24/7 Wall St. Insights

- An NFL team owner continues to boost a stake in an energy stock.

- Insiders made notable purchases in tech and health care stocks last week as well.

- Also: 2 Dividend Legends to Hold Forever.

Summer has started to wind down and market volatility is a concern. Yet, insider buying remained fairly active in the past week. Some were repeat purchasers, including the owner of the Dallas Cowboys. Other purchases were prompted by collaborations between companies and by a secondary offering. Stocks pulling back after earnings also brought out some buyers. Let’s take a quick look at these transactions.

Is Insider Buying Important?

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that even with earnings-reporting season winding down, some insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week, starting with the largest and most prominent.

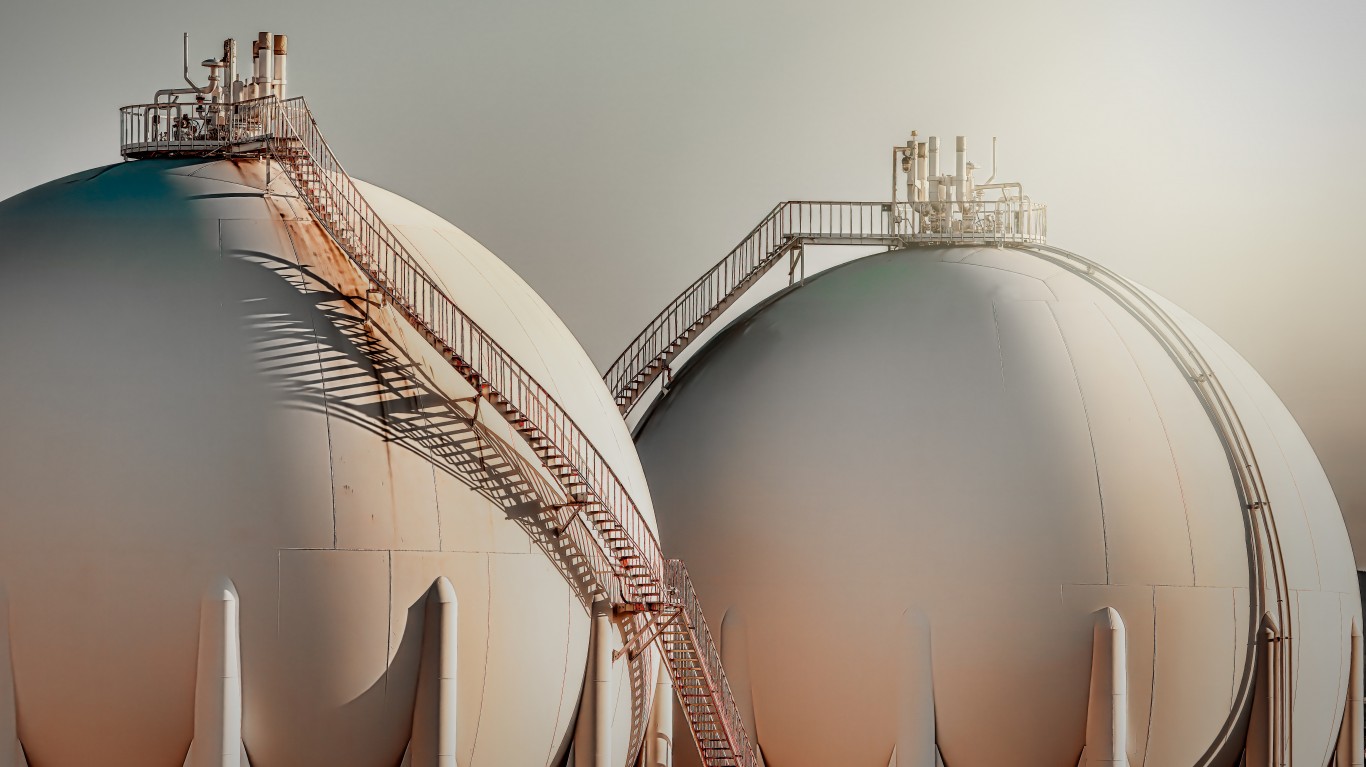

Comstock Resources

- Buyer(s): 10% owner Arkoma Drilling

- Total shares: over 3.1 million

- Price per share: $10.92 to $11.10

- Total cost: more than $34.4 million

This beneficial owner is affiliated with beneficial owner Blue Star Exploration, which recently acquired almost 2.5 million shares of Comstock Resources Inc. (NYSE: CRK). Arkoma also scooped up 5.6 million shares last week. Both Arkoma and Blue Star are owned by Dallas Cowboys owner Jerry Jones. The Texas-based leading producer of natural gas posted disappointing quarterly results at the end of July. Shares pulled back almost 20% after the earnings report but have recovered. They are now 24% or so higher year to date and trading within the buyer’s purchase price range. The share price has overrun the $9.91 consensus price target. Just three of the eight analysts who follow the stock recommend buying shares.

Personalis

- Buyer(s): 10% owner Tempus AI

- Total shares: 3.5 million

- Price per share: $5.07

- Total cost: more than $17.7 million

Cancer genomic test maker Personalis Inc. (NASDAQ: PSNL) and Tempus AI have announced the expansion of their ongoing collaboration to bring products to market. Shares of Personalis recently hit a 52-week high in the wake of a quarterly report that included better-than-expected revenue. The stock is up about 78% since the second-quarter report, as well as around 178% higher since the beginning of the year. The $7.05 consensus price target signals that analysts anticipate 23% upside in the next 12 months. Five out of six analysts recommend buying shares. Note that the chief financial officer and other executives were selling small batches of shares in May and June, when they were changing hands for around $1.30 apiece.

Nerdy

- Buyer(s): CEO Charles Cohn

- Total shares: more than 13.1 million

- Price per share: $0.83 to $1.09

- Total cost: almost $12.0 million

St. Louis-based Nerdy Inc. (NYSE: NRDY) operates a platform for live online learning and has a mission to transform the way people learn through technology. Its stock plunged about 50% to a post-IPO low of $0.72 a share after its second-quarter report was released earlier this month. Shares have recovered to above $1 apiece but are still down more than 69% year to date. Wall Street has a mean price target of $3.07, which signals more than 192% upside potential in the next 52 weeks. That is well below the all-time high above $12. Seven out of nine analysts recommend buying shares. Note that Cohn also acquired over 3.7 million shares back in June, and more last March.

Sonida Senior Living

- Buyer(s): 10% owner Sam Levinson and a director

- Total shares: 253,700

- Price per share: $27.00

- Total cost: more than $6.8 million

These purchases were part of a secondary offering of Sonida Senior Living Inc. (NYSE: SNDA) shares. The Texas-based senior housing operator intends to use the funds to acquire eight communities in Florida and South Carolina. The company also appointed its first chief investment officer last spring. The stock is up about 180% since the start of the year. However, analysts on average expect the shares to underperform in the next 12 months. There is no consensus price target. Note that Levinson’s stake is up to about 2.7 million shares.

Sarepta Therapeutics

- Buyer(s): a director

- Total shares: more than 37,000

- Price per share: $132.46 to $134.82

- Total cost: almost $5.0 million

While Sarepta Therapeutics Inc. (NYSE: SRPT) earnings topped estimates in the second quarter, its sales lagged and guidance was weak. The share price pulled back around 11% after the report but has recovered. The stock is about 46% higher than at the beginning of the year. It got a boost after Sarepta’s muscular dystrophy treatment gained FDA approval in June. The $188.73 consensus price target signals almost 35% upside potential in the coming year. All but one of the 18 analysts who cover the stock recommend buying shares, six of them with Strong Buy ratings. Note that some executives sold shares after the bump in the share price in June.

Appian

- Buyer(s): 10% owner Abdiel Capital

- Total shares: around 67,000

- Price per share: $30.82 to $31.50

- Total cost: almost $2.1 million

After picking up more than $16 million worth of shares recently, this hedge fund manager returned to further boost its stake in Appian Corp. (NASDAQ: APPN) to more than 9.6 million shares. The cloud computing and enterprise software company posted better-than-expected second-quarter sales but also a net loss. More recently, it announced plans to expand its footprint in Japan. Shares plunged after the report and are down about 17% year to date but just above the buyer’s latest purchase price range. The stock has a Hold recommendation from the consensus of analysts. Their mean price target has dropped to $34.50.

And Other Insider Buying

In the past week, some insider buying was reported at Align Technology, Blue Owl Capital, CNX Resources, Darling Ingredients, Dillard’s, Healthcare Realty Trust, Kratos Defense & Security Solutions, Madison Square Garden Entertainment, Matador Resources, O-I Glass, STAAR Surgical, Teladoc Health, Webtoon Entertainment, Workiva, WP Carey, and Yum China.

Prediction: This Health Care Stock Will Be the Best Performer the Rest of 2024

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.