Investing

Prediction: This Health Care Stock Will Be the Best Performer the Rest of 2024

Published:

24/7 Wall St. Insights

The prospects for health care stocks seemed to improve this year, after they struggled in the previous two years. However, they are still slightly underperforming the broader markets so far in 2024. So, with a market rotation underway, where should investors seeking opportunities in the industry be looking now?

Let’s take a look at health care stocks for which Wall Street analysts have big expectations for the rest of the year and into the next. (Note that we revealed our prediction for the best-performing pharmaceutical stock in a separate post.)

| Stock | Mean Target | Upside |

| Accolade Inc. (NASDAQ: ACCD) | $7.71 | 79.7% |

| Alphatec Holdings Inc. (NASDAQ: ATEC) | $19.46 | 230.9% |

| CRISPR Therapeutics AG (NASDAQ: CRSP) | $81.21 | 60.1% |

| Standard BioTools Inc. (NASDAQ: LAB) | $3.17 | 65.1% |

| Ocular Therapeutix Inc. (NASDAQ: OCUL) | $14.88 | 67.2% |

| OPKO Health Inc. (NASDAQ: OPK) | $3.96 | 149.0% |

| Pacific Biosciences of California Inc. (NASDAQ: PACB) | $2.92 | 79.1% |

| Royalty Pharma PLC (NASDAQ: RPRX) | $44.83 | 62.7% |

So far as Wall Street is concerned, Alphatec has the greatest potential upside of these health care stocks in the coming year. Does that mean that its shares are undervalued? Or perhaps one overzealous analyst has skewed the mean?

Alphatec stock is down about 92% from its 2022 initial public offering (IPO) share price. Shares were last seen trading shy of $6 apiece. They hit an all-time high above $91 back in 2010.

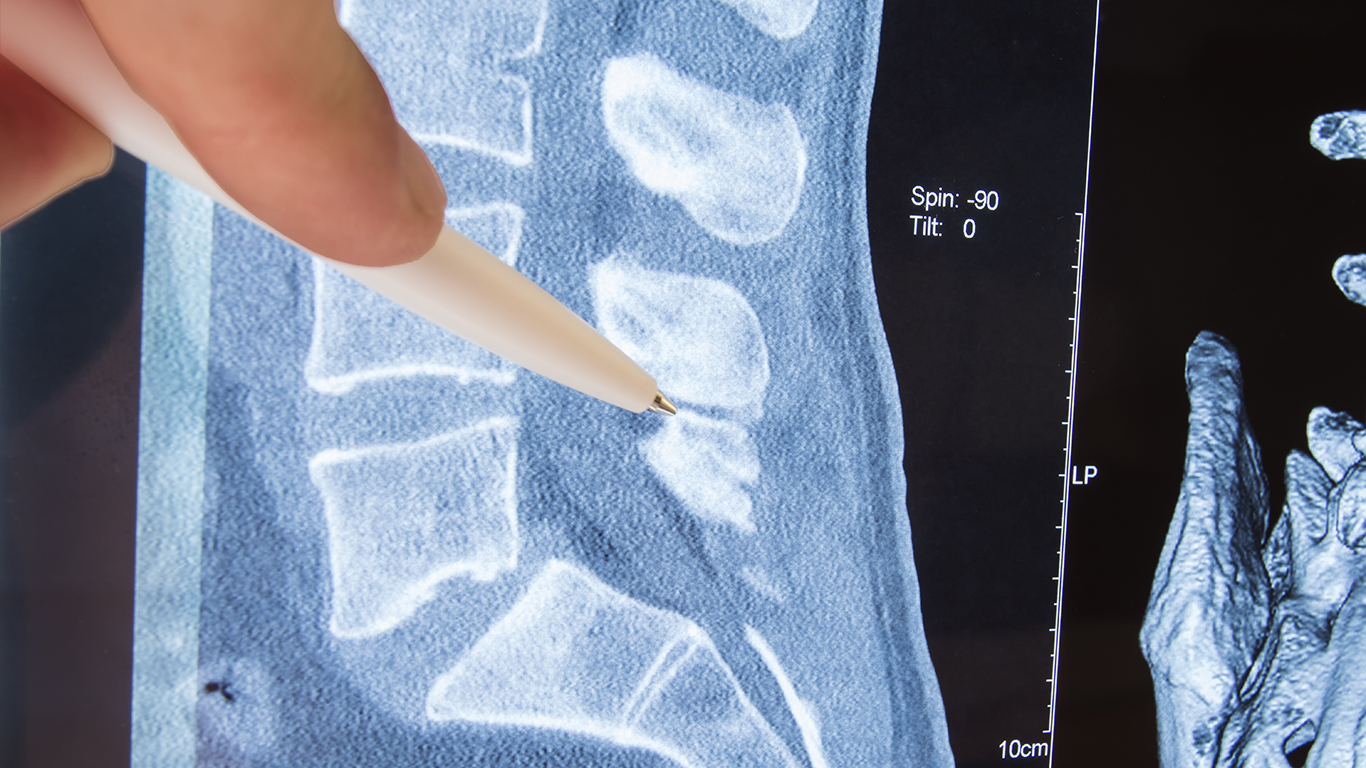

The company’s products are intended to address a variety of spine pathologies, including congenital deformities, disease and degeneration, and trauma. Alphatec says its goal is to revolutionize the approach to spine surgery and become the standard-bearer in spine. It also calls itself a solution-minded, problem-solving organization committed to providing outstanding patient outcomes.

The company does not offer a dividend. The stock ended 2023 with a gain marginally less than that of the S&P 500. However, shares retreated to a multiyear low after the most recent quarterly report. So, the question is whether the shares are poised for a rebound. Let’s have a look at what Wall Street expects.

This medical technology company designs, develops, and markets of spinal fusion technology products and solutions for the treatment of spinal disorders. It offers intra-operative information and neuromonitoring technologies, access systems, interbody implants, fixation systems, and various biologics offerings. And it sells its products through a network of independent sales agents and direct sales representatives.

Alphatec is based in Carlsbad, California, which is near San Diego. The company was founded in 1990. In June of 2006, it went public. The company competes with or is similar to Globus Medical Inc. (NYSE: GMED), Integra LifeSciences Holdings Corp. (NASDAQ: IART), Medtronic PLC (NYSE: MDT), and Orthofix Medical Inc. (NASDAQ: OFIX).

Though the company posted a second-quarter net loss, its revenue topped Wall Street expectations. Revenue also exceeded top-line estimates back in the first quarter. This summer, Alphatec launched its AI-powered EOS Insight spine surgery platform. Last year, it acquired a robotics platform.

The share price has pulled back about 61% since the beginning of the year. In that time, the Nasdaq is up almost 19%. Note that the $19.46 consensus price target would be a multiyear high. The consensus recommendation of analysts has been to buy shares for at least three months. A number of analysts reiterated Buy-equivalent ratings following the second-quarter report. These include Stifel, Needham, Piper Sandler, and Wells Fargo.

Institutional investors hold more than 67% of the shares. BlackRock, Vanguard, and JPMorgan Chase have notable stakes. More than 98 million shares, or over 13% of the float, are held short. Note that two directors recently bought about 40,000 shares each. And executive sold more than 545,000 shares earlier in the summer.

Wall Street expectations for where the stock goes in the next 52 weeks vary widely but are all very positive. Even the lowest target signals that the share price has some room to run in the next 52 weeks.

| Low target | $8.00 | 36.1% |

| Mean target | $19.46 | 230.9% |

| High target | $32.00 | 444.2% |

Despite Alphatec’s growing revenue, there are still concerns about its balance sheet. Some see a moderate chance that the company faces financial hardship in the next two years. However, if it can manage its debt and make a turn toward profitability, shares could soar.

Wall Street does not seem too concerned, though, and remains optimistic, at least in the short term.

This State Sees the Highest Fatality Rate Due to Medical Care Complications

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.