24/7 Wall Street Insights

- Closed-End Mutual Funds (CEF) trade like stocks but provide comparable performance to their Open-End Mutual Fund cousins and may have additional advantages.

- Mutual Funds, by design, have a built-in diversification factor that mitigates the volatility that one might experience with individual stocks.

- For investors seeking dividends, click here for a free report on two high dividend stocks.

Dividend stocks are an excellent asset class source for passive income. 24/7 Wall Street has a massive database of thousands of dividend stocks that have been highlighted in many past articles. For those prospective investors who lack the time to monitor a stock portfolio closely, mutual funds might be a suitable way to invest in a prorated stock portfolio with the benefit of professional management. However, finding mutual funds with sufficient yields to meet one’s needs can be a task in itself, as there are thousands to choose from.

Mutual Funds: Closed-End Funds (CEF) That Trade Like Stocks

Mutual funds are often an excellent way to invest in the market with a built in diversification factor for risk containment purposes. The two primary types are either Open-End, meaning that shares are added or reduced as investors add or deduct funds, or they are Closed-End, meaning that the number of shares is fixed and the value of each share rises or falls in proportionate value to the fund’s holdings. The Closed-End mutual funds are listed like stocks and trade primarily on the NYSE, although some trade on NASDAQ. Open-End mutual funds are either direct subscription, or obtained through brokerage firms.

While both types of mutual funds routinely have active managers, Closed-End funds will often perform slightly better, all other factors being equal. This is because closed-end mutual funds generally come with a cash requirement, as shares cannot be redeemed. Therefore, more of the money is actually invested, since not needing to hold cash for redemptions increases the overall return of a Closed-End mutual fund relative to an Open-End mutual fund.

The following 14 Closed-End funds collectively average slightly over 11% APY. Although the $15,000 income total is based on $10,000 invested in each fund, this is obviously scaleable up or down. Prices and yields are based on market quotes at the time of this writing.

RiverNorth Opportunities Fund

Stock #1 : RiverNorth Opportunities Fund (NYSE: RIV)

Yield: 15.43%

Shares for $10,000: 800

Annual Passive income: ~$1,543.00

RiverNorth Opportunities Fund contains a mix of equities and fixed income securities which are delivering an impressive 15.43% annual yield.

The fund is managed by Chicago, IL based RiverNorth Capital Managers, LLC and ALPS Advisors, Inc. As of July, the fund was weighted 54% fixed income and bonds, 8% US equities, and 9% Non-US equities. Additionally, RIV has an 8% allocation in SPAC deals.

The top 3 equity side sector holdings in RIV’s $268.94 million net AUM portfolio is focused 31.8% in financials, 15.95% in technology, and 15.28% in healthcare. On the fixed income side, the portfolio favors corporates, with the remainder in municipal and government bonds. Nearly 30% of bonds are BBB, with almost 21% rated AA.

PGIM Global High Yield Fund, Inc.

Stock #2 : PGIM Global High Yield Fund (NYSE: GHY)

Yield: 12.23%

Shares for $10,000: 802.56

Annual Passive Income: ~$1,223

The PGIM Global High Yield Fund is a closed end high-yield bond fund founded by Prudential Securities subsidiary PGIM in 2012. Located in Newark, NJ, the PGIM Global High Yield Fund is essentially a high-yield bond mutual fund. Management policy prefers shorter duration maturities of bonds that are rated no higher than Ba1 or BB+ by Moody’s and Standard & Poor’s, respectively. As of August, its $675.78 million total AUM portfolio held 95.85% fixed income securities, with 1.06% US stocks, 0.57% foreign stocks, and the rest in cash.

PIMCO High Income Fund

Stock #3 : PIMCO High Income Fund (NYSE: PHK)

Yield: 11.95%

Shares for $10,000: 2,085

Annual Passive Income: ~$1,195

Formed in 2003, the PIMCO High Income Fund is a closed-end fund that is co-managed by Pacific Investment Management Company and Allianz Global Investors Fund Management, LLC. Headquartered in Newport Beach, CA, the PIMCO High Income Fund manages a $905.21 million AUM portfolio. 78% is allocated to fixed-income securities, primarily high-yield Collateralized Debt Obligations(CDO). 9.20% is in equities 0 as of July, 2024.

abrdn Global Premier Properties Fund

Stock #4 : abrdn Global Premier Properties Fund (NYSE: AWP)

Yield: 11.85%

Number of shares for $10,000: 2,433

Monthly Dividend Income:~ $1,185.00

Headquartered in Aberdeen, Scotland, UK, the abrdn Global Premier Properties Fund is a closed-end mutual fund that invests in global stocks engaged in the real estate industry. The FTSE EPRA/NAREIT Global TR Index, MSCI US REIT Gross Total Return Index, and S&P Developed BMI Property Index Net TR Index are abrdn Global Premier Properties Fund’s benchmarks against which it compares the performance of its portfolio.

With $442.38 million total AUM as of August, 2024, the fund is roughly 65.36% US stocks and 33.85% foreign stocks, with the remainder in cash. 99.5% are, unsurprisingly, in the real estate sector.

The top three largest percentage positions being held in the portfolio are: Prologis Inc. (NYSE: PLD) – 7.83%; Welltower Inc. (NYDE: WELL) – 5.65%; and Equinix Inc. (NASDAQ: EQIX) – 5.53%.

Nuveen Credit Strategies Income Fund

Stock #5 : Nuveen Credit Strategies Income Fund (NYSE: JQC)

Yield: 11.47%

Shares for $10,000: 1,760.5

Total monthly dividend income: ~$1,147.00

The San Francisco based Nuveen Credit Strategies Income Fund is a closed-end mutual fund that mostly invests in global senior loans, high yield corporate debt, and collateralized loan obligation (CLO) debt. The fund uses leverage and may also invest in the public equities markets.

To curb risk, the fund has a 30% ceiling for its portfolio in securities rated CCC/Caa or lower. It also has a 25% cap on CLO issues. There are no percentage limits on instruments rated BB+/Ba1 or higher.

As of early July, 2024, Nuveen Credit Strategies was invested 72.4% in senior loans, 20.1% in corporate bonds, and 4.6% in ABS, with 2.4% in cash. Sector wise, 17.4% were Consumer Discretionary, 15.6% were Industrials, and Infotech was 13.8%.

Geographically, 78.1% of issues were from the US, 4.7% from U.K., and 3.7% from the Cayman Islands.

First Trust Senior Floating Rate Income Fund II

Stock #6 : First Trust Senior Floating Rate Income Fund II (NYSE: FCT)

Yield: 11.30%

Shares for $10,000: 968

Annual Passive Income: ~$1,130

The First Trust Senior Floating Rate Income Fund II is a closed-end mutual fund that invests a minimum of 80% of its portfolio in senior secured floating rate corporate loans. Based in Wheaton, IL, the $319.5 million AUM fund gauges its performance against the S&P/LSTA Leveraged Loan Index.

As of July 2024, 38.42% of the portfolio holdings were rated B, 17.08% were B+, and 15.86% were B-. Average maturity was 4.81 years. The top issuers being held in the portfolio were: 1) Nexstar Broadcasting – 2.51%, 2) Clarivate Analytics PLC (Camelot) – 2.34%, and 3) HUB International, Ltd. – 2.28%.

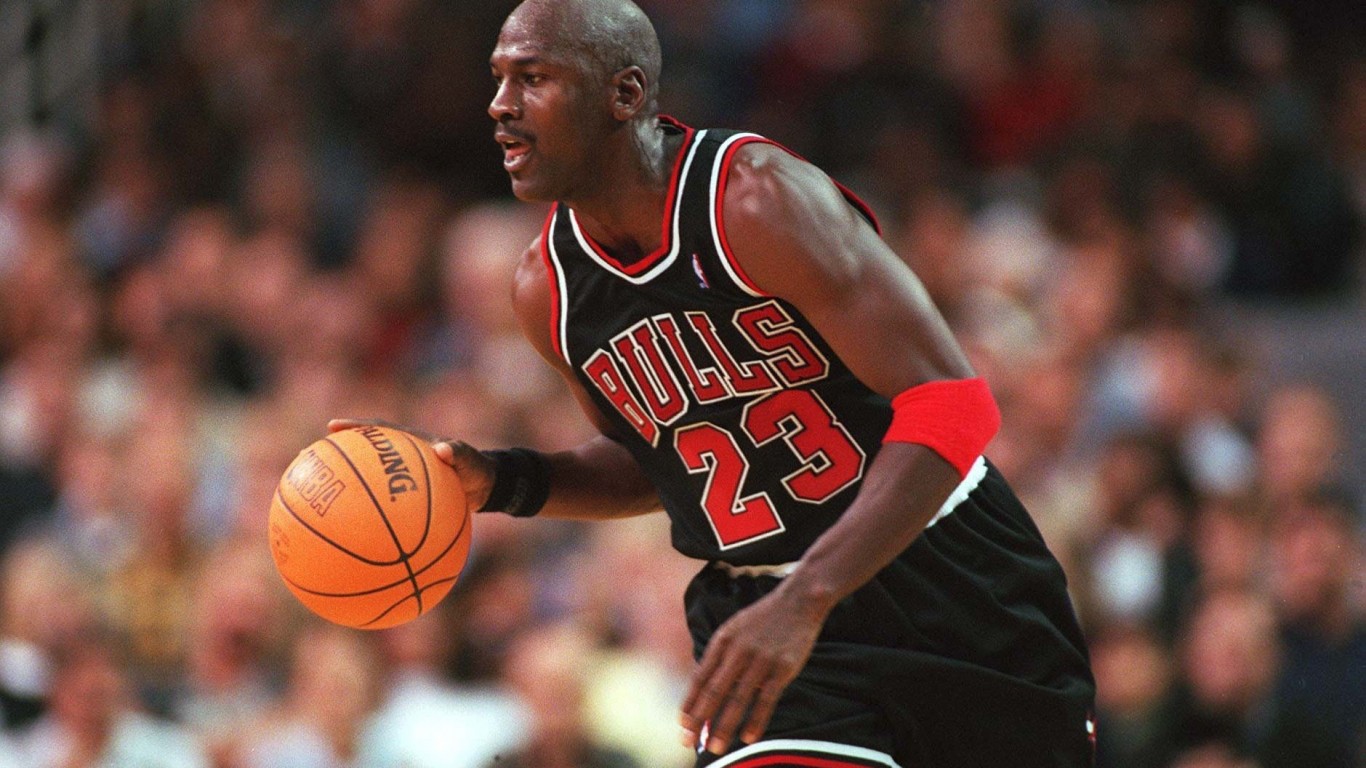

Virtus Artificial Intelligence & Technology Opportunities Fund

Stock #7 : Virtus Artificial Intelligence & Technology Opportunities Fund (NYSE: AIO)

Yield: 11.16%

Shares for $10,000: 477.35

Annual Passive Income: ~$1,116.00

With Artificial Intelligence reigning as the hottest sector on Wall Street, numerous asset managers and private equity funds have entered the fray, vying for stakes in what may be the next Nvidia Corp. (NASDAQ: NVDA). NY headquartered Virtus Investment Partners is no exception. Its Virtus Artificial intelligence & Technology Opportunities Fund takes stakes in select public and private A.I. and other cutting edge technology companies via convertible securities or direct equity investment.

Over half of its $859.2 million portfolio is invested in common stocks (51.16%). Convertible bonds (31.15%) and high-yield bonds (15.29%) round out the rest of the holdings, apart from cash on hand. The three largest positions include two “Magnificent 7” stocks: Nvidia (3.99%), and Microsoft (3.10%), with Eli Lilly & Co. at 3.02%.

In an ironic parallel to the sci-fi film, Blade Runner, which focused on cyborgs with a built-in termination of lifespan, Virtus has chosen to terminate its Virtus Artificial Intelligence & Technology Opportunities Fund on October 29, 2031, absent a Board of Trustees vote for an extension.

24/7 Wall Street has a free report to read on what may be “the next Nvidia” if you click here.

Guggenheim Active Allocation Fund

Stock #8 : Guggenheim Active Allocation Fund (NYSE: GUG)

Yield: 11.01%

Number of shares for $10,000: 638.97

Monthly Dividend Income:~$1,101.00

While some mutual funds take a conservative approach towards managing a portfolio by simply buying and selling securities, there are others that are much more aggressive. Chicago based Guggenheim Active Allocation Fund is one such fund, with emphasis on “active”.

Guggenheim Active Allocation Fund is a closed-end balanced mutual fund that invests in global stocks as well as fixed-income securities. With $737 million AUM, the management on the equity side invests in common stocks, shares in Limited Liability Companies, trust certificates, and other securities that can be categorized as “equities”. Additionally, the fund’s manager will utilize covered call option writing for added income, along with put options to short stocks when opportunities present themselves, all with the goal of maximizing returns.

On the fixed-income side, the fund has a cap of 25% maximum of portfolio allocation into securities rated CCC or below. Otherwise, government bonds, corporate bonds, loans, loan participations, mortgage bonds, asset-backed securities, collateralized debt obligations, mezzanine loans and convertible bonds are all fair game for inclusion. As of July, the portfolio was weighted 90% in favor of fixed-income investments.

Additionally, non-US dollar denominated securities will be considered, so Forex markets and strategies are also monitored for opportunities.

An added plus for investors who choose to participate is the fund’s DRIP (Dividend Re-Investment Plan). The DRIP price is calculated by either of the following steps: First, if the Common Shares are trading at a discount, the DRIP price is the weighted average cost to purchase the Common Shares from the NYSE or elsewhere. Secondly, if the Common Shares are trading at a premium, the DRIP price is determined either by the NAV or approximately 95% of the Common Share price, whichever is higher.

Voya Global Equity Dividend and Premium Opportunity Fund

Stock #9 : Voya Global Equity Dividend and Premium Opportunity Fund (NYSE: IGD)

Yield: 10.95%

Shares for $10,000: 1,821.49

Annual Passive Income: ~$1,095.00

Located in Scottsdale, AZ, the Voya Global Equity Dividend and Premium Opportunity Fund is a dividend focused closed-end mutual fund that invests in the global equity markets. As a global fund, it will use a covered call writing strategy against individual stocks, ETFs, or indices to enhance returns. It will also use some forex hedging strategies to mitigate currency risk in its foreign stock holdings. Its $477.5 million AUM portfolio

As of July, 2024, the fund’s top sector weightings are in financials – 22.43%, healthcare – 13.85%, and industrials – 13.64%, with 69.38% US companies, 6.62%, Japanese, and 3.52% Canadian.

The fund’s top three largest holdings are: 1) Johnson & Johnson (NYSE: JNJ) – 1.63%, 2) UnitedHealth Group (NYSE: UNH) – 1.63%, and 3) AbbVie, Inc. (NYSE: ABBV) – 1.48%.

Neuberger Berman Energy Infrastructure and Income Fund

Stock #10 : Neuberger Berman Energy Infrastructure and Income Fund (NYSE: NML)

Yield: 10.54%

Shares for $10,000: 1,278.77

Annual Passive Income: ~$1,054.00

The concept behind most mutual funds is to offer investors a proportionate portfolio of varying securities with inherent diversification to mitigate risk from individual stocks’ or their sector’s volatilities.

NY based Neuberger Berman Energy Infrastructure and Income Fund is one of the few exceptions. Its focus is solely in the public equity energy market, particularly in common stocks and midstream oil and gas limited partnership and limited liability companies. Its $501 million AUM portfolio, as of August, held 55.11% oil and gas securities, 11.85% utilities, and 7.96% financials. The top three largest holdings were: 1) Targa Resources Corp. ORD (13.84%); 2) Energy Transfer LP (13.24%); and 3) Enterprise Products Partners LP (12.39%).

Nuveen Core Equity Alpha Fund

Stock #11 : Nuveen Core Equity Alpha Fund (NYSE: JCE)

Yield: 10.47%

Shares for $10,000: 689.16

Annual Passive Income: ~$1,047.00

Growth oriented mutual funds that also pay a double-digit dividend can be the best of both worlds for investors seeking income and capital appreciation. The Nuveen Core Equity Alpha Fund is a $236 million AUM closed end fund that is designed exactly for that purpose. Using the S&P 500 Index as its benchmark, the Nuveen Core Equity Alpha Fund uses a trading predicated quantitative analysis methodology, combined with the use of options and futures to augment returns.

The top largest holdings in the portfolio as of the beginning of April 2024 are: 1) Microsoft – 7.9%, 2) Apple (NASDAQ: AAPL) – 7.4%, and 3) Nvidia Corp. (NASDAQ: NVDA) – 7.3%.

Calamos Convertible Opportunities and Income Fund

Stock #12 : Calamos Convertible Opportunities and Income Fund (NASDAQ: CHI)

Yield: 10.39%

Shares for $10,000: 907.44

Total monthly dividend income: ~$1,039.00

Convertible bonds are a niche area of investing that does well in situations where stocks may offer more ROI potential than bonds. Issued as bonds by public companies, convertible bonds contain an option for the bondholder to convert the bond to a predetermined number of equivalent common stock shares.

The Calamos Convertible Opportunities and Income Fund is a closed-end mutual fund that is focused on the convertible bond market. T\As of July, the Naperville, IL fund has a $1.18 billion warchest and its assets are invested in a menu of sectors. The top three largest positions are: Consumer Discretionary (19.9%), Infotech (19.7%) and Healthcare (12.8%).

15.5% of bonds are BB, 12.2% are BBB, and 9% are B. The three largest convertible bond issuer positions being held in the portfolio are from Uber Technologies (1.7%), ON Semiconductor (1.5%), and Ford Motor Co. (1.4%) – all statistics as of August, 2024.

US securities account for 92.4% of holdings, with China at 1.7% and Israel at 1.3%.

LMP Capital and Income Fund, Inc.

Stock #13 : LMP Capital and Income Fund (NYSE: SCD)

Yield: 8.73%

Shares for $10,000: 635.3

Annual Passive Income: ~$873.00

The LMP Capital and Income Fund, jointly managed by Franklin Templeton’s Legg Mason Partners Fund Advisors, LLC, Western Asset Management, and Clearbridge Investments, is the closest dividend stock in this list to what would be characterized as, “a diversified, blended mutual fund”.

NY headquartered LMP Capital and Income Fund invests its $359.2 million AUM portfolio in a variety of large cap stocks and investment grade bonds rated A- or higher, as well as REITs and both energy and non-energy limited partnerships. Because energy opportunities exist worldwide, the LMP Capital and Income Fund portfolio invests globally, so its 64.7% common stock holdings contain non-US securities as well as US ones as of August.

The top three largest positions held at the present are: 1) Energy Transfer. Equity LP (4.84%); 2) Apple Inc. (3.79%); and 3) Enterprise Products Partners LP (3.78%).

BlackRock Health Sciences Term Trust

Stock #14 : BlackRock Health Sciences Term Trust (NYSE: BMEZ)

Yield: 8.10%

Shares for $10,000: 622.66

Total monthly dividend income: ~$810.00

Recently reporting over $10 trillion AUM, BlackRock has a foot in every modern financial platform in existence. The BlackRock Health Sciences Term Trust is a closed-end mutual fund that invests in the global market of stocks engaged in the healthcare and life science sectors.

As of August, the fund’s $1.9 billion AUM, BlackRock Health Sciences Term Trust is invested 79.46% in the US companies, 3.73% in German issuers, and 2.91% in Danish company stocks. The three largest holdings are: 1) Alnylam Pharmaceuticals Inc. (2.70%); 2) West Pharmaceutical Services (2.61%); and 3) Intuitive Surgical, Inc. (2.38%).

While mutual funds require considerably less monitoring than a stock portfolio, it is still a prudent idea to keep track of the various funds in a portfolio at least on a weekly basis. The returns from these mutual funds offer capital appreciation upside potential as well as passive dividend income, so choose wisely!

| Name: | Yield: | Annual Dividend Income: |

| RiverNorth Opportunities Fund (NYSE: RIV) | 15.43% | ~$1,543.00 |

| PGIM Global High Yield Fund (NYSE: GHY) | 12.23% | ~$1,223 |

| PIMCO High Income Fund (NYSE: PHK) | 11.95% | ~$1,195 |

| abrdn Global Premier Properties Fund (NYSE: AWP) | 11.85% | ~ $1,185.00 |

| Nuveen Credit Strategies Income Fund (NYSE: JQC) | 11.47% | ~$1,147.00 |

| First Trust Senior Floating Rate Income Fund II (NYSE: FCT) | 11.30% | ~$1,130 |

| Virtus Artificial Intelligence & Technology Opportunities Fund (NYSE: AIO) | 11.16% | ~$1,116.00 |

| Guggenheim Active Allocation Fund (NYSE: GUG) | 11.01% | ~$1,101.00 |

| Voya Global Equity Dividend and Premium Opportunity Fund (NYSE: IGD) | 10.95% | ~$1,095.00 |

| Neuberger Berman Energy Infrastructure and Income Fund (NYSE: NML) | 10.54% | ~$1,054.00 |

| Nuveen Core Equity Alpha Fund (NYSE: JCE) | 10.47% | ~$1,047.00 |

| Calamos Convertible Opportunities and Income Fund (NASDAQ: CHI) | 10.39% | ~$1,039.00 |

| LMP Capital and Income Fund (NYSE: SCD) | 8.73% | ~$873.00 |

| BlackRock Health Sciences Term Trust (NYSE: BMEZ) | 8.10% | ~$810.00 |

| Total: | $15,558 |

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.