Investing

10% Owner Funds Trucking Acquisition, Plus More Big Insider Buying

Published:

24/7 Wall St. Insights

As summer starts to wind down and market volatility increases, insider buying has been quite active in the past week. Most notably was a huge purchase of shares by a beneficial owner meant to provide funding for a pending merger. There were also a couple more big purchases of energy stocks, as well as at an e-commerce firm and a biotech company. Let’s take a quick look at these transactions.

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that while the earnings-reporting season is still underway, many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest and most prominent.

This transaction was part of a $550 million private financing deal. RXO Inc. (NYSE: RXO) intends to use the proceeds to finance a portion of the pending acquisition of Coyote Logistics from UPS. Note that this beneficial owner was a frequent buyer of shares back in the spring, and now its stake is up to almost 27.6 million shares. The North Carolina-based transportation company’s stock is up more than 22% year to date, most of that gain coming since the Coyote acquisition was announced in June. Analysts seem to be in wait-and-see mode, with consensus Hold recommendation and a mean price target less than the current share price.

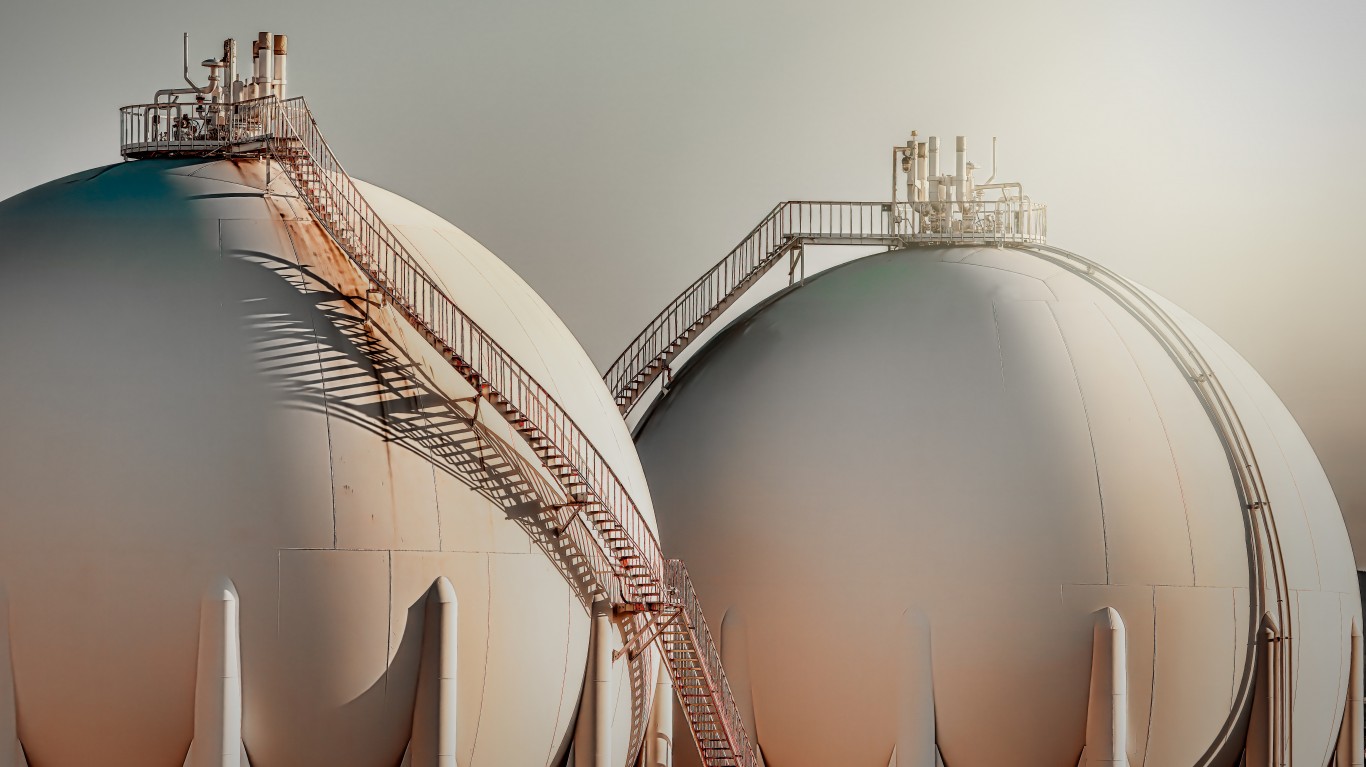

This beneficial owner is affiliated with beneficial owner Blue Star Exploration, which acquired almost 2.5 million shares of Comstock Resources Inc. (NYSE: CRK) in the previous week. Both are owned by Dallas Cowboys owner Jerry Jones. The Texas-based leading producer of natural gas posted disappointing quarterly results at the end of July. Shares pulled back almost 20% after the earnings report but have recovered. They are now 19% or so higher year to date and trading above the buyer’s purchase price range. The share price has overrun the $10.18 consensus price target. Just three of the eight analysts who follow the stock recommend buying shares.

Long’s share of the above transaction was 20,000 shares of Energy Transfer L.P. (NYSE: ET) for $313,600. The stock was last seen trading above the buyers’ purchase price, and it is up more than 16% since the beginning of the year. That is marginally better than the S&P 500 in that time. Analysts on average expect the share price to rise to $19.35 in the next 52 weeks. That would be a gain of over 21%. The consensus recommendation is to buy shares, with seven of 16 analysts giving it a Strong Buy rating. Note that Energy Transfer boosted its quarterly cash distribution to investors in July.

This Seattle-based e-commerce platform operator blamed its first quarterly loss since 2022 on the recent Farfetch acquisition. However, since the start of the year, Coupang Inc. (NYSE: CPNG) stock is more than 38% higher, outperforming the broader markets. The $26.33 consensus price target is greater than the 52-week high, and it is more than 18% higher than the current share price. Analysts on average recommend buying shares, and the stock is also a top pick of billionaires Bill Gates and Stanley Druckenmiller. Note though that the company CFO sold some shares this past week as well.

These insiders acquired shares in a secondary offering of Precigen Inc. (NASDAQ: PGEN) stock. The proceeds of the offering are expected to fund the biotech company’s operations into early 2025. An impairment charge impacted the recently posted quarterly results, and the company is prioritizing its lead program. The stock recently hit a year-to-date low of $0.82 but was last seen trading for more than $1 a share. Note that the consensus target price of three analysts is up at $10. Analysts on average recommend buying the shares and have for at least two months.

When Lions Gate Entertainment Corp. (NYSE: LGF-A) recently reported its fiscal first-quarter results, the entertainment giant fell short of expectations on both the top and bottom lines. Since the report, the share price is down more than 10%, and it is about 28% lower year to date. Shares were last seen trading below the buyer’s purchase price range, but analysts anticipate nearly 55% upside in the coming year to their consensus price target of $12.02. Note that this same buyer acquired more than $3 million worth of the shares earlier in the month, and its stake is up to nearly 12 million shares.

In the past week, some insider buying was reported at Appian, Black Stone Minerals, Bloomin’ Brands, Elanco Animal Health, Goodyear Tire & Rubber, Healthcare Realty Trust, Herbalife, Huntsman, Lyft, Papa John’s, Pebblebrook Hotel Trust, Post Holdings, Warby Parker, Workiva, WP Carey, and Yum China as well.

Prediction: This Semiconductor Stock Will Be the Best Performer the Rest of 2024

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.