24/7 Wall St. Insights

- Wall Street analysts are optimistic about Rivian Automotive Inc. (NASDAQ: RIVN) stock.

- However, the electric vehicle maker does face three glaring problems.

- Also: Discover 2 dividend legends to hold forever.

Only a few short years ago, advances in battery and charging technology were making electric vehicles (EVs) a viable option for a wider range of consumers. In a world facing not only climate change concerns but high oil and fuel prices as well, EVs were supposed to be the next big thing. The major automakers invested millions of dollars into EV technology, and a rash of startups arose worldwide. Tesla came out as an early frontrunner, but soon plenty of models from a variety of makers became available. Consumer reluctance about EVs started to melt. Then, a year or so ago, demand unexpectedly began to wane.

EV makers struggled, some resorting to price cuts they could little afford in an attempt to hold on to scraps of market share. Many startups, including Fisker and Lordstown, failed. One of those struggling companies is Rivian Automotive Inc. (NASDAQ: RIVN). Wall Street analysts remain optimistic, but the question for investors is whether the stock will indeed soar or will go down the drain.

Why Invest in Rivian?

Rivian stock is down almost 90% since it went public. Though shares once traded for more than $135 apiece, they were last seen changing hands for less than $14.

The company says it is creating solutions that shift consumer mindsets and inspire other companies to fundamentally change the way they operate. The aim is to build the kind of future our kids and our kids’ kids deserve by stopping the carbonization of our atmosphere. Rivian has signed the Climate Pledge to reach the goal of net-zero carbon emissions by 2040, or 10 years ahead of the Paris Agreement.

The company does not offer a dividend. The stock outperformed the S&P 500 in 2023, ending the year more than 27% higher. The question is whether the shares are likely to continue rising.

Rivian, the Company

Rivian designs, develops, manufactures, and sells electric vehicles and accessories. Its consumer vehicles include a two-row, five-passenger pickup truck under the R1T brand and a three-row, seven-passenger sport utility vehicle under the R1S name. They are recognized for their innovative and tech-rich interiors and adventurous spirit. In the pipeline are the R2, R3, and R3X, which are smaller SUVs.

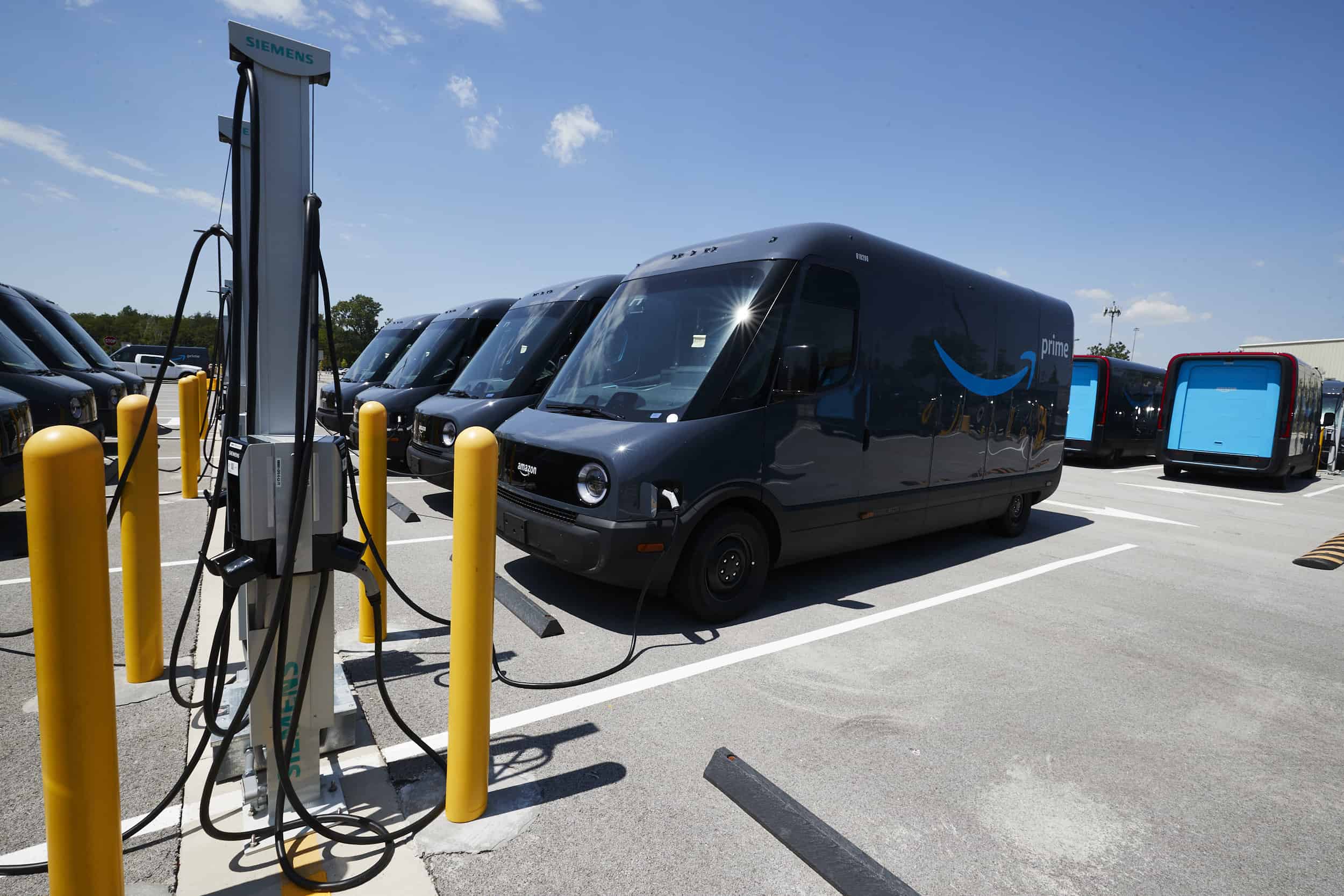

Rivian also has a commercial delivery van platform. Amazon is its primary customer. And it designs, develops, manufactures, and operates the Rivian Adventure Network Direct Current fast chargers.

Furthermore, the company provides consumer services, such as digital financing and leasing, telematics-based insurance, vehicle maintenance and repair services, software services, and charging solutions. The company sells its products directly to customers in the consumer and commercial markets.

Rivian is headquartered in Irvine, California, which is in Orange County. The company was founded in 2009 by engineer and entrepreneur Robert “R.J.” Scaringe. The company went public in November of 2021. It competes with or is similar to Lucid Group Inc. (NASDAQ: LCID) and Tesla Inc. (NASDAQ: TSLA). There is also electric truck maker Nikola Corp. (NASDAQ: NKLA), and the major automakers have competing EVs, notably the Ford Motor Co. (NYSE: F) F-150 Lightning.

A recent fire at a manufacturing plant damaged many Rivian vehicles. Some executives have left the company in recent months. Parts shortages caused a delay in production of delivery vans for Amazon. However, the company also has received significant financial support from Volkswagen.

Three Problems With Rivian

The first and perhaps largest challenge Rivian faces is its struggle to find profitability in the competitive EV marketplace, made even more challenging by the softer-than-expected demand. The struggle is due in part to production issues arising from parts shortages. The recent halt in production of Amazon delivery vans is a prime example. Note that, at its current cash-burn rate, Rivian could run out of cash early next year. While it is striving to improve that situation, it is well known that it costs the company more to build its EVs than it can charge for them.

A second problem is the perceived quality of its vehicles. Consumer Reports listed Rivian as among the worst car brands of 2024, based on surveys of owners. Also note that the 2022 Rivian R1T has been recalled six times by the National Highway Traffic Safety Administration for issues including steering, suspension, shocks, struts, and EV charging. Other recalls have been due to improperly aimed headlights, side curtain airbags that could deploy improperly, and incorrect data on the tire placard label.

And legal issues plaguing Rivian are the third big concern. Tesla filed a lawsuit against Rivian in 2020, alleging that it recruited and employed Tesla employees who then divulged Tesla’s trade secrets. Though Rivian claimed it investigated the alleged trade thefts, the evidence it provided failed to convince a judge that the investigation was adequate. Furthermore, a class-action lawsuit claims, among other things, that the company failed to disclose that it had overstated demand for its vehicles, concealed the negative effect inflation and higher interest rates had on demand, failed to increase production of EVs at the rate it claimed, and did not admit the likely negative impact on anticipated earnings and vehicle production targets for 2024.

Prospects for the Stock

The share price is about 24% higher than it was six months ago. In that time, the S&P 500 is up around 7%. Note that the $17.83 mean price target is less than the 52-week high but represents more than 34% upside in the next 12 months. The consensus recommendation of analysts is to buy shares of Rivian. Just this week, Cantor Fitzgerald reiterated its Overweight rating.

Institutional investors hold nearly 50% of shares. Amazon is a beneficial owner, and Blackrock, T. Rowe Price, and Vanguard have notable stakes. About 727 million shares, or about 17% of the float, are held short. And note that CEO Scaringe exercised options and sold shares in July and June, and more recently the chief financial officer sold a small batch of shares.

Three EV Stocks With Troubles Ahead

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.