Investors love stocks that give high-quality, consistent returns, and blue chip stocks are just the type that can provide the kind of portfolio stability so many are after. Blue chip companies are those with proven track records in the market that operate with strong business models. These companies tend to provide reliable dividends and consistent stock price appreciation, making them easier to forecast over the long-term. Accordingly, it should be no surprise that many institutional investors focus on the quality metrics that lead their funds to hold such securities as long-term investments.

Wall Street often debates between the value of upside potential relative to the predictability and stability of the returns many blue-chip stocks can provide. Higher-risk strategies might offer big rewards but come with vulnerabilities, while a strong defensive portfolio focuses on stability, exemplified by blue-chip stocks. Investing in established, high-quality companies, known for their steady performance and wide recognition, is a safer bet. These large-cap firms offer reliability, similar to making consistent, incremental gains rather than risky, high-stakes moves.

With that said, let’s dive into three notable blue-chip stocks investors should already be aware of, and why these companies may be excellent bets in this current environment.

Key Points About This Article:

- Blue-chip stocks provide an element of stability and predictability to portfolios, which is what leads many top institutional investors to own these stocks over the long-term.

- Here are three such companies that look well-positioned to flourish over time, no matter what part of the economic cycle we could be headed into.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

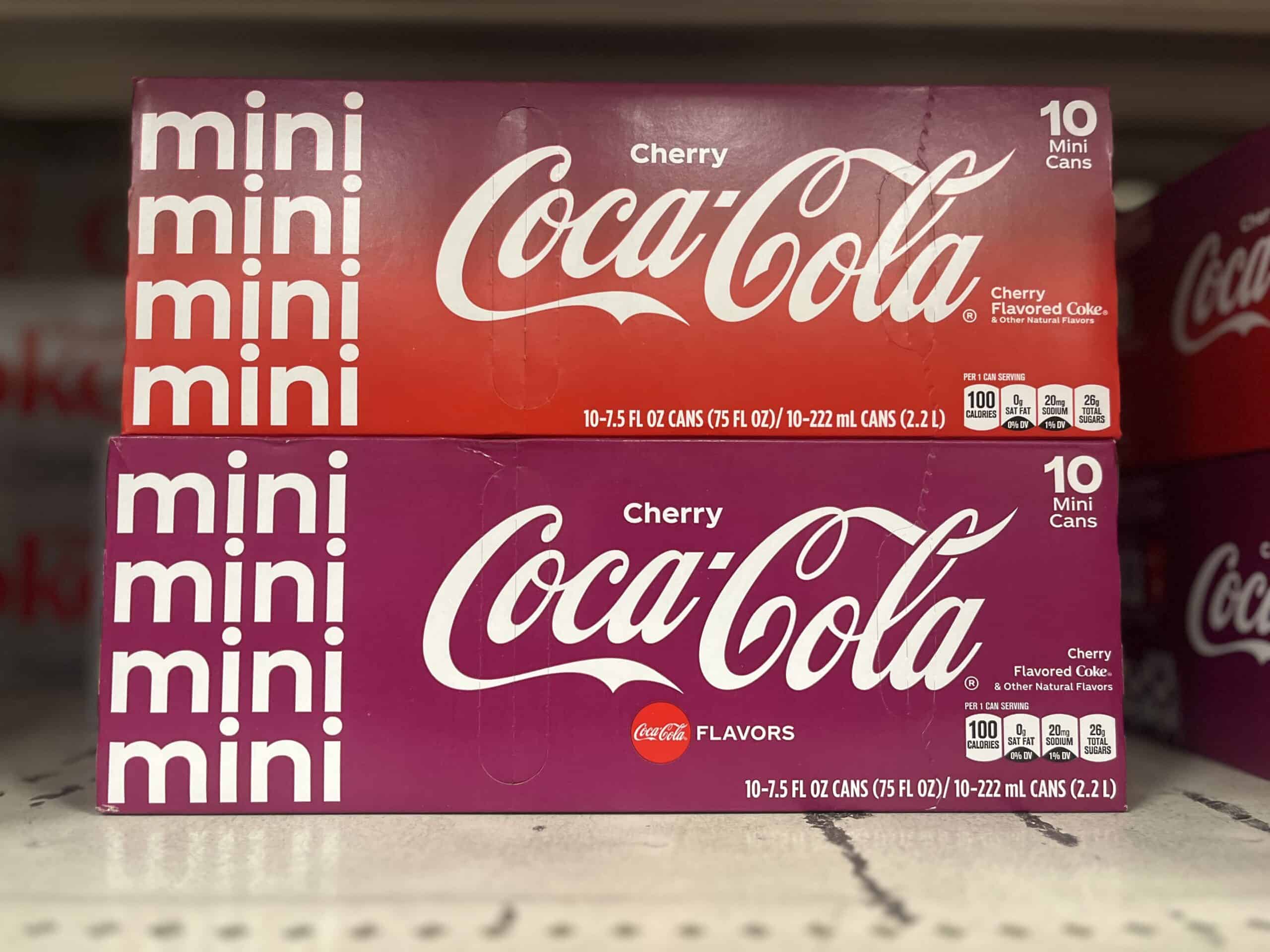

Coca-Cola (KO)

One of the best blue-chip and defensive stock to own is beverage giant Coca-Cola (NYSE:KO). Some investors may certainly point to Coca-Cola’s recent results as a reason to own this stock. In fact, KO stock has performed very well this year, gaining 15% on a year-to-date basis. That’s a lot better than the returns many higher-beta stocks have provided of late, and that’s not even accounting for the stock’s meaningful 2.8% yield.

A company with a very loyal customer base and a world-renowned brand, Coca-Cola remains a stalwart a number of prominent investors (such as the man I’m going to discuss below) have owned for a very long time. And it does appear that the company continues to run on all eight cylinders.

In Coca-Cola’s Q2 2024, the company reported strong results. Its earnings report beat estimates, outpacing its own revenue and earnings forecast for this year. Net income reached $2.41 billion, driving strong earnings per share which came in at $0.56 cents. As far as stable returns in an era of uncertainty, this otherwise boring consumer discretionary stock continues to outperform.

In 2024, Coca-Cola upgraded its revenue growth estimates to 10% from 8%, while earnings growth forecasts were also revised from 5% to 6% at the higher end of the range. CFO John Murphy says that the revised guidance numbers were due to the company’s excellent performance in Q1. The stock surged 1% in the morning trading, attracting investors to buy KO.

Over the long-term, it’s hard to bet against Coca-Cola. And while the company’s valuation multiple has increased in part due to strong investor buying interest in the name following these results, it’s my view that further strong fundamental performance should drive additional upside from here.

Berkshire Hathaway (BRK-B)

Another top stock to consider during market crashes is Warren Buffett’s Berkshire Hathaway (NYSE:BRK-B). Although the company doesn’t pay dividends, its diverse portfolio of dividend-paying stocks helped it achieve a $277 billion cash reserve. Its noble history of effective capital management and buybacks are also commendable. If ever Berskhire does plan to issue dividends, the stock could soar much, much higher from here.

In June, Berkshire reported operating income growth of 15.5%. Strong insurance results also drove higher pricing claims, offsetting weaknesses in other segments. Investment income also surged due to decreased Treasury bill holdings, reaching $6.9 billion in Q2 2024. This income boost as well as notable divestitures (which have led to a cash stockpile of more than $275 billion) provide an incredible amount of stability for those worried about market volatility.

If we look at the long-term value, Berkshire is definitely a must have, especially for beginners. This company ffers exposure to other blue-chip companies, while providing additional flexibility to continue buying when major market corrections take place. Buffett’s strategic buying during previous crises have highlighted the agility of the company, of which investors cannot find in other stocks. At least, not easily.

Northrop Grumman (NOC)

Northrop Grumman (NYSE:NOC) is a major U.S. defense player, which has continued to provide portfolio stability unlike any other company in the market. With geopolitical tensions ratcheting up, this is a company that investors will want to have on their radar. That goes double for those concerned about full-blown conflict spilling over into the Western sphere.

Northrop has consistently exceeded earnings estimates, beating forecasts in all four previous quarters. In the latest report on July 25, 2024, the company posted $6.36 in earnings per share, surpassing the $5.95 consensus analyst estimate. For FY 2024, revenues are expected to reach $41.34 billion (more than 5% higher-year-over-year), while earnings per share are expected to grow 7.3%. In 2025, NOC earnings should reach $27.71 per share, reflecting a 4.28% increase, driving 10.87% EPS growth.

Northtrop Grumman’s Cygnus cargo ship named “SS Patty Hilliard Robertson” departed on July 12. The said ship is set to deliver 8,200 pounds of supplies and research equipment. The company also launched two satellites for Space Norway’s Arctic Satellite Broadband Mission, utilizing GEOStar-3 technology for internet and secure military communications in the polar region. Northrop Grumman and Boeing are vying for the Space Force’s anti-jamming satellite project, with Northrop Grumman’s ESPAStar-HP bus-based satellite set to power this initiative in 2025.

For those seeking true defensive exposure in this market, this major defense player is worth considering right now in my view.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.