Investing

How to Earn $14,500 a Year in Passive Income Off America's Energy Dominance

Published:

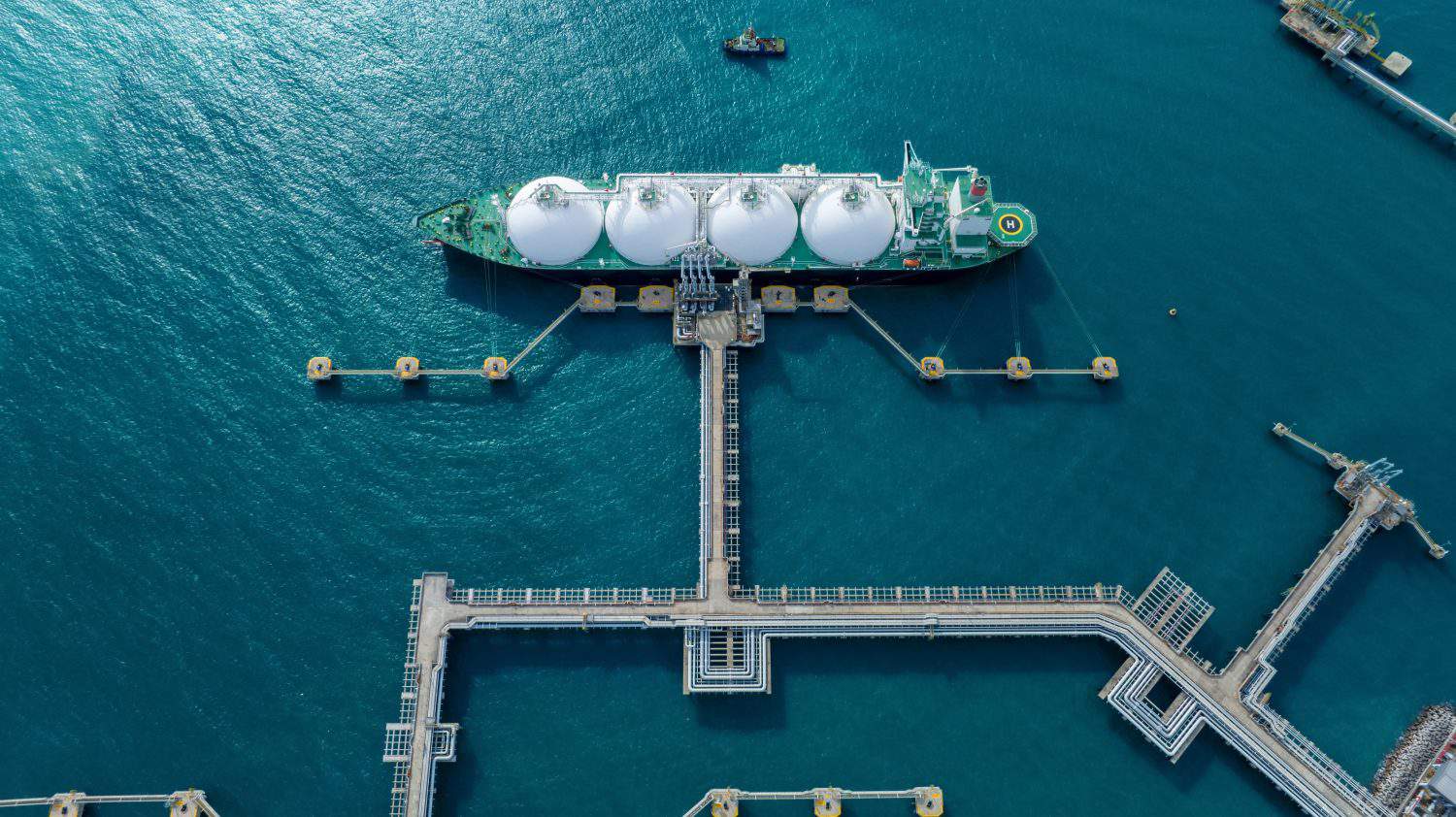

Films and books like There Will Be Blood, Oklahoma! and Syriana have often romanticized oil drilling and production. However, the refining, processing, storage, and transportation functions of the energy supply chain in getting usable products to the end-user is where true value is generated. Midstream companies, which categorize those operations, are a less glamorous, but arguably more essential part of the energy fuels process than exploration.

24/7 Wall Street Insights

The explosion of AI growth and the corresponding expansion of data centers required to operate AI has led to an exponential domino effect of demand escalation for electric power. Elon Musk recently concurred with President Donald Trump in their X interview that electricity requirements will more than double in order to successfully utilize AI in its current state.

Despite massive government subsidies and bureaucratic legislation designed to promote solar and wind power at the expense of fossil fuels, green energy has proven grossly inadequate to the task at hand. Its unreliability and inefficiency have caused the tech industry to push towards a return to reliable and comparatively inexpensive oil and gas.

As green energy failures mount, the pendulum has already begun swinging back towards oil and gas, which will greatly benefit the midstream industry as a whole in these areas:

The following list contains a number of MLP and LP midstream stocks and a shorter list of closed end funds that invest exclusively in midstream and energy stocks. If treated as a portfolio collection, the 15 listed here have a combined average APY of 9.16%. The suggestions are based on $10,000 invested per stock, but that is clearly scaleable in either direction.

Stock #1 : Mach Natural Resources LP (NYSE: MNR)

Yield: 17.47%

Shares for $10,000: 487.33

Annual Dividend Income: $1,747.00

Categorized in the oils-energy sector, OK based Mach Natural Resources acquires, develops, and produces oil and natural gas assets in the Anadarko Basin region. This area encompasses parts of Oklahoma, Kansas, and Texas. The company only went public in 2023. Its founder is natural gas legend Tom Ward, who previously co-founded Chesapeake Energy in 1989.

Institutional ownership comprises 78% of shareholders, with American Century Companies, Inc. the largest one at 2.13% of outstanding shares, and FMR, LLC the next largest shareholder at 0.66%.

Wall Street analysts from Stifel Nicolaus, Raymond James, and Stephens all have “buy” ratings for Mach Natural Resources, with Stifel’s Derrick Whitfield targeting a price of $27.

Stock #2 : Delek Logistics Partners, LP (NYSE: DKL)

Yield: 11.17%

Shares for $10,000: 259.13

Annual Passive Income: $1,117.00

Delek Logistics Partners, LP provides all of the aforementioned services via its network of pipeline access, tankers, trucks, storage facilities and other equipment platforms in Texas, Arkansas, and Tennessee. Delek’s operations are separated into three departments:

Delek Logistics’ largest customer is parent company Delek US Holdings. However, the company is trying to expand its third-party client base, and has current distribution coverage of 1.32x. This strong cash ratio ensures the high dividend’s stability while these growth initiatives are implemented. For investors, the company has an unbroken streak of 46 consecutive quarters of dividend payments.

Stock #3 : CrossAmerica Partners LP (NYSE: CAPL)

Yield: 10.53%

Shares for $10,000: 503.27

Annual Passive Income: $1,053.00

CrossAmerica Partners LP is a midstream limited partnership engaged specializing in the wholesale and retail distribution of motor oil products. As a wholesaler, CrossAmerica Partners supplies wholesale gasoline to 1,800 stations in the US that are under the following brands:

Additionally, CrossAmerica Partners supply fuel, food, car washes, and other convenience products and services to 250 US outlets under the following retail brands:

Furthermore, CrossAmerica has partnerships with individual Dunkin’ Donuts, Arby’s and Subway locations. Since it also deals in retail outlets, there is a real estate component to its business model, as well as branding and other operational facets outside of the oil and gas industry. For example, Cross America Partners obtained 106 7-Eleven locations in May. It is rebranding them as Joe’s Kwik Marts outlets. It is also partnering its nationally recognized fuel brand supply clients to different Kwik Mart sites.

Of interesting note: Cross America Partners currently has a price/sales ratio of 0.18 vs an industry average of 0.53. Therefore, there is an undervaluation component to the company’s fundamentals that could justify potential upside price appreciation.

Stock #4 : Western Midstream Partners. LP (NYSE: WES)

Yield: 9.00%

Shares for $10,000: 265.88

Annual Dividend Income: $900.00

Headquartered in The Woodlands, TX, Western Midstream Partners, LP is a Master Limited Partnership midstream company. Its primary operations are in the Delaware Basin in West Texas and NM, and the DJ Basin in northeastern CO. Additional assets and investments are located in South Texas, UT, and WY. Western Midstream Partners, LP’s General Partner is Occidental Petroleum Corp. (NYSE: OXY).

The company’s focus is primarily on natural gas and natural gas liquids (NGL) processing, as well as crude oil. Western Midstream’s operational assets feature 14,373 total miles of pipeline. The breakdown includes the following:

Stock #5 : MPLX LP (NYSE: MPLX)

Yield: 7.98%

Shares for $10,000: 237.81

Annual Dividend Amount: $798.00

MPLX LP is based in Findlay, OH. Incorporated in 2012, MPLX LP is a subsidiary of Marathon Oil (NYSE: MPC), which owns 64% of outstanding shares. There are two primary operations units, in addition to Marathon Oil’s Capline and Mark West pipeline networks.

Logistics and Storage handles transportation, distribution, storage and marketing of crude oil, refined products and other hydrocarbon-based products throughout the U.S. These assets consist of a network of wholly and jointly-owned common carrier crude oil and refined product pipelines, associated storage assets, refined product terminals, storage caverns, refinery integrated tank farm assets, rail and truck racks, a marine business, export terminals, and wholesale and fuels distribution businesses.

Gathering and Processing is dedicated to natural gas and separating various hydrocarbon components from it for different markets. The heavier and more valuable hydrocarbon components, which have been extracted as a mixed NGL stream, are then further separated into their component parts for end-use sale through the process of fractionation. MPLX sells basic Natural Gas Liquid (NGL) products, including ethane, propane, normal butane, isobutane and natural gasoline.

MPLX LP’s Q2 2024 earnings reported $3.05 billion revenues, exceeding analysts’ $2.92 billion target and Q2 2023’s reported $2.69 billion. EPS of $1.15 beat the consensus target of $0.98. For income investors, MPLX LP has increased its dividend annually since 2013.

Stock #6 : Energy Transfer LP (NYSE: ET)

Yield: 7.85%

Shares for $10,000: 622.27

Annual Dividend Income: $785.00

Dallas, Texas based Energy Transfer LP (NYSE: ET) has built a solid business for itself in the past 28 years by providing storage and transport of crude oil, natural gas, natural gas associated liquids (NGL), and refined products. At the start of 2024, Energy Transfer was the third largest US midstream company by market cap size. Its supply chain network spans Texas, New Mexico, West Virginia, Pennsylvania, Ohio, Oklahoma, Arkansas, Kansas, Montana, North Dakota, Wyoming, and Louisiana. With over 125,000 miles of continental US infrastructure under its auspices, Energy Transfer’s business structure and forward thinking strategy situates it very advantageously going forward.

Energy Transfer is a Limited Partnership with several wholly owned divisions, and large institutional ownership stakes in to other publicly trading companies:

An in-depth 24/7 Wall Street profile of Energy Transfer was published in July and is available here.

Stock #7 : Hess Midstream LP (NYSE: HESM)

Yield: 7.22%

Shares for $10,000: 275.55

Annual Dividend Income: $722.00

Established to supply logistics for parent company Hess Oil, Houston, TX based Hess Midstream LP is a midstream company that also serves third party clients. The company owns gas, oil, and water handling assets primarily in the Bakken and Three Forks Shale plays in the Williston Basin area of North Dakota. Its Gathering, Processing & Storage, and Terminaling & Export divisions are distributed between the following facilities and locations:

Primary NGLs produced are propane, and butane, in addition to natural gasoline.

Stock #8 : Plains All American Pipeline, L.P. (NYSE: PAA)

Yield: 7.15%

Shares for $10,000: 572.73

Annual Dividend Amount: $715.00

Plains All American Pipeline, L.P. is a Houston based midstream company focused on the handling of Natural Gas Liquids (NGL) and crude oil.

Operating in both the US and Canada, Plains All American Pipeline’s transportation activities entail the use of pipelines, barges, railcars, and trucks for transportation of product to terminals, storage facilities, processing locations, and merchants. Its processing operations yield ethane, propane, butane, isobutane, and gasoline. These may be used for industrial fuels, engine fuels, and heating applications.

Primarily focused on the Permian Basin, the company’s pipelines are strategically important for supply throughout North America. Plains All American Pipeline’s 2Q 2024 financials showed that product sales revenues increased to $12.49 million, up from $11.20 million in the same period last year. Service revenues also saw an uptick, reaching $440 million compared to $401 million previously. An encouraging upside potential metric is the fact that the company has a price to book ratio of 1.14, vs the industry average of 2.11. This indicates a potential undervaluation, which could rectify in upcoming months. Therefore, bullish analysts may be justified with Scotiabank and Truist Financial both with targets of $23, with Stifel Nicolaus close behind at $22.

Stock #9 : Enterprise Products Partners LP (NYSE: EPD)

Yield: 7.13%

Shares for $10,000: 343.52

Annual Dividend Income: $713.00

Houston, TX headquartered Enterprise Products Partners LP operates in CO, NM, LA, MS, WY, and TX. Founded in 1968, Enterprise Products has continued to expand its operations and has amassed a gigantic collection of midstream assets and services, which contribute to make it the current midstream “King of the Hill” by market cap size.

Enterprise Products Partners LP has a 7% compound annual growth rate, which will likely get a boost in the future: the company has close to $7 billion worth of expansion projects currently under construction, so the company’s growth prospects are very bullish. These include a new fractionator scheduled to launch operations in 2025, three new NGL plants in 2025-2026, and a new propane and ethane export terminal in 2026. Since the stock trades at roughly 10-11 times earnings, institutional investors on the prowl for value investments with strong and stable dividends will likely take notice.

Enterprise is one of the largest publicly traded Master Limited Partnerships in the US and has a 25 year track record of dividend increases, so dividend size may also have upside prospects for investors of record.

For a 24/7 Wall Street in-depth look at Enterprise Products Partners LP published in July, click here.

Stock #10 : Enbridge, Inc. (NYSE: ENB)

Yield: 6.81%

Shares for $10,000: 256.08

Annual Dividend Amount: $681.00

Headquartered in Calgary, Canada, Enbridge, Inc. is a midstream company energy infrastructure company with 5 separate divisions:

Founded in 1949, Enbridge, Inc.has a dividend record stretching for almost 7 decades, while raising payouts for almost 30 years.Through its Mainline and Express pipelines, Enbridge transports 3 million barrels of crude daily. This allocation accounts for almost 63% of the Canadian crude oil production transported to the U.S. annually.

Enbridge, Inc. has recently been reaching out to Canada’s Indigenous tribes to include them in new renewable energy projects. The Seven Star Energy project with Six Nations Energy Development (an Indigenous tribe consortium) announced a 200 MW wind power project in Saskatchewan. It is anticipated to supply emissions-free clean power to over 100,000 households. Six Nations will acquire a minimum 30% interest, giving the tribes a stable income stream.

Additionally, Enbridge, Inc.’s acquisition of three natural gas processing facilities from Dominion Energy should finalize this year. They have cleared regulatory compliance hurdles so far on two of them thus far. The addition of the three assets should increase the natural gas utilities’ earnings from 12% of EBITDA to 20%. This will subsequently reduce the contribution from oil pipelines from 57% to 50% and take natural gas pipelines from 28% to 25%.

There are a number of closed end funds that specialize in buying energy and midstream stocks for their portfolios. As the yields from midstream companies can vary and the above listed are from the higher side, the following closed end fund stocks are also distributing hefty dividends. Add the risk mitigation diversification component of multiple stocks in each, and midstream closed-end funds can also be a useful addition to anyone’s income based holdings.

Stock #11 : Neuberger Berman Energy Infrastructure and Income Fund (NYSE: NML)

Yield: 10.54%

Shares for $10,000: 1,261.03

Annual Passive Income: $1,054.00

NY based Neuberger Berman Energy Infrastructure and Income Fund’s focus is solely in the public equity energy market, particularly in common stocks and midstream oil and gas limited partnership and limited liability companies. Its total $603 million AUM portfolio, as of August, held 78.3% energy securities, 19.62% utilities, and 1.18% financials. The top three largest holdings were: 1) Energy Transfer LP (13.08%); 2) Targa Resources Corp. (13.05%); and 3) Enterprise Products Partners LP (11.87%).

Stock #12 : Duff & Phelps Utility and Infrastructure Fund (NYSE: DPG)

Yield: 10.06%

Shares for $10,000: 933.70

Annual Passive Income: $1,006.00

Duff & Phelps defines utilities and infrastructure to encompass companies dealing with: electric, gas, water, telecommunications, midstream energy, toll roads, bridges, tunnels, highways, airports, seaports, and railroads. Its $624 million total AUM portfolio is over 90% invested in the energy and midstream industries.

As of August 2024, the primary portfolio allocation was: 62.6% utilities, 28.28% midstream & energy, and 1.47% communications. The top three largest holdings were: 1) NextEra Energy (NYSE: NEE) : 8.4%, 2) Southern Co. (NYSE: SO): 6.2%, and 3) Duke Energy (NYSE: DUK) – 5.97%.

Stock #13 : Tortoise Energy Infrastructure Corporation (NYSE: TYG)

Yield: 8.45%

Shares for $10,000: 277.77

Annual Passive Income: $845.00

Overland Park, KS headquartered Tortoise Energy Infrastructure Corporation is a closed end fund that is basically operating as a fuel and commodity services company.

Tortoise Energy’s portfolio holds mostly stocks, with 77% allocation, and then Master Limited Partnerships (midstream stocks) at 19%. Its top five holdings as of August 2024 are:

1) Targa Resources, Corp. (NYSE: TRGP): 9.4%

2) Williams Companies, Inc. (NYSE: WMB): 8.2%

3) ONEOK Inc. (NYSE: OKE): 7.6%

4) Sempra Energy (NYSE: SRE): 7.4%

5) MPLX LP (NYSE: MPLX): 7.2%

Stock #14 : ClearBridge MLP and Midstream Total Return Fund Inc. (NYSE: CTR)

Yield: 8.76%

Shares for $10,000: 248.69

Monthly Dividend Income: $876.00

The ClearBridge MLP and Midstream Total Return Fund Inc. is an open ended, mutual fund of funds managed by Legg Mason out of New York. It invests in shares of public energy companies, primarily LPs and MLPs.

With $187 million AUM, the ClearBridge MLP and Midstream Total Return Fund Inc. portfolio was unsurprisingly invested 96.31% in the energy sector and 3.69% in utilities, as of August, 2024.

10.76% of the portfolio was invested in Energy Transfer LP (NYSE: ET), 9.20% was in Targa Resources, Corp. (NYSE: TFGP) and 8.35% was in ONEOK Inc. (NYSE: OKE).

Stock #15 : ClearBridge Energy Midstream Opportunity Fund Inc (NYSE: EMO)

Yield: 8.28%

Shares for $10,000: 251.25

Annual Dividend Amount: $828.00

As the common name implies, ClearBridge Energy Midstream Opportunity Fund Inc. is a closed-end mutual fund managed by Legg Mason, a subsidiary of Franklin Resources, out of New York City. The fund invests in public US companies, primarily Limited Partnerships and Master Limited Partnerships.

As an investment fund that takes no active management in any midstream operations, ClearBridge Energy Midstream Opportunity Fund Inc. gets to participate in the revenue streams of the companies on the front lines without any of the liabilities of a potential oil tanker leak like the Exxon Valdez disaster or a gas pipeline explosion from an accidental ignition.

Going into August, 2024, 97.42% of the fund’s $357 million AUM portfolio was dedicated to the energy sector. The remaining 2.58% was in utilities. The three largest positions were: Energy Transfer LP (NYSE: RT): 11.72%, Targa Resources, Corp. (NYSE: TFGP): 8.69%, and Western Midstream Partners (NYSE: WES): 7.94%.

Stock #16 : Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE:KYN)

Yield: 8.27%

Shares for $10,000: 946.073

Annual Dividend Income: $827.00

Kayne Anderson Energy Infrastructure Fund, Inc. is a closed end mutual fund that is mandated to invest at least 80% of its AUM in publicly traded North American energy infrastructure companies. The company defines “energy infrastructure” to include utilities, midstream oil and LNG infrastructure companies, and renewable energy companies. Based out of Houston, TX, Kayne Anderson Energy Infrastructure Fund, Inc. has $2.64 billion AUM.

As of the beginning of August, 2024, 81.26% of the portfolio was dedicated to midstream and energy companies. Utility companies made up 18.94%. The top three largest portfolio positions were: 1) MPLX LP (NYSE: MPLX): 18.27%; 2) Enterprise Products Partners, L.P. (NYSE: EPD): 14.93%, and 3) Energy Transfer, LP (NYSE: ET): 11.04%.

| Name: | Yield: | Total Annual Dividend Amount: |

| Mach Natural Resources LP (NYSE: MNR) | 17.47% | $1,747.00 |

| Delek Logistics Partners, LP (NYSE: DKL) | 11.17% | $1,117.00 |

| CrossAmerica Partners LP (NYSE: CAPL) | 10.53% | $1,053.00 |

| Western Midstream Partners. LP (NYSE: WES) | 9.00% | $900.00 |

| MPLX LP (NYSE: MPLX) | 7.98% | $798.00 |

| Energy Transfer LP (NYSE: ET) | 7.85% | $785.00 |

| Hess Midstream LP (NYSE: HESM) | 7.22% | $722.00 |

| Plains All American Pipeline, L.P. (NYSE: PAA) | 7.15% | $715.00 |

| Enterprise Products Partners LP (NYSE: EPD) | 7.13% | $713.00 |

| Enbridge, Inc. (NYSE: ENB) | 6.81% | $681.00 |

| Neuberger Berman Energy Infrastructure and Income Fund (NYSE: NML) | 10.54% | $1,054.00 |

| Duff & Phelps Utility and Infrastructure Fund (NYSE: DPG) | 10.06% | $1,006.00 |

| Tortoise Energy Infrastructure Corporation (NYSE: TYG) | 8.45% | $845.00 |

| ClearBridge MLP and Midstream Total Return Fund Inc. (NYSE: CTR) | 8.76% | $876.00 |

| ClearBridge Energy Midstream Opportunity Fund Inc (NYSE: EMO) | 8.28% | $828.00 |

| Kayne Anderson Energy Infrastructure Fund, Inc. (NYSE:KYN) | 8.27% | $827.00 |

| TOTAL: | $14,667 |

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.