Investing

The 5 Highest-Yielding S&P 500 Stocks Are the Perfect Recession Safety Net

Published:

24/7 Wall St. Insights

Investors love dividend stocks because they provide dependable income, passive income streams, and an excellent opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or portfolio consists of income and stock appreciation.

For example, if you buy a stock at $20 that pays a 3% dividend, and it goes up to $22 in a year, your total return is 13%. That is, 10% for the increase in stock price and 3% for the dividends paid.

Despite the always-bullish chorus from Wall Street strategists and analysts, there is a sense that things may not be as good economically as the reported numbers make it out to be. Layoffs have skyrocketed; Dell Technologies Inc. (NYSE: DELL) just announced that 12,500 employees will be given a pink slip, while Cisco Systems Inc. (NASDAQ: CSCO) unveiled a layoff of 4,000 employees. If the economy is so great, why are these mega-cap tech giants laying off thousands of employees?

Given the potential for an upcoming recession, an expansion in the hostilities in the Middle East, and Ukraine now fighting in Russia, it makes sense to move to safer ground. The five highest-yielding S&P 500 stocks may be a perfect “safety-net” portfolio. All are rated Buy at top Wall Street firms and offer outstanding entry points. Dividend investors also should grab this free report.

Dividend stocks provide investors with reliable streams of passive income. Passive income is characterized by its ability to generate revenue without requiring the earner’s continuous active effort, making it a desirable financial strategy for those seeking to diversify their income streams or achieve financial independence. We listed the stocks in this post in the order of the highest dividends.

This huge drugstore chain is a safe retail play, paying a massive 9.36% dividend. Walgreens Boots Alliance Inc. (NYSE: WBA) is a pharmacy-led health and beauty retail company with three segments:

The Retail Pharmacy USA segment sells prescription drugs and various retail products, including health, wellness, beauty, personal care, consumables, and general merchandise, through its retail drugstores.

It also provides specialty pharmacy services and mail services. This segment operates nearly 10,000 retail stores under the Walgreens and Duane Reade brands in the United States and six specialty pharmacies.

Walgreens Boots Alliance’s Retail Pharmacy International segment is a testament to its diverse product offerings. It sells prescription drugs, health and wellness products, beauty products, personal care products, and other consumer products through its pharmacy-led health and beauty stores and optical practices.

The Pharmaceutical Wholesale segment engages in the wholesale and distribution of specialty and generic pharmaceuticals, health and beauty products, and home healthcare supplies and equipment, as well as provides related services to pharmacies and other healthcare providers.

The shares were hit hard after the company cut the dividend earlier this year. Still, with management trying to sell Boots pharmacies based in the United Kingdom and also looking to sell the Village MD part of the company, investors have again started to bid higher shares.

This tobacco company offers value investors a rich 8.46% dividend. Altria Group Inc. (NYSE: MO) manufactures and sells smokable and oral tobacco products in the United States through its subsidiaries.

The company provides cigarettes primarily under the Marlboro brand, as well as:

It sells its tobacco products primarily to wholesalers, including distributors and large retail organizations, such as chain stores.

Altria used to own over 10% of Anheuser-Busch InBev N.V. (NYSE: BUD), the world’s largest brewer. The company sold 35 million of its 197 million shares through a global secondary offering. That represents 18% of their holdings but still leaves a hefty 8% of the outstanding shares in their back pocket. They also announced a $2.4 billion stock repurchase plan partially funded by the sale.

This top telecommunications company offers tremendous value, trading at just 8.75 times estimated 2025 earnings and paying investors a hefty 6.53% dividend. Verizon Communications Inc. (NYSE: VZ), through its subsidiaries, provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

It operates in two segments:

The Consumer segment provides wireless services across the wireless networks in the United States under the Verizon and TracFone brands and through wholesale and other arrangements.

It also provides fixed wireless access (FWA) broadband through its wireless networks and related equipment and devices, such as:

The segment also offers wireline services in Mid-Atlantic, northeastern United States, and the District of Columbia through its fiber-optic network, Verizon Fios product portfolio, and a copper-based network

The Business segment provides wireless and wireline communications services and products.

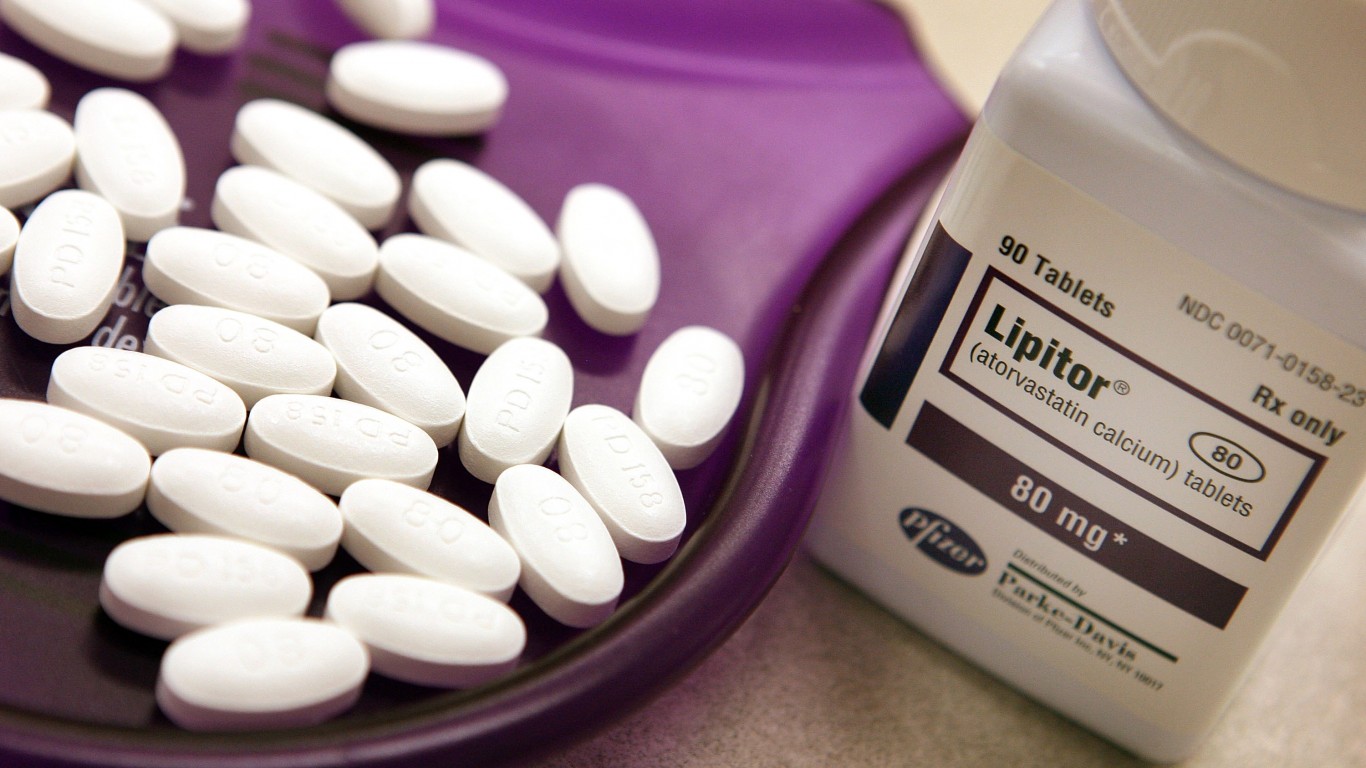

This top pharmaceutical stock was a massive winner in the COVID-19 vaccine sweepstakes but has been beaten down over the last year as many are not getting boosters. Pfizer Inc. (NYSE: PFE) discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide and pays a hefty 5.88% dividend, which has risen yearly for the last 14 years.

The company offers medicines and vaccines in various therapeutic areas, including:

Pfizer also provides medicines and vaccines in various therapeutic areas, such as:

Trading not far from its lowest split-adjusted level in thirteen years, the stock is an incredible bargain at current levels and pays a massive dividend. Pfizer reported revenues of $13.3 billion in the second quarter, representing 3% year-over-year operational growth, despite an expected decline in COVID revenues and a 14% year-over-year operational increase in revenues from the company’s non-COVID product portfolio.

The pharmaceutical giant raised full-year 2024 revenue guidance to $59.5 billion to $62.5 billion and lifted adjusted diluted EPS guidance to $2.45 to $2.65. Patient investors will get paid one of the highest blue-chip dividends, and shares trade at a reasonable 9.88 times estimated 2025 earnings.

This top cell tower company offers incredible growth and income possibilities with a fat 5.66% dividend. Crown Castle International Corp. (NYSE: CCI) is one of the largest U.S. wireless tower companies, with over 40,000 towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every primary U.S. market.

The company’s core business is leasing space on its wireless towers, primarily to wireless carriers, government agencies, and broadband data providers. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology, and wireless service — bringing information, ideas, and innovations to the people and businesses that need them.

Crown Castle is one of the best stocks in the sector for more conservative investors. Its high yield distribution and low volatility make it a good holding for accounts seeking growth, income, and less risk.

Five Dividend Champions Can Deliver Investors a Passive Income Home Run

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.