September tends to be the worst month to buy stocks. There is even a name for the phenomenon: the “September Effect.”

Dow Jones Market Data shows that going all the way back to 1928, the S&P 500 typically loses 1.1% on average this month. So far in 2024, it is living up to that reputation with the benchmark index down 2.7%.

Many are counting on the Federal Reserve cutting interest rates next week to reenergize the market. A 0.25%, or better, a 0.5% rate cut could cause stocks to soar. The biggest beneficiaries could be small-cap stocks. They have been disproportionately hurt by the high-rate environment of the past few years because they don’t have the same access to financial resources larger companies do.

With their borrowing costs elevated, they are less able to invest in their business. Over the past three years as inflation soared and the Fed ratcheted up rates, the Russell 2000 small-cap index lost over 5% of its value compared to a 23% gain by the S&P 500.

The pendulum, though, is beginning to swing. Since the sector rotation began two months ago, small-cap stocks are beating their larger brethren by better than two-to-one. While even a half-percentage point rate cut is no panacea for the damage that’s been done, it sets the stage for a small-cap rally and these three Russell 2000 stocks are the best to buy in September.

Key Points About This Article:

- September is historically the worst month to buy stocks, but Federal Reserve interest rate cuts could spark a market rally, especially for small-cap stocks.

- Small-caps have but hurt worse than larger companies because they have fewer financial resources to tap, but these three Russell 2000 stocks can surge now and in the future.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

York Water (YORW)

Utility stocks have arguably been the sector hit hardest by high interest rates. These capital intensive businesses need to invest in expansion, repair, and maintenance no matter the market conditions so they’ve seen their expenses soar while profits were hurt.

Small utility operator York Water (NASDAQ:YORW) exemplifies that problem. Its operating expenses grew from $29.4 million in 2020 to $41.5 million last year, a compound annual growth rate of over 12% while earnings rose less than 10%. Those gains, though, were largely due to acquisitions that added more customers to its base and a rate increase approved by regulators.

York Water provides clean water and wastewater treatment services to 56 municipalities in south-central Pennsylvania. Few companies today have been in business longer than York, which was established in 1816. It has also paid dividends to investors longer than any other company on the market, some 206 years straight. While its stock has struggled over the past few years, the water utility has returned over 1,220% to investors over the last 25.

As market conditions improve once more for York Water, look for its stock to soar this month and beyond.

ACM Research (ACMR)

Specialized semiconductor equipment manufacturer ACM Research (NASDAQ:AMCR) was bypassed by most of the growth experienced by the tech sector. While it started to gain traction earlier this year, the threat of trade sanctions on China and the tech selloff sunk its stock. Shares are down 19% this year.

Although much of its semiconductor cleaning equipment is not subject to the trade restrictions since its equipment is not used for the sort of advanced chips the ban covers, there was a lot of uncertainty surrounding its business nonetheless. Yet it flourishes.

Second-quarter revenue jumped 40% from last year to $202.5 million and it increased its sales guidance for the full year to $715 million at the midpoint of its range. That amounts to a 4% increase from its prior forecast and up 28% from the year-ago period.

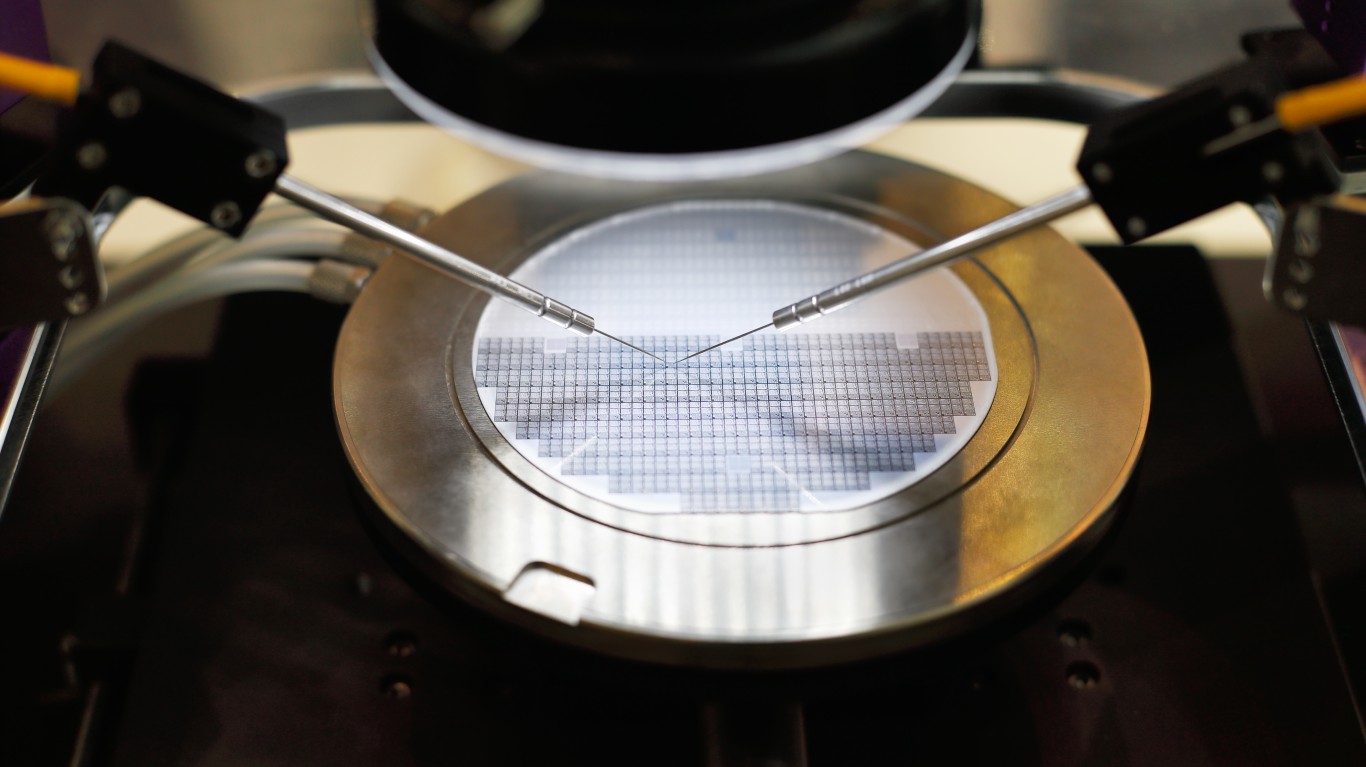

That growth is coming because of the nature of ACM’s equipment, which is critical to developing AI chips. Its machines eliminate contaminants from wafer surfaces at the front end of the chip processing cycle, an important step for chip manufacturers that need pristine surfaces before they start manufacturing the wafers.

ACMR stock trades a steep discounts to estimated earnings and sales. That could be because it is somewhat hidden behind more showy AI chipmakers. Yet this picks-and-shovels stock should shine going forward.

Archer Aviation (ACHR)

Archer Aviation (NYSE:ACHR) is another deeply discounted small-cap stock ready for liftoff. It is one of the leading players in the nascent electric vertical takeoff and landing (eVTOL) industry and is poised to launch a commercial air taxi service next year. It is wending its way through the Federal Aviation Administration’s regulatory labyrinth but is on track to receive its final certification sometime next year.

As a pre-revenue company, that’s not the stat you need to look at. Instead, look at the substantial industry backing it has received, especially from automaker Stellantis (NYSE:STLA), which is helping to finance Archer’s manufacturing effort. It recently reached an agreement for the carmaker to contribute up to $400 million for Archer to produce as many as 650 of its Midnight aircraft annually. That helps free up the eVTOL leader’s limited resources for other critical areas.

It signed a separate agreement with Southwest Airlines (NYSE:LUV) to operate its air taxi service out of California airports where the airline operates when it is granted FAA certification. It has a similar agreement with United Airlines (NASDAQ:UAL) for its hubs at Newark International and Chicago O’Hare airports.

ACHR stock will likely be volatile, but it is a small-cap stock to buy for long-term gains.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.