24/7 Wall St. Insights

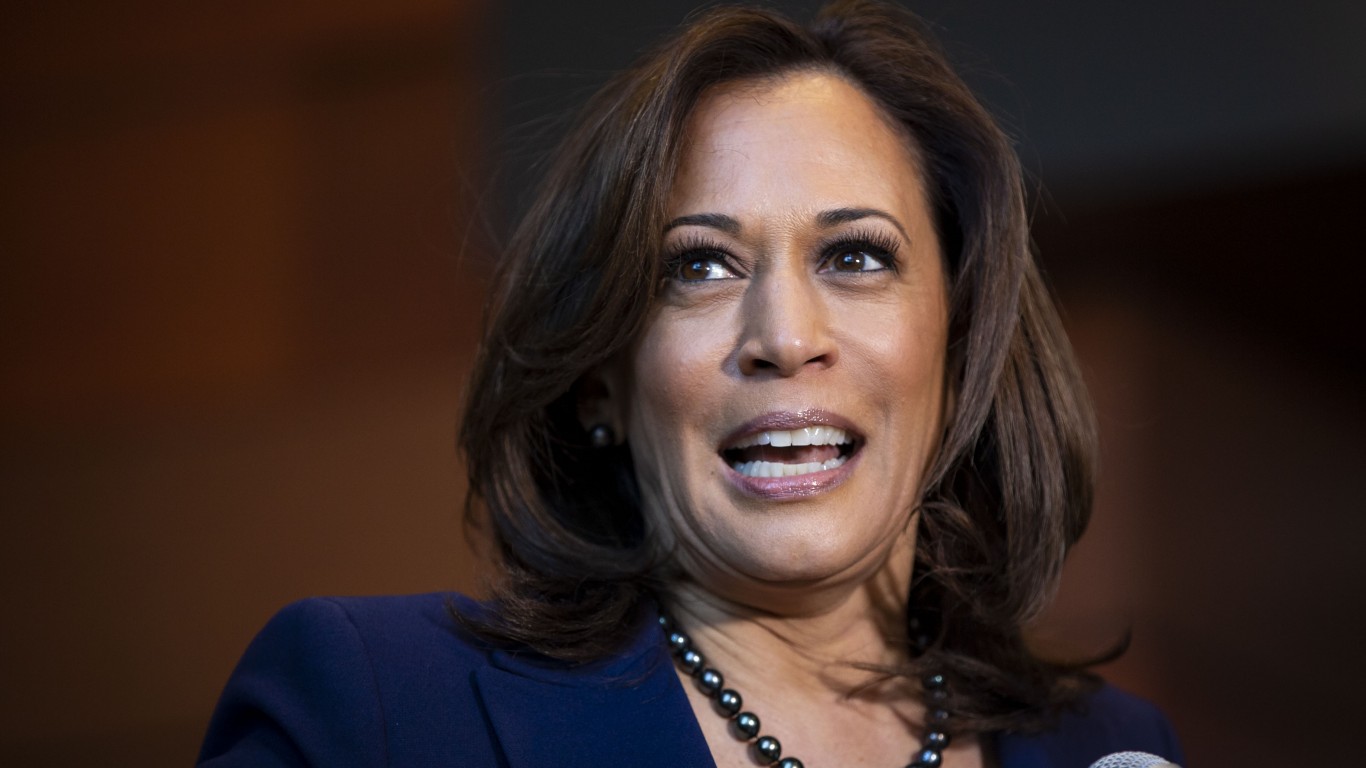

- A Kamala Harris victory in the 2024 presidential election could provide a boost for stocks in a variety of sectors.

- This is so despite a president having limited impact on the stock market.

- Still, these four stocks in particular could pop if Harris defeats Trump.

- Also: 2 Dividend Legends to Hold Forever.

With the 2024 presidential election in the final stretch, it remains a close race. While Democratic candidate Kamala Harris appears to have some momentum, former President Donald Trump has a history of being underestimated.

Should Harris succeed at becoming the 47th president of the United States, what might that mean for the stock market? Harris is expected to continue the policies of the Biden administration in some areas, such as a focus on clean energy, expanding access to medical care, and decriminalizing cannabis. In other areas, Harris will no doubt look to put her own stamp on other policies. Among her first campaign announcements was a plan to encourage home ownership. And having come to prominence in California, she has earned the support of many major players in Silicon Valley, who may look for her to go easy on regulation of the industry.

Does It Matter Who Is President?

The president does appoint cabinet secretaries who implement and enforce laws and regulations. Also, the president nominates the chairperson of the Federal Reserve, who may have a larger impact on the economy and stock market by setting federal monetary policy.

Some economists would argue that stock market performance influences who is president more than the other way around.

That said, stock performance is also often a matter of expectations. Let’s take a look at four stocks that investors expect could see a nice bounce if Harris is elected.

Array Technologies

- Stock: Array Technologies Inc. (NASDAQ: ARRY)

- Segment: renewable energy

- YTD performance: −63.5%%

- Projected upside: 125.1%

- Consensus recommendation: Buy

Harris has shown strong support for environmental protections and renewable energy. Albuquerque-based Array Technologies is a manufacturer of ground-mounting systems used in solar energy projects. It posted better-than-expected quarterly results last month, but disappointing guidance weighed on the stock. The share price is almost 30% lower than before the report. However, analysts anticipate huge growth in the next 52 weeks to their consensus price target of $13.73. Eight out of nine analysts who cover the stock recommend buying shares, three of them with Strong Buy ratings.

Others in that segment that might also see a boost from a Harris victory include energy storage company Fluence Energy Inc. (NASDAQ: FLNC) and solar tech company Nextracker Inc. (NASDAQ: NXT).

Aurora Cannabis

- Stock: Aurora Cannabis Inc. (NASDAQ: ACB)

- Segment: cannabis

- YTD performance: 21.0%

- Projected upside: 478.3%

- Consensus recommendation: Buy

Cannabis stocks and exchange-traded funds saw solid gains after Harris replaced Biden as the likely Democratic nominee. Aurora Cannabis is based in Edmonton, Canada, and it recently announced that it would launch a CBD lozenge that could help keep its strong revenue growth going. Much of that growth came from an acquisition earlier this year. The stock is nearly 10% higher than a year ago, despite retreating about 5% in the past week. The $31.82 consensus price target suggests huge upside, but note that it is the only analyst target price. Four analysts cover the stock, though, and all of them have Buy or better ratings.

Others in that segment that might also get a boost from a Harris victory include SNDL Inc. (NASDAQ: SNDL), another Canadian cannabis products maker, and Turning Point Brands Inc. (NYSE: TPB), which makes branded smoking and tobacco products.

Installed Building Products

- Stock: Installed Building Products Inc. (NYSE: IBP)

- Segment: housing

- YTD performance: 12.1%

- Projected upside: 24.6%

- Consensus recommendation: Buy

Harris also has a focus on reducing poverty and homelessness. Increased homebuilding, remodeling, and sales would provide a boost for this Columbus, Ohio-based provider of installation of insulation, waterproofing, garage doors, and more services. It posted mixed quarterly results last month, but earlier this summer it completed a couple of acquisitions. Despite retreating since the earnings report, the stock is still up more than 48% from a year ago. And analysts see plenty of room for shares to run in the next year. All but one of the eight analysts covering the stock recommend buying shares.

Other stocks that might also get a boost from a Harris victory include homebuilder M/I Homes Inc. (NYSE: MHO) and building products maker Owens Corning (NYSE: OC).

Super Micro Computer

- Stock: Super Micro Computer Inc. (NASDAQ: SMCI)

- Segment: technology

- YTD performance: 40.7%

- Projected upside: 119.5%

- Consensus recommendation: Buy

Harris is a proponent of consumer privacy and digital security. This maker of high-performance server and storage products is based in San Jose. It has a 10-for-1 stock split coming up. The stock has retreated almost 36% since a disappointing quarterly report last month. The share price is still over 41% higher than a year ago. And the pre-split consensus price target is up at $850.42, pulled up by an extraordinarily high upper price target of $1,500. But for now, just two of six analysts recommend buying shares. It seems Supermicro could use a Harris boost.

Others in that segment that might also benefit from a Harris victory include Advanced Micro Devices Inc. (NASDAQ: AMD), Broadcom Inc. (NASDAQ: AVGO), and Zscaler Inc. (NASDAQ: ZS).

Three Stocks to Buy for a President Kamala Harris Market

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.