Investing is centered around the concept of risk and reward. Typically, investments with a higher level of risk have the potential to produce larger returns than their low-risk counterparts. For example, some penny stock investments grow by tens of thousands of percentage points over the long run.

Then again, that doesn’t mean you should invest everything you have into penny stocks. In fact, most experts say you should keep your high-risk investments to a minimum, typically representing 5% or less of your total portfolio value. That’s because if you blindly invest in 10 penny stocks, chances are that you’ll lose money on nine of them.

So, what if you have $300 that you’re comfortable risking on penny stocks? It’s important to choose strong picks that have a high likelihood of growth. Here are a few to consider:

Key Points:

- You should limit your exposure to penny stocks due to their extreme risk. However, maintaining a small portion of your portfolio’s asset allocation in these stocks could lead to significant gains.

- Hesai Group is a strong LiDAR stock to consider.

- ATRenew is one of China’s leading ESG plays and analysts expect it to fly ahead.

- Are you looking for low-cost stocks to buy now that have the potential to produce 10X or more gains? Check out our free Discover “The Next NVIDIA” report to find two such opportunities now.

Hesai Group Is a Compelling LiDAR Play

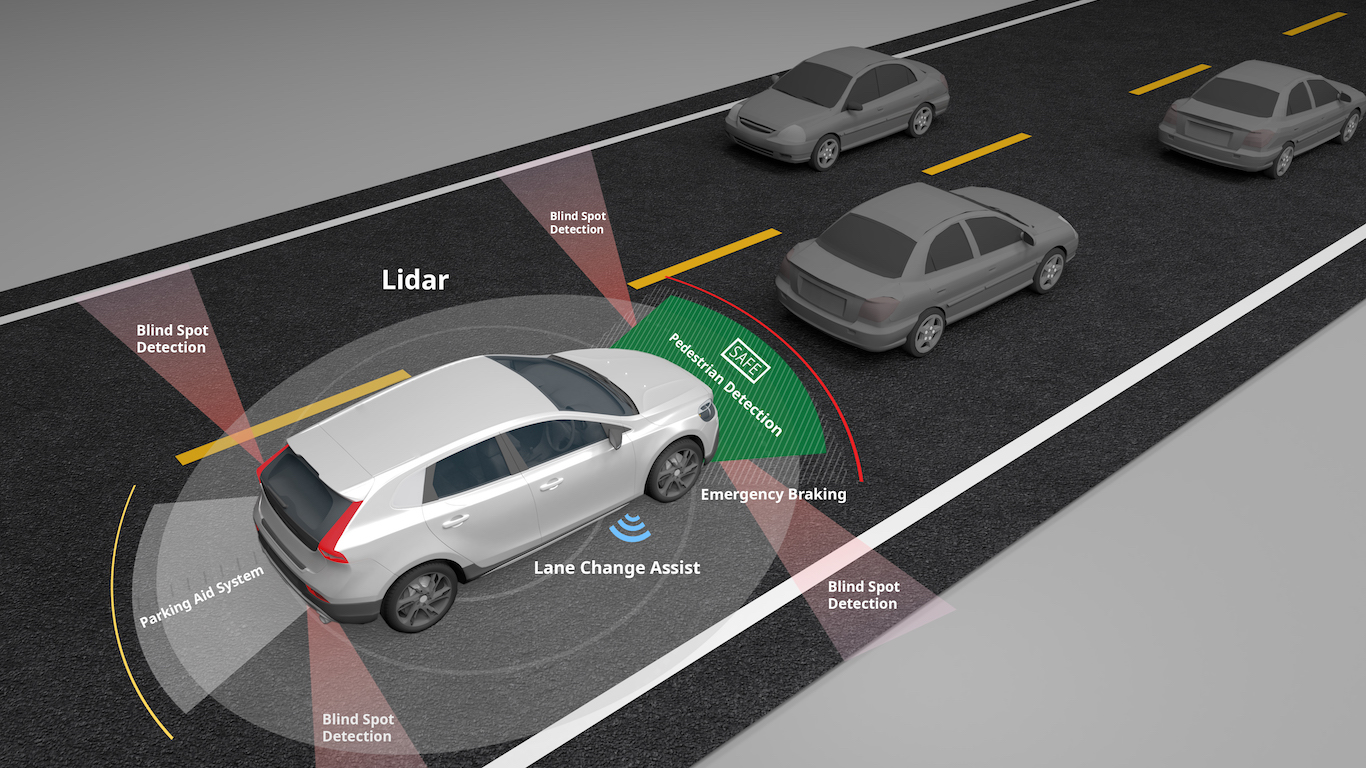

Hesai Group (Nasdaq: HSAI) is a Chinese technology company that seems to be in the right place at the right time. The company develops, manufactures, and distributes LiDAR (light detection and ranging) solutions globally. That could prove to be big business relatively quickly.

At the moment, leading auto manufacturers as well as emerging companies are working to perfect autonomous vehicles. Autonomous vehicles are vehicles that drive themselves — a futuristic idea that could soon come to fruition. One of the technologies most commonly used by companies working to develop autonomous vehicles is LiDAR.

The artificial intelligence that drives an autonomous vehicle must be able to see road hazards, lines, traffic signals, stop signs, and more. LiDAR makes that possible, giving these vehicles the ability to safely navigate streets. In fact, some vehicles already offer LiDAR-centric lane assistance, automatic braking, and more.

And the automotive industry isn’t the only application for Hesai Group’s LiDAR products. The company’s technology is also used in robotics applications and gas detection products. So even if driverless vehicles never make it to the mass market, Hesai Group has the potential to generate meaningful revenue and earnings.

Perhaps that’s why the eight analysts weighing in on the stock have such a positive opinion. Six of them rate it a Buy, one rates it an Outperform, and one rates it a Hold. But the most shocking part of analyst opinions is the median price target, which currently sits at $46.75. Considering the stock’s current sub-$4.00 price, that means analysts expect Hesai Group to climb by more than 10X over the next 12 months.

ATRenew Could Climb Ahead

Anytime I look into penny stocks, I like to dive into emerging economies. After all, emerging economies typically grow at a faster rate than developed economies. That means the companies that operate within those economies often experience more growth opportunities.

With China being one of the largest emerging economies in the world, it makes sense to look for growing players in the Chinese market. That’s where ATRenew (NYSE: RERE) comes in. Not only is the company in an emerging economy, but it’s also operating in a market that could see tremendous growth ahead — pre-owned electronics.

As technological innovation continues to shape the development of new products, more and more pre-owned cell phones, laptops, and other electronics are hitting the market. ATRenew is capitalizing on this trend in the Chinese market by acting as an electronics recycling business.

At its core, ATRenew has three arms of business:

- AHS Recycle: AHS Recycle is a consumer-to-business platform. It gives consumers a way to trade or sell their unused electronics to companies that may be interested in the components that make up the electronics.

- PJT Marketplace: ATRenew’s PJT Marketplace is a business-to-business platform surrounding pre-owned consumer electronics. Essentially, this gives businesses a way to buy, sell, and trade electronics once they’re done using them.

- Paipai Marketplace: Finally, the company’s Paipai marketplace is a platform that’s centered around selling premium pre-owned devices to consumers at steep discounts on the cost of the devices when purchased new.

The stock is even more impressive if you’re an ESG investor. After all, ATRenew isn’t just recycling used electronics; they’re one of the leading ESG stocks in all of China.

At the moment, two analysts are weighing in on the stock. While they have both offered price targets, only one has offered a rating. The good news is that rating is a Buy. The median price target is $22.57 — that’s nearly 10 times the current price of the stock!

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.