Tesla (NASDAQ:TSLA) stock has been an under-performing mega-cap stock this year, to say the least. The EV company’s stock price is down approximately 15% on a year-to-date basis, significantly underperforming most indices, particularly those involving growth stocks.

Tesla’s growth has slowed as competition has ratcheted up in the EV sector. Notably, the company’s U.S. EV sales set a record in Q2, despite growth slowing to 11%, down from 52% in 2023. Tesla’s deliveries fell 5% to 443,956 units, automotive revenue dropped 7% to $19.88 billion. These results were driven by the lowest vehicle production the company has seen since Q3 of 2022, with only 410,831 units produced.

For Tesla bulls, much of the company’s existing valuation relies on its future potential in the autonomous vehicle market. The company’s “Full Self Driving (FSD)” technology remains critical to the investment thesis behind this company, in addition to other moonshot bets like its Optimus robotics program. Notably, Tesla’s Full Self Driving (FSD) version 12.3 showed improvement. But even those most bullish on the company will note that there are issues the company needs to iron out – visibility issues in certain conditions, and other related issues make regulatory approval for Level 4 or 5 fully autonomous driving seem like a ways out.

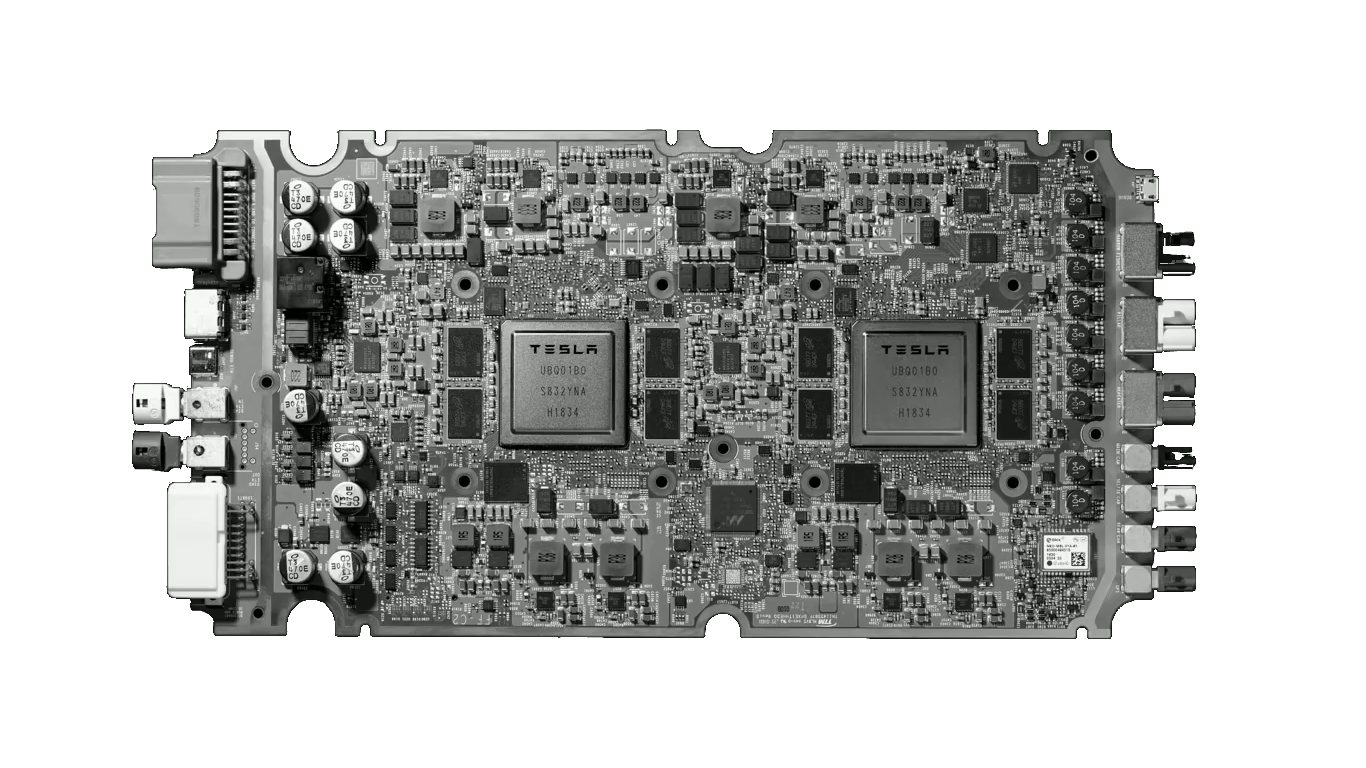

There’s currently plenty of debate over whether Tesla’s AI can overcome current hardware limitations as it processes more data. While some believe the system will improve, others (including myself) doubt that vision-only technology is sufficient for the future.

Let’s dive into the bull case behind Tesla’s FSD promises, and if the company is positioned to humiliate its doubters, like me.

Key Points About This Article:

- Tesla’s Full Self Driving (FSD) software is impressive, and has certainly garnered plenty of attention from analysts and investors, who price TSLA stock at a premium largely due to this catalyst.

- Heightened competition in this space, as well as other technological issues, have posed questions for many, but the question is whether Tesla can once again humiliate those who bet against this stock.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

What Will Robotaxis Mean for TSLA Stock?

Tesla’s focus on its non-core businesses such as robotaxis and Optimus robotics offerings has certainly intensified in recent quarters. In fact, on the company’s most recent Q4 earnings call, the company spent a disproportionate amount of time talking up its new detailed product roadmaps, which will be forthcoming for announcement events, while also delaying the company’s robotaxi unveiling to October 10 from the previously-stated August 8.

We’ll have to see what the company ultimately puts forward with its upcoming release. This delay does suggest that crucial improvements and additional features will be included in the release, though most of what’s being speculated online is just that at this point in time – speculation.

With plans on developing future ride-hailing capabilities, potentially competing with services like Uber and Lyft, it will be interesting to see how, if possible, Tesla is able to re-shape existing industries once again.

In mid-June, Cathie Wood’s Ark Invest set a $2,600 Tesla stock price target for 2029, continuing their bullish coverage on the stock. Notably, this upgrade was driven by optimism over Tesla’s robotaxi ambitions. Ark estimates that by 2029, robotaxi operations could account for 90% of Tesla’s value and earnings, and while many may be skeptical of that number and the math of how Ark’s analysts came to this figure, if they’re right, the market is seriously undervaluing Tesla stock right now.

Tesla’s Investor Base Is Bifurcated

Not all analysts and investors are as bullish as Cathie Wood, and that’s kind of obvious. Right now, selling electric vehicles is the name of the game for Tesla. And on that front, things aren’t necessarily going well, with the company missing its 50% long-term growth projections considerably in recent quarters.

On these production and deliveries misses, long-time investor Ross Gerber recently sold roughly half of his stake in the company, amounting to $60 million. His concerns, over the company’s ability to meet its growth targets, aren’t contained. Many others on Wall Street seemingly share this view, with the market clearly viewing Tesla stock as a much more risky proposition today than at the beginning of the year.

While some are calling for increased focus on the company’s core EV business and less on its speculative tech developments, that’s where the lion’s share of future earnings are expected to come from, according to most bulls. Thus, it appears to be a bifurcated group when it comes to Tesla analysts and investors at this point in the cycle.

More Downside May Be Ahead, Unfortunately

Aside from the various concerns many investors and analysts have voiced about Tesla’s core business, there’s also growing concern that CEO Elon Musk may need to sell some of his Tesla stock to address X’s financial issues. If that’s the case, spooked investors could ride his coattails lower. And given the size of Musk’s stake in the EV maker (with his pay package still up in the air), significant selling pressure could offset any sort of bullish sentiment the company is able to garner from its future releases.

I’m not sure what to expect with the upcoming robotaxi unveiling. If it’s anything like the Optimus release, I think investors may want to sell the rumor and sell the news. We’ll see. But for now, I think the market is taking the correct approach to Tesla stock and taking a cautious approach to its valuation.

Maybe I’ll be among those who are humiliated in the long-term, but with increased competition growing in this space (see my piece on the Waymo vs. Tesla robotaxi race), there are other players in this game to be considered as well.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.