Nvidia (NASDAQ:NVDA) has become the face of the artificial intelligence revolution. Its H100 graphics processing unit (GPU) is the de facto standard for data centers seeking the power of AI-enhanced chips to support hyperscaler demands.

The chipmaker’s second-quarter earnings report contained the sort of outsized results investors were hoping for. Revenue of $30 billion easily surpassed Wall Street’s elevated expectations for $28.75 billion in sales while profits of $0.68 per share easily slid past forecasts of $0.64 per share.

Yet Nvidia’s stock didn’t jump. In fact, in after-hours trading, NVDA shares slumped 9%, though when the market opened on Friday the decline wasn’t nearly as pronounced. Still, it may have surprised some that the AI leader didn’t run ahead considering the robust performance the chipmaker produced.

Here are three main reasons why there was no stock surge after earnings.

Key Points About This Article:

- Nvidia’s second-quarter earnings report was better than expected with the chipmaker beating top and bottom line estimates.

- Yet NVDA shares fell in response as the leading AI company also showed cracks in its priced-to-perfection stock.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Revenue Forecast Was Mostly In-Line With Estimates

Nvidia stock was priced for perfection. Shares ran up nearly 900% in less than two years as AI sucked all the oxygen out of the room. The stock was also up 160% from where it started 2024. That meant Nvidia needed to keep posting blowout numbers. It may have beat analyst predictions in the second quarter, but Nvidia’s outlook for the third didn’t wow anyone.

The chipmaker said it expected to see sales grow to $32.5 billion, plus or minus 2%. Although that is 79% above the year-ago figure, that is well below the 122% increase this quarter and indicates a potential deceleration in future growth. It was also pretty much inline with analyst expectations of $31.8 billion.

While no company can keep growing at accelerated rates indefinitely, and analysts can get caught up in the moment too and raise their forecasts higher than they might otherwise, this may be happening sooner than many expected.

Gross Margins Guidance Miss Expectations

Despite Nvidia being wildly profitable, margins are starting to deteriorate. In the first quarter, the chipmaker posted gross margins of 78.9%, but they slipped to 75.7% in the second. Now Nvidia says it expects them to come in at 75% in the third period. That’s still better than the 74% it posted a year ago, but suggests the money-making machine is running into pushback on the high prices.

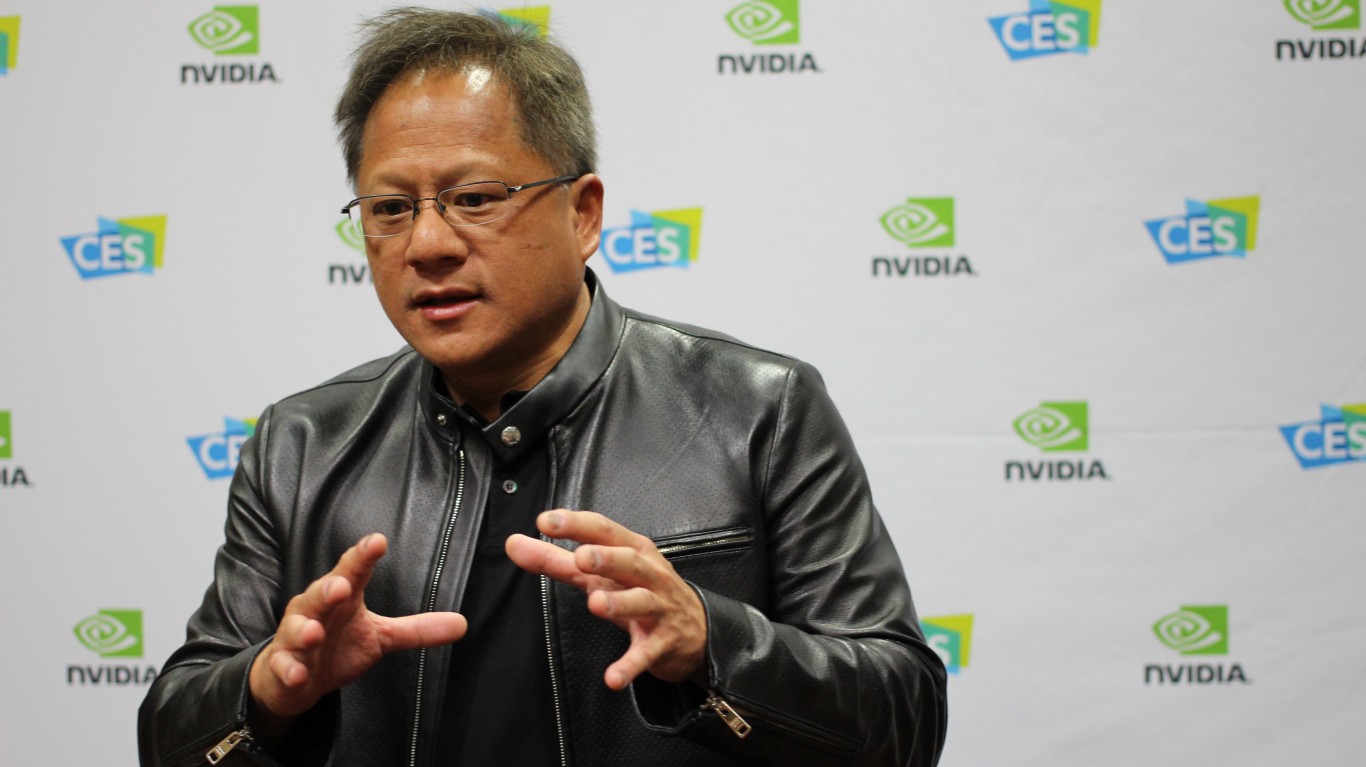

Taiwan Semiconductor Manufacturing (NYSE:TSM) has said it may raise the price on what it charges Nvidia to produce its chips. Chairman C.C. Wei told reporters after the foundry’s annual meeting, “I did complain to Nvidia’s CEO Jensen Huang — the ‘three trillion guy’ — that his products are so expensive.” Taiwan media estimates Huang is worth 3 trillion New Taiwan dollars, or nearly $93 billion.

Wei thought the time had come for TSM to realize some of the value it was producing for Nvidia. While the chipmaker’s accelerators are “really valuable for sure, but I am thinking about showing our value as well,” Wei said.

New Blackwell Chips Are Delayed

Full production of Nvidia’s newest generation of accelerators, the Grace Blackwell chip, has been pushed back into the fourth quarter. Last quarter, Huang told analysts production would start in the second quarter, ramp up in the third, and be operational in data centers in the fourth. This time around, however, he said the production ramp wouldn’t occur until the beginning of 2025 after Nvidia “executed a change” to improve yields.

The one-quarter shift probably isn’t too severe, and investors were probably bracing for the worst after it was rumored delays were occurring. After all, Huang did say Blackwell would “start shipping out in billions of dollars” by the end of the year, but it shows how much the chipmaker has riding on the advanced accelerator.

Customers from Amazon (NASDAQ:AMZN) and Meta Platforms (NASDAQ:META) to Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) are awaiting shipment of Blackwell to power their data centers. Delays from Nvidia pushes back their plans as well.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.