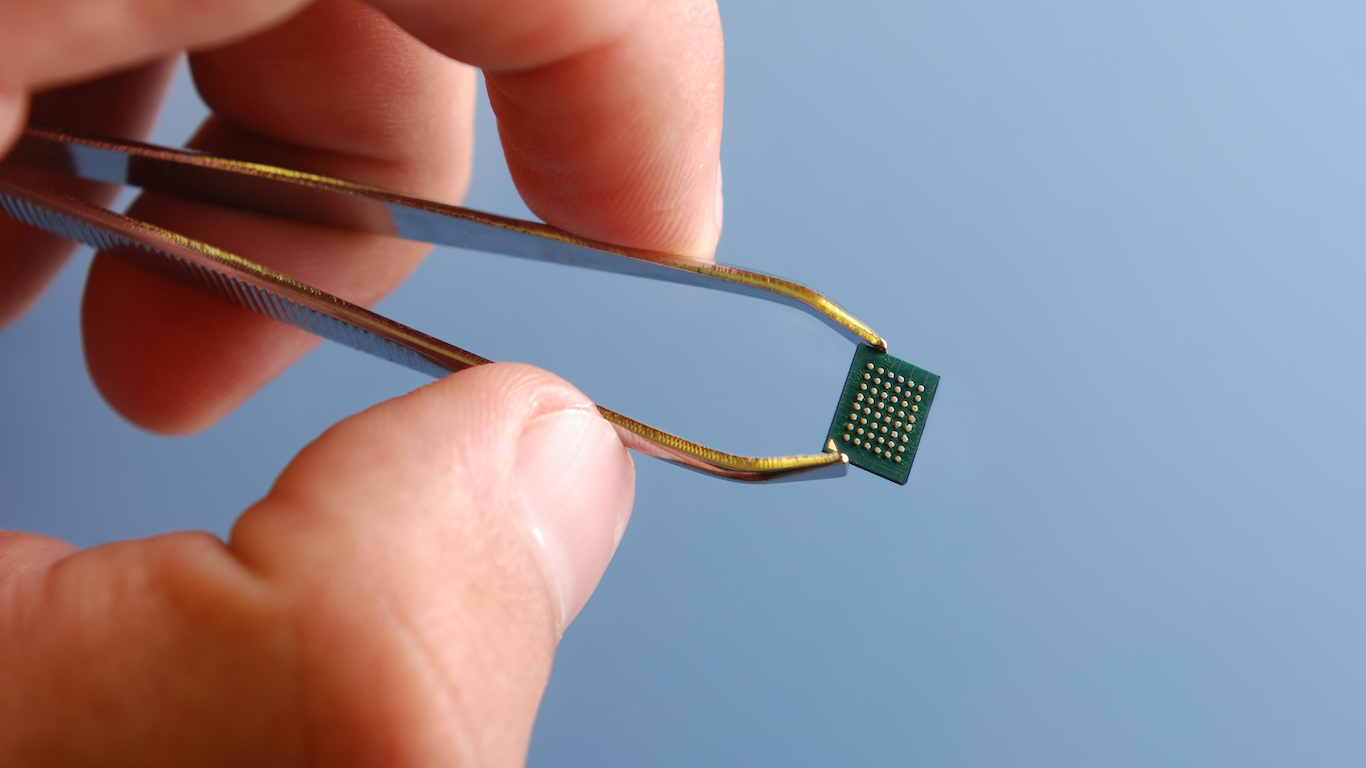

Taiwan Semiconductor (NASDAQ:TSM) remains among the top chip stocks many long-term investors continue to focus on. There’s good reason for that, given the company’s 62% market share in the foundry business. The most essential supplier to key high-growth chip makers like Nvidia (NASDAQ:NVDA), Taiwan Semi is a company that’s continued to benefit from robust demand for AI chips. And while TSM stock hasn’t appreciated to the same degree as Nvidia’s, this is a company many view as a more stable way to play that long-term growth trend, particularly as Taiwan Semi diversifies its production capacity around the world.

For those who believe in the long-term growth trajectory of the AI trend, and see Taiwan Semi as a clear winner in this space, here are a few reasons why TSM stock may be among the best options to consider buying in September.

Key Points About This Article:

- Taiwan Semiconductor remains among the top chip stocks investors looking for exposure to AI secular growth tailwinds may want to consider.

- A leading foundry provider, Taiwan Semi’s bid for greater geographical diversification could bode well for investors looking at this stock now.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Strong Demand

Taiwan Semi expects to put forward $30 billion in AI-related capital expenditures this year, as the company seeks to accelerate its market share lead and growth prospects in the AI chip space. Aside from AI demand, the company sees strong high-performance computing and 5G chip demand as key drivers of its long-term expected growth. And as a key partner to a host of mega-cap tech companies looking for chips, the company’s customizable production processes could get even greater recognition from analysts and investors as this investment race heats up.

Analysts at JPMorgan certainly believe this is the case, as the firm raised its price target to NT$1,200 on TSM stock, maintaining an Overweight rating. In a note to investors, the company highlighted the company’s strong margin improvement prospects driven by continued AI demand.

It’s important to also recognize that Taiwan Semi’s 3nm and 5nm technologies are seeing robust demand, bolstered by its multi-project wafer service that lowers mask costs. The company’s ramp-up in 3nm production and 2nm development, along with its performance in 7nm, 16nm, and 28nm technologies, supported significant revenue growth. In Q2 2024, these technologies contributed significantly to overall growth, with most attention being placed on the company’s smaller chips.

Data centers demand energy-intensive GPUs, with the company’s more efficient 2nm chips (expected in 2025) holding the potential to help clients cut energy usage by 25% to 30%. That’s the kind of technological advancement we’re going to need, if AI is as big as everyone says it is.

Robust Financials

Taiwan Semi’s revenue grew 13% to $18.9 billion in Q1 2024, with Q2 revenue rising even faster at 33% to $20.8 billion. For Q3, TSMC projects it will bring in $22.8 billion, representing a 34% year-over-year increase. July’s revenue surged 45% from the previous year, hinting that even faster growth could be possible. I think the upcoming quarters should provide easy beats, given the level of spending we’re seeing from top tech companies for Nvidia’s chips.

That’s partly because Nvidia’s H100 AI graphics card uses Taiwan Semi’s 5-nanometer process, and Nvidia has secured enough of Taiwan Semi’s 3nm chips for the next few years. Indeed, Nvidia’s strong performance is expected to positively impact TSMC’s stock, notwithstanding the stock’s recent drop due to antitrust related probes.

It’s worth pointing out that Taiwan Semi, Nvidia, and the overall chip sector could see amplified volatility, given how high valuations have gotten in this space. But with strong demand providing revenue and earnings growth acceleration, I do think these multiples are justified currently. And at less than 20-times forward earnings, TSM stock looks anything but overvalued at current levels.

TSM Looks Like a No-Brainer Buy

TSM stock looks well-positioned for significant upside, particularly if the tailwinds we’ve seen form in the high-performance computing space continue. Cloud giants, hyperscalers, and mega-cap tech companies are all ramping up their spending on chips in a bid to gain or maintain market share in an increasingly competitive space. As the world reaches for new AI capabilities, the companies that truly provide the backbone of this growth will continue to see strong investor interest.

At a reasonable valuation multiple, Taiwan Semi looks like a screaming buy at current levels. And while there’s certainly some geopolitical risk tied to this stock, given its manufacturing base of Taiwan (and what’s going on with Chinese tensions of late), the company’s foray into the U.S. and European markets should bolster confidence in this company’s ability to continue to provide long-term growth. The faster they can build these factories, the better.

Take Charge of Your Retirement In Just A Few Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

- Answer a Few Simple Questions. Tell us a bit about your goals and preferences—it only takes a few minutes!

- Get Matched with Vetted Advisors Our smart tool matches you with up to three pre-screened, vetted advisors who serve your area and are held to a fiduciary standard to act in your best interests. Click here to begin

- Choose Your Fit Review their profiles, schedule an introductory call (or meet in person), and select the advisor who feel is right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.