Investing

Microsoft (MSFT) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Everyone knows Microsoft (NASDAQ: MSFT) and its best-known products, including the Windows operating system and Microsoft 365 suite of productivity apps, but its growing cloud computing platform, Azure, is the future of the company.

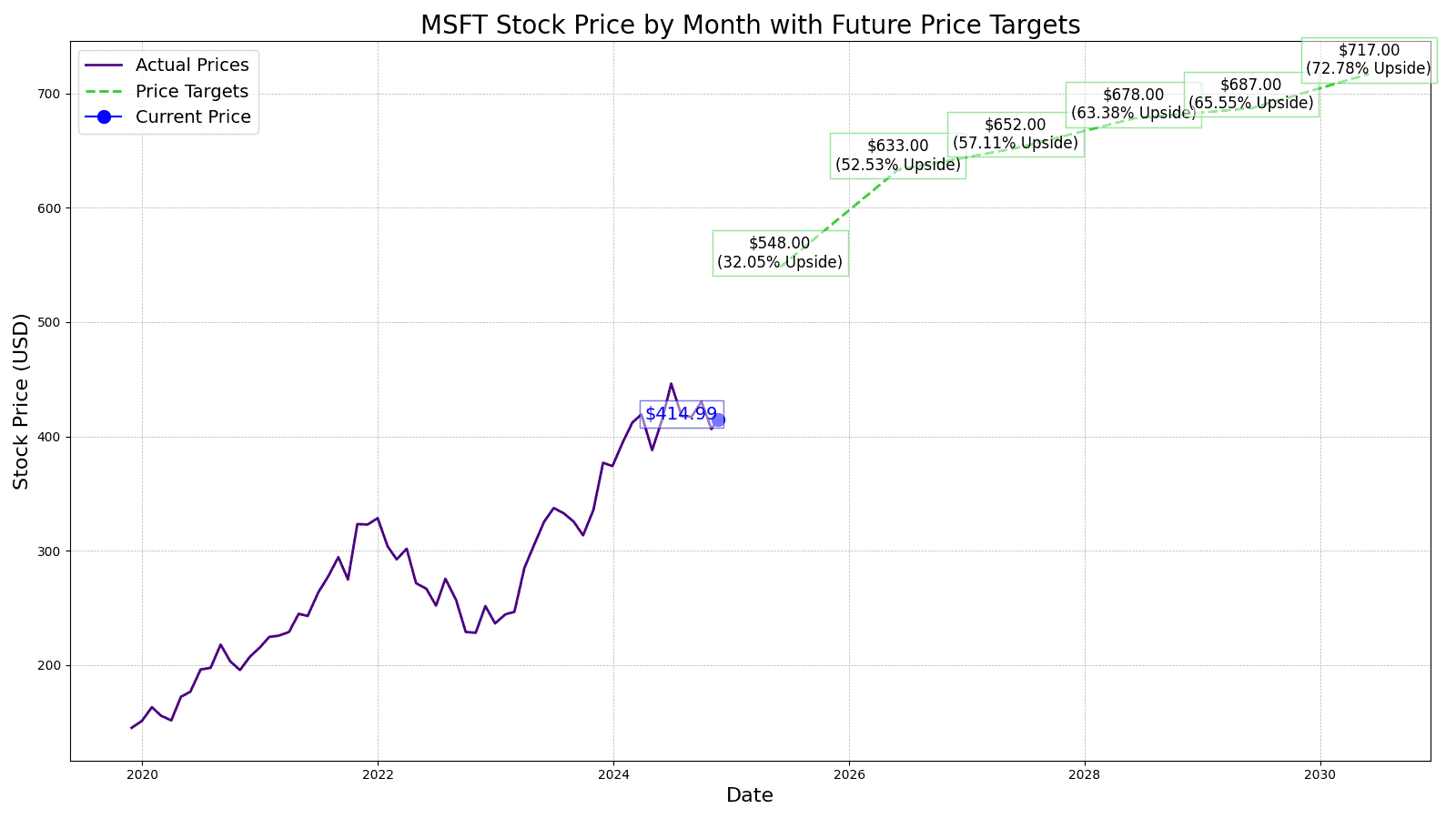

Microsoft stock has been a millionaire maker for decades, with a stock split-adjusted IPO price of $0.14, which means at today’s stock price of $414.99, the stock is up 426405.65%. That would have turned a $1000 investment at Microsoft’s IPO into $4.27 million today.

As one of the most valuable companies in the world, the only thing investors focus on is what the stock will do over the coming years. Wall Street analysts only go as far as 1 year out when giving a stock prediction. But long-term investors want to know where Microsoft might be several years down the road.

24/7 Wall Street aims to give you our assumptions on the stock and provide our insights around the numbers coming from Microsoft and which markets the company is operating in that are most exciting to us.

11/21/2024

Microsoft’s stock price fell 1% today, trading as low as $410.29.

11/20/2024

Next month Michael Saylor, former MicroStrategy CEO, will pitch a Bitcoin adoption plan to Microsoft’s board of directors. Saylor believes Bitcoin could be a game-changer for Microsoft, potentially generating the company’s next trillion dollars.

11/19/2024

Microsoft announced a new application server at its 2024 Ignite conference today: the Azure AI Foundry, which aims to streamline AI development. Microsoft plans to do this by consolidating Microsoft’s diverse AI models, tools, safety measures, and monitoring capabilities into a single, integrated platform.

11/18/2024

Microsoft has come under scrutiny for its business practices with the U.S. government. A recent report revealed that Microsoft pledged $150 million in cybersecurity services to the federal government in 2021, including access to the premium Microsoft 365 Government G5 suite. While this move was initially seen as an effort to bolster U.S. cybersecurity, some critics argue that it could also have anti-competitive implications, locking the U.S. government into Microsoft’s ecosystem, limiting competition, and potentially increasing costs.

11/15/2024

Microsoft is adopting a new format called CSAF as the company changes the way it shares information about security vulnerabilities. CSAF is easier for computers to read and will help organizations quickly identify and fix security problems.

11/14/2024

Microsoft is under investigation by the Federal Trade Commission (FTC) for potential anti-competitive behavior in its cloud computing business. The FTC is concerned that Microsoft might be using its dominant position in productivity software to unfairly limit customers’ choices, particularly with the company’s cloud services making it difficult for customers to switch to other cloud providers.

11/12/2024

Despite a broader market downturn today, Microsoft rose 1.20% to $423.03.

11/11/2024

Isabell Sheang has rejoined Microsoft as a group product marketing and go-to product manager. In her new role, Sheang will lead a team focused on global strategies for Windows Commercial. Sheang previously worked for Microsoft from 2008 to 2016, in addition to working at VMWare and as an adjunct professor at the University of Washington.

11/8/2024

Microsoft is testing out a greener approach to data center construction with Cross-Laminated Timber (CLT). CLT is a fire-resistant wood material that can greatly lower carbon emissions compared to traditional materials like steel and concrete. By using CLT, Microsoft aims to cut carbon emissions by 35% and reduce greenhouse emissions by 65%.

11/7/2024

Released three years ago, Windows II now accounts for 35.55% of the market. This surge in popularity comes as Microsoft prepares to end support for Windows 10, charging a fee for extended service.

11/6/2024

Microsoft is expanding the capabilities of Windows on Arm by testing an important update that will enable more x64 software and games to run under Prism emulation. The update is specifically designed for Copilot Plus PCs powered by Qualcomm’s Snapdragon X Elite or X Plus processors.

Here’s a table summarizing performance in share price, revenues, and profits (net income) from 2014 to 2018.

| Share Price | Revenues | Net Income | |

| 2014 | $46.16 | $86.83 | $22.07 |

| 2015 | $46.70 | $93.58 | $12.19 |

| 2016 | $56.21 | $91.15 | $20.54 |

| 2017 | $72.26 | $96.57 | $25.49 |

| 2018 | $108.04 | $110.36 | $16.57 |

| 2019 | $138.06 | $125.84 | $39.24 |

| 2020 | $205.01 | $143.02 | $44.28 |

| 2021 | $286.50 | $168.09 | $61.27 |

| 2022 | $276.41 | $198.27 | $72.74 |

| 2023 | $330.72 | $211.92 | $72.36 |

| TTM | $465.39 | $279.99 | $86.18 |

Revenue and net income in $billions

In the last decade, Microsoft’s revenue grew 222% while its net income went from $22.07 billion to over $86 billion (in the trailing 12 months). A big driver of profits over the past decade was Microsoft’s Intelligence cloud business, which grew 18% annually and drove operating profits of $37.88 billion in 2023 from $8.44 billion in 2014.

As Microsoft looks to the second of the decade, a few key areas will determine its performance.

The current consensus 1-year price target for Microsoft stock is $500.00, which is a 20.48% upside from today’s stock price of $414.99. Of all the analysts covering Microsoft, the stock is a consensus buy, with a 1.39 “Buy” rating.

24/7 Wall Street’s 12-month forecast projects Microsoft’s stock price to be $495. We see Azure continuing its 20+% growth and earnings per share coming in right at $11.80.

| Year | Revenue | Net Income | EPS |

| 2024 | $244.97 | $88.93 | $13.32 |

| 2025 | $278.00 | $99.25 | $15.67 |

| 2026 | $321.63 | $115.65 | $18.10 |

| 2027 | $370.79 | $136.81 | $20.40 |

| 2028 | $416.08 | $151.87 | $22.62 |

| 2029 | $453.39 | $166.56 | $25.45 |

| 2030 | $503.13 | $181.71 | $28.70 |

Revenue and net income in $billions

We expect to see revenue growth just over 8% and EPS of $15.67 for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Microsoft at $548.00 in 2025, which is 32.05% higher than the stock is trading today.

Going into 2026, we estimate the price to be $633.00, with small revenue gains but margins expanding and an EPS of $18.10. We expect to see Microsoft’s P/E ratio steep down slowly each year through 2030. The stock price estimate would represent a 52.53% gain over today’s share price of $414.99.

Heading into 2027, we expect the stock price increase not to be as pronounced and earnings estimates of $20.40 per share, the stock price target for the year is $652.00. That is a 3% year-over-year gain from the previous year, but still up 57.11% from today’s stock price.

When predicting more than 3 years out, we expect Microsoft’s P/E ratio to drop to 30x in 2028 but grow its top line 14%. In 2028, we have Microsoft’s revenue coming in around $420 billion and an EPS of $22.62 suggesting a stock price estimate at $678.00 or a gain of 63.38% over the current stock price.

24/7 Wall Street expects Microsoft to continue its 10% revenue growth again and to generate $12.30 per share of earnings. With a price to earnings multiple of 35, the stock price in 2029 is estimated at $687.00, or a gain of 65.55% over today’s price.

We estimate Microsoft’s stock price to be $717.00 per share with a sub 10% year-over-year revenue growth. Our estimated stock price will be 72.78% higher than the current stock price of $414.99.

| Year | Price Target | % Change From Current Price |

| 2024 | $495.00 | Upside of 19.28% |

| 2025 | $548.00 | Upside of 32.05% |

| 2026 | $633.00 | Upside of 52.53% |

| 2027 | $652.00 | Upside of 57.11% |

| 2028 | $678.00 | Upside of 63.38% |

| 2029 | $687.00 | Upside of 65.55% |

| 2030 | $717.00 | Upside of 72.78% |

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.