The release of OpenAI‘s ChatGPT chatbot in November 2022 unleashed a frenzy of investor interest in artificial intelligence that propelled Nvidia (NASDAQ:NVDA) to the forefront of the industry.

The chipmakers graphics processing units (GPU) designed primarily to handle the complex demands of computer gaming graphics almost seemed purpose-built for the advanced and challenging computing tasks AI requires. Nvidia quickly became the face of AI and its stock tripled in 2023. It is maintaining a similar pace this year with its shares soaring another 128% higher, even after a 20% decline in value.

Yet NVDA stock is a laggard compared to the performance of other stocks this year, some of which are replicating last year’s success by the chipmaker — or doing even better! The three stocks below are putting up crazy numbers in 2024 and you just might want to put them on your buy list.

Key Points About This Article:

- Nvidia became the face of artificial intelligence in 2023 and it continues to put on a clinic in outperformance this year, but a number of other stocks are doing even better in 2024.

- The following three companies are handily outperforming the chipmaker and despite their phenomenal growth already, they are likely to see additional gains in the future.

- If you’re looking for some other stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Viking Therapeutics (VKTX)

Vying for the second-most important stock market trend after AI is weight-loss drugs. The introduction of Wegovy and Zepbound to the market kicked off a frenzy of biotech investing in anti-obesity therapeutics, and one of the best opportunities in the space is Viking Therapeutics (NASDAQ:VKTX).

Where Novo Nordisk (NYSE:NVO) staked out the early lead with Ozempic and Wegovy, it was followed quickly by Eli Lilly (NYSE:LLY) with Mounjaro and Zepbound. They are raking in billions of dollars in sales from their glucagon-like peptide-1 (GLP-1) drugs, a class of medications used to treat type 2 diabetes and obesity.

Viking is taking a different route. While its lead drug candidate VK2735 also targets the GLP-1 receptor, its therapy also targets glucose-dependent insulinotropic polypeptide (GIP) receptors. Even better, The biotech’s drug is in pill form compared to the injections required by the competition. Weight loss in pill form is considered the Holy Grail of treatment, especially for those who fear or would rather not get a needle, which opens up massive potential for Viking.

VKTX stock is up 237% year-to-date but it has more room to run. Weight loss isn’t Viking’s only target. It recently reported positive results for VK2809, a “best-in-class” therapy treatment for liver disease. With plenty of irons in the fire, Viking Therapeutics has plenty of gas in the tank.

Avidity Biosciences (RNA)

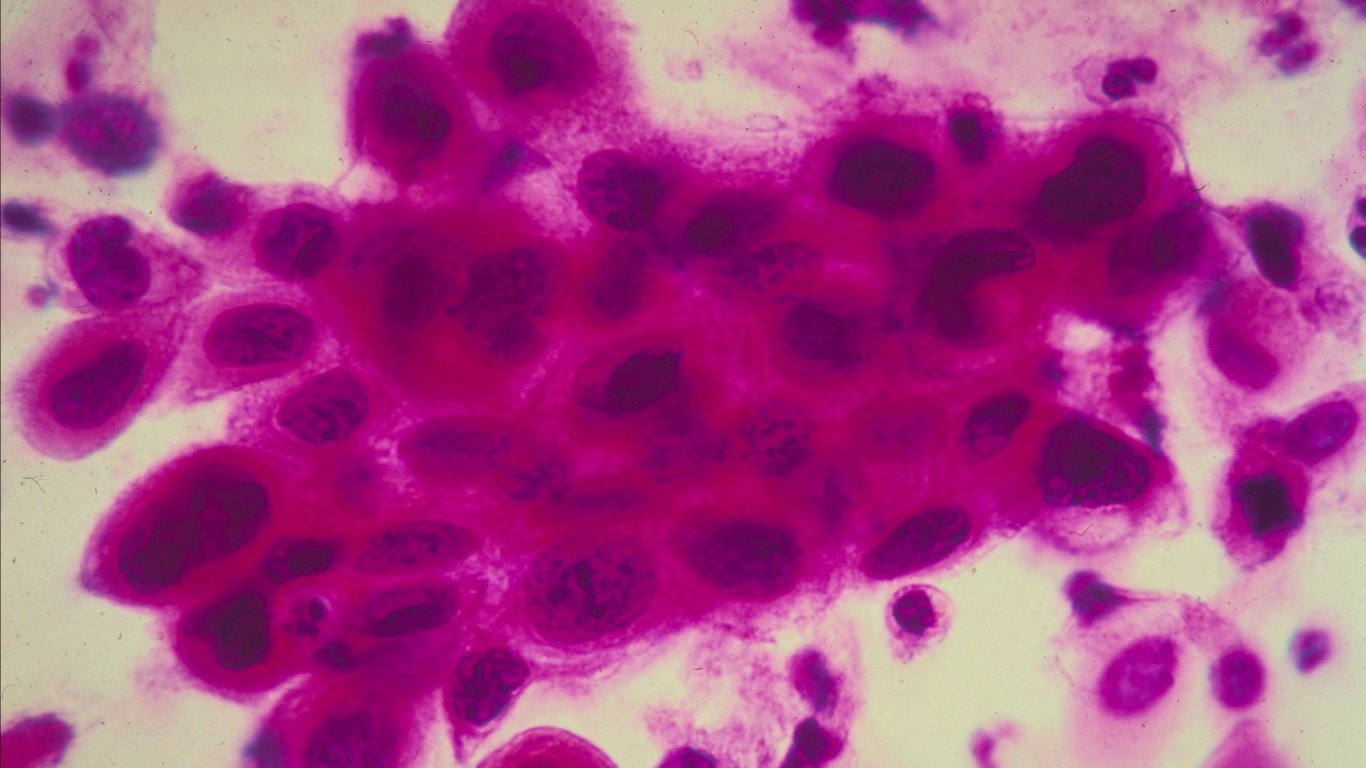

A second crazy stock outperforming Nvidia is Avidity Biosciences (NASDAQ:RNA), which seeks to deliver a new class of RNA therapeutics called antibody-oligonucleotide conjugates (AOC). Its proprietary drug platform combines “the specificity of monoclonal antibodies, or mAbs, with the precision of RNA therapeutics to target the root cause of diseases previously untreatable with RNA therapeutics.”

Avidity’s lead therapy AOC 1001 (del-desiran) looks to treat a form of muscular dystrophy called myotonic dystrophy type 1 that affects skeletal and smooth muscle as well as the eye, heart, endocrine system, and central nervous system.

The Food & Drug Administration granted Avidity’s AOC 1001 breakthrough therapy designation, which expedites drug development and regulatory review. The biotech plans to initiate Phase 3 clinical trials of the therapy. It also has other drugs under study, including AOC 1020, or delpacibart braxlosiran (del-brax), for facioscapulohumeral muscular dystrophy (FSHD), a rare genetic disease of the muscles. Avidity also attained positive results for the treatment in early studies.

Shares of Avidity Biosciences have rocketed 358% this year, and though biotech investing can be risky, it looks as though it has the potential for bigger future gains.

Corbus Pharmaceuticals Holdings (CRBP)

Completing the trio of stocks making Nvidia look like a piker is Corbus Pharmaceuticals Holdings (NASDAQ:CRBP). Shares of this oncology biotech have hit the stratosphere, rising 876% since February. The stock went from under $10 a share to over $61 a share in about six months. That’s equivalent to a run rate of more than 9,450% over the course of a year. Yowser!

Its antibody-drug conjugate (ADC) CRB-701 seeks to block the ability of cells to send destructive signals to cancer cells and so far is showing significant potential in early clinical trials.

While that is hopeful, biotech investors know that positive early results can always peter out and fail in later trials. So what is adding to the lift Corbus is experiencing is its therapies hold out hope for a possible acquisition. Pharmaceutical giants have been scooping up biotechs pursuing ADC treatments and paying a handsome premium.

Between last November and this past January, AbbVie (NYSE:ABBV), Bristol-Myers Squibb (NYSE:BMY), and Johnson & Johnson (NYSE:JNJ) have all acquired biotechs in the ADC space.

No one has made any overtures to Corbus Pharmaceuticals yet, and it seems a worthy investment in its own right, but it is something investors should be mindful of.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.