Key Points

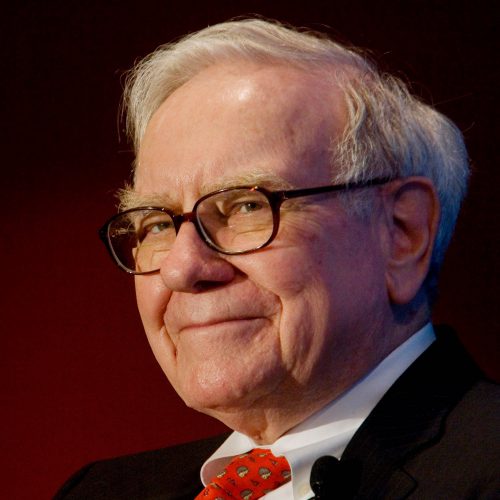

- Warren Buffett turns 94 on August 30.

- Last week, he made headlines for reducing his position in Apple.

- Over the years, the Oracle of Omaha has provided a wealth of knowledge to investors.

- Also: Don’t miss out on these Two Dividend Legends to Hold Forever

Warren Buffett made headlines last week when he announced that Berkshire Hathaway Inc. (NYSE: BRK.A/BRK.B) was cutting its position in Apple Inc. (NASDAQ: AAPL) by about half, with its position going from 790 million shares to 390 million shares with a valuation of roughly $84.2 billion.

But in his 93 years on Earth, the famed investor, philanthropist and Berkshire Hathaway chairman has also made headlines by distilling loads of sage advice.

And although he has sometimes mixed in humor — like his witty remark, “I buy expensive suits; they just look cheap on me” — the focal points of many of his musings provide sound takeaways for investing, money management and personal finance.

Here are three Warren Buffett quotes about money that everyone should be aware of.

No. 1: “Someone is sitting in the shade today because someone planted a tree along time ago.”

It is unclear how much of Buffett’s roughly $130 billion fortune will be given to each of his three children, but no matter what that amount winds up being, it will be significant and due to the seeds he sowed long ago.

While Albert Einstein is credited with labeling compound interest as the eighth wonder of the world, this Buffett quote insinuates something similar — that is, sticking to long-term plans will help produce bounty down the line. The takeaway for savers and investors alike is that patience pays, and with time comes reward.

Whether the goal is to provide a security net for your children, ensure your partner is taken care of after you are gone or to create generational wealth that will help your family’s finances for generations to come, your efforts today can go a long way in benefitting them in the future.

No. 2: “Only when the tide goes out do you discover who’s been swimming naked.”

Anyone can find success during a bull market. And while anyone can make bad investments, it is considerably easier to find good ones when the S&P 500 is pumping. But where investors prove their mettle is during downturns and outright bear markets. That is when those who have been embracing strategies with outsized risk are exposed, and those who know how to reallocate accordingly can make it back to land safely.

Whether or not the markets are currently heading for a correction or crash, being prepared is always ideal. One example of this is portfolio rebalancing with a risk-off approach. This could entail anything from moving away from asset classes that experience higher volatility to rotating out of growth stocks and into value stocks.

Certain sectors always provide safety and shelter during down markets. Think of wants rather than needs: utilities, which provide home with electricity; energy, which provides the gas upon which America relies; and consumer staples, which provide the food, clothing and other necessities of life.

The market may be in the midst of a bull run, but if the past few weeks’ massive stock market sell-offs have taught us anything, it is that conditions can change in an instant. Being prepared and having a plan in place will help shelter you from the storm.

No. 3: “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.”

The lesson here is that buy-and-hold investors are more likely to find success than short- and medium-term traders. In fact, from 2010 through 2021, in any of those given years, between 55% and 87% of actively managed funds failed to beat the benchmark index.

If professional traders and fund managers are mostly incapable of beating the market on a year-by-year basis, retail investors should focus on the long term. According to U.S. News & World Report, “it may take longer for buy-and-hold investors to see returns,” but the end product is statistically more fruitful. “Buy and hold can result in significant capital gains, which are often taxed at a lower rate than short-term gains.”

Additionally, it has been found that a mind-boggling percentage of short-term traders ultimately lose money. While only 1% to 20% find success in the near term, as few as 1% of day traders are able to maintain profitability over five years or more.

In this regard, Buffett’s takeaway is to not focus on buying stocks, but rather to focus on buying companies. Taking that a step further, he is a proponent of buying fundamentally sound companies with strong historical track records and impenetrable competitive moats that ensures reduced competition in an industries that are resilient and in high demand.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.