Investing

Want $3,000 in Passive Income? Invest $1,250 Into These 21 Dividend Stocks

Published:

Dividend stocks are a good way for beginners to break into the stock market and receive monthly or quarterly payouts. There are several examples of investors living off the dividends of the stocks they have accumulated. Dividend Stocks are investments that pay you back for owning them. Dividends come from the leftover profits corporations have at the end of each pay-out quarter.

Corporations pay out dividend stocks to demonstrate financial strength and attract more investors. If there is a pause, or suspension, of dividend distribution, that will spook shareholders to sell, and decrease the value of the company. Looking for companies that have a consistent dividend payment history can indicate a good company to invest in. Dividends are not a way to “get rich quick,” but it is possible to potentially earn hundreds of dollars a month in passive income with the right stock accumulation in your portfolio.

A dividend yield is the amount of money a company pays to shareholders relative to its stock price. Dividend companies distribute bi-annually, quarterly, or even monthly to investors. A high yield percentage doesn’t necessarily determine a stock’s quality, but consistency is a big factor. A healthy company should consistently increase its dividend per share each year. Green flags to look for when choosing dividend stocks to invest in are consistent payouts combined with steady gains long-term. It’s also important to consider a company’s dividend payout ratio, and whether it’s appropriate for the sector the company is in.

A dividend payout ratio equals the total annual dividend payments divided by the annual earnings. This ratio is important because it means that not all high-yield dividend stocks are actually smart investments. A high dividend payout ratio is not always a good thing, depending on the sector. In a slow-growing sector, for example, where companies are generating steadily increasing revenue, they can afford to have a higher dividend payout ratio. Because of the consistency, they don’t necessarily need to retain as many profits. These companies can afford to have a higher dividend payout ratio, around 75% or higher.

The opposite is true in fast-growing sectors. Fast-growing sectors plan to have more inconsistent cash flow. Because of this, the companies need to hold on to more of their profits to re-invest in business expansion. For these sectors, an ideal dividend payout ratio is less than 50%.

You will see high or low stock valuations mentioned in this list. This refers to the process of determining the actual value of a share in a company stock. This is determined by two different methods, relative valuation (or the comparables approach) and absolute valuation (or discounted cashflow method). It’s not that important to understand how valuations are determined, but it’s important to understand what a high or low valuation means. So, if you see that a stock has a high valuation, that means you will be paying more for it than it’s actually worth. Conversely, if it’s a low valuation, that means that you pay less than what a dividend stock is actually worth (that’s great for you!) Stock valuations are determined by the market, not by the company itself.

There are tools to know whether a dividend investment is good or not. AAII created the Dividend Investing Grader, which helps potential investors condense all of the relevant information over the past 5 years and gives it a grade from A–to F. These recommended companies and stock information have been gathered from The Motley Fool Stock Advisor Analyst Team, Newsweek Vault, Nerd Wallet, the S&P 500, and Russell 2000. All Dividend Valuation Grades and Dividend Growth Score Grades are sourced from the American Association of Individual Investors (AAII).

It can be hard knowing where to start when beginning your investment journey. There is a plethora of advice and recommendations. We want new investors and experienced investors to both find value when investing, so we found the best dividend stocks that everyone can invest in to make the best returns.

The Ready Capital Corp (NYSE:RC) is a multi-strategy estate finance company and has seen a steady 5-year dividend growth rate increase with a history of consistent dividend payout history. It generates income by acquiring small to medium-sized commercial loans as well as financing, servicing, and originating loans. It holds loans that are backed by the federal government (U.S. Small Business Administration Loans, and U.S. Department of Agriculture OneRD Initiative loans). It currently has a consensus rating is “Hold,” and currently the dividend payout ratio is listed as N/A.

The Arbor Realty Trust Inc. (NYSE:ABR) is a multifamily finance company and has had a consistent 5-year average dividend growth rate and consistent dividend payouts. It is currently trading at a low valuation. It is considered an mREIT in the real estate sector.

Buckle, Inc. (NYSE:BKE) is a clothing retail company that has had a consistent 5-year average dividend growth rate and has a history of consistent dividend payouts. Buckle, Inc. has 451 stores across 42 states. It sells private-label and brand-name apparel. It was established in 1948. It is currently considered to be undervalued, as the stock is trading below its intrinsic value. Its valuation is low.

Pennymac (NYSE:PMT) is a Mortgage Real Estate Investment Trust (mREIT) company in the Real Estate Sector. mREITs focuses on real estate financing. It makes money from the interest income by purchasing originated mortgages and mortgage-backed securities. That means that as interest rates increase, mREITs generate more income.

Pennymac’s Ultra-high 11.55% yield makes this a great investment, and according to the stock book value, it is most likely undervalued at current levels. That means it is a great time to buy in. What makes this a risky investment is that Pennymac’s earnings are dependent on interest rates, which are hardly ever consistently stable. Dividends are also taxed as ordinary income, which is also something to consider. High Risk but High Reward. This might not be the best investment for first-time shareholders. Additionally, something else to consider is that over the past five years, the stock has dropped around 30%.

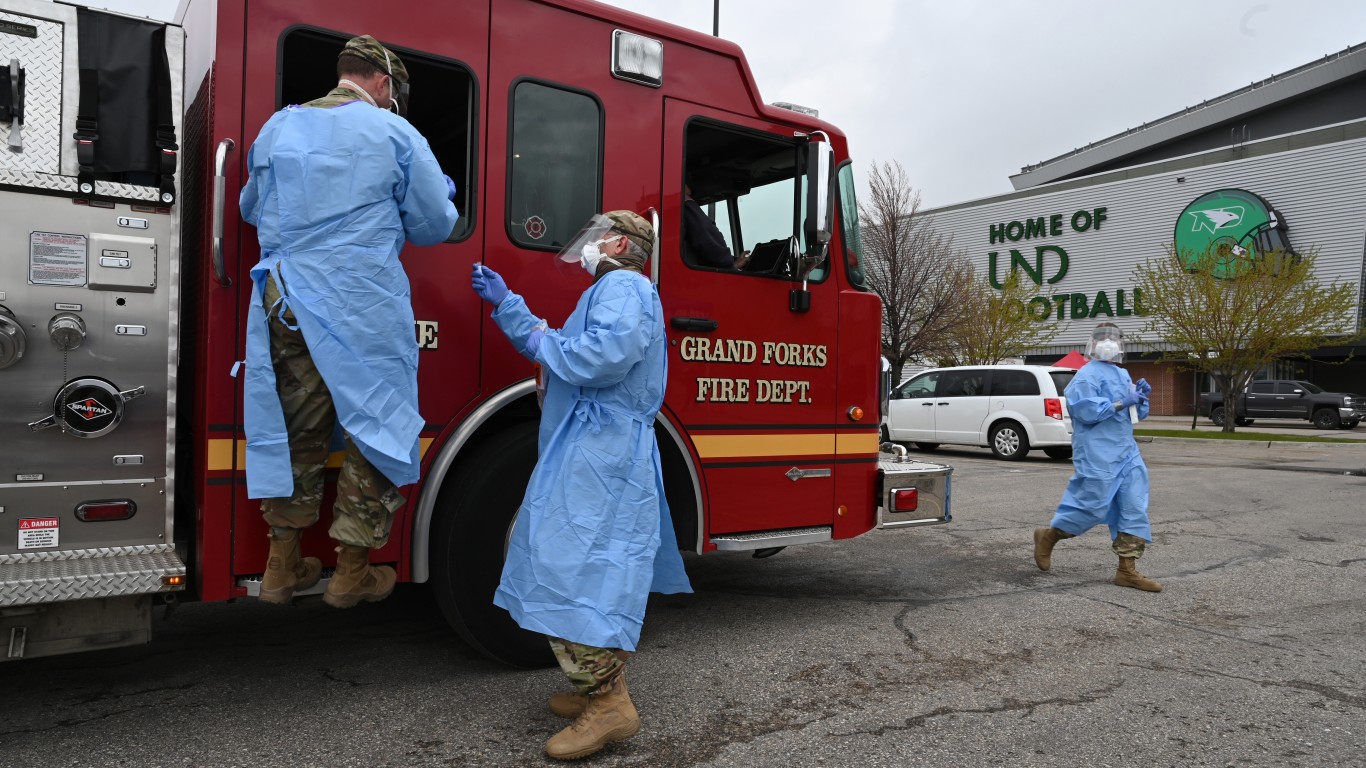

REV Group Inc (NYSE:REVG) is a manufacturing company that has had a consistent 5-year average dividend growth rate and has a history of consistent dividend payouts. It generates revenue by manufacturing specialty vehicles like ambulances, recreational vehicles, firefighting trucks, buses, and commercial vehicles. The REVG is comprised of 24 brands and was founded in 2010. It has seen a rise in share price by 172% over the past 5 years, with the specialty vehicle products driving growth.

One area of weakness for the group is the Recreational Vehicle segment. Over the past year, it had a 30% sales loss. Despite this, the Specialty Vehicle segment is able to cover the profit lost from the Recreational Vehicle Segment. The stock is currently undervalued and has been assigned a rating of, “Buy.”

If you have access to this stock, it is work investing in (if you have no moral qualms about investing in Russian companies), since it was delisted from the NYSE in 2022. Mobile TeleSystems is a Russian telecom company, based in Moscow. Currently, it operates cellular networks, local telephone services, mobile television, broadband, digital television, satellite television, and cable. It has over 84.9 million subscribers in 3 countries, making it the largest mobile network operator in Russia.

Over the past half-decade, the average yield has been 9%, and the yield is based on its operating performance. With its rollout of 5g in the Urban areas of Russia, and upgrade to 4g in more rural areas, the yield is only going to increase. Mobile TeleSystems is also diversifying beyond just a wireless company by expanding into cloud services, TV subscriptions, and Banking.

Annaly Capital Management (NYSE:NLY) is another ultra-high-yield mortgage real estate investment trust (mREIT). Annaly borrows money at short-term, low rates to buy repurchasing agreements such as mortgage-backed securities (MBS), and reinvests the revenue into asset-back securities (ABS). Asset-backed securities are financial investments that are backed by a pool of assets, like student loans, credit card balances, receivables, and mortgages. This pool of assets usually can’t be sold on its own, so the ABS Issuer (the party that sells them to Annaly) packages a group of these assets together into one portfolio and then resells them to companies like Annaly.

Annaly typically maintains a large net interest margin, which is good for you. Over the past 20 years, it’s maintained an average 10% yield which equals over $20 billion back to the dividend shareholders (you). You could potentially see a doubling in your investment in under 10 years.

Ares Capital Corporation (NASDAQ:ARCC) provides financing to middle-market businesses and is considered a publicly traded business development company (BDC), the largest one. Ares serves the upper end of the middle market sector, which is largely ignored by other BDCs.

BDCs are smart investments because they are required to return 90% or more of earnings in the form of shareholder dividends. Its dividend has consistently increased for the past 14 years and is still climbing. According to The Motley Fool, even if its share price went nowhere, it would generate a return of 80% by 2030.

CVR Energy Inc. (NYSE:CVI), is a holding company that is comprised of renewable fuel, nitrogen fertilizer manufacturing, marketing business, and petroleum refining. It pays out dividends quarterly and has had an average of 4.9% over the past 5 years.

AGNC Investment Corp (NASDAQ:AGNC) is another mortgage REIT. It is internally managed and focused on investments in Agency residential mortgage-backed securities. The majority of AGNC’s assets are mostly agency securities, which are backed by the federal government.

This does lower the yield potential, but also gives AGNC more leverage than non-agency assets. Another plus is that AGNC pays its dividends monthly, and the average yield has been at least 10% over the past decade. Its current dividend yield is 15.1% as of this quarter and has a total stock return of 371% since 2008. The 8.9% yield listed is the average.

Pfizer (NYSE:PFE) is one of the most well-known drugmakers in the world. It is a pharmaceutical and biotechnology company. Its highest-selling products include vaccinations, autoimmune disease drugs, insulin, COVID-19 Vaccines, neurological medications, cardiac medications, and cancer therapies. As a global corporation, only 46% of revenues came from the United States.

In other words, it provides medications globally to populations who need its products to live, making it a company that sells essentials. Because it holds a lot of the drug market, it is a safe investment. Pfizer is projecting an additional $20 billion per year of revenue from product sales and an additional $25 billion in business development revenue.

Main ST Capital Corporation (NYSE:MAIN) is a good choice due to its monthly dividend payouts. It’s considered a high-yield company and is in the finance sector, which is a historically reliable sector. One of the only cons of this stock is that dividends are taxed as ordinary income because of the monthly payouts. So it really depends on when you want your dividends.

Citigroup (NYSE:C) is a leader in the finance sector. Because of this, professionals consider it just too big to fail. Citi was established in 1812 and has endured through all of the economic crises since then. Something to consider is that Citi shares have underperformed for the past 5 years, which has resulted in low dividend growth. Because patience is the game, this might not be as red of a flag as it may seem.

PepsiCo (NASDAQ:PEP) is probably one of the safest dividend stocks to invest in, because of its 23% hold in the savory snacks market. Beyond that, it holds the second-largest share of the beverage market. This is a safe investment due to its extremely diverse brand portfolio, projected shares trading at 18.7 times its 2026 earnings, and consistently steady dividend growth.

Procter & Gamble (NYSE:PG) is a company in the Consumer Discretionary sector. It was founded in 1837 and its dividend has been rising for the past 68 years. It has demonstrated great resilience as a company despite several periods of economic uncertainty. It is a safe investment because it produces essential products that people are always going to need. Besides the 68 years of consecutive dividend increases, it also had 134 consecutive years of dividend payouts. Although steady, it does have a rather low dividend growth rate.

J.P. Morgan (NYSE:JPM) is a large financial firm. It is labeled by the stock market as, “Too Big to Fail,” which makes it a generally safe investment. Although the yield is on the lower side, it has really high profit margins. One red flag to consider is that J.P. Morgan has seen decelerating revenue growth recently.

Broadcom (NYSE:AVGO) is a semiconductor company that is a leader in the Technology Sector. It historically has offered a respectable yield while also raising its dividend by 10% annually. With the rise of demand for Artificial intelligence, there has been a correlating demand for its chips. Broadcom has also recently acquired VMware, which was a significant competitor. Unfortunately, Broadcom’s biggest potential competitor is Apple, which is currently its biggest customer. Apple is currently in the process of producing in-house chips. So, that is definitely something to consider.

Caterpillar (NYSE:CAT) is one of the leaders in the construction market. It has seen an average growth rate of an average of 10% over the past few years. Because Caterpillar has been in the game for almost 100 years, the expanding profit margins are still holding steady. Something to consider is potential future supply chain issues and a slowed-down revenue growth.

Moody’s (NYSE:MCO) is a great Fintech stock to snatch up. Moody’s is a global risk assessment firm that has seen a consistently rising dividend of 10% per year. This is a company to watch out for because of the growth opportunities that can result from its in-progress AI initiatives. Some things to keep in mind are its low yield and its potential risk assessment of firms’ competition.

Visa (NYSE:V) is a leader in the Consumer Discretionary sector as a credit card company. One of the biggest advantages of investing dividend stock in Visa is that its profit margins are over 50%, doubled in the past 5 years, and the steadier inflation means that Visa’s revenue is only going to increase. Our consumer structure centers around credit and debit card use, which means this product is essential. A potential red flag to look out for is that it is experiencing a high valuation, and has a relatively low dividend yield.

Microsoft (NASDAQ:MSFT), is, of course, a very large American multinational technology corporation that has been around since 1975. It was created by Bill Gates and Paul Allen. It has its fingers dipped in several industries such as gaming, cloud computing, and artificial intelligence among many others. It ranked number 14 in the Fortune 500 Rankings in 2022 and is one of the “Big Five,” American technology companies. It is currently the most valued publicly traded company.

Its best-known products are the Windows line of operating systems, Edge web browser, Xbox video game consoles, touchscreen personal computers, and Microsoft 365 Suite. The fact that the shares are well-diversified makes this a reliable investment, in addition to the fact the shares have tripled over the past half-decade. Since 2020, it has acquired several companies such as Affirmed Networks, ZeniMax Media, Nuance Communications, Takelessons, Activision Blizzard, and most importantly for future revenue, an investment deal with OpenAI.

While the revenue and earnings growth are reliable, a few potential cons are that there is a lot of up-and-coming competition in artificial intelligence, low yield percentage, and shares that ran up in 2023. This is the safest investment on this list, but you might not see a doubling of your investment sooner than a decade.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.