In 2023, the S&P 500 reached new peaks despite having to work through a number of headwinds to get to these fresh highs. Market volatility has picked up, though many stocks continue to trade near their all-time highs. And while investor sentiment does appear to be largely positive right now, there are a growing number of investors who appear ready to hunker down for what could be a harsh winter ahead.

For those looking to position their portfolios more defensively, the good news is that there are plenty of blue-chip dividend paying stocks to choose from. Companies that pay out consistent and growing dividends over time typically have stronger balance sheets, and a belief in their ability to grow cash flows over time. These are the sorts of long-term investments many are seeking, given the plethora of companies out there with less-than-favorable balance sheets at the moment trading at sky-high multiples.

With anticipated rate cuts on the horizon, here are three top defensive dividend stocks I think are worth considering at this point in time.

Key Points About This Article:

- Amid increased market uncertainty, here are three defensive dividend stocks for investors to consider over the long-term.

- These three companies have rock-solid balance sheets and the ability to weather whatever economic climate could be forthcoming.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

PepsiCo (PEP)

As one of the best Dividend Aristocrats in the market, PepsiCo (NYSE:PEP) has proven itself a blue-chip stock investors can trust during economic downturns. Such events push consumers towards essentials, and PepsiCo’s products are among the most popular for consumers across all demographics. This strong brand equity has allowed Pepsi to retain some of the best pricing power in its sector. That’s an asset that’s hard to replicate, and it’s one of the key investment theses that’s easiest to understand.

Aside from a solid core business that leads to consistent cash flow growth over time, Pepsi is also an incredible dividend stock. With a yield of 3.1%, investors looking for long-term dividend stocks to buy and hold continue to flock to this name. Part of the reason for this is the fact that Pepsi has been paying dividends and increasing distributions for the past 53 years, earning its Dividend King title.

By all accounts, this dividend growth is expected to continue, with analysts expecting 7.5% EPS growth in 2025, surpassing Coca-Cola’s 5.9% growth rate by a rather wide margin. On these sorts of estimates, it’s not surprising to see analysts from outfits like Barclays rising their PEP price target to $187 per share.

PepsiCo’s consistent growth and innovation in its dividends make it a great company to invest in. As far as defensive dividend stocks are concerned, Pepsi remains among my top picks right now.

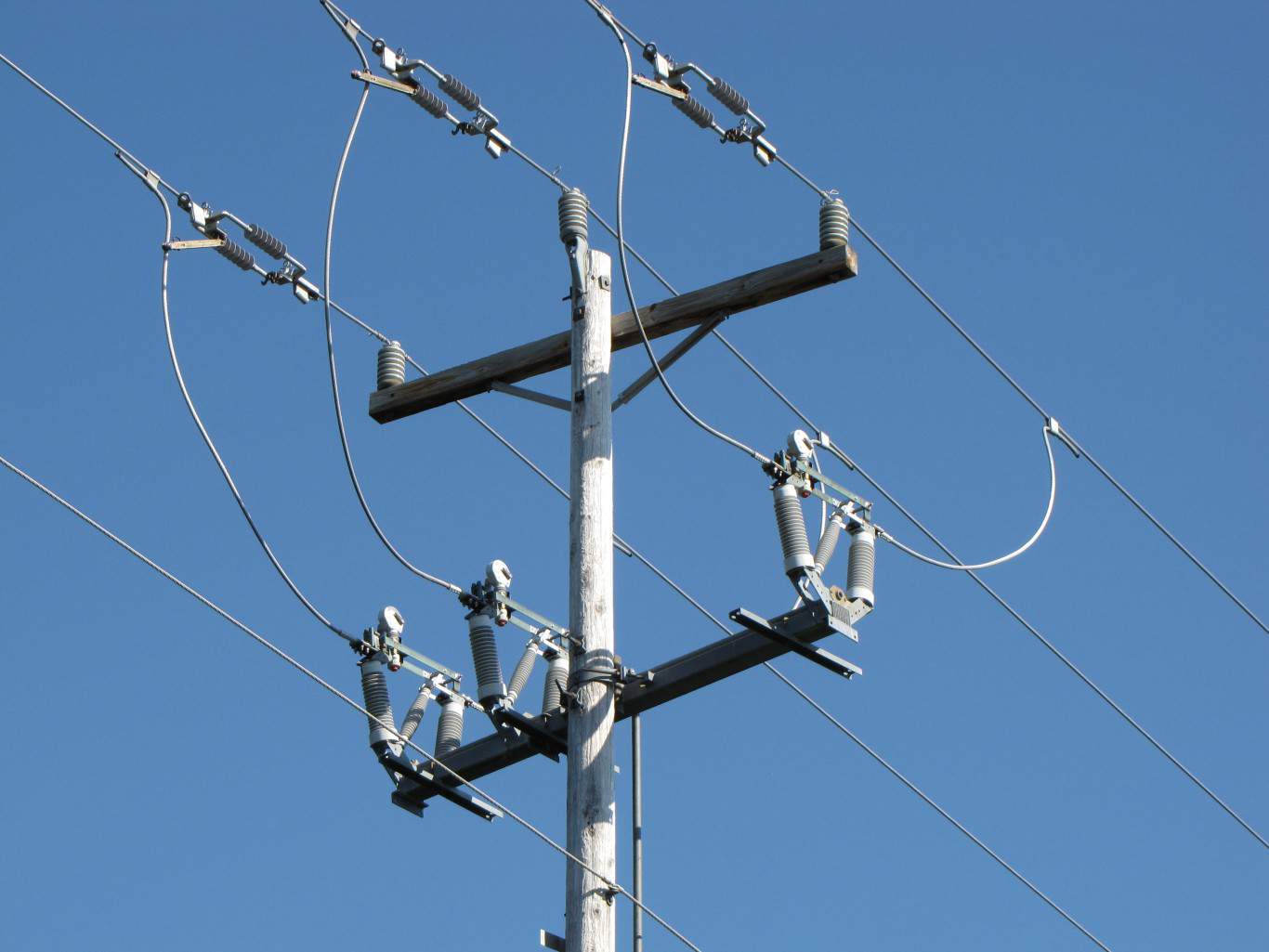

Fortis (FTS)

Fortis (NYSE:FTS) operates 10 utility assets in the U.S. and Canada, serving 3.4 million customers. The company’s stable recurring revenue provides reliable cash flow. This is, in and of itself, a very defensive attribute investors can clearly take solace in.

Fortis’ recent Q2 2024 results were strong, with the company reporting earnings per share which increased from $0.62 to $0.67, with consistent annual growth expected as customer base expands and rate hikes are pursued.

Utilities like Fortis, providing essential goods consumers have no choice but to pay for, remain resilient in downturns. The company’s dividend growth rate typically sits between 4%-6% annually, making it a promising dividend growth stock to own. Moreover, Fortis has joined the Dividend Kings as it has been paying out dividend for more than 50 years. Serving 3 million customers across North America, Fortis is a recession-resistant stock with plans for $25 billion in capital spending from 2024-2028 to support further growth.

Until folks shut off their heat and air conditioning units, and don’t require electricity, Fortis’ cash flows are likely to remain robust. This is a defensive stock I think is worth considering for its dividend yield and more.

Restaurant Brands (QSR)

Parent company of many of the largest and most well-known fast food chains in the world, Restaurant Brands International Inc. (NYSE:QSR) is a defensive stock investors should certainly consider right now. The Burger King and Tim Horton’s parent continues to expand, most recently acquiring Firehouse Subs in 2021. This move has driven solid results in Q1 2024, with the company bringing in 5% system-wide sales growth across its portfolio, and diluted earnings per share growth of more than 14% on a year-over-year basis.

In May, Restaurant Brands went even further and bought Carrols Restaurant Group for $1 billion, with plans to allocate $500 million in renovations to improve this business over time. So long as Restaurant Brands continues to expand its footprint into new markets, and enhance its existing organic growth, there’s a lot to like about how the company is positioned.

Restaurant Brands represents a trade-down thesis, that consumers will simply move toward lower-priced options if economic conditions change. In other words, if times get tough, investors aren’t likely to see the kind of cash flow degradation other companies will with QSR stock. On the flip side, in boom times, investors have seen how great things can be.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.