Investing

Eli Lilly (LLY) Stock Price Prediction and Forecast 2025-2030

Published:

Last Updated:

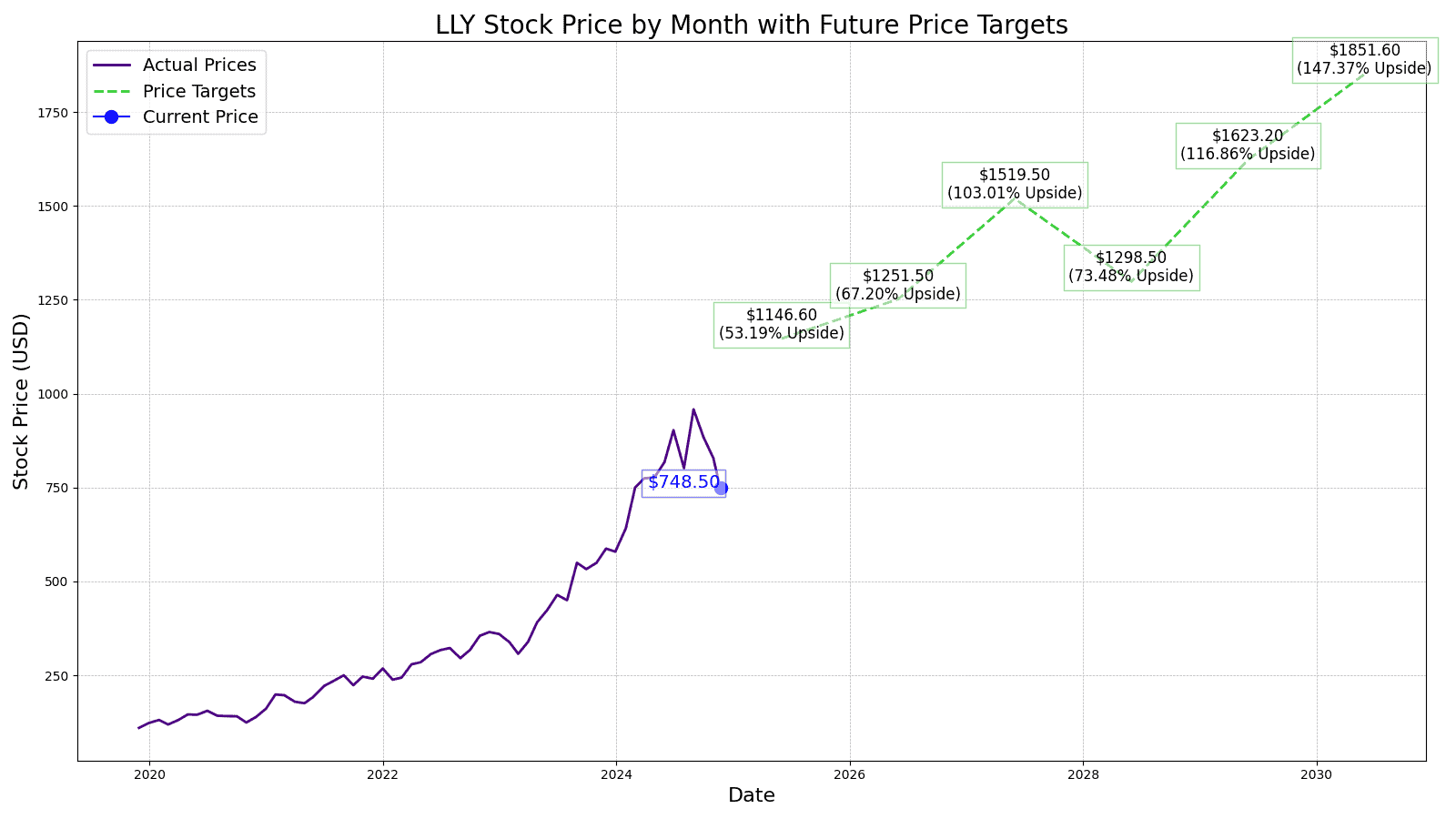

Since the start of 2020, Eli Lilly’s (NYSE: LLY) stock price chart has been straight up and to the right, up 466.14% and currently trading at $748.50.

The company has been around since 1876 and the stock didn’t go public until 1952 but in the last 4 years, Eli Lilly went from a $100 billion market capitalization to $740 billion today, which also makes it a potential stock split stock.

However, as investors, we care about the stock price years down the line and what Eli Lilly will do in the next 3 to 5 years and beyond.

That is why 24/7 Wall Street looks at projected revenue and net income to give you our best estimate of future stock prices from 2025 to 2030.

Other “experts” look at past growth rates and assign future stock prices to those past numbers. However, we will walk you through our assumptions and give you the key drivers we see propelling Eli Lilly’s stock in the future.

11/22/2024

The FDA is still evaluating the supply situation for Eli Lilly’s weight-loss drug, tirzepatide. They are reassessing their previous decision to remove it from the drug shortage list. Until the FDA makes a final decision, compounders of tirzepatide will not face regulatory action.

11/21/2024

Eli Lilly recently announced a new partnership with Laekna Therapeutics, a Hong Kong-based biotech firm. The partnership will work on advancing the development of LAE102, an antibody targeting the ActRIIA receptor, primarily aimed at treating obsesity.

11/20/2024

Eli Lilly and Verge Genomics have made great strides in their joint venture to combat amyotrophic lateral sclerosis (ALS). Leveraging Verge’s AI-powered CONVERGE platform, the partnership has successfully identified two promising drug targets for the debilitating neurodegenerative disease.

11/19/2024

The Canadian Drug Agency (CDA) has announced its final recommendation for Ebglyss. The CDA-AMC has determined that Ebglyss should not be covered by public drug plans (except in Quebec) for the treatment of moderate-to-severe atopic dermatitis in adults and adolescents aged 12 and older. Eli Lilly, however, is unhappy with this decision, with representatives asserting the company will continue to fight for both public and private reimbursement in Canada.

11/18/2024

Eli Lilly’s experimental drug, muvalaplin, has demonstrated potential in reducing a specific type of cholesterol. Data presented at the American Heart Association meeting in Chicago revealed that the highest dose of the drug led to a 70% reduction in lipoprotein(a) (or Lp(a)) levels measured by a traditional blood test. A more specific test developed by Eli Lilly further showed an even more impressive reduction of nearly 86%.

11/15/2024

Eli Lilly is taking legal action against the Department of Health and Human Services. The lawsuit seeks a court order that will let the company reduce the discounts they give to hospitals for their drugs.

11/14/2024

Eli Lilly’s weight-loss drug, tirzepatide, has shown promising results in preventing diabetes. After three years of weekly injections, nearly 99% of patients remained diabetes-free. This suggests that for every nine patients treated with tirzepatide, one new case of diabetes could be prevented.

11/12/2024

Eli Lilly’s CEO, Dave Ricks, has been named the recipient of the 2024 August M. Watanabe Life Sciences Champion of the Year Award by BioCrossroads. Under Ricks’ leadership, the company has invested billions of dollars in research and development to address critical health challenges, particularly in areas like oncology, obesity, immunology, and neurodegenerative diseases.

11/11/2024

Susan McGowan, a 58-year-old nurse from Scotland, tragically passed away after taking two doses of tirzepatide, a weight-loss drug manufactured by Eli Lilly. McGowan experienced multiple organ failure, pancreatitis, and septic shock a few days after taking the medication. This is believed to be the first such death in the U.K. officially linked to the medication.

11/8/2024

There is a strong bullish sentiment surrounding Eli Lilly, as seen by the increase in call option trading volume. This surge, particularly in the 820 and 830 strike calls expiring today, suggests that traders are anticipating a potential upside in the stock price.

How did Eli Lilly’s stock price soar so much in the past few years? Let’s take a look at the numbers:

| Share Price | Revenues* | Net Income* | |

| 2016 | $80.36 | $21.22 | $2.74 |

| 2017 | $77.55 | $19.94 | ($0.21) |

| 2018 | $122.13 | $21.49 | $3.23 |

| 2019 | $140.83 | $22.32 | $8.32 |

| 2020 | $206.46 | $24.54 | $6.19 |

| 2021 | $238.31 | $28.32 | $5.58 |

| 2022 | 329.07 | $28.54 | $6.25 |

| 2023 | $745.91 | $34.12 | $5.24 |

*Revenue and Net Income in Billions

Since 2016, Eli Lilly’s revenue grew by 60% but income grew by 91%. Typically you wouldn’t expect a company growing at its top line by 7% annually to see an 828% increase in share price, however, investor sentiment for the next line of drugs front ran the stock price.

For example, in 2016 Eli Lilly was trading 13 times the trailing 12 months earnings and the market has increased its valuation each year and currently trades at a 125 times earnings multiple.

This raises the valid question, is Eli Lilly overvalued or will future revenues make up for the expensive valuation?

The current Wall Street consensus 1-year price target of Eli Lilly stock is $1030.00, which is 37.61% higher than today’s price of $748.50. Of the 26 analysts covering Eli Lilly stock, the current rating is 1.67 or “Outperform” with 1-year price targets as high as $1,100 and as low as $540.00.

24/7 Wall Street sets its 1-year price target at $1,040. Taking a look at the sum of its parts, we see Eli Lilly’s vertices valued as follows:

| Endocrinology | $735/ share |

| Oncology | $122/ Share |

| Cardiovascular | $4/ Share |

| Neuroscience | $16/ Share |

| Immunology | $38/ Share |

| Others and Pipeline | $110/ Share |

| Cash | $17/ Share |

Valuing Eli Lilly’s stock price for the coming years, we will take a look at expected revenue and net income and give our best estimate of the market value of the company by assigning a price-to-earnings multiple.

| Revenue | Net Income | EPS | |

| 2025 | $52.8 | $17.29 | 19.11 |

| 2026 | $62.5 | $22.49 | 25.03 |

| 2027 | $70.87 | $27.12 | 30.39 |

| 2028 | $80.68 | $32.2 | 25.97 |

| 2029 | $87.99 | $36.45 | 40.58 |

| 2030 | $96.67 | $41.12 | 46.29 |

*Revenue and net income reported in billions

We expect Eli Lilly’s P/E ratio in 2025 to be 60 with an EPS of $19.11, resulting in a price target of $1140.00 This prediction is based on strong revenue growth of 18.37% to $52.80 billion and net income expansion to $17.29 billion, continuing the upward trajectory from previous years.

For 2026, we anticipate a P/E ratio of 50 with an EPS of $25.03, leading to a price target of $1250.00. This reflects significant revenue growth of 18.37% to $62.50 billion and an increase in net income to $22.49 billion, driving higher earnings per share.

Heading into 2027, we project the P/E ratio to remain at 50, with EPS increasing to $30.39. This results in a price target of $1520.00. Continued revenue growth of 13.39% to $70.87 billion and net income expansion to $27.12 billion justifies this substantial increase in stock price.

With an EPS of $25.97 and a P/E ratio of 50 in 2028, we forecast the stock price to be $1300.00. A slight dip in EPS growth is expected, but sustained strong performance in net income to $32.20 billion and revenue growth of 13.84% to $80.68 billion keeps the stock highly valued.

By 2029, we estimate Eli Lilly’s EPS to rise to $40.58, with the P/E ratio adjusting to 40. This gives us a price target of $1623.00. The continuous revenue growth of 9.06% to $87.99 billion and net income expansion to $36.45 billion supports this higher valuation.

Price Target: $1850.00

Upside: 145.55%

By 2030, we estimate Eli Lilly’s EPS to rise to $46.29, with the P/E ratio adjusting to 40. This gives us a price target of $1850.00. The continuous revenue growth of 9.86% to $96.67 billion and net income expansion to $41.12 billion supports this higher valuation.

| Year | Price Target | % Change From Current Price |

|---|---|---|

| 2025 | $1140.00 | Upside of 52.30% |

| 2026 | $1250.00 | Upside of 67.00% |

| 2027 | $1520.00 | Upside of 103.07% |

| 2028 | $1300.00 | Upside of 73.68% |

| 2029 | $1623.00 | Upside of 116.83% |

| 2030 | $1850.00 | Upside of 147.16% |

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.