Investing

If Nvidia's Run Is Over, These 3 Chip Stocks Could Be Better Picks

Published:

The semiconductor sector is absolutely dominated by Nvidia (NASDAQ:NVDA) right now. Everyone knows that. After all, we’re talking about the first ever chip maker to become the most valuable company in the world. That’s an achievement that deserves applause only.

The thing is, Nvidia’s stock price has started to wobble, as investors look to rotate into companies they perceive to have greater value. The company’s valuation multiples don’t look crazy at first glance, but it’s also true that there’s plenty of growth baked into Nvidia’s valuation. And this growth will need to continue for a long time in order for this valuation to hold up.

On the other hand, a range of other chip stocks are starting to look very attractive. I’m going to highlight three of the top options I think are excellent Nvidia alternatives, for those NVDA stock skeptics out there.

Without further ado, let’s dive in.

Last year, Taiwan Semiconductor Manufacturing (NYSE:TSM) led the semiconductor market holding about 13% of the market and 58% market share in foundry. The company also plans to expand to a greater degree, with growth plans in Germany, Arizona, Japan, and Taiwan driven by strong demand of advanced chips.

Over the past week, TSMC reported the strongest revenue growth it had in six quarters. TSMC’s Q2 results far surpassed expectations, with revenues of $20.8 billion (32.8% up year-over-year) and earnings per ADR of $1.48. The boost was driven by the company’s 3-nanometer technology and growth in HPC and DCE, marking a significant turnaround from previous quarters. Despite a minor dip in smartphone sales, the company showed strong performance across sectors.

Benefitting from the AI surge, TSM is driven by strong demand, making the stock a great buy to own. In my view, this is the sort of foundry business long-term investors will want to own as a picks-and-shovels play on overall chip growth. If companies like Nvidia and its competitors are growing, TSMC should certainly follow suit.

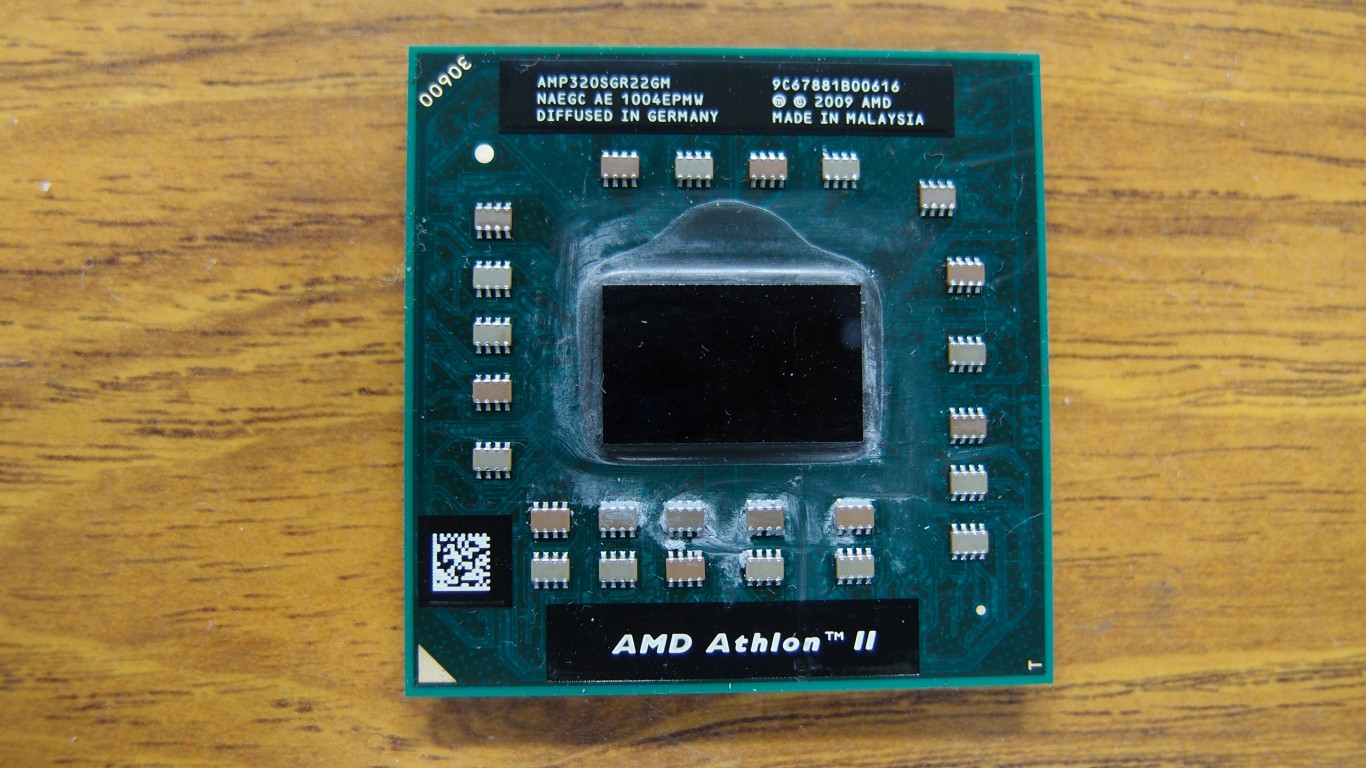

As Nvidia’s top rival, Advanced Micro Devices (NASDAQ:AMD) come second in this list. Investors are looking forward for AMD to releasing its Q2 earnings report. The market anticipates to see positive numbrs, with the company expected to bring in $5.73 billion revenue and $0.68 of earnings per share.

Notably, AMD stock has performed well following previous earnings reports due to the company’s CPU sales, with AMD reaching $1.4 billion revenue in Q1. This was possible due to strong revenue from its Ryzen 8000 Series processors. Global PC shipments saw a 3.1% increase, benefiting from inventory restocking and server growth. The company’s MI300X chips are also important to consider, due to its impressive AI workload capabilities. Thus, it should be no surprise that AMD expects its AI chips sales to exceed its $3.5 billion forecast for 2024.

Dropping from $190 down to $130 per share, AMD stock has found strong support despite declines. Analysts, including Stifel, gave it a Buy rating with a $200 target, praising AMD as a key player in GPU-based AI. The market expects Q2 earnings to reveal $5.74 billion in revenue and $343 million in net income, with a focus on AMD’s AI revenue outlook.

For investors highly confident in the future of AI and chip technology, buying ASML Holdings (NASDAQ:ASML) stock is a good move to take now. The company continues to innovate with its extreme ultraviolet lithography machines, which play a vital role in producing high-end chips. ASML is also pivotal in the tech sector, showing impressive growth in its profits and strong financials quarter after quarter.

On Tuesday, Barclays upgraded ASML Holding to Overweight, raising its price target from €930 to €1,150. The upgrade follows a recent decline in ASML’s stock, influenced by China concerns, AI investment debates, and a cautious 2025 outlook. Barclays views the drop as a buying opportunity for this globally respected firm, noting that other covered companies face higher immediate risks.

Barclays expects ASML to see significant growth by 2026, driven by new fabrication plants, advancements to 2-nanometer technology, and sustained AI investments. A 15% growth projection is set for 2026, following a 27% increase in 2025. Forecasts also show optimistic growth for the stock. I tend to agree.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.