Electric vehicle maker Rivian Automotive (NASDAQ: RIVN) IPO’ed in November 2021 and immediately made a splash with its stock price skyrocketing to $180 in just its first week of trading.

The cash infusion was a much-needed lifeline for Rivian, with $3.7 billion in operating expenses in 2021 and only delivering 920 vehicles. The company also had backers in Amazon (NASDAQ: AMZN) and Ford (NYSE:F), who held 260 million shares of Rivian collectively at IPO.

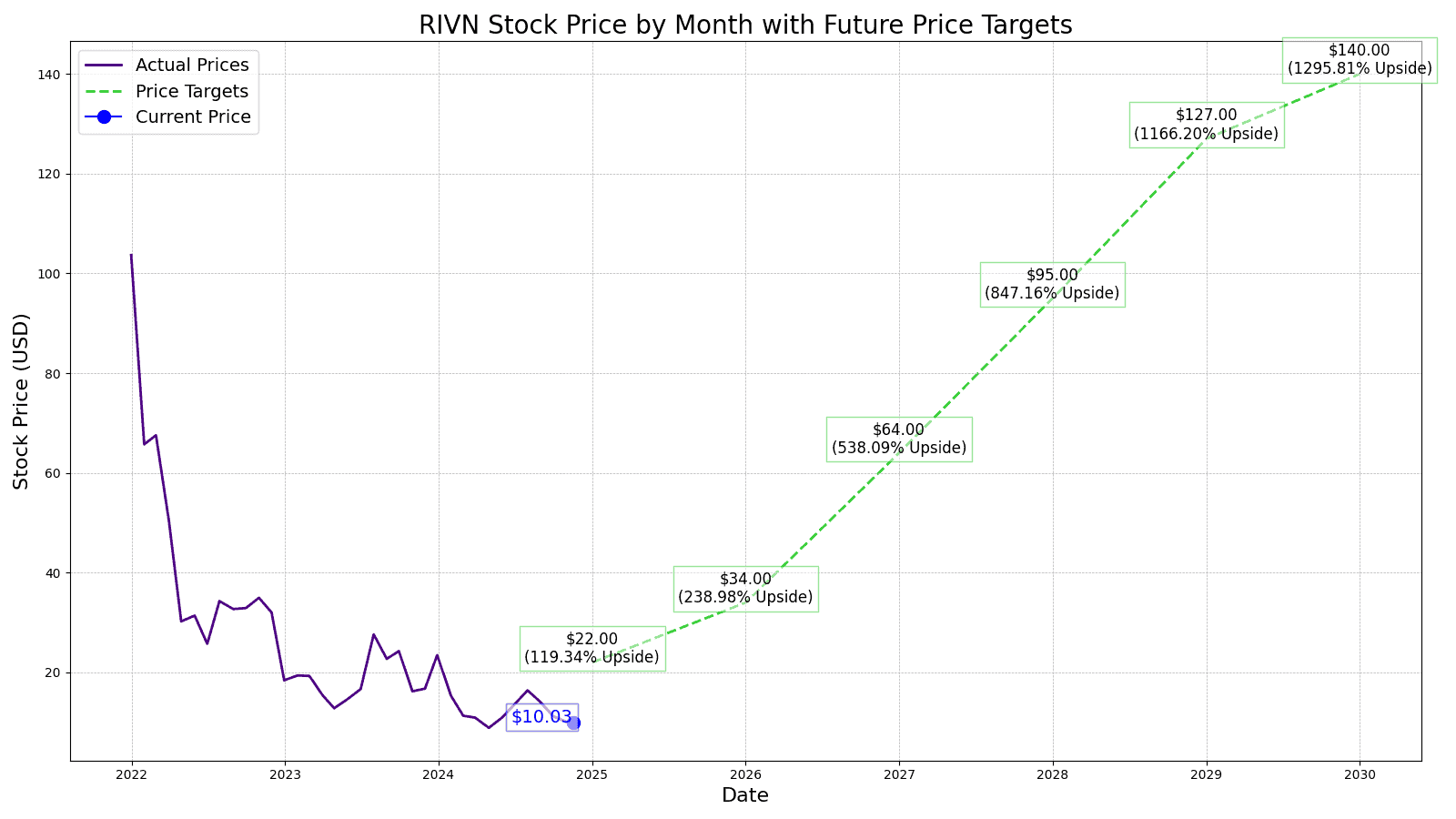

But as the COVID lockdown investing frenzy died out, it left an SUV-sized hole in Rivian’s stock price, currently trading for $10.03 per share, down 87.14% since its IPO 3 years earlier.

24/7 Wall Street aims to provide readers with our assumptions about the stock prospects going forward, what growth we see in Rivian for the next several years, and what our best estimates are for Rivian’s stock price each year through 2030.

Key Points in this Article:

- Key growth drivers include cost reduction in EV components and increased production capacity, targeting profitability by 2027.

- Rivian aims to cut material costs by 45% with the introduction of its Gen 2 platform by 2026.

- If you’re looking for a megatrend with massive potential, make sure to grab a complimentary copy of our “The Next NVIDIA” report. The report includes a complete industry map of AI investments that includes many small caps.

Recent Rivian Stock Updates and News

11/18/2024

Volkswagon announced that it will increase its investment in Rivian, leading to a rise in Rivian’s stock today.

11/11/2024

Investment firm Stifel has adjusted its price target for Rivian from $18.00 to $16.00 today. However, the firm maintains a “Buy” rating on the stock. Rivian’s stock price rose 1.9% today, trading as high as $10.80.

11/8/2024

Rivian suffered through a tough third quarter due to supply chain issues, as seen in the company’s recent Q3 earnings report. Even though Rivian managed to produce and deliver a significant number of vehicles, the high costs and low revenue led to a loss of nearly $30,000 per vehicle.

11/7/2024

Rivian is scheduled to report its Q3 earnings today after market close. With its recent supply chain issues impacting production, investors are concerned that the company may experience its first revenue decline since going public.

11/6/2024

Guggenheim’s equities researchers have decreased Rivian’s target price from $21.00 to $18.00 with a “buy” rating on the stock.

11/5/2024

Rivian is set to release its third-quarter financial results on November 7th. During the same quarter last year, Rivian reported a significant loss of $1.37 billion, equivalent to $1.44 per share. However, the company generated $1.34 billion in revenue and produced 16,304 vehicles. In the second quarter of this year, Rivian exceeded Wall Street’s expectations by posting a loss of $1.13 per share and automotive revenue or $1.16 billion.

10/29/2024

David Hasselhoff is back as Michael Knight in a new YouTube ad for Rivian. This special Halloween update from Rivian allows owners to dress up their electric vehicles in fun “costumes”, including a Knight Rider-inspired look, until November 4th.

10/25/2024

Rivian is introducing a new pre-owned sales program for its R1T and R1S models, offering consumers a more affordable entry point into owning an electric vehicle.

10/24/2024

Rivian’s stock price is rising because of positive news about Tesla’s recent performance, as investors are more optimistic about the electric vehicle market.

10/23/2024

Rivian’s stock is plummeting today following a Bloomberg report that highlighted 16 serious OSHA violations at the company’s Normal, Illinois factory over the past 21 months. These incidents included severe injuries like a cracked skull and an amputated finger, as well as employees experiencing adverse health effects from exposure to paint without adequate protection.

Life and Business are Not Easy For an Automotive Start-Up

The following is a table of Rivian’s revenues, operating income, and share price for the first few years as a public company.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2021 | $50.24 | $55.0 | ($4,220.0) |

| 2022 | $19.30 | $1,658.0 | ($6,856.0) |

| 2023 | $10.70 | $4,434.0 | ($5,739.0) |

| TTM | $15.35 | $4,997.0 | (5,790.0) |

Revenue and net income in $millions

Now let’s take a look at Tesla in the first few years it manufactured and sold the Model S (the official launch of the Model S was June 22, 2012).

| Share Price (End of Year) |

Revenues | Operating Income | |

| 2011 | $2.24 | $204.2 | ($251.5) |

| 2012 | $2.25 | $413.3 | ($394.3) |

| 2013 | $16.87 | $2,013.5 | ($61.3) |

| 2014 | $13.81 | $3,198.4 | ($186.7) |

While revenue growth for both firms after launching their first mass-market vehicles is similar, Tesla’s operating expenses were much more favorable, particularly around SG&A and R&D expenses.

Elon Musk, Tesla’s CEO, has always been a proponent of word-of-mouth marketing and a hawkish approach to minimizing product costs, allowing his company to stay afloat while moving to new lines of automobiles.

The biggest question facing Rivian investors today is, can they lower costs, and when will positive net income be realized?

Key Drivers of Rivian’s Future Stock Performance

- EV Technology and Cost Curves: Rivian’s next generation (G2) R1 vehicles are designed for performance upgrades while at the same time reducing component costs. For example, the number of electronic components will be reduced by 60%, over 60 parts will be eliminated, the compact motor will be redesigned, and close to 2000 connections or welds will be removed. These changes alone are expected to drop materials costs by 20% and speed up the assembly line by 30%. Looking into the back half of 2026, Rivian sees a material cost reduction of 45% for the R2 line of vehicles. Rivian is also investing in enhanced advanced driver assistance systems with improved cameras, radar, and NVIDIA-powered computing power, creating highway assist and 360-degree visibility.

- Electric Vehicle Demand and Incentives: Rivian is currently delivering around 13 thousand vehicles per quarter, which is above analyst estimates, and producing 9 thousand new G2 vehicles per quarter, which keeps it on pace to produce 57,000 units in 2024. The total plant capacity is 215,000 vehicles with expansion plans of 400,000 additional vehicles in Georgia.

- Management’s Path to Profits: Rivian also expects profitability from the R1 platform through premium configurations and scale benefits. The company targets positive adjusted EBITDA by 2027, with long-term goals of 25% gross margin, high teens adjusted EBITDA margin, and 10% FCF margin

- Material cost Reduction: The introduction of the Gen 2 platform and commercial cost downs are expected to reduce material costs by ~20%.

- Fixed Cost Reduction: Improved labor and overhead costs, reduced depreciation, and lower LCNRV charges due to a 30% increase in production line rate and design changes.

- Increased Revenue from Credits: Strong demand for regulatory credits, with over $200 million contracted for FY24.

Rivian (RIVN) Stock vs. Tesla Stock: Why Rivian Receives Different Treatment

Taking a historic look at pricing Rivian stock would start by comparing the sales multiples Tesla received in 2012 to 2015 when the Model S scaled. Tesla was feeling the weight of expansion and keeping its debt load manageable and the market-priced Tesla stock was close to 10x sales.

While Rivian is in a similar situation, albeit with more debt and higher expanses, the market is only valuing the stock at under 3 times sales. Let’s take a look at why that is the case.

- Market Position and Brand Recognition:

- Tesla: By 2011-2015, Tesla had already established itself as a leading innovator in the electric vehicle (EV) market, with significant brand recognition and a first-mover advantage.

- Rivian: Rivian is relatively new to the market and still building its brand and market position.

- Production and Sales Volumes:

- Tesla: From 2011-2015, Tesla ramped up production and sales, particularly with the Model S, which was gaining popularity and market traction.

- Rivian: Rivian is still in the early stages of production, with limited sales volumes compared to Tesla’s growth phase.

- Investor Expectations and Sentiment:

- Tesla: Investors had high expectations for Tesla’s future growth and disruptive potential in the auto industry, leading to higher valuation multiples.

- Rivian: While Rivian has potential, it has not yet demonstrated the same level of market disruption or growth trajectory that Tesla did during its comparable early years.

- Competitive Landscape:

- Tesla: Had fewer direct competitors in the EV space during its early years, allowing for a larger market share and higher investor confidence.

- Rivian: Faces more competition from established automakers entering the EV market and other new entrants, impacting its relative valuation.

Rivian(RIVN) Stock Forecast Through 2030

| Year | Revenue | Shares Outstanding | P/S Est. |

| 2025 | $6,680.64 | 978 mm | 2x |

| 2026 | $10,675.45 | 978 mm | 2x |

| 2027 | $16,491.69 | 978 mm | 2.5x |

| 2028 | $25,124.38 | 978 mm | 2.5x |

| 2029 | $37,538.90 | 978 mm | 2.5x |

| 2030 | $49,394.84 | 978 mm | 2.75x |

Revenue in $millions

Rivian Share Price Estimates 2025-2030

How Rivian’s Next 5 Years Could Play Out

Wall Street analysts have Rivian’s stock price over the next year to be $17.00 which gives the stock a 69.49% upside over today’s price. Of the 28 analysts covering the stock, the consensus recommendation is a 2.1 ‘Outperform’ Score.

We expect to see strong revenue growth of 60% for 2025 and a price-to-sales multiple of 2x, which puts our price target at $21.82.

Going into 2026, we estimate the price to be $33.72, with another strong 50%+ revenue bump. However, with EBITDA still well in the negative, we see the market not rewarding the stock as much and giving it a lower valuation multiple.

Heading into 2027, we expect the stock price increase to leap forward to $64.30 with another strong 50%+ revenue growth year-over-year. That is a 97% year-over-year gain and up 541.08% from today’s stock price.

When predicting more than 3 years out, we expect Rivian’s P/S ratio in 2028 to be 2.5x and top-line growth of 50%. In 2028, we have Rivian’s revenue coming in around $25 billion, suggesting a stock price estimate at $95.00 or a gain of 847.16% over the current stock price.

24/7 Wall Street expects Rivian’s stock to continue its revenue growth and to generate $37 billion in revenue. The stock price in 2029 is estimated at $127.00, or a gain of 1166.20% over today’s price.

Rivian Stocks Price Target for 2030

We estimate Rivian’s stock price to be $140.00 per share. Our estimated stock price will be 1295.81% higher than the current stock price of $10.03.

| Year | Price Target | % Change From Current Price |

| 2024 | $17.51 | Upside of 74.58% |

| 2025 | $22.00 | Upside of 119.34% |

| 2026 | $34.00 | Upside of 238.98% |

| 2027 | $64.00 | Upside of 538.09% |

| 2028 | $95.00 | Upside of 847.16% |

| 2029 | $127.00 | Upside of 1166.20% |

| 2030 | $140.00 | Upside of 1295.81% |

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.