Investing

These 3 Stocks Could Be the Politically-Charged Companies You'll Want to Keep an Eye On

Published:

We’re now in the thick of election season, with less than three months to go heading into the upcoming November U.S. presidential election.

The stock market had initially priced in a so-called “Trump trade,” with stocks heading higher in anticipation of his almost assured win against current president Joe Biden. However, with a Democratic shift and a move to promote vice president Kamala Harris to the top of the ticket, things have changed dramatically. It’s now a neck-and-neck race, with RFK Jr. just announcing he’ll be dropping out of the race and endorsing Trump. We’ll have to see how this affects the polls, and how the market ultimately reacts to this news over time.

Who wins this election matters a great deal to investors, and while this election is clearly more of a personal issue for most, for those with large sums invested, it can mean a great deal for their overall holdings.

Of course, not all stocks are as politically-charged as the three I’m going to discuss here. But these three stocks could see the biggest swings in the coming months heading into this election. So, strap in and enjoy the ride!

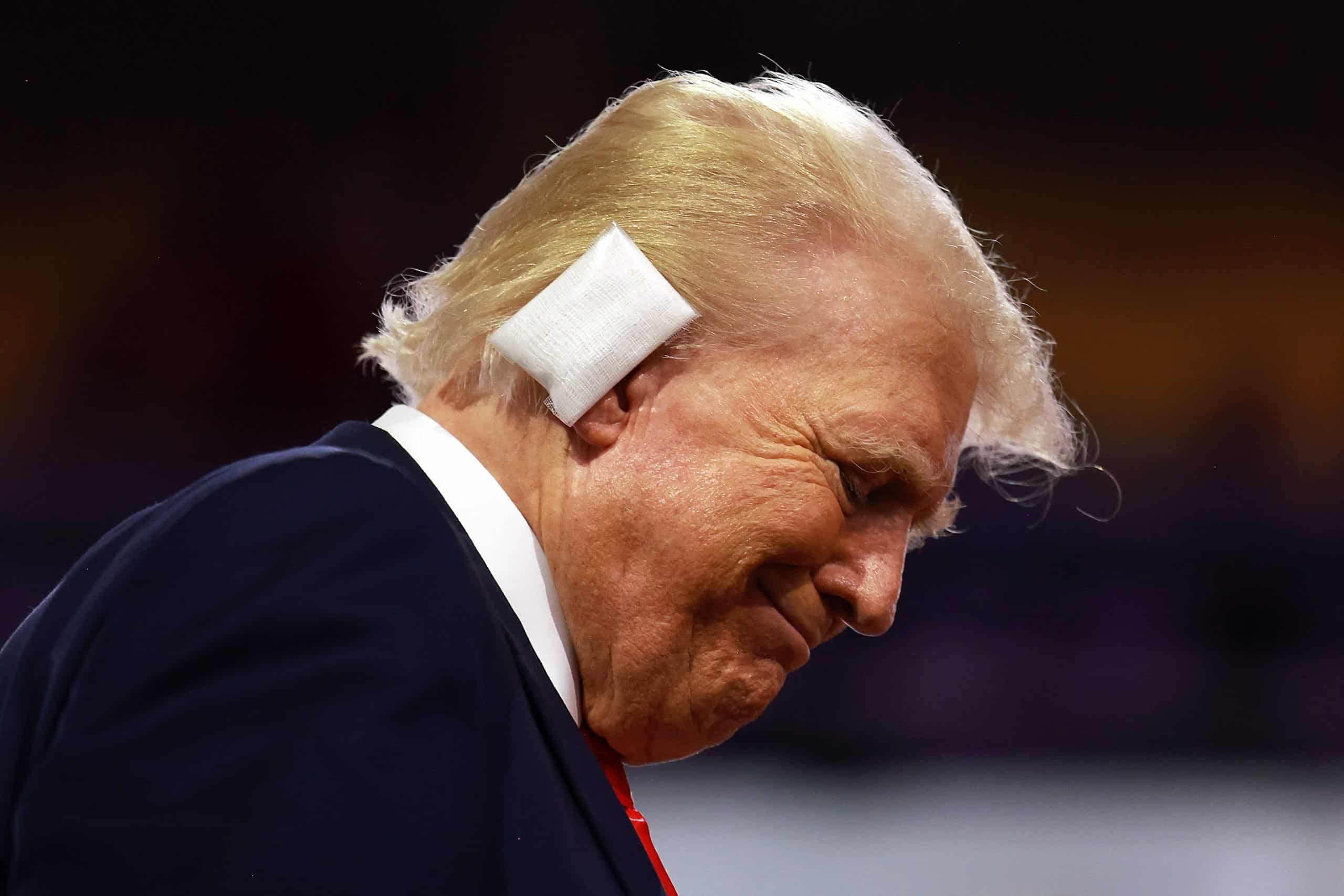

Truth Social, owned by Trump Media & Technology Group (NASDAQ:DJT), is closely tied to Trump’s political fortunes. The stock surged after a recent assassination attempt on Trump, reflecting its sensitivity to his projected political outcome in the coming election. While Truth Social may not appeal to those prioritizing strong financials, it could be attractive for traders banking on a Trump return to the White House next year.

The company reported just $837,000 in revenue last quarter, a 30% decline from the previous year, despite a $5 billion valuation. Losses continued to mount, with the company losing $16.4 million in its first full quarter as a public entity. Trump Media is betting on a conservative-focused streaming service to reverse its fortunes, but disappointing financial results led to a 4% drop in share price, raising doubts about its valuation. Since Vice President Kamala Harris entered the presidential race, Trump Media has lost over a quarter of its value.

Moreover, shares of Trump Media & Technology Group fell near record lows on Wednesday due to weak earnings and Trump’s return to social media platform X. His declining poll numbers and election betting market position have also impacted the stock, which is tied to his bid for a second term. Trump recently reappeared on X with an interview with Elon Musk, after being reinstated by Musk following a suspension. I think if Trump will win this election, DJT stock could be in for big gains. But we’ll have to see – in any case, DJT stock should provide a real-time market perspective on the likely outcome of the election.

In July, Meta Platforms (NASDAQ:META) lifted all penalties and restrictions on Donald Trump’s Facebook and Instagram accounts as the 2024 election approaches. Initially suspended in 2021 due to concerns over inciting violence, Trump’s accounts were reinstated in early 2023 but remained under restrictive conditions. With the recent change, any future violations by Trump would result in much shorter suspensions, potentially lasting only a few days.

Meta Platforms, with its vast data from 3.27 billion users and nearly 600,000 Nvidia H100 GPUs, is well-positioned to dominate in the AI race. The company has developed its own AI models, such as Llama, and is building a comprehensive AI ecosystem. However, the company is also a player in the political landscape, given the importance of its social media platforms for those looking to discuss such issues.

Advertising revenue could get a boost from the upcoming election, something fundamental investors are increasingly focused on. In Q2 2024, Meta’s revenue soared to $39.1 billion, a 136% increase from five years ago. With global digital ad sales set to grow 15.5% annually through 2030, Meta remains highly profitable, and this could be just another catalyst investors are watching right now.

Overall, Meta is the kind of company I’d view as a picks-and-shovels way to play excitement (or anxiety) around this upcoming election. Election year or not, this is a long-term holding that’s certainly the highest-quality pick on this list, in my view.

Tesla’s (NASDAQ:TSLA) earnings have struggled, often missing reduced forecasts, due to a range of sector-specific and company-specific factors. CEO Elon Musk is a divisive figure, and one that’s certainly shifted in terms of his political views and affiliations in the past.

One could argue that the EV giant wouldn’t be around today, if not for former president Obama’s EV tax credits initiated during his 8-year presidency. Elon Musk’s own views on then-Twitter were mostly very left-leaning (at least they appeared that way). And the kind of Tesla buyer that you’d describe as the median or average Tesla owner would be a middle-aged, tech-inspired, early adopter of new technologies that could help save the planet. That was Musk’s initial mission to begin with.

However, Elon Musk’s more recent foray into supporting Donald Trump has certainly been quite the 180 many may not have seen coming. His prior customer base may be looking for other options, as Tesla’s recent slowing growth doesn’t appear to be only a function of the overall market.

If Donald Trump wins the election, I think Tesla stock could certainly be an outperformer. If he doesn’t, that may be a whole other story. So, there’s yet another potential headwind for investors to price into TSLA stock today that maybe wasn’t there four years ago.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.