Investing

Forget Visa: This Stock Is the Next Millionaire Maker

Published:

Last Updated:

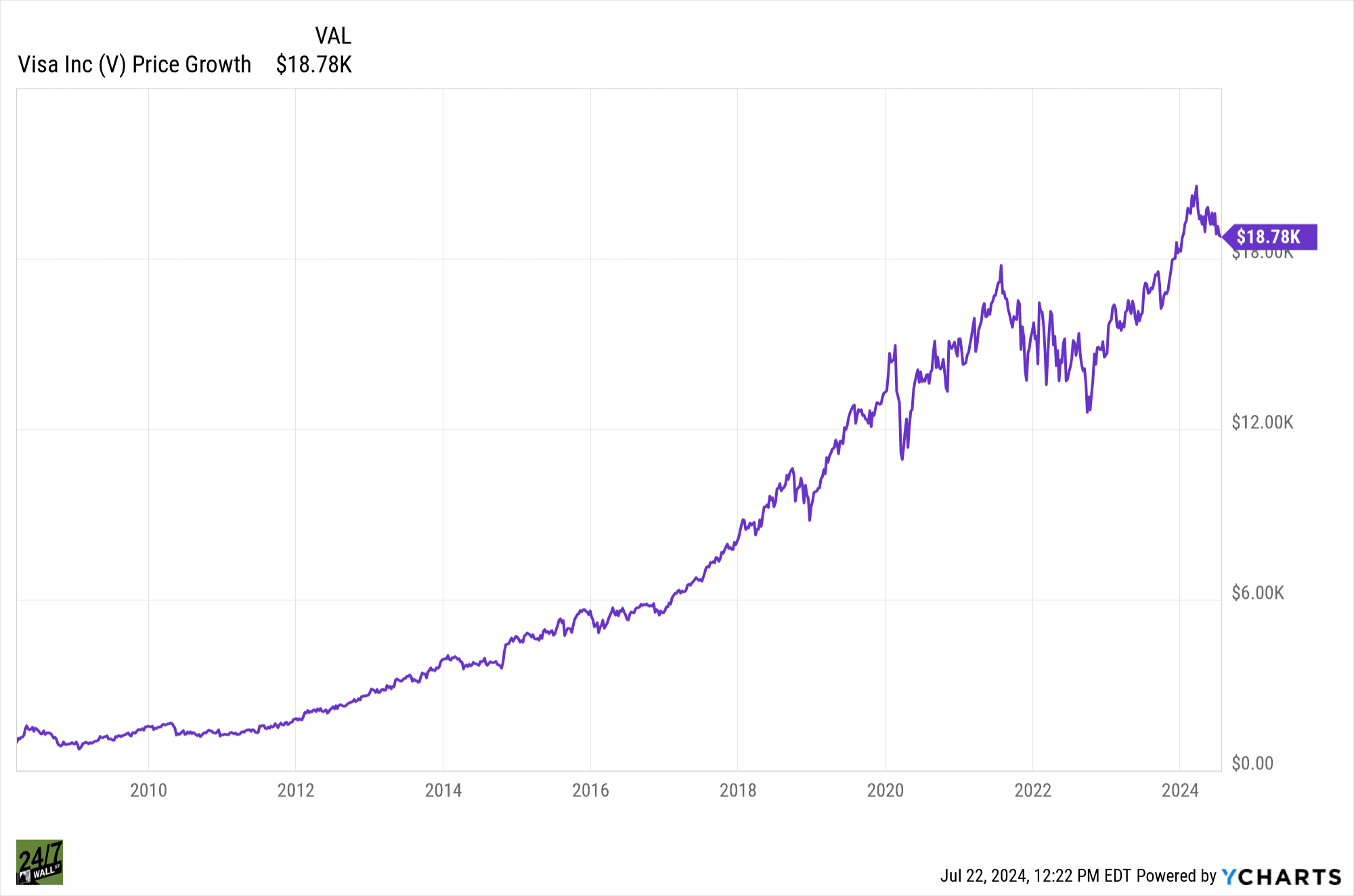

For decades, giants like Visa (NYSE: V) have dominated the world of financial transactions. Visa offers a wide range of well-established services, and just about everyone in the US recognizes their brand. Their stock has performed remarkably well, too. $1,000 invested at IPO would have grown into over $15,400.

Chart Source: Courtesy of YCharts

However, technology moves quickly, and many competitors have popped up over the last decade to compete with Visa. Enter Block, Inc. (NYSE: SQ), formerly known as Square. Block has carved out a unique space in the financial technology industry by focusing on the needs of these often-underserved demographics.

Block has a lot of things going for it. It’s very user-friendly, even for the tech-unsavvy. Cash App has blown up in popularity since its inception, and Block has been quick to embrace cryptocurrency.

Here’s a quick summary of what you need to know:

Block may be a competitor with Visa and other traditional financial giants. However, that doesn’t mean it’s competing for the same clients. Instead, it’s meeting very specific needs for two demographics that are often left behind by large, traditional businesses.

Traditional financial institutions are complex and often over-priced for small businesses. Many larger financial institutions haven’t designed their products for small businesses. They often require a high minimum balance and can charge hefty fees.

Block directly counters these issues by offering user-friendly solutions, such as the Square Point-of-Sale system. Square POS allows small businesses to do just about everything, including accepting payments and managing inventory. It’s affordable and has an intuitive interface, making it perfect for smaller businesses.

Millennials, particularly, are drawn to Block’s innovative approach, too. They crave convenience and mobility, which Block delivers with Cash App, a mobile platform that makes transferring money exceptionally easy.

Cash App allows users to perform lots of financial transactions, including managing their payroll and investing in stocks.

Block is constantly innovating and offering new financial products, too. For instance, Cash App began as a simple payment app. However, it now allows users to buy fractional shares of stocks, a feature that is great for younger investors who don’t have the capital to purchase whole stocks.

Cash App also offers banking services like direct deposit and debit cards, further blurring the lines between traditional finance and the modern fintech world.

Block was one of the first adopters of Bitcoin integration. This cryptocurrency appeals to the younger generations, too. Block placed itself at the forefront of the digital currency revolution by making this move.

But that isn’t the only recent innovation, either. Square Online Store now helps businesses create an online presence and sell their products online without leaving Block’s platform. It’s very likely that Block will continue to add new features in the future.

Of course, for Block to be a millionaire-maker stock, it also has to have serious growth potential. It can’t just compete. It has to explode.

Luckily, Block’s financial performance has been positive recently. Recent quarters have seen impressive revenue increases, fueled by the rising adoption of Square POS and Cash App. This upward trend indicates a healthy and growing business model.

Block may even be on the shortlist to join the S&P 500.

But, it’s important to realize that finances are just a small snapshot of how the company is doing. Block isn’t just resting and enjoying its success. This company continuously expands its reach through strategic initiatives, like international expansion. Plus, as we’ve already discussed, they’re constantly introducing new features.

Of course, there are lots of fintech competitors out there, many of which also have great financials and growth potential. Established financial institutions like Visa are always in the background, and new fintech startups are popping up all the time.

Competition is also inevitable for all industries. Block must continue innovating and capturing more of the market to be successful.

Block is an exciting investment proposition because of its potential for high returns. Historically, disruptive technology companies have produced serious gains for investors who got in early. However, choosing the companies that will disrupt the industry is exceptionally challenging.

Block is a growth-oriented company in the crowded fintech landscape. Its user-centric approach makes it a great choice for small businesses and younger people who want to do much of their banking online. While they are competing with companies like visa, it’s their niche solutions that drive much of their growth.

For instance, their user-friendly Square POS has become the norm for small businesses that don’t want hard-to-use, expensive financial tools. Cash App has also grown from a money-transferring app to a full-blown financial institution. Users can now invest and even buy Bitcoin through Cash App.

Could Block be the next millionaire-maker investment? While historical examples of disruptive tech companies generating significant returns exist, the stock market is inherently risky. It’s possible that they could perform very well in the future and become a household name. It’s also possible that they’ll stop innovating and connecting with their customer’s needs.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.