24/7 Wall St. Insights

- We used data from the Social Security Administration and State Laws

- Many states provide exemptions for Social Security income, giving retirees extra breathing room.

- Also, Discover “The Next NVIDIA”

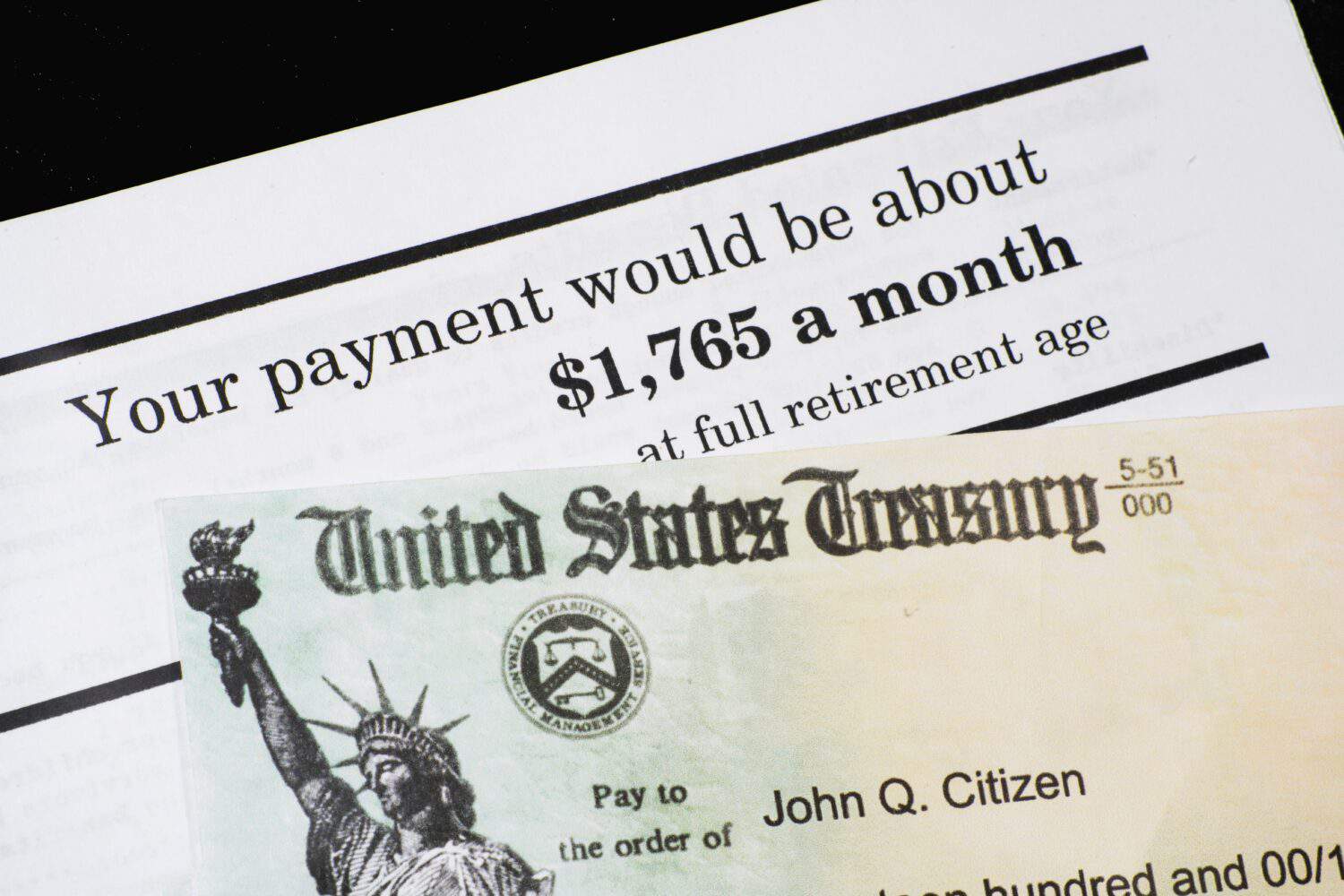

Many retirees are surprised to learn that their Social Security benefits may be taxed by the Federal government and even some states! Most retirement dreams are built on the foundation of financial security, and for many Americans, Social Security benefits are the cornerstone of that security. Luckily, most states don’t fall into this category. Many states provide exemptions for Social Security income, giving retirees extra breathing room. If you live in one of these states, your benefits can stretch further.

We dove into the laws surrounding each state to give you an accurate depiction of the taxes they may collect from your Social Security (or not). Below, we’ve listed all states without Social Security taxes in no particular order.

Generally, these states fall into two different categories. They either have no income tax at all or provide exemptions for those receiving Social Security.

Why Does This Matter?

As the grocery bill climbs and gas prices become ridiculous, making the most of your retirement income becomes even more important. Many retirees rely on Social Security, and taxes only reduce the amount of money in their pockets. If you don’t live in one of the states mentioned below, you may need to budget for extra taxes on your Social Security income.

You can learn more about planning for retirement on our Social Security hub page.

1. Alabama

Alabama does not have any state-level income tax at all. Therefore, you don’t have to worry about paying taxes on your Social Security income.

2. Arkansas

Arkansas offers retirees a natural financial advantage, allowing them to skip paying their Social Security taxes.

3. Florida

Florida is another state without income taxes, which means they also don’t require taxes to be paid on Social Security income.

4. Georgia

Georgia exempts Social Security from state income tax, so you can focus on enjoying your golden years. The vast majority of Social Security retirees qualify.

5. Louisiana

Louisiana lets you keep all of your Social Security benefits despite having a state income tax. They have laws exempting Social Security from these taxes.

6. Oklahoma

Oklahoma also joins the ranks of states that don’t tax your Social Security, giving you more freedom in your golden years.

7. South Carolina

South Carolina keeps your Social Security benefits out of the state taxman’s grasp so you can relax and enjoy the Lowcountry charm. The state does have an income tax, but they provide exemptions for Social Security.

8. Tennessee

The Volunteer State has no income tax, allowing retirees to keep their whole Social Security check in their pockets.

9. Texas

Texas is another state that doesn’t have any state income tax, allowing everyone to keep as much of their income in their pocket as possible. This includes retirees receiving Social Security.

10. Virginia

Virginia offers a tax-free haven for your Social Security. They do have a state income tax, but they don’t make retirees pay taxes on their Social Security.

11. Alaska

Since there’s no state income tax here, your retirement income stays yours. It’s one of the few states that doesn’t implement an income tax at all.

12. Arizona

Retirees in Arizona get to keep their whole Social Security check, thanks to the state’s specific exemptions.

13. California

The Golden State also exempts all Social Security income from the state income tax, making your retirement a little bit brighter.

14. Colorado

Colorado is a bit complicated. They allow retirees to deduct up to $24,000 of Social Security benefits from their income, which removes the Social Security tax in practice (though not necessarily in name).

15. Hawaii

Hawaii also exempts those receiving Social Security benefits from paying state income taxes on those benefits. However, they do have a state income tax that may affect other portions of your income.

16. Idaho

Idaho does have a state income tax. However, they offer exemptions for Social Security benefits.

17. Illinois

Social Security benefits are also exempt from Illinois state income tax. However, you may have to pay tax on other parts of your income.

18. Indiana

Indiana exempts Social Security, letting you enjoy all the state has to offer tax-free. This is through exemption, though, as the state does have an income tax.

19. Iowa

Iowa offers tax cuts to retirees by exempting Social Security from state income taxes. Therefore, you can keep a bit more money in your pocket if you live in this state.

20. Mississippi

Thanks to their exemptions, Mississippi allows you to keep as much of your income in your pocket as possible. You don’t have to worry about paying your Social Security benefits taxes here.

21. New Hampshire

New Hampshire has no income tax, so you don’t have to worry about paying taxes on your Social Security or any other income. However, they do have other taxes, like sales tax.

22. South Dakota

South Dakota is another state that doesn’t have any income taxes. You won’t have to worry about paying income tax at the state level, but federal taxes still apply.

23. Washington

Washington is another state that doesn’t have any state income tax. Instead, the state is funded through other taxes, like sales and property taxes.

24. Wyoming

Wyoming may not be one of the most popular places to retire, but it has no income tax. Because no one pays income tax, you don’t have to worry about your Social Security income being taxed, either.

25. Delaware

Delaware does have a state income tax. However, they do not count Social Security income for this purpose.

26. Kentucky

Kentucky does have an income tax, but they don’t include Social Security income in this category. Therefore, retirees don’t have to worry about paying taxes on their Social Security.

27. Maine

Maine is another one of those states that has an income tax but exempts Social Security income from these taxes.

28. New Jersey

New Jersey does have an income tax, but they don’t count any Social Security income towards this tax. Other types of income may be counted, though.

29. New York

New York also recently exempted those with Social Security income from paying taxes on that income.

30. North Carolina

Just like in South Carolina, you don’t have to pay state-level income taxes on your Social Security benefits in North Carolina, either.

31. Ohio

Ohio has joined the majority of states that don’t require Social Security income to be counted as income for tax purposes. Therefore, you don’t have to worry about paying income taxes.

32. Pennsylvania

Pennsylvania also doesn’t require Social Security benefits to be counted as income for tax purposes. While they do have an income tax, this factor prevents retirees from having to pay taxes on their Social Security income.

33. West Virginia

West Virginia is like many states on this list. They do have an income tax. However, they don’t count Social Security benefits as income for this purpose.

34. Nevada

Nevada has no state income tax at all. Therefore, you don’t have to worry about paying taxes on any amount of your income.

35. Maryland

Maryland exempts all Social Security benefits from their state income tax. That said, retirees will have to pay federal income taxes, just like in every other state.

36. Massachusetts

Massachusetts is like most of the states on this list. While they do have a state income tax, they don’t count Social Security benefits as income for the purpose of taxes, exempting more retirees from paying any income tax.

37. Michigan

Michigan absolutely has a state income tax, but most retirees don’t have to pay it. They exempt Social Security benefits from this tax, but they may require retirees to pay on other income they receive.

38. North Dakota

While others must pay income tax in North Dakota, this doesn’t apply to retirees who only receive Social Security. You only have to pay income tax if your other income exceeds a certain tax bracket.

39. Oregon

Oregon doesn’t require any retirees to pay income taxes on their Social Security income, leaving you with more money in your pocket.

40. Wisconsin

Wisconsin also doesn’t require retirees to pay taxes on Social Security benefits, though they do have a state-level income tax.

Bonus: 41. District of Columbia

The District of Columbia is not a state. However, they don’t require income tax to be paid on Social Security, so we added them to this list, too.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.