24/7 Wall St. Insights

- Rivian Automotive Inc. (NASDAQ: RIVN) remains too small and loses too much money to survive, even if its vehicles are well-regarded.

- Also: 2 Dividend Legends to Hold Forever.

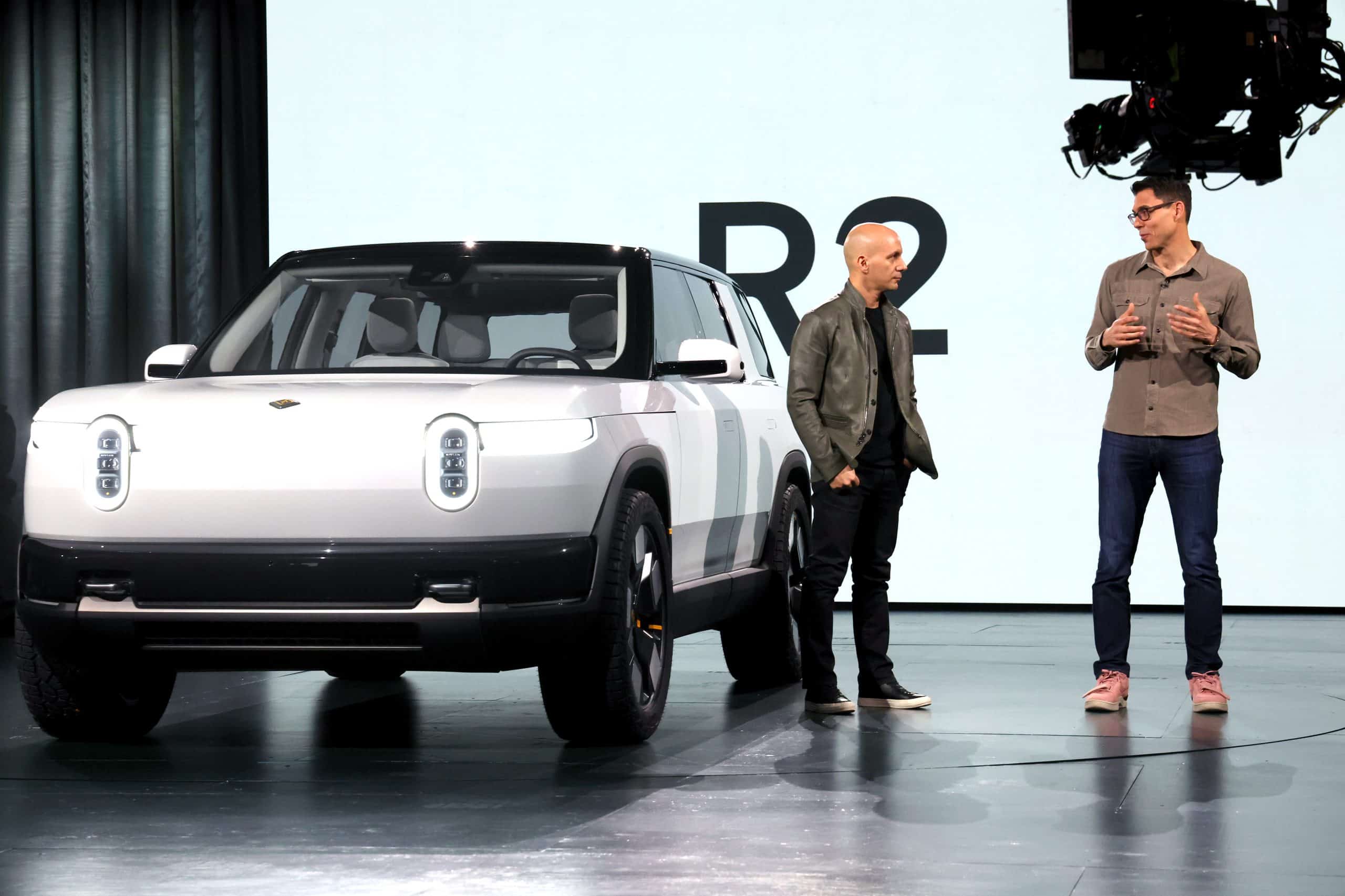

Rivian Automotive Inc. (NASDAQ: RIVN) stock is down 15% for the past month and 56% in two years. The market, which might have given up on the stock earlier in the year, has completely abandoned it recently. The fact that a fire damaged or destroyed about 50 Rivian vehicles is not the reason. The company remains too small and loses too much money to survive, even if its vehicles are well-regarded.

Investors became excited when Volkswagen said it would invest $5 billion in Rivian. It is worth looking again. The sum is $1 billion, with some investment to come later. The operative phrase in the announcement is “up to $5 billion.” If the venture’s early results disappoint VW, it may pull back. The investment does not negate that Rivian loses about $40,000 on each vehicle it builds.

Rivian’s revenue in the most recently reported quarter rose by a fraction year over year to $1.2 billion. It lost $1.4 billion, adding to several quarters in which it has lost $1 billion or more. It produced a tiny 9,612 units.

Rivian needs to be bigger, and its mid-range vehicles are too expensive to compete with Tesla or the mass of legacy car companies entering the EV sector. They cost about $80,000. To clear out inventory or drive demand, the company has resorted to 2.99% loans for 60 months. Loans of this kind usually carry an interest rate of 6% or higher.

There are no signs Rivian can be a success.

Three EV Stocks With Troubles Ahead

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.