Investing

3 Blockchain Stocks That Could Benefit from a Trump Presidency

Published:

Last Updated:

Former President Donald Trump has shifted from his previous criticism to a more favorable view of cryptocurrencies, recognizing their potential benefits. This change was evident in recent speeches, including at the Bitcoin Conference in Nashville, TN.

Now, Bitcoin (CRYPTO:BTC) hasn’t performed as well as many would have hoped with the recent tech selloff we’ve seen in recent days. A collapsing Yen carry trade, and a search for liquidity, has led to selloffs of other safe haven assets, from gold to Bitcoin.

But if we do live in a future where Bitcoin’s long-term fundamentals do hold value in terms of a store of value, and the right political backdrop supports the world’s top cryptocurrency, it’s possible another leg higher in this crypto bull market could be upon us. That’s why many investors are viewing Trump’s recent pivot to being very crypto friendly as conducive to rising prices, as a supportive regulatory environment potentially takes hold. Many billionaires are now donating to his campaign, which Mark Cuban calls “the Bitcoin play.”

No matter where you stand on the political spectrum, it’s true that the outlook for the crypto sector varies widely across the two campaigns voters are considering. Let’s dive into the top three blockchain stocks that could benefit from a potential Trump presidency, and a return to a bull market in crypto.

Coinbase (NASDAQ:COIN) was expected to report lower Q2 trading volumes and revenue, with revenues projected to fall from $1.6 billion to $1.36 billion due to stable bitcoin prices. Despite these projections, analysts at Oppenheimer believe the stock’s potential remains strong, especially with the upcoming election. These analysts are among a growing cohort that believe that decreased trading volumes, down 31% from the previous quarter, were influenced by pre-halving price adjustments and ETF outflows.

Coinbase reported $1.4 billion in Q2 revenue, slightly above Oppenheimer’s $1.36 billion estimate but below Q1’s $1.6 billion. Transaction revenue fell 27% to $781 million, while subscriptions and services brought in $600 million. That said, transactions on Base grew 300% quarter-over-quarter. Coinbase highlighted significant progress in regulatory clarity and the advancement of crypto legislation as positives during the quarter, noting over 1.3 million crypto advocates in swing states and growing political support.

Analysts forecast increased revenue from stablecoins and blockchain, with USDC showing signs of recovery. Some experts continue to focus on Coinbase’s international growth and the potential of its Coinbase International Exchange, which saw $76 billion in Q1 trading revenue, as key to the company’s long-term bullish thesis. I’m of the view that if the crypto bull market continues, Coinbase should be a no-brainer stock that will benefit from this move as transaction volumes increase among individual and institutional investors.

In July, MicroStrategy (NASDAQ:MSTR) added 169 Bitcoin worth $11.4 million to its haul. This increases the company’s total reserves to 226,500 Bitcoin at an average price of $36,821. Indeed, as far as a Bitcoin holding company is concerned, MicroStrategy remains a top option for investors who seek high liquidity and direct crypto exposure, without the fees many exchange traded products provide.

MicroStrategy reported a $102.6 million net loss due to digital asset impairment in Q2, reflecting lower market prices than the company’s purchase cost. Despite this setback, subscription services revenue rose 21% year-over-year. MicroStrategy’s total Bitcoin holdings, valued at $8.3 billion, include an additional 12,222 coins acquired in the quarter.

MicroStrategy scheduled a 10-for-1 stock split for a $2 billion equity offering on August 8. CEO Phong Le remained optimistic about Bitcoin, while CFO Andrew Kang highlighted careful capital management as key to the company’s long-term success. Despite bold strategies, investor concerns persisted due to Bitcoin’s price volatility and significant impairment losses. That goes double for those concerned about the company’s capital raises to purchase more Bitcoin, particularly near the digital asset’s most recent peak.

MicroStrategy saw a 12.2% increase in year-to-date BTC Yield, a key measure of its Bitcoin strategy. The firm serves as a role model for traditional companies like Metaplanet, which recently joined “Bitcoin for Corporation” and acquired over 225 BTC in four months. These companies have seen long-term sustainability, value storage, and are viewed as key ways to play the crypto rally long-term. Those seeking more direct exposure to Bitcoin may want to consider this option as a pure play on the publicly-traded stock market.

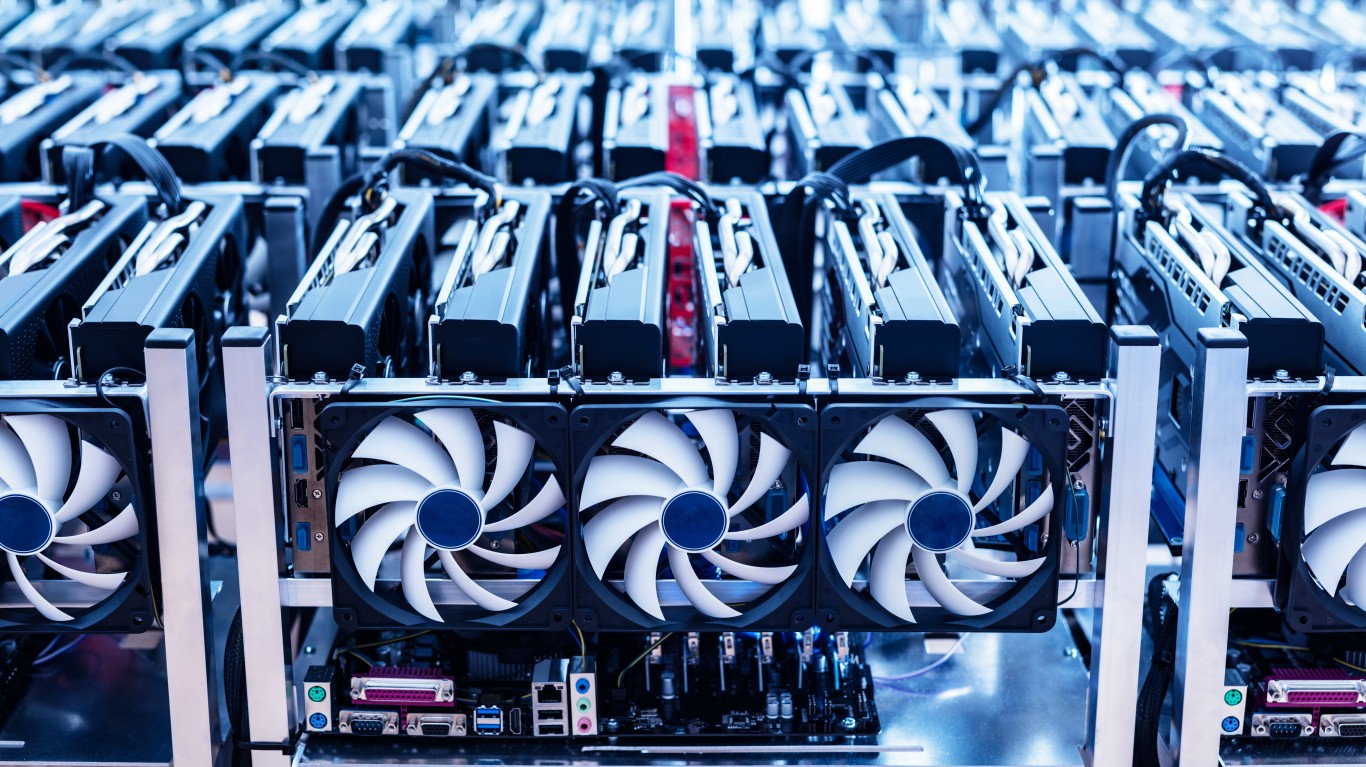

With the Vance-Trump tandem now set to revamp the regulatory environment around Bitcoin, various Bitcoin miners are also coming into focus. Companies like Marathon Digital (NASDAQ:MARA) are top options in this space investors continue to look to for upside, as Bitcoin prices potentially move higher.

Marathon Digital is among the top Bitcoin miners in the world, with $162.5 million in revenue generated in Q1 2024 alone. The company’s focus is on mining Bitcoin, but Marathon Digital has also recently moved into mining Kaspa, with 93 million KAS tokens worth $15 million mined as of late June. This move diversifies the company’s revenue, and provides an intriguing vertical for investors to consider.

With the company’s total Bitcoin holdings increasing 28% year-over-year, Marathon Digital is another option investors can look to as a way to play rising crypto prices over time. Now, Marathon Digital does fund some of its operations using Bitcoin, so the question is how many tokens the company can accumulate relative to how many it’s forced to sell over time.

But with the company expanding beyond bitcoin mining into tech and energy ventures, there’s a lot to like about this particular Bitcoin miner’s long-term viability. Those looking for a more diversified way to play growth in this space may certainly want to consider this stock moving forward, in my view.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.