Investing

Nancy Pelosi Stock Alert: 3 Stock The Pelosi's Are Throwing Down Serious Money On

Published:

Last Updated:

Former House Speaker Nancy Pelosi is among the most prominent stock traders in congress. She remains active in reporting trades, despite stepping down as House Democratic leader in early 2023.

Under the STOCK Act, which mandates disclosure of stock trades by lawmakers, Pelosi and her husband recently reported various movements that have caught the eye of many investors. Recent sales of various high-profile tech stocks have suggested to some that the forward prospects for the tech-driven economy may not be as good as many in the media are making things out to be.

Pelosi achieved nearly three times the S&P 500’s returns in 2023, ranking ninth among Congress members for investment performance, according to Unusual Whales. All disclosed trades were listed under her husband, Paul Pelosi, as the owner.

With that in mind, let’s dive into some of Nancy Pelosi’s biggest recent trades, and what investors may want to make of these moves.

Nvidia (NASDAQ:NVDA) continues to be a very popular stock Mr. and Mrs. Pelosi like to trade. That’s been true for a long time, and is once again the case via information released in recent filings.

Nancy Pelosi reported recent stock trades by her husband, Paul, on July 30. On July 26, Paul bought 10,000 shares of Nvidia, valued between $1 million and $5 million, and sold 5,000 shares of Microsoft, also valued between $1 million and $5 million. This followed a prior purchase of 10,000 Nvidia shares in late June.

Holding a 90% market share in GPUs for generative AI, Nvidia saw its stock soar over the past two years, contributing significantly to the S&P 500’s returns. Despite a recent 10% drop, anticipation that the company will be able to rebound following a decline on its recent Q2 report released on August 28 remains high. The company continues to report triple-digit revenue growth, and while margins have come down, many investors do like the $50 billion buyback announced by Nvidia, signaling the company still believes its stock is cheap.

It remains to be seen whether this trade will ultimately work out for Pelosi, as it’s still too early to know if she’s sold out of this position or not. But one thing’s for sure – despite recent concerns, Nvidia is still expected to thrive, with 66 analysts rating its stock as a Buy, just seven as Hold, and only one as Sell. Wall Street remains confident in Nvidia’s prospects, bolstered by strong results from TSMC, which makes Nvidia’s chips. Unlike software firms still testing AI’s impact, Nvidia’s chips offer immediate benefits for hyperscalers developing AI models. This tangible value supports optimism for Nvidia’s upcoming performance, and hope for Nancy Pelosi’s portfolio.

Nancy Pelosi and her husband Paul, invested millions in Apple (NASDAQ:AAPL) and Microsoft in June, capitalizing on tech sector gains amid controversy over congressional trades. Paul has long owned significant shares in top tech companies and various properties, but his ramped-up bets on Apple do appear to be well-timed, considering the iPhone maker’s surge in recent months.

A long-time investment for Nancy Pelosi, Apple has faced headwinds in early 2024 due to concerns over Chinese sales and AI competition. However, a recent earnings report and a new agreement with OpenAI have sparked a recovery. Analysts predict a 7.49% average rise over the next year, with some forecasting a potential 33% surge to $250 in 2025.

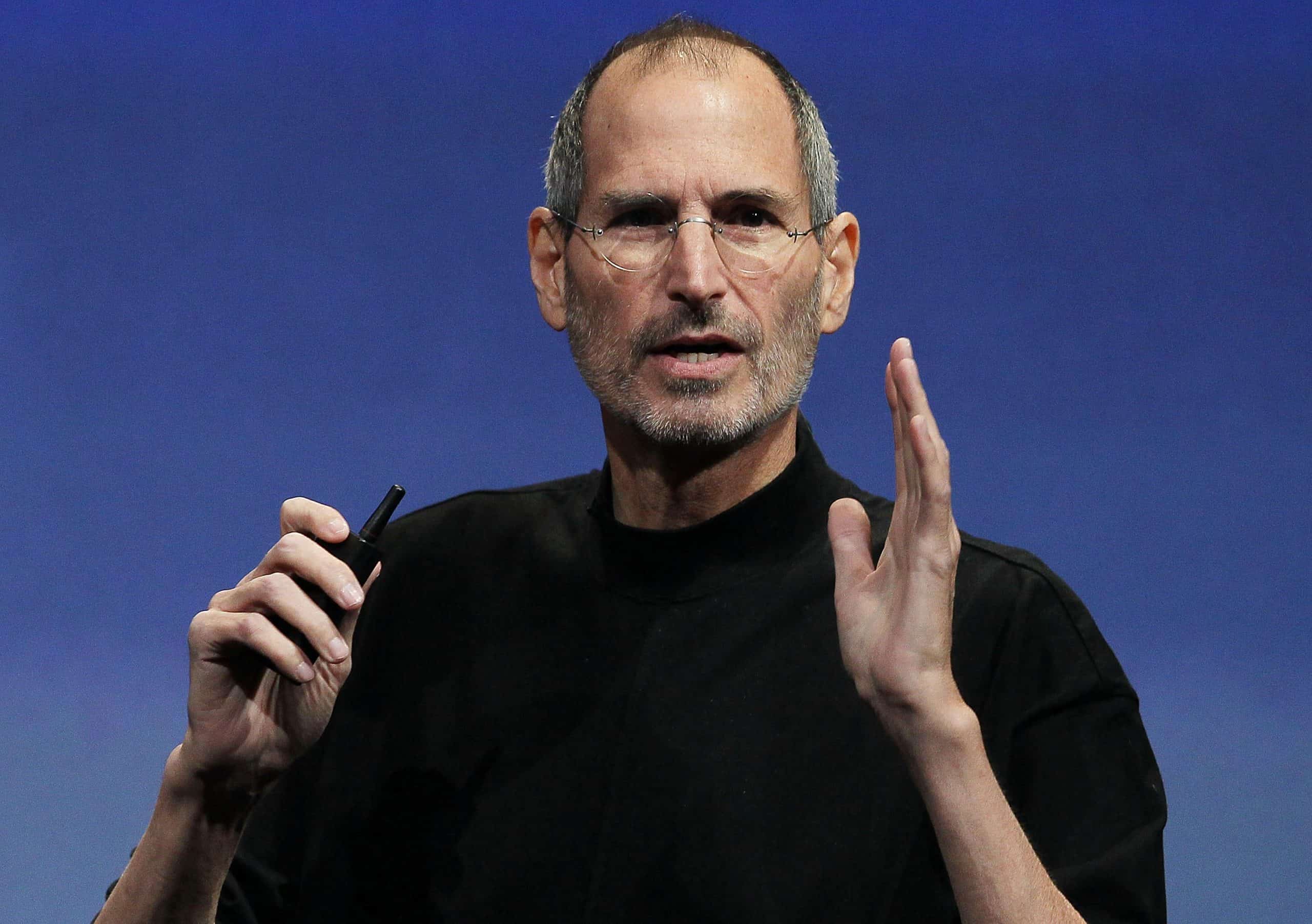

The company is integrating AI into its products, with the upcoming iPhone expected to feature Apple Intelligence. This new AI will enhance apps like Siri and Genmoji, potentially behind a paywall. CEO Tim Cook highlighted the performance of Apple’s in-house chips, which power Mac computers with advanced neural engines and built-in privacy, supporting new AI products with Mac OS Sequoia.

Another stock Pelosi is a big fan of of is Disney (NYSE:DIS). Disney’s margins are at near-record lows, but investments in streaming could boost them once they pay off. With rising market share and projected 18.5% EPS growth, analysts see a strong potential for Disney stock. J.P. Morgan anticipates a 32% price move over the next year, targeting $140 per share.

Under CEO Bob Iger, Disney’s pivot to streaming has paid off. Disney+ quickly gained 100 million subscribers, propelling the company ahead in the streaming wars. Recently, Disney’s streaming segment, including Disney+, Hulu, and ESPN+, turned profitable, achieving an operating income of $47 million, a significant turnaround from the previous year’s $512 million loss. The division saw a 15% income increase, totaling $6.4 billion.

During Disney’s D23 2024 Expo, the company showcased upcoming shows, movies, and announced major theme park expansions. Barton Crockett from Rosenblatt Securities highlighted concerns over Disney’s theme park performance, noting a shift from expected growth to pressure in recent months. Despite this, Disney continues to invest in its parks, a key asset. Crockett emphasized that while Disney’s long-term value is tied to its parks, the near-term challenges in the media space, particularly with Netflix dominating, make it a tough environment for competitors.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.