Investing

Defensive Dividends, Oh My! 3 Top Income Picks to Buy Right Now

Published:

Dividend investing remains popular for steady income and long-term growth. Stocks with significant yields often face short-term challenges, but may outperform benchmarks like the S&P 500 over a long-term time horizon. Additionally, companies that pay relatively high yields can allow growth investors to reinvest their dividends, providing unreal compounding power, particularly if these stocks continued to see capital appreciation as well over time.

The three companies on this list all provide reasonable yields, in line with or slightly lower than longer-term bonds right now. But for those betting on interest rate cuts from the Federal Reserve, these yields could soon become very attractive. That’s the benefit loading up on value-first dividend-paying stocks can provide when the tides turn.

So, no matter whether you’re in the recession camp or among the group of investors who see only good times ahead, I think these are three stocks worth your attention right now. Let’s dive in.

A top defensive stock in the market, Restaurant Brands (NYSE:QSR) is also a top dividend pick. With a current dividend yield of 3.3%, this fast food giant continues to pass on its cash flow growth to investors. Over time, I expect these distributions to increase, supported by the global growth the company expects to see from its core banners which include the likes of Tim Horton’s, Burger King, Popeye’s and Firehouse Subs.

Over time, the company expects to expand to a global footprint of more than 40,000 locations, supporting more than $60 billion in revenue. That’s staggering, and would make the stock very attractive on a price-sales basis alone, considering the company is currently valued at a market capitalization of just $31 billion. More market expansion, particularly into high-growth areas of the globe in Asia and Latin America, should bode well for the current investor base.

The great thing about this top large-cap dividend stock is that it’s relatively a lot cheaper than it once was. When I first started looking at the Burger King parent, its multiple was closer to 35-times. As the company’s grown, it’s gotten cheaper, and its yield has actually increased. That’s a rarity in this world, with most such stocks sustaining a relatively stable yield over time.

I think this is a long-term dividend stock that’s worth holding for its strong fundamentals and growth prospects. Those thinking long-term may want to give this stock some consideration.

Ranking second in the beverage sector and also dominating the snack sector, global leader PepsiCo (NASDAQ:PEP) is a stock to own for investors seeking stable gains. The company has been consistent with its generous dividends, with a quarterly dividend raised by 7%. Currently yielding around 3.1%, PEP stock remains a top holding of many prominent institutional investors, for good reason.

On July 11, PEP shares declined following a mixed Q2 results and lowered 2024 guidance and estimates. The company reported a $22.5 billion revenue, which came in slightly below its estimates. That said, there are reasons for this underperformance. For one, the company’s weak North American showing can be tied to its beverage segment which saw slower growth in certain pockets of the market, with the company’s Quaker Oats brand seeing stark declines.

Concerns around the potential long-term headwinds GLP-1 drugs will provide have also contributed to these declines. Personally, I think these concerns are overblown. Over the long-term, consumers will continue to reach for affordable snacks from the brands they know and love. In this regard, Pepsi’s core portfolio remains one of the best in this sector. And with pricing power to boot, this is a stock that could be a key winner from long-term trends in consumer discretionary spending, inflation or no.

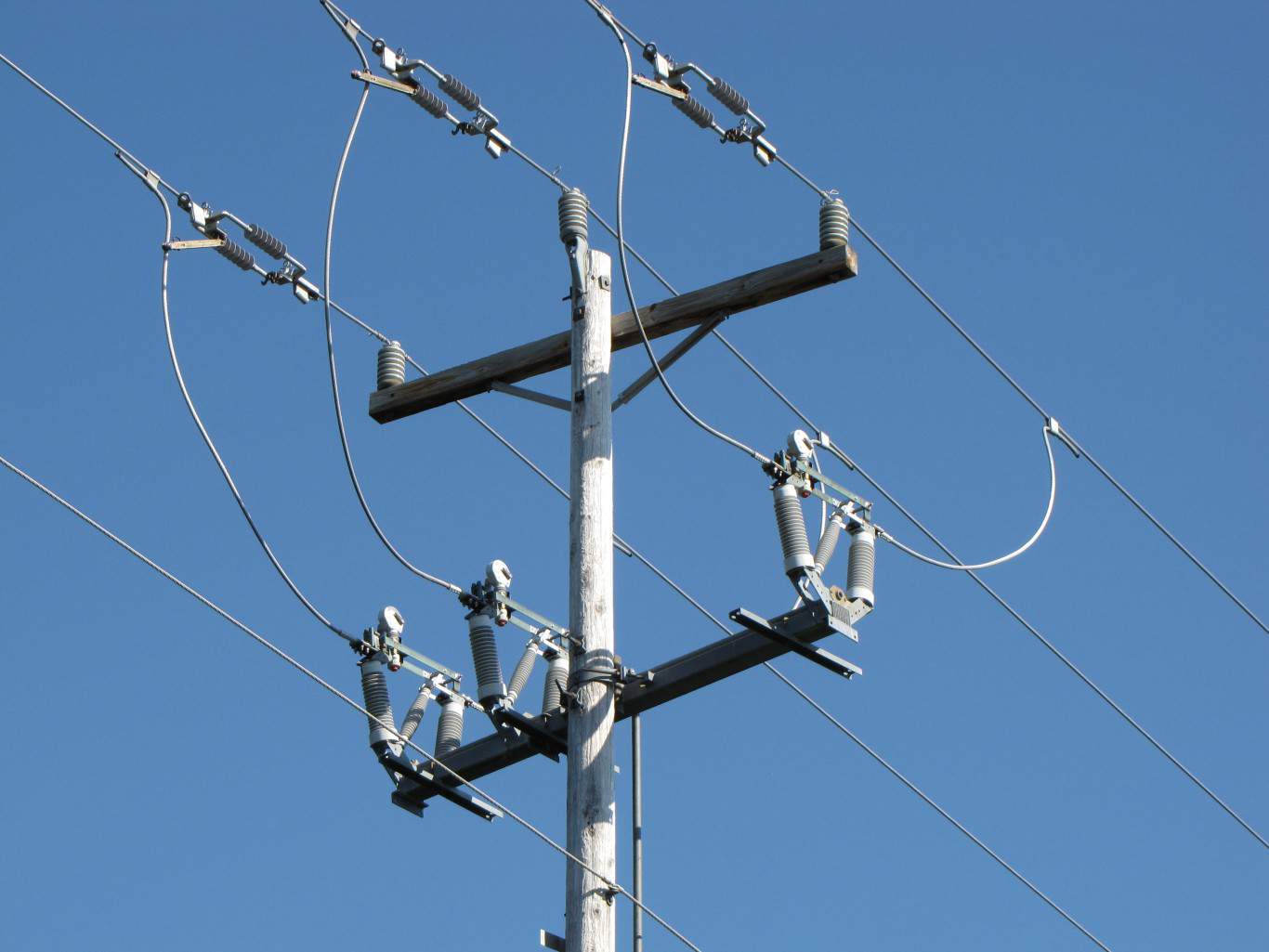

Perhaps the most truly defensive pick on this list, American Electric Power (NASDAQ:AEP) is a utilities giant to behold. The company’s core electricity generation, distribution, and transmission business provides rock-solid cash flows from which the company pays a 3.6% yield. Indeed, for long-term investors look to create a passive income stream, utilities companies have proven their worth as top options to consider in this area of the market.

The company recently provided strong earnings, with its EPS coming at $1.35 for the past fiscal year. The company did miss its Q4 target. However, many in the market still believe AEP stock is undervalued, and for good reason. At just 19-times earnings, it’s hard to find a company with the fundamental stability and dividend growth profile to match in this current market.

Now, American Electric Power is about as far from a “sexy” stock as they come. There are plenty of AI plays for investors to choose from for growth. But for those seeking consistency and defensiveness in this current market, there’s something comforting about owning such a solid dividend paying stock in this current environment.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.