Rummaging through the portfolios of billionaire investors can be a useful strategy for finding investment ideas. With a universe of thousands of stocks to choose from, narrowing down the list to a more manageable number by seeing where the so-called smart money is putting their cash can help direct your own investments.

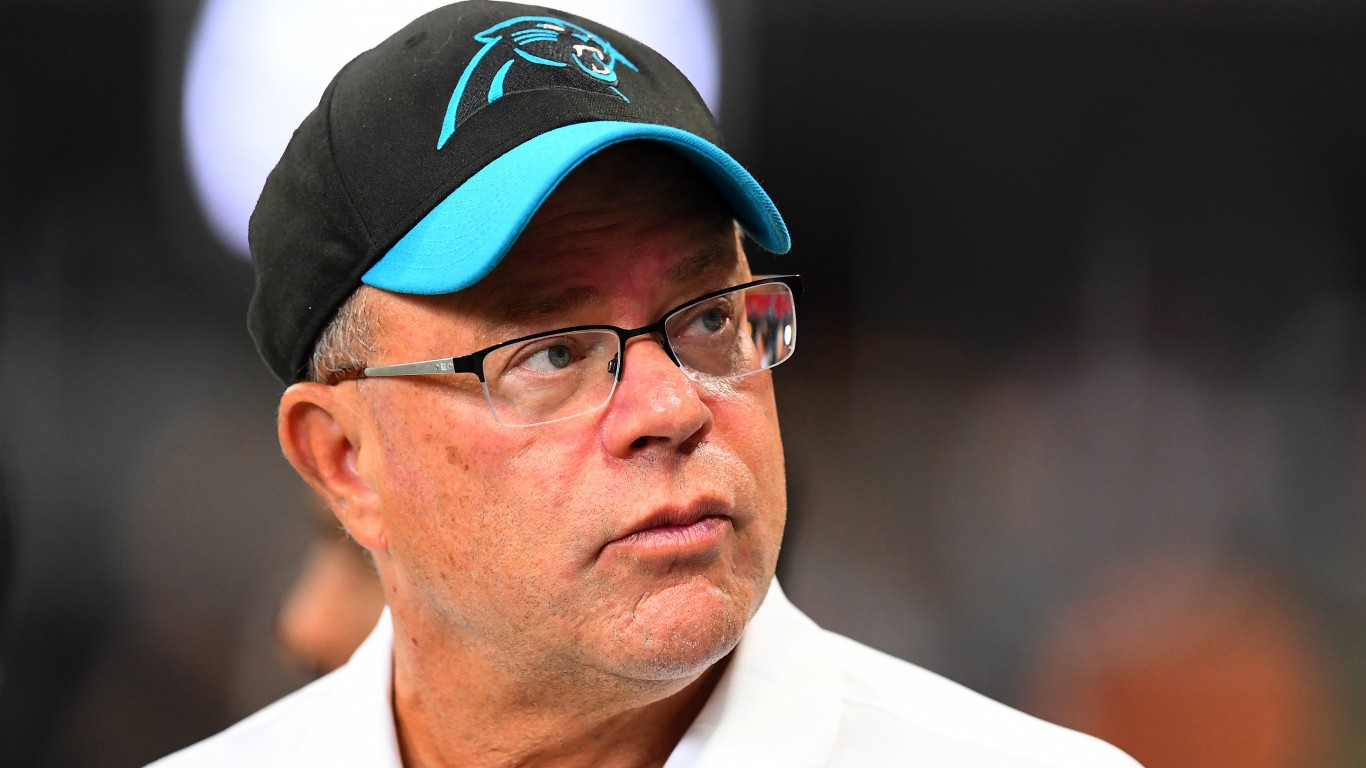

The portfolio of David Tepper’s Appaloosa Management is an excellent place to start. Founded in 1993, the hedge fund operator has enjoyed annualized returns of around 25%. That’s a rarity on Wall Street.

Yet unlike many money managers, Tepper doesn’t have a particular style. He’s not strictly a value investor, growth investor, or someone who follows the momentum crowd. His style is far more eclectic.

Beyond just buying stocks, Tepper also buys distressed debt, buying high-yield bonds, bank loans to very leveraged companies, and more. These are strategies typically not available to the average investor and also not very visible either since they are not reported on the fund’s 13F filings with the Securities & Exchange Commission.

So while a lot of Tepper’s returns result from these esoteric investments, his equity positions are still instructive. He owns about three dozen companies, but the top four positions below account for 40% of the total.

Key Points About This Article:

- David Tepper has proved to be a skilled, but rare money manager who has generated annualized returns of 25% since Appaloosa Management was founded 31 years ago.

- The hedge fund operator doesn’t neatly fit into a value or growth category, but is opportunistic in his investments, including the four largest positions in his portfolio.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Alibaba (BABA)

Leading Chinese e-commerce platform Alibaba (NYSE:BABA) has diversified its operations over the years and now has its fingers in numerous pies, including cloud computing and digital media. Over the past few years, Alibaba became the focus of intense regulatory scrutiny as Beijing grew leery of founder Jack Ma’s growing economic power.

Following Ma criticizing regulators for thwarting innovation, the e-commerce giant was subjected to investigations that accused it of employing monopolistic practices. Alibaba’s stock suffered in the aftermath. Over the past three years, BABA stock has lost nearly half its value.

That cloud was recently lifted. Beijing recently announced Alibaba has ceased its monopolistic ways and it coincides with calls for greater economic support by the government for private businesses. BABA stock is up 3% since the announcement.

Alibaba is Tepper’s biggest holding, accounting for 12.2% of Appaloosa’s portfolio. He owns 10.5 million shares valued at $756 million. Although he pared his position slightly in the second quarter, the number of shares owned is two-and-a-half times greater than where it was at the end of 2023.

Amazon (AMZN)

It seems clear Tepper likes the e-commerce space and the sprawling operations the industry giants have developed as his second-largest position is Amazon (NASDAQ:AMZN). Yet the U.S. e-commerce leader blazed the path others follow as its Amazon Web Services is the premier cloud services business and has become the backbone of commercial online presence.

AWS has long been Amazon’s profit center and continues in that role. It is also serving as the online retailer’s growth engine, with segment revenue rising 19% year-over-year to $26.3 billion. AWS’s operating profits surged 72% from last year, hitting $9.3 billion or 64% of the total.

Amazon represents 10.9% of Appaloosa’s portfolio, meaning Tepper has nearly a quarter of his fund’s $6.2 billion in assets under management in the world’s two biggest e-commerce and cloud service operations. He owns 3.5 million shares of AMZN stock worth $671.5 million. Although that’s down slightly from his recent peak of almost 4 million shares in last year’s third quarter, it remains a sizable holding.

Microsoft (MSFT)

Tech giant Microsoft (NASDAQ:MSFT) is Tepper’s third largest position. It shows his affinity for artificial intelligence stocks, which is likely also partially the reason for holding such large tranches in Alibaba and Amazon. Microsoft has quickly become an AI, adopting the technology early on and integrating it throughout its products and suite of services. In particular, its Azure cloud platform, Office 365, and Dynamics 365 will continue benefiting from AI’s adoption.

Azure, for example, saw revenue jump 30% in the second quarter, six percentage points of which was directly connected to AI’s contribution.

Tepper owns almost 1.2 million shares of MSFT valued at $528 million or 8.6% of Appaloosa’s total. It is another stock he’s been taking profits on, reducing his holdings from 1.7 million shares in 2023’s fourth quarter. Since the beginning of 2023, though, Microsoft stock has gained 80%.

Meta Platforms (META)

Technology is also a favored theme for Tepper as Meta Platforms (NASDAQ:META) is his fourth biggest position. He owns 935,000 shares valued at $471.5 million, making for a 7.6% position in the portfolio.

Yet here Tepper has reduced his stake by more than half, having owned 2 million shares just one year ago. Smart move or selling too early? Since the end of the second quarter last year, META stock has risen 86%, suggesting Tepper left a lot of money on the table by dumping his shares.

As the social media platform nearly tripled in value from late 2022 to when the hedge fund operator began selling, it looks like he was buying all the way up and maybe felt it had come too far, too fast. Yet with a massive and still growing user base across its platforms, and the ability to leverage them to rapidly increase digital advertising on them, Meta Platforms looks like it has much more growth in the cards.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.