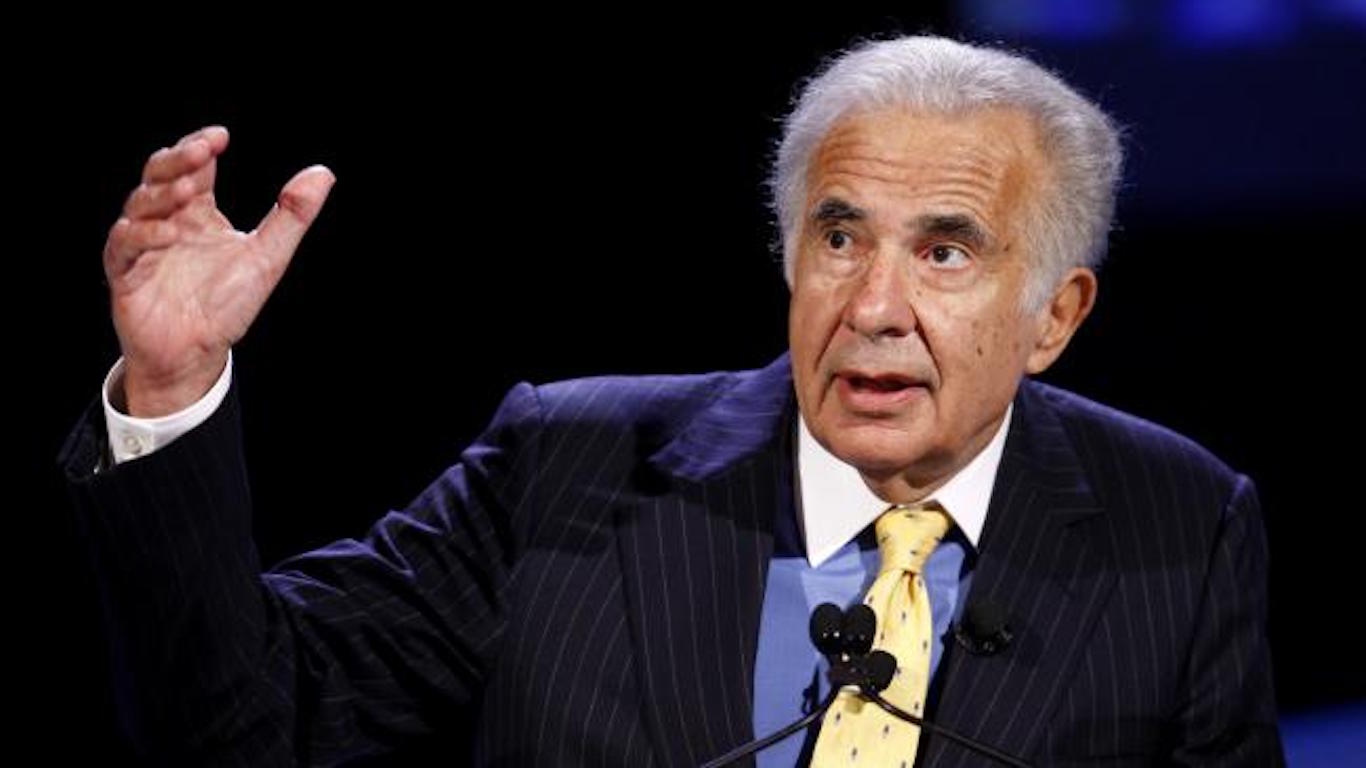

Billionaire investor Carl Icahn gained his reputation as a hard-nosed corporate raider in the 1980s. He was known for engaging in hostile takeovers of companies using leverage buyouts (LBOs) and then stripping the businesses of their valuable assets.

Other targets of his investment would pay him substantial sums to abandon his takeover attempt. The term “greenmail” was often associated with Icahn. Today, his image has softened a bit. No longer the quintessential corporate raider, he is more often viewed as a more benign activist investor.

He runs Icahn Enterprises (NYSE:IEP), a diversified holding company with its assets divided between investments, automotive, food packaging, real estate, home fashion, and pharmaceuticals. It is structured as a master limited partnership (MLP) that has $10.8 billion in assets under management. Icahn is the majority owner of the MLP and controls all of IEP’s operations through Icahn Enterprises Holdings.

Although Icahn styles himself as a Dodd & Graham type of value investor, he admits he is not willing to wait around for results. Instead, he actively tries to bring about the change he seeks.

Below are two stocks the billionaire investor has put 78% of his portfolio into.

Key Points About This Article:

- Carl Icahn burnished his investing reputation by being a corporate raider that took over companies through leverage buyouts and stripped them of their valuable assets.

- Today he is viewed as more of a benign activist investor, but more than three-quarters of his company’s portfolio is in just two stocks.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Icahn Enterprises (IEP)

Icahn has put most of his holdings in Icahn Enterprises itself. The MLP owns 406 million shares valued at $6.7 billion, or 61.8% of the portfolio’s total holdings. You can’t say Icahn doesn’t believe in investing in himself.

It may also be because IEP pays a dividend of $4 per share, which has a yield of over 25%. Yet that’s likely the only salve. Icahn Enterprises stock has been terrible over the years and is down 29% in 2024 when counting in the dividend.

Over the last decade it has lost nearly two-thirds of its value, though most of that occurred last year after short-seller Hindenburg Research accused Icahn of running a “Ponzi-like” business to simply pay itself dividends. It was subsequently contacted by the U.S. Attorney’s office for the Southern District of New York.

More recently the Securities & Exchange Commission fined IEP and Icahn $2 million for failing to disclose he personally benefited from taking out margin loans that used the company’s own stock holdings as collateral.

CVR Energy (CVI)

At 16.5% of IEP’s portfolio, CVR Energy (NYSE:CVI) is the second largest position Icahn’s taken. He’s owned the stock for over a decade, acquiring a majority stake in 2012 in the independent refiner, manufacturer of renewable fuels, and marketer of transportation fuels.

Refining is performed through a subsidiary, CVR Refining, while CVR Partners (NYSE:UAN) manufactures the fertilizer through facilities in Kansas and Illinois.

CVR has been a slightly better investment than IEP. Shares are down 26% year-to-date and are up 16% over the last 10 years, but only thanks to its generous dividend that yields 10% annually. Without the payout, CVI stock would have lost half of its value.

Wall Street doesn’t think much of CVR Energy either. They have a strong sell recommendation on the stock, though there is a one-year consensus target price of $27 per share, which implies 29% upside.

Although CVR owns or has joint ventures in over 950 miles of pipelines with over 7 million barrels of crude oil and product storage, the company is not large enough to take advantage of economies of scale. Fitch Ratings also says it is exposed to volatile crack spreads and oil differentials. Its high dividend payout also works against it.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.