Microsoft (NASDAQ:MSFT) certainly deserves consideration as a top tech stock investors should consider. The company’s rise to become the most valuable company in the world (again) denotes just how valuable its core software and cloud businesses are, and how highly-valued the company’s growth investments have been.

Sure, plenty of attention is being paid to the company’s relatively early investment in OpenAI and its commitment to enhancing productivity using technology. In many respects, Microsoft has bene a leader in this regard, and I certainly think it deserves the valuation multiple it trades at.

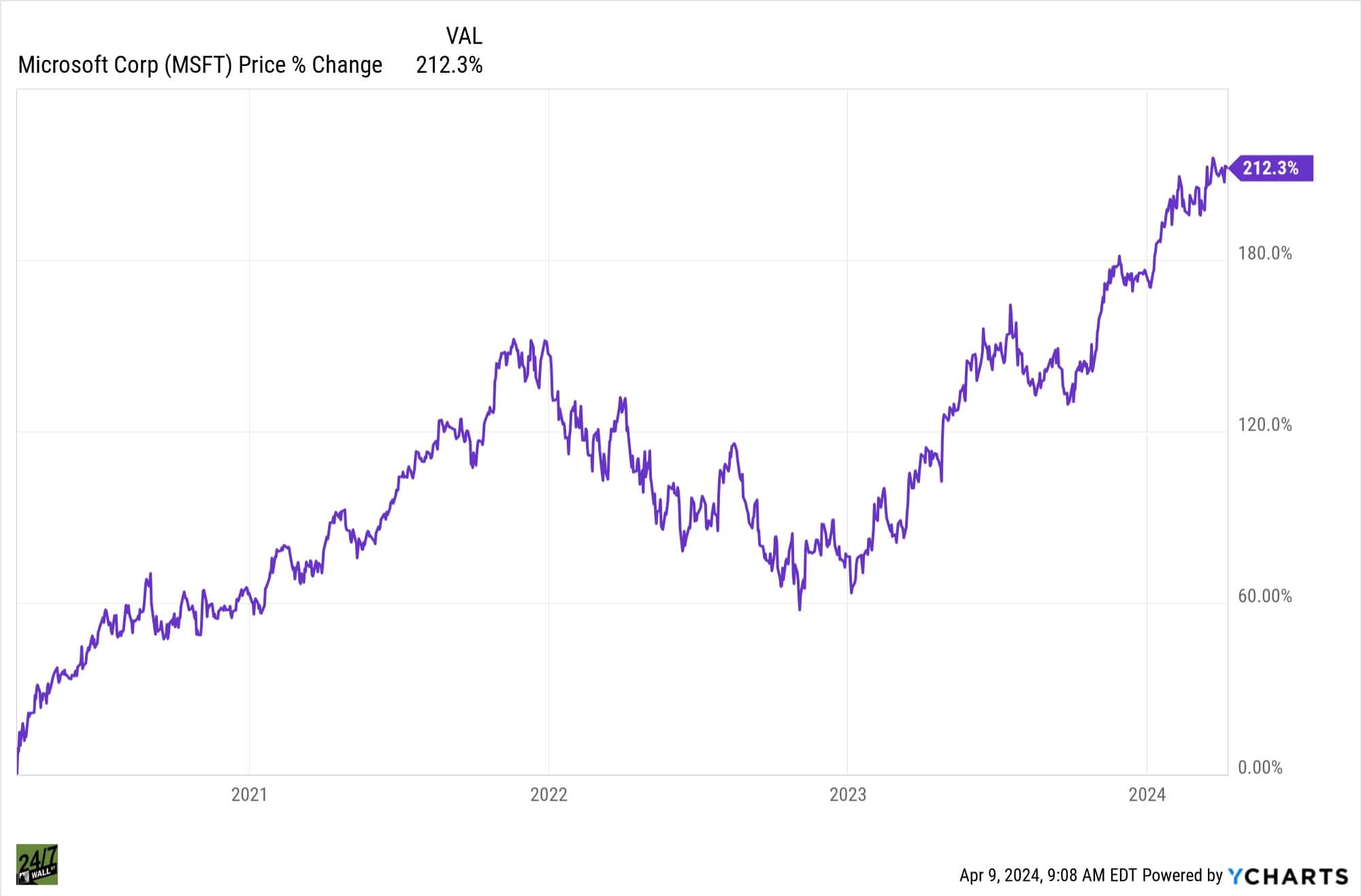

That said, it’s also true that Microsoft has gone on quite a run this year. The question many investors have is whether this rally can truly continue from here, or if other companies may represent better long-term growth bets at their current valuation.

Here’s why Shopify (NYSE:SHOP) is one stock I think investors may want to think of as a much earlier-stage Microsoft.

Key Points About This Article:

- Microsoft continues to be a core holding for many long-term investors, but its status as a high-growth stock may be nearing an end.

- Those looking for a higher-growth portfolio replacement may want to consider this top e-commerce platform provider.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

E-commerce and now AI company Shopify’s shares increased 25% following its Q2 2024 earnings release that impressed analysts. After a slowdown during the pandemic, Shopify has rebounded and slowly makes profits again despite the stock declining year-to-date as of August 8 data.

In its report, Shopify reached a $2.05 billion revenue, with GMV increasing 22%. Merchant solutions segment reached $1.5 billion in revenue, while revenue from subscriptions reached $563 million. Shopify’s CFO Jeff Hoffmeister believes that Shopify can succeed despite looming economic challenges.

Here’s a deeper insight as to why SHOP could be every investor’s millionaire-maker stock.

Strong Q2 Results

For any stock, earnings matter. Seeing how a given company performed in recent quarters can tell the story of how growth is projected to continue, or not, moving forward. Indeed, for a company like Shopify, I think reviewing recent results is more important than with other names, in large part due to the fact that much of the company’s premium multiple is based on growth continuing.

In the company’s second quarter, Shopify reported $2.05 billion in revenue, reflecting 21% year-over-year growth. Earnings estimates came in at $2.01, which Shopify handily beat. This top and bottom line beat was driven by strong performance across segments like Merchant Solutions and Subscription Solutions, which surged 19% and 27% respectively. Gross merchandise value also improved 22%, and monthly recurring revenue reached $169 million. According to Shopify’s president Harley Finkelstein, the results only show how resilient and unstoppable Shopify is during market fluctuations.

Estimates for Q3 2024 is expected to see more growth from its users aging low- to mid-20 percent range. Now, operating expenses are also expected to surge 41%, so investors will certainly have to keep a close eye on margins. That’s likely a significant reason why SHOP stock has dropped 30% this year, as well as ongoing concerns that growth may slow further from here. However, recent strong results and optimistic guidance appear to have reassured isome nvestors. J.P. Morgan analyst Reginald Smith noted that the guidance met all investor expectations with solid revenue growth and controlled expenses.

Shopify stock recently surged 24% to $67.08 following these results, as investors appear to have liked what they saw. After all, the company reported its higher ever revenue number, and there’s reason to believe this growth can continue, as Shopify executes on its international growth strategies and improves efficiency over time.

Artificial Intelligence Remains a Key Catalyst for Shopify

AI marketing employs artificial intelligence to enhance strategies by providing insights and automating tasks. A 2023 Instapage survey revealed that 95.8% of marketers use AI, with 55% integrating it into their workflows for social media, content ideation, and creation. Shopify provides a platform allowing for easy sales and purchases, allowing developers to keep all revenue up to $1 million. Its user-friendly tools integrated with AI made it a top choice for merchants and developers, especially as they move away from Amazon.

Shopify, in no doubt, is a leading e-commerce company using AI to enhance user experience through automation and integration with third-party tools. Despite a 30% drop in stock over six months and current losses, Shopify has seen 23.4% revenue growth and maintains strong cash flows exceeding $1 billion. Analysts project a potential upside of more than 80% for SHOP stock, with an average price target of $108. Shopify’s ease of use and recent solid growth make it a promising AI stock to consider in this world where everyone is becoming an AI play at the same time.

SHOP Stock Looks Like a Solid Buy for Growth Investors

Nothing is for certain, and while Shopify’s recent growth has been strong, it’s important to remember that there have been periods following the pandemic where the e-commerce company showed very slow growth.

I think that reality was due to a number of factors, including incredibly high comps from the pandemic. Thus, the question is just how valid investors think the long-term growth thesis is for e-commerce as a whole, and whether Shopify can continue growing market share in this space relative to the likes of Amazon. Indeed, it’s a big pie that’s growing, but the dynamics here are changing all the time.

The thing is, at the company’s current valuation of around 64-times forward earnings, I think any sort of upside surprise to EPS in the coming quarters could warrant a massive move higher. This is a high-growth company that’s trading closer to the multiples seen in much larger companies with less ability to grow over time. So long as small and medium sized businesses continue to set up online shops and choose Shopify as a key provider of their portoflio of services, this is a company that could have plenty of room to run from here.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.