Investing

No Big Short Here: Michael Burry Put 50% of His Money in These 3 Stocks

Published:

Michael Burry is best-known as the billionaire investor who correctly predicted the housing market crash in 2007 that was detailed in the book, The Big Short. It was subsequently made into a movie of the same name, but ultimately Burry understood the government’s subprime mortgage policies would wreck the housing market.

His Scion Capital hedge fund made nearly $1 billion in profits by betting against the housing market. Yet Burry is lesser known as the investor who also unwittingly sparked the meme stock craze.

Two years prior to the stock trading frenzy that erupted, Burry bought shares in GameStop (NYSE:GME) believing its shares were undervalued. He wrote to management several times and told them to buy back their shares and get their house in order.

After amassing a 5% stake in the company for about $14 million, he was joined by Chewy (NASDAQ:CHWY) founder Ryan Cohen who acquired a 13%, $76 million stake in the video game retailer in early 2021. That was picked up by traders on the Reddit (NASDAQ:RDDT) social media platform led by Keith Gill, better known as Roaring Kitty, who banded together to force a “gamma squeeze” on the stock.

GameStop stock ended up rocketing 2,500% higher. Although Burry did not stay in for the long haul, he profited by some $250 million off his $14 million investment.

Today, Burry runs Scion Asset Management that has $52.5 million in assets under management. It holds just nine stocks in its portfolio, but almost half (49%) is in just the three stocks listed below.

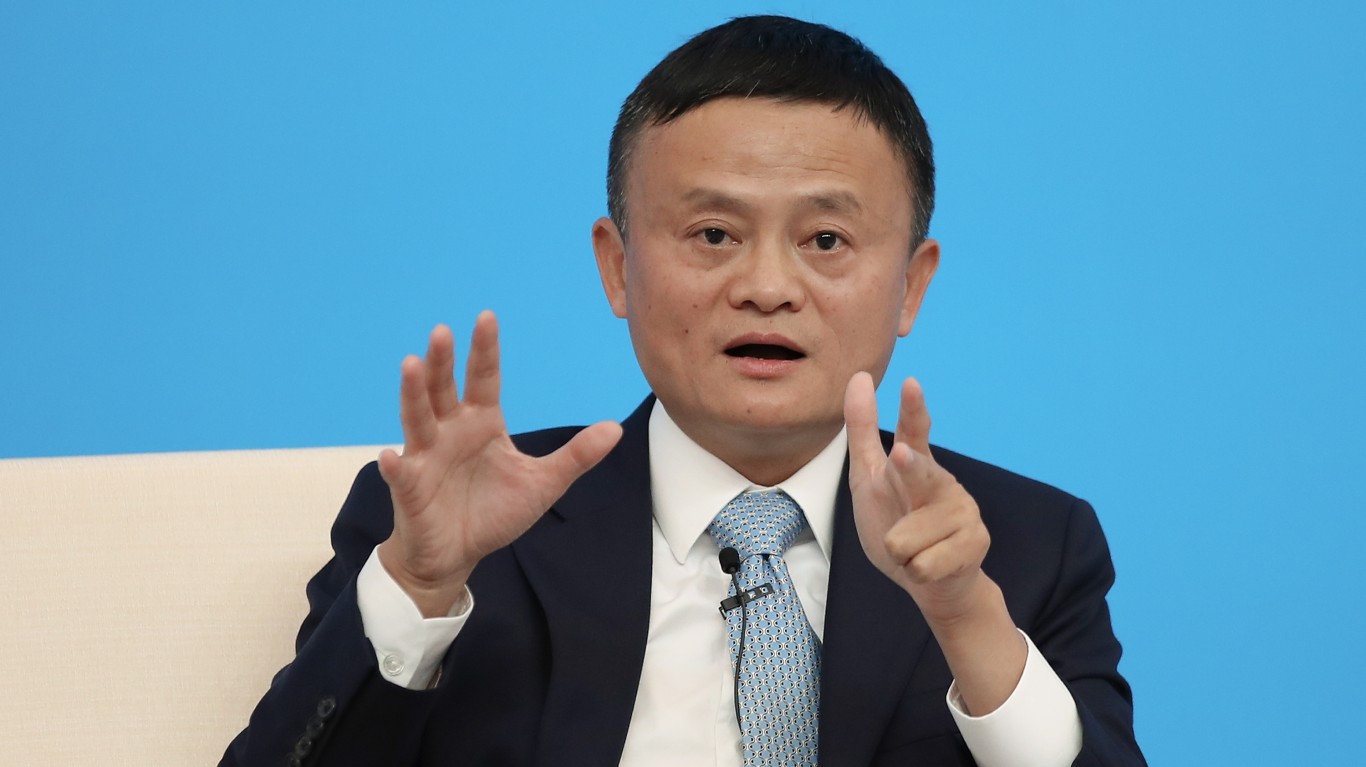

The largest holding in the hedge fund’s portfolio is Chinese e-commerce giant Alibaba (NYSE:BABA). Burry owns 155,000 shares valued at $11.2 million, which represents a 21% share of the total.

Burry began buying the stock late last year and has been steadily accumulating more shares each quarter. In the second quarter, he bought an additional 30,000 shares and has an average buy-in price of around $79 a stub. That’s about a 7% gain so far.

The stock is up 10% year-to-date though it is down 2.5% over the past 12 months. After undergoing intense regulatory scrutiny by Beijing several years ago that saw it fined $2.1 billion for monopolistic practices, the e-commerce leader recently completed a three-year “recertification process” that brought it back into regulatory compliance.

Alibaba has faced an intense competitive environment. Not only does it square off against JD.com (NASDAQ:JD), but upstarts such as Schein and PDD Holdings (NYSE:PDD) Temu have eaten into its market share. Growth is starting to return, but it will be slower going from here.

Burry just acquired his first tranche of shares in fintech stock Shift4 Payments (NASDAQ:FOUR), buying 100,000 shares for $7.3 million, making it his second-largest holding at 14% of the total. With an average buy-in price of less than $70 a share, Burry is already sitting on a 19% gain.

Shift4 is a payments processing company that initially focused on the restaurant industry, but diversified its business so that hotels and resorts now account for one-third of the volume it processes. It has over 200,000 customers across the hospitality, leisure, restaurant, and retail industries.

FOUR stock is up 55% over the past year as volume and revenue has grown. Volume rose 50% in the second quarter to $40.1 billion leading to a 30% jump in revenue to $827 million. Profits grew 48% to $54 million resulting in adjusted EBITDA rising by a similar percentage.

Despite having nearly doubled from recent lows, Shift4 Payments is not overvalued. The stock goes for 17 times earnings estimates, less than twice sales, and 19x the free cash flow it produces. With Wall Street forecasting long-term earnings growth for the payments processor growing at an annual rate of 49%, there seems plenty of capital appreciation still in the cards.

The third-largest holding in Burry’s portfolio at just under 14% is Molina Healthcare (NYSE:MOH). It’s another new position for the billionaire investor who picked up 24,500 shares worth $7.3 million. He has an average buy price of $354 per share.

While MOH stock is essentially flat so far in 2024, the stock has jumped 26% off the lows it hit in July. Molina’s second-quarter earnings showed robust gains in revenue as premiums soared during the period helping to lift profits ahead of expectations. The health insurer saw its membership rolls grow across each of its business lines, but there are concerns about declining Medicaid enrollment.

Rival insurer Centene (NYSE:CNC) told a Wells Fargo (NYSE:WFC) conference it was experiencing lower Medicaid enrollments due to eligibility questions, and it sent shares of most insurers tumbling. The Wall Street Journal reports some 20 million people have been disenrolled from Medicaid over the past year, leaving insurers with higher-cost members, which is hitting profits.

Molina also reported higher Medicaid costs in the second quarter, but it expects that to be offset in the back half of the year. MOH stock has since regained all the lost ground after Centene’s statement. Shares trade at just 13 times estimates and a fraction of its sales, indicating plenty of upside is still available.

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.