Investing

I Love TopGolf, but Here Are 3 Reasons I Will Never Buy The Stock

Published:

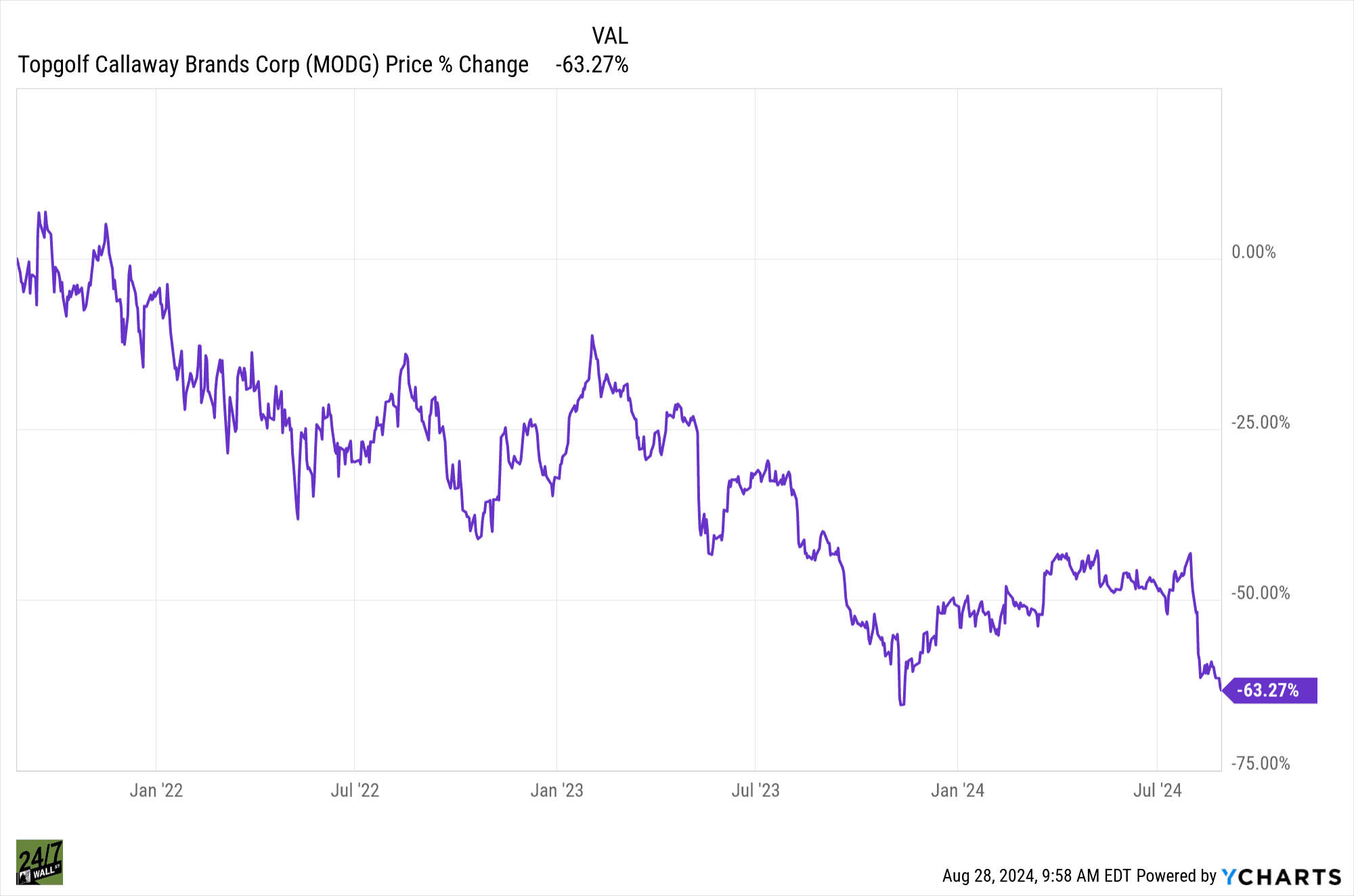

August has been a month to forget for Topgolf Callaway Brands (NYSE:MODG), whose share price has lost 32% through Aug. 26. You would think with the FedEx Cup playoffs in full swing — the final 30 players compete over four rounds this coming weekend at the Tour Championship in Atlanta — the maker of Callaway golf clubs and balls would be riding high on fan interest.

Unfortunately, for longtime MODG shareholders, the stock is suffering for several reasons. While it’s hard not to like the Topgolf experience, the business remains a drain on the entire company.

Topgolf Callaway management is said to be open to a spinoff of its Topgolf entertainment venues. However, some analysts believe the move will come too late to salvage any value from its $3 billion acquisition in early 2021.

I love Topgolf, but there are three reasons I would never buy its stock.

As I said in the introduction, the all-stock merger between Callaway Brands and Topgolf in March 2021 valued the golf entertainment company’s equity at $2 billion. Callaway already owned 14% of Topgolf, so it issued nearly 90 million shares to Topgolf shareholders to close the deal.

It’s good that Callaway didn’t pay for Topgolf’s equity with new debt because the company already had plenty. As of the March 8, 2021, acquisition date, Topgolf had $535.1 million in long-term debt plus $1.02 billion in operating lease liabilities for a total debt of $1.56 billion.

Topgolf Callaway Brands finished Q1 2021 (March 31) with $2.65 billion in total debt, according to S&P Global Market Intelligence. Fast forward to Q2 2024, and it was $4.41 billion, 66% higher than immediately after its merger’s completion and more than double its current market cap.

The company’s annual interest expenses in 2020 were $47 million. By the end of 2022, the first full year with Topdog’s results included, they were $143 million. In the first six months of 2024, they were $116 million, or $232 million annualized.

That’s a tall order to keep on top of.

Callaway CEO Chip Brewer stated that when it completed its acquisition of Topgolf, the two companies were better together.

“Callaway’s leadership in the global golf equipment market and geographic diversity, combined with Topgolf’s revolutionary technology platform and access to golfers of all abilities, will allow both companies to accelerate growth and create competitive advantages,” Brewer stated on March 8, 2021.

“This transformational merger has already created and will continue to create meaningful shareholder value.”

That didn’t turn out to be the case. Since merging, MODG shares have lost about 60% of their value.

As the company scrambles to preserve some of the value from its ill-timed acquisition, the word on the street is that it wants to spin off the Topgolf business and return its focus to golf equipment and apparel.

However, Raymond James analyst Joseph Altobello believes the move could be too late. Altobello recently double-downgraded MDOG stock from Outperform to Underperform.

“Our rating largely reflects the recent deterioration in same-venue sales at Topgolf, and while we applaud management’s openness to a potential spinoff of the business, the company’s levered balance sheet appears to limit its opportunities,” Bloomberg reported Altobello’s Aug. 23 comments.

“Investors should avoid the shares until we gain greater clarity on both situations.”

There is no question that Callaway’s business without Topgolf would be in better financial shape.

As for growth, its Golf Equipment and Active Lifestyle segments would be left after a sale or spinoff, generating $1.38 billion in revenue in the first half of 2024, 6% lower than a year earlier. The non-Topgolf segments also experienced declining operating profits in the year’s first half.

The entire reason it acquired Topgolf in the first place was to reignite growth. Without Topgolf, it must figure out how to organically grow its remaining businesses. However, if there had been a way, Chip Brewer would have already done so.

In 2023, its Golf Equipment and Active Lifestyle segments had revenue of $2.52 billion, 2.9% higher than in 2022. A 1.4% decline partly offset a 9.2% gain in the latter. Excluding currency, Golf Equipment’s revenue was flat year-over-year.

Golf Equipment operating profits were $193.3 million, 23% lower than a year earlier, while Active Lifestyle operating profits rose 51% to $117.0 million. Overall, they fell by 5.6%.

If you want to own a golf-related business, Acushnet Holdings (NYSE:GOLF) is a pure play with significantly less debt and more growth.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.