nederland Terminal– New refrigerated storage facilities at Nederland will increase Energy Transfer’s butane storage capacity by 33% and propane storage capacity by 100%. This will expand Energy Transfer’s current exports of over 700,000 barrels per day of NGLs from Nederland Terminal.

- Natural Gas Processing Capacity– On top of the added capacity from the 2023 Crestwood acquisition, Energy Transfer is expanding 200 million cubic feet per day of natural gas processing capacity in West Texas. A separately recently completed South Texas facility upgrade has ramped up an extra 60 million cubic feet per day.

- Marcus Hook Terminal– Energy Transfer is expanding its Marcus Hook Terminal operations to incorporate newethane refrigeration and storage capacity.

- Lone Star Express and Gateway– To eliminate pipeline bottlenecks from its latest acquisitions, Energy Transfer is adding 90,000 barrel per day capacity to its Lone Star Express pipeline and when the Gateway Pipeline overhaul is completed, 1.3 million extra barrels per day in total will be deliverable to Mont Belvieu.

- New Infrastructure Sectors– Energy Transfer is in the midst of developing transport and storage of natural gas and CO2 to ammonia and sequestration sites. It is also experimenting with deep-water marine loading for its Nederland and Lake Charles sites.

Supplying the AI Market

Energy Transfer’s co-founder, Kelcy Warren, is still CEO and Chairman of the company. A 40 year energy industry veteran and Texas Business Hall of Fame member, he has built an executive team and Board of Directors that have helmed the company through the choppy waters of the energy industry. All of them have decades of experience in the NGL and related industries. Most impressive is former Secretary of Energy and Texas governor Rick Perry, whose insights were likely instrumental for the following brilliant tactic:Over the last few years, Energy Transfer has built pipelines to connect to over half of all of the power plants in Texas. Low corporate taxes in Texas have attracted a large migration of tech companies, including Tesla (NASDAQ: TSLA) and others. The popularity of AI is also driving significant corporate relocation to Texas, especially in Dallas and Austin. As a result, Goldman Sachs anticipates that new data centers in Texas will hike power demand by 160%. Due to the above explanations, Energy Transfer has been selected as 24/7 Wall Street’s Single Best Stock to Buy under $25 for July.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.