Investing

Forget Adobe: This Stock Is the Next Millionaire Maker

Published:

Last Updated:

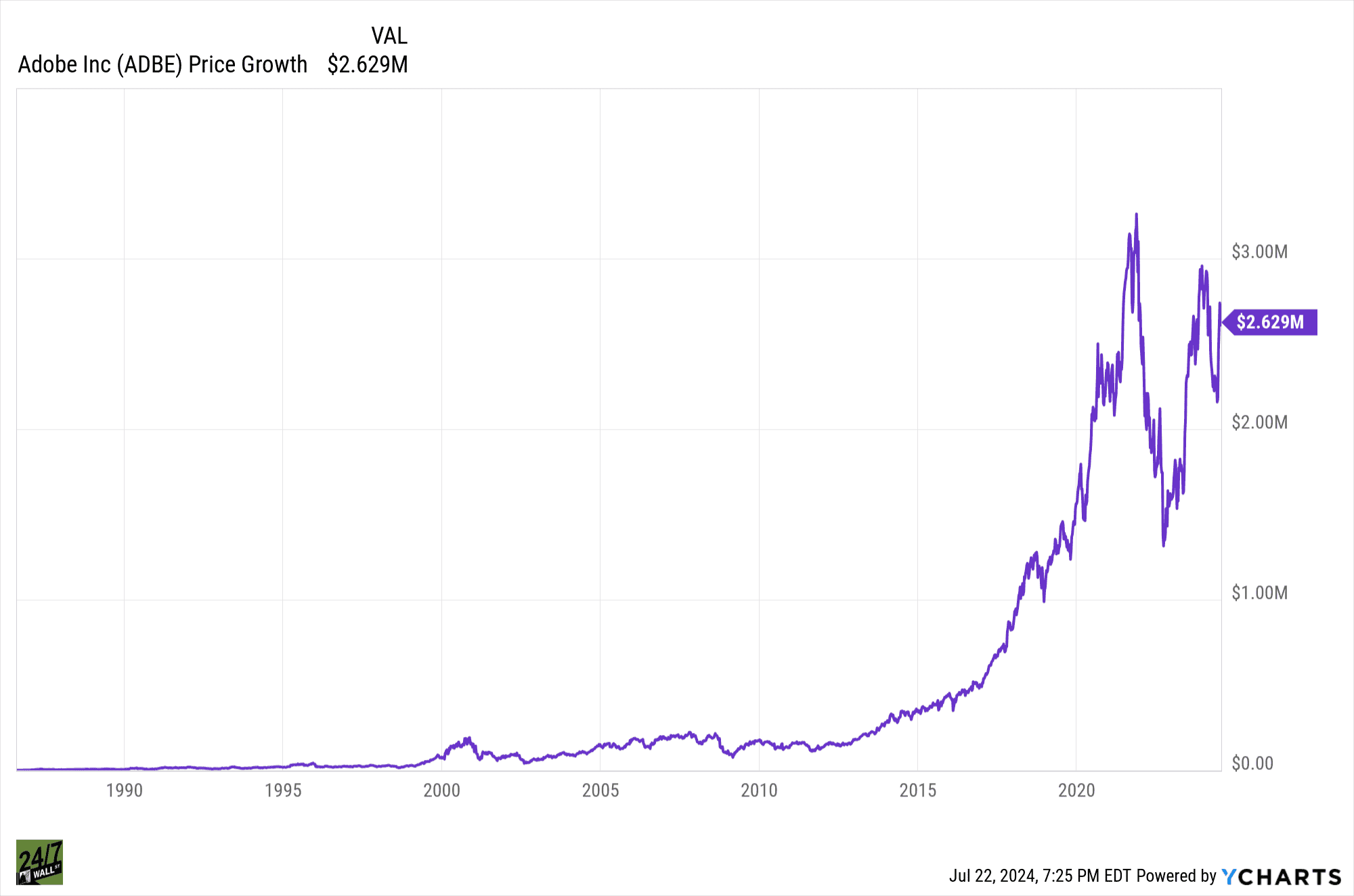

The world of software has many household names, including Adobe (NASDAQ: ADBE). Adobe has become synonymous with creativity and graphic design, and its stock price reflects this massive following. If you had invested $1,000 into Adobe at IPO, you’d have almost two million dollars now.

However, software is constantly evolving. More and more companies are introducing different software ideas. For instance, Open Text (NASDAQ: OTEX), a leader in Enterprise Content Management, offers a powerful selection of tools to help businesses, unlike their information’s potential.

While Adobe reigns supreme in creative circles (and is more of a household name), Open Text could be the next enterprise software giant. They’ve recently begun strategically integrating Artificial Intelligence into their software and already have a comprehensive information management platform.

These two factors (among others) could lead to significant growth over the next few years. Here are some key factors you need to know:

There are tons of software companies we could choose from. So why do we recommend Open Text? Well, it comes down to three simple advantages:

Open Text’s platform is very robust. It isn’t a simple document manager. Instead, it acts as a central hub for a company’s content, encompassing documents, emails, and even social media data. This centralized approach fulfills tons of different needs for businesses.

For instance, it prevents information from being scattered across many different systems. Businesses can easily look at everything and collaborate on a single platform. It also makes finding specific information much easier thanks to its advanced search functionalities. With the introduction of AI, this sort of search is likely going to get even more accurate.

Open Text also uses robust security features to safeguard sensitive information. Security is becoming more and more important for companies as the years pass, and Open Text is already on top of this.

Open Text isn’t scared of the new developments in AI. Instead, it’s integrating AI into its platform. Repetitive tasks like document classification can now be automated with AI, making companies more efficient (and letting employees do what they can add value too, not just do the same repetitive tasks over and over again).

AI-powered analytics also helps companies identify trends and make sense of data more easily.

While all of Open Text is still actively integrating AI into its software, it’s ability to innovate with this newest industry is a good sign for its future.

There are tons of different software companies that businesses can choose to work with. However, Open Text provides a unique value proposition that makes it a very exciting choice. It fulfills several key needs at the same time:

While established players like Adobe offer solutions for specific content creation needs, Open Text delivers a broader value proposition. It simply allows companies to make better decisions with their data and work more efficiently.

These advantages of Open Text put them in a good position to grow, especially as information becomes more and more plentiful. The more business operations get moved online, the more data there will be to collect. It’s likely that businesses will be dealing with even more information in the future, not less.

Data security is also becoming a bigger and bigger problem for businesses. Thankfully, Open Text is already developing robust security features to help keep companies safe. This not only prevents hacks, but it also fosters trust between businesses and Open Text.

Open Text offers its platform as a cloud-based service, eliminating the need for expensive on-premise infrastructure. This lowers IT costs and increases scalability.

Thanks to Open Text’s continued innovation, this company is already becoming the go-to solution for businesses seeking to navigate complex data. It’s likely that the company will continue to grow even more as more and more companies require data-management software.

While Open Text has a lot of things going for it, that doesn’t make it bulletproof. There are many challenges ahead that are vital to keep in mind for anyone considering investing in Open Text.

The enterprise software market is crowded with many large companies, like Microsoft (NASDAQ: MSFT) and IBM (NYSE: IBM). Open Text must differentiate its platform to compete with these giants. Otherwise, it wouldn’t take much to eat them up.

Adobe is a strong competitor, too, though not directly. In fact, it’s one of the AI stocks we recommend.

There are tons of software programs similar to Open Text’s platform out there. The market is heavily saturated, which makes it even more challenging to stand out, as Open Text needs to. It’s likely the market will become even more saturated in the future, leading to potentially slower growth.

Open Text isn’t always an easy company for businesses to start working with, either. Implementing this company’s platform requires significant investment in training and re-working how the business is run. Therefore, there is a barrier to entry that Open Text needs to work on to increase client acquisition.

Open Text’s future growth is also reliant on outside technological development, like AI. While the company uses these advancements heavily, they aren’t doing the development themselves. This is a potentially deadly challenge if technological innovation slows down.

Open Text does not have the wide recognition that Adobe does. However, they do offer a compelling investment opportunity for those looking for exposure to a potential growth software stock.

This company has a lot of potential. For instance, it has a comprehensive information management platform that already meets several needs of its clients. It’s constantly adding more features and improving those it already has. Thanks to the recent development of AI, Open Text has also been able to integrate AI into several of its features.

Open Text’s platform allows companies to potentially save money in several different directions, too. The platform can lower IT costs and automate repetitive tasks when used correctly.

Of course, some challenges exist, but Open Text has already proven that it can innovate continuously, which makes us hopeful that these challenges will be overcome.

All investment carries risk, even if a company looks promising. Any company that has the potential to go up substantially also has the chance to move in the opposite direction just as much. Open Text should be considered a riskier investment, as are most companies in the tech industry. Consider your risk tolerance and investment goals before deciding to invest in Open Text.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.