Key Points:

- Waymo logged 100,000 trips in a week, showing strong progress in self-driving technology.

- Tesla and Chinese companies lead in data collection, but Waymo’s tech-focused approach is competitive.

- Successful commercialization of Waymo could significantly boost Alphabet’s market value.

- Also: Investors believe they’ve found ‘The Next Nvidia’, unlock the stock picks for free by clicking here now.

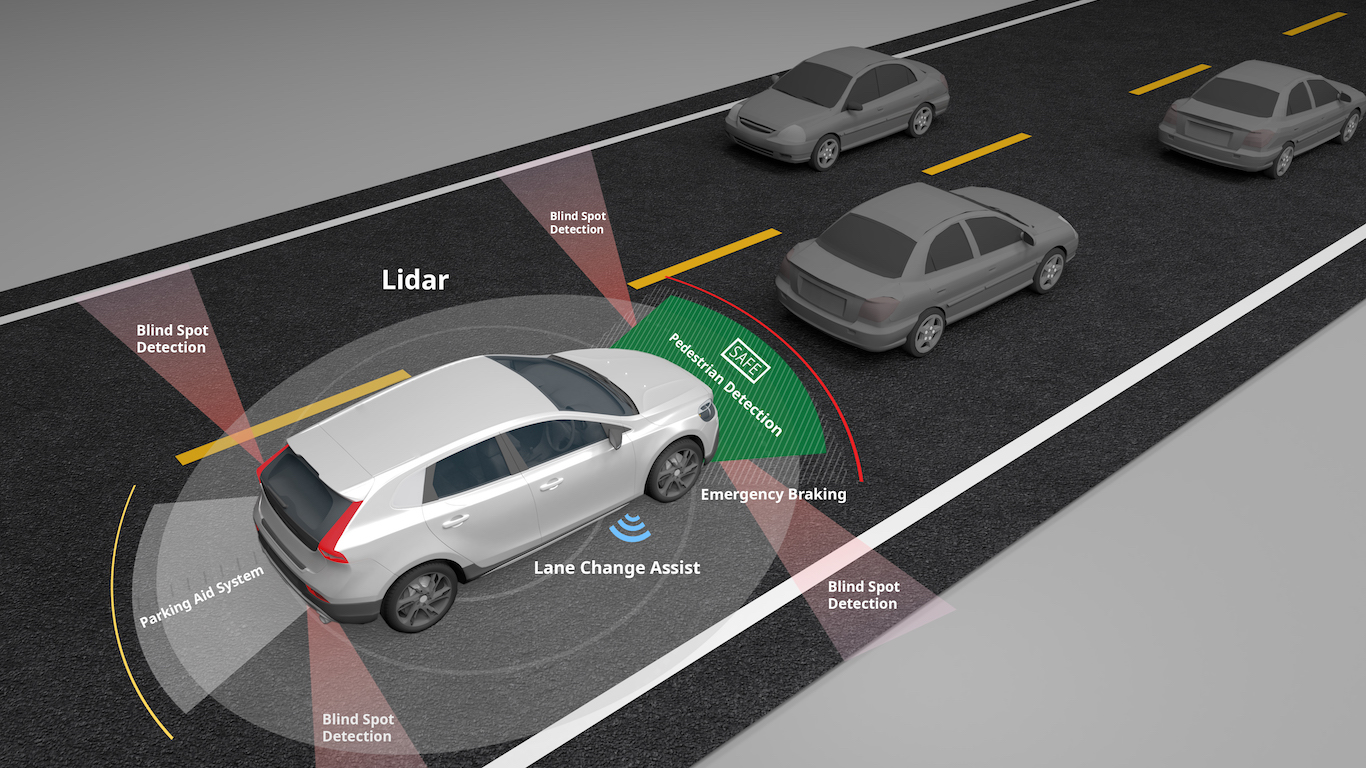

In a recent conversation, Wall Street veterans Douglas McIntyre and Lee Jackson discuss Alphabet’s (NASDAQ: GOOG) involvement in the self-driving car industry through its subsidiary, Waymo. They highlight Waymo’s recent milestone of achieving 100,000 trips in a week, which they find impressive for a still-developing service. The conversation compares Waymo’s approach to Tesla’s (NASDAQ: TSLA), noting Tesla’s extensive data collection through its vehicles, which gives it an edge in mapping and AI capabilities. They also mention the competition from Chinese companies that are similarly collecting vast amounts of data. While they acknowledge that self-driving technology is still in its early stages, they believe Waymo is close to making significant breakthroughs.

A summary of their conversations most important points follows.

- Alphabet, known widely as Google, is heavily invested in the self-driving car business through its subsidiary, Waymo.

- Waymo recently achieved 100,000 trips in a week, signaling significant progress in the autonomous vehicle industry.

Comparing Waymo to Tesla and Chinese Competitors

- Waymo’s approach differs from Tesla’s, which uses extensive video data from its vehicles to map U.S. roads.

- Unlike Tesla, Waymo relies more on in-car technology rather than pre-mapped data, which presents both challenges and opportunities.

- Chinese companies like Baidu are also ahead in data collection, creating a competitive landscape in the self-driving market.

The Strategic Importance of Self-Driving Technology

- Tesla’s current market valuation is heavily influenced by its advancements in self-driving technology.

- Alphabet sees the potential of self-driving cars as a multi-billion-dollar opportunity, especially as they face other challenges like potential antitrust actions.

Future Prospects and Collaborations

- Alphabet’s extensive mapping data from Google Maps and Street View could give Waymo an edge in the autonomous vehicle race.

- The possibility of a joint venture between Alphabet and Tesla is intriguing but unlikely, as Tesla’s valuation is tied to its proprietary AI and self-driving capabilities.

The Road Ahead for Self-Driving Cars

- Self-driving technology is still developing, with occasional accidents highlighting the need for further refinement.

- Waymo appears close to a breakthrough that could turn self-driving cars into a mainstream commercial product, significantly impacting Alphabet’s market cap.

Potential Market Impact and Advertising Integration

- Alphabet is looking to expand its advertising reach, which could be integrated with the self-driving car business for further growth.

- The success of self-driving cars could offset concerns about competition from uncensored AI search engines and other emerging threats.

Revisiting the Future of Autonomous Vehicles

- As the technology progresses, announcements from companies like Tesla or Waymo could accelerate the adoption of self-driving cars.

- The conversation around self-driving vehicles will continue to evolve, with future developments potentially reshaping the industry.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.