24/7 Wall Street Insights

- A 4,000 person Jenius Bank survey revealed that inflation has put 50% of them in dire financial straits.

- Lending Tree found that one-third of American households can’t pay for food, housing, and medicine.

- For investors seeking dividends, click here for a free report on two high dividend stocks.

On July 15th, CBS News reported the following inflation survey comments:

“A June survey of 4,000 Americans by Jenius Bank found that half of respondents are losing sleep because of their dire financial situation. Many respondents blame persistent inflation and rising debt for their increased stress over finances, the bank said. A Lending Tree report released this week found that one-third of American households are financially insecure, meaning they find it somewhat or very difficult to pay for expenses like food, housing, car payments and medicine.”

The IMF reported the next day that it expected interest rates to remain high, as the factors required to significantly reduce inflation are not being met.

The financial and psychological pressures of stubborn inflation can be a devastating combination that may wreck families on emotional, physical, and reputational levels. Creating a passive income stream can present a possible partial solution. Since neither forgoing the primary paycheck or getting a second job is a viable option for many, dividend stocks may present the ideal platform.

Dividend Stocks: The Missing Ingredient?

There are attributes that dividend stocks feature which, combined, are hard to find in any other asset class, especially for the individual investor:

- Low ticket price – Real estate, limited partnerships, and other passive income vehicles all cost tens of thousands of dollars just for the entry fee. Stock investments can be made in hundreds of dollars, if desired.

- Liquidity – Emergencies are sudden and unexpected when they occur, and often require much needed cash. Investments in real estate or private businesses can take weeks to months in order to sell one’s stake. Selling stocks now make liquid funds available at T+1 settlement, i,e., the next business day after the sale.

- Diversification – A mixed portfolio of stocks from different industrial sectors can protect the portfolio from the risk of company specific lawsuits or attacks. An investment in a property or a specific business can sink without a backup if subject to fire, vandalism, flooding, or other kinds of hazards.

- Risk Tolerance – Whether an investor has a strong stomach for risk or gets nauseous from market turbulence, the wide range of thousands of dividend stocks available means a portfolio can mix and match stocks to allow all investors to sleep at night.

24/7 Wall Street has been publishing a voluminous number of articles on dividend stocks over the years. We have an extensive library of stocks and assemble various combinations to highlight for prospective portfolio consideration. The following stock selections, cumulatively, would yield over 10%, based on market price at the time of this writing.

XAI Octagon Floating Rate & Alternative Income Trust

Stock #1 : XAI Octagon Floating Rate & Alternative Income Trust Inc. (NYSE: XFLT)

Yield: 15.72%

Shares for $10,000: 1,426.5

Annual Passive Income: ~$1,572

Chicago, IL headquartered XAI Octagon Floating Rate & Alternative Income Trust Inc. is a company that manages a portfolio of debt instruments majority weighted towards floating rate bonds or other debt structures. This means that their coupon payments have a basis point spread against a variable rate pegged to a particular interest rate benchmark, like, for example, LIBOR or the 10-year US Treasury Bond. Mechanically, this is akin to a floating rate mortgage.

FS KKR Capital Corp.

Stock #2 : FS KKR Capital Corp. (NYSE: FSK)

Yield: 13.76%

Number of shares for $10,000: 492.6

Annual Dividend Total: ~$1,376

When titans form partnerships to do business, history shows that failures are common, due to incompatible corporate cultures and other more nuanced differences, as capital and resources are plentiful. Philadelphia based FS KKR is an example of a successful one. Combining the business development company (BDC) expertise of FS Investments with the legendary KKR’s credit division resulted in a $14 billion AUM whale of a BDC that dwarfs most of its rivals.

Business development corporations fulfill an important financial role in the private corporate sector. Acquisitions, corporate buyouts, refinancings, and a host of other activities requiring capital are often outside of the scope of commercial banks’ expertise or are too expensive. The BDC has the flexibility to mix and match debt, equity, and other types of structures to solve these corporate hurdles.

FS KKR offers these and other services to small and middle-market US companies. Qualifying criteria is for the company to have revenues between $10 million and $2.5 billion. Upper middle companies qualify with EBITDA of $50 million to $100 million.

A look at the current FS KKR portfolio shows that 57% of its financings are First Lien Senior Secured Loans, with asset based financings accounting for 14.6%, and a Credit Opportunities joint venture structure with 9.8%. The top three largest industry sector exposures are: Software: 16.5%, Capital Goods: 14%, and Commercial & Professional Services: 13.8%.

Two Harbors Investment Corp.

Stock #3 : Two Harbors Investment Corp. (NYSE: TWO)

Yield: 13.02%

Number of shares for $10,000: 715.3

Annual Dividend Total: ~$1,302

Real EstateInvestment Trusts (REIT) that trade publicly register with the SEC in order to access the capital markets and public investor money. In exchange, they are required to remit 90% of their profits to their shareholders. This win/win scenario lets individual investors participate in the profits from large rent rolls without the management headaches.

Some REITs are hands-on owners and managers of brick-and-mortar real estate properties. There are others whose involvement remains solely on the financial side. This can manifest in underwriting loans or mortgages. Another type of REIT only deals in a third-party capacity as a fundlike entity in buying and selling securitized bundles of mortgage loans or other real estate predicated debt paper. This is the category where Two Harbors Investment Corp., a St. Louis Park, MN based REIT, solidly resides.

Two Harbors’ portfolio holdings include: Federal agency backed mortgage securities (i.e., Fannie Mae and Freddie Mac), collateralized fixed and/or floating mortgage loans, and other real estate based loans.

One somewhat obscure asset class that Two Harbors actively trades is Mortgage Servicing Rights (MSR). MSRs can be viewed as an option type of mortgage derivative that can transfer the rights and income streams from managing a specific mortgage or collection of mortgages.

NextEra Energy Partners LP

Stock #4 : NextEra Energy Partners LP (NYSE: NEP)

Yield: 12.97%

Number of shares for $10,000: 359.7

Annual Dividend Total: ~$1,297

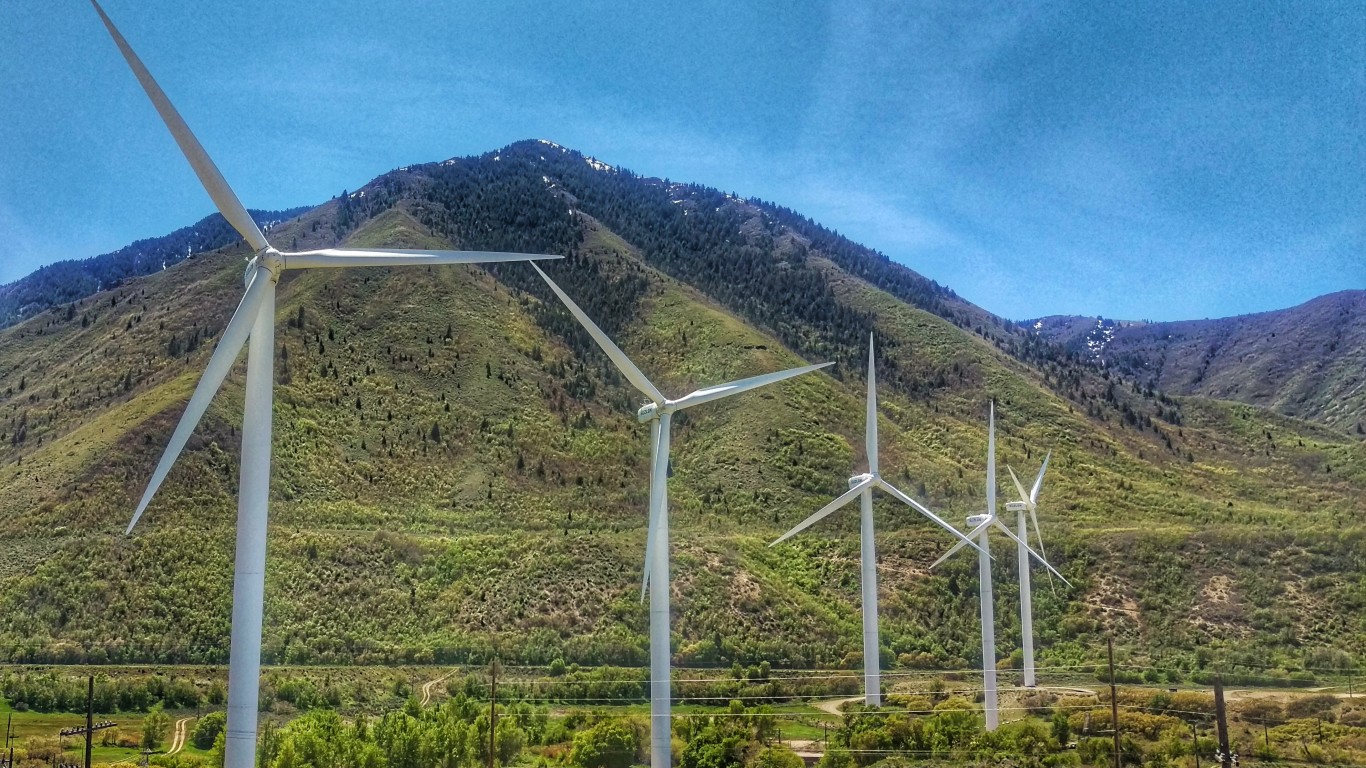

Renewable and clean energy sources have expanded globally over the past two decades, supported by green energy initiatives and government subsidies. Juno Beach, FL based NextEra Energy Partners LP acquires, owns, and manages a portfolio of clean energy assets, such as:

- Windmills

- Solar Panels

- Solar energy storage

- Standalone rechargeable batteries

- Natural gas pipeline assets

NextEra Energy Partners is a subsidiary of NextEra Energy Inc. (NYSE: NEE), which is a major electric utility company in Florida and is the parent company of Florida Power and Light. For dividend minded investors, NextEra Energy Partners LP has a 10 year unbroken streak of quarterly dividend payments.

Atlantica Sustainable Infrastructure plc

Stock #5 : Atlantica Sustainable Infrastructure plc (NASDAQ: AY)

Yield: 8.08%

Number of shares for $10,000: 453.9

Annual Dividend Total: ~$808

Located across the Atlantic Ocean in Brentford, UK, Atlantica Sustainable Infrastructure is also in the renewable energy space. As an international company, it wholly owns or has significant stakes in solar, wind, natural gas, hydropower, and electricity transmission assets in a menu of nations:

- UK: wind

- US (AZ, CA, IL, MN, OR, TX): solar, wind

- Chile: solar, electric lines

- Colombia: solar

- Uruguay: solar, wind

- Peru: hydropower, electric lines

- Spain: solar

- Italy: solar

- South Africa: solar

- Mexico: natural gas

- Canada: electric

Please note that Atlantica Sustainable Infrastructure is scheduled to be acquired in 2025 by a private equity firm for $2.5 billion, so if the stock was held in portfolio, it would likely need to be replaced once the acquisition is officially consummated.

EPR Properties

Stock #6 : EPR Properties (NYSE:EPR)

Yield: 7.88%

Shares for $10,000: 226.8

Total monthly dividend income: ~$788

In real estate, the difference between a net lease and a gross lease is that in a net lease, the tenant or lessee has to pay all costs and expenses. EPR Properties is a leading net lease REIT operator that focuses on a lucrative, but specialized type of property.

Just as some REITs specialize in mortgage securities, others manage commercial real estate properties, and some will focus on retail shops, factories, and other areas. Kansas City, MO headquartered EPR Properties bills itself as “The Diversified Experiential REIT”. Pioneering the particulars of the movie theater business, ERP currently deploys its $6.8 billion + AUM through ownership and management of:

- 166 commercial spaces for chains like AMC;

- 11 ski resorts;

- 58 Family Entertainment Centers in collaboration with partners like Topgolf;

- 23 Attractions (i.e., amusement parks, water parks, and indoor skydiving centers);

- 7 Experiential Lodging properties, which provide lodging adjacent to some of the aforementioned entertainment and/or resort properties);

- 20 fitness and gym locations;

- 3 Cultural properties (i.e.,museum, zoo, aquarium);

- 1 Gaming (i.e, casino) Resort property;

- 9 Private School locations,

- 61 Child-care centers

EPR Properties are located in 44 different states within the USA. Dividend investors will appreciate that EPR pays out dividends monthly.

The RMR Group, Inc.

Stock #7 : The RMR Group, Inc. (NASDAQ: RMR)

Yield: 7.19%

Number of shares for $10,000: 388.95

Annual Dividend Total: ~$719

When commercial real estate developers or REITs acquire properties, many of them outsource the management to professional companies experienced in that industry. The RMR Group, Inc. of Newton, MA has capitalized on its asset management expertise in commercial real estate to generate $5 billion in annual revenues.

Among RMR Group’s clients are senior living provider AlerisLife, Inc., Sonesta International Hotels, Corp., and five publicly traded REITs:

- Service Properties Trust (NASDAQ: SVC)

- Diversified Healthcare Trust (NASDAQ: DHC)

- Office Properties Income Trust (NASDAQ: OPI)

- Industrial Logics Properties Trust (NASDAQ: ILPT)

- Seven Hills Realty Trust (NASDAQ: SEVN)

RMR Group also has its own in-house commercial real estate finance division and RMR Residential, a $5 billion multifamily residential collection of properties.

Highwoods Properties, Inc.

Stock #8 : Highwoods Properties, Inc. (NYSE: HIW)

Yield: 7.02%

Number of shares for $10,000: 344

Annual Dividend Total:~ $702

When Elon Musk took over ownership of Twitter and renamed it as X, one of the biggest steps he took was to demand workers return to the office. Work-at-home practices became ubiquitous during the pandemic, but Musk’s announcement hailed a return to an actual workplace.

Highwoods Properties, Inc. is a Raleigh, NC headquartered REIT that is focused on commercial office real estate. Highwoods Properties, acquires, owns, develops, and manages workplace properties in Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond, and Tampa.

The company is benefiting from the return-to-work trend, especially in the high-growth Sun Belt markets. Q1 2024 saw Highwoods leasing 922,167 square feet of second generation office space, with 422,889 square feet of new leases. As of April, Highwoods held $17 million of available cash and only $10 million drawn from its $750 million revolving credit line.

It is prudent to monitor a stock portfolio on a regular basis, since the market’s volatility has increased precipitously over the past 20 years. A dependence on dividends makes portfolio monitoring an even more crucial task. It’s wise to have other dividend stocks on the radar with similar yields, just in case a substitution is required, such as would likely be the case with Atlantica Sustainable next year.

| Name: | Yield: | Annual Passive Dividend Income: |

| XAI Octagon Floating Rate & Alternative Income Trust Inc. (NYSE: XFLT) | 15.72% | ~$1,572 |

| FS KKR Capital Corp. (NYSE: FSK) | 13.76% | ~$1,376 |

| Two Harbors Investment Corp. (NYSE: TWO) | 13.02% | ~$1,302 |

| NextEra Energy Partners LP (NYSE: NEP) | 12.97% | ~$1,297 |

| Atlantica Sustainable Infrastructure plc (NASDAQ: AY) | 8.08% | ~$808 |

| EPR Properties (NYSE:EPR) | 7.88% | ~$788 |

| The RMR Group, Inc. (NASDAQ: RMR) | 7.19% | ~$719 |

| Highwoods Properties, Inc. (NYSE: HIW) | 7.02% | ~ $702 |

| Annual Passive Dividend Income Total: | $8,564 |

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.