Investing

What's Going on With Carl Icahn: A Dive Into Turmoil at Icahn Enterprises

Published:

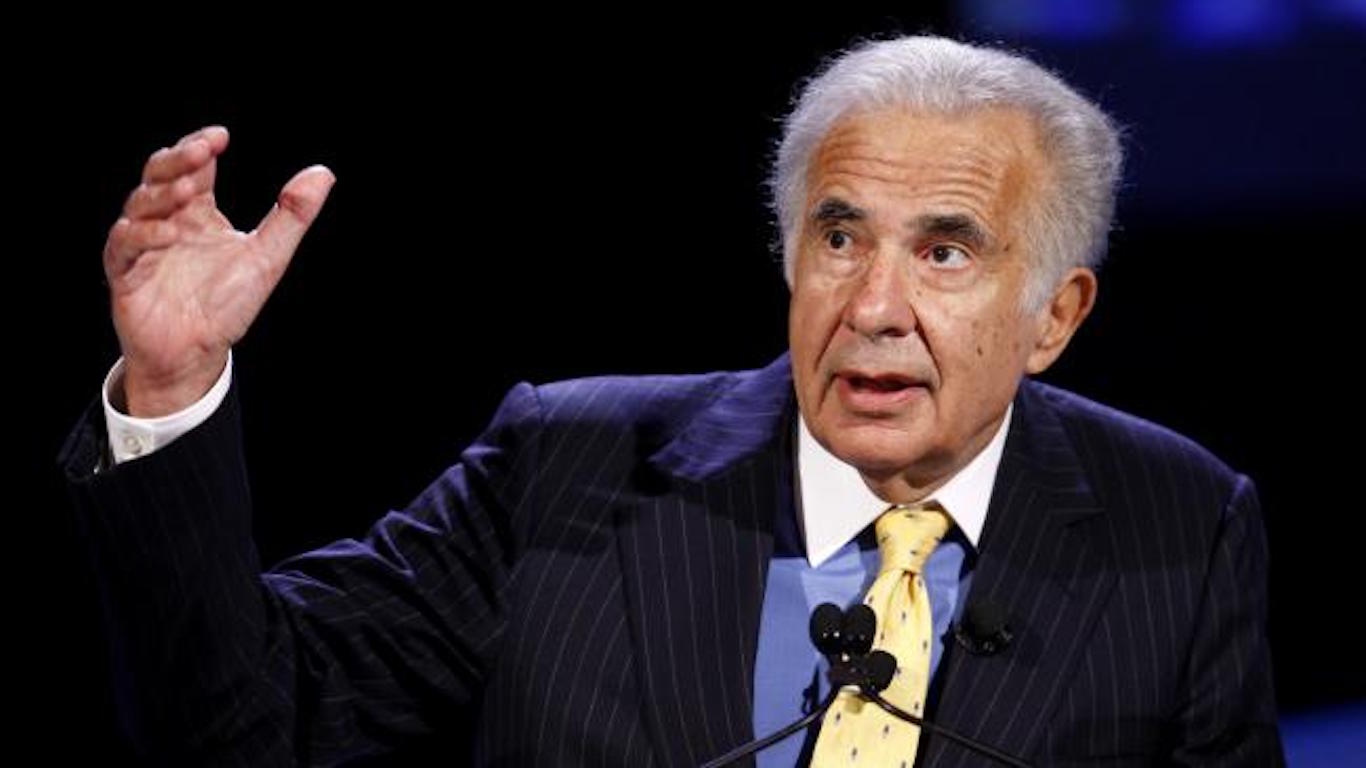

Carl Icahn is among the most influential activist investors in the market. When Icahn steps into a stock, many management teams start shaking in their boots. That’s because this man has quite the track record of inspiring change at many of the largest and most powerful companies in the world – a service many view as a positive thing.

However, the corporate leader who has been responsible for pressuring change at companies like Apple and Netflix is now himself under pressure. His investment firm, Icahn Enterprises (NASDAQ: IEP), has been under fire over the past year, losing more than 50% of its value over that time frame.

Now, Icahn Enterprises’ share price has rebounded somewhat. However, many investors appear to be concerned with the stability of this company, and the potential for Mr. Icahn to be forced to sell shares (he owns more than 80% of the firm) if lenders push for early repayment or call any of his loans against this stock.

Let’s dive more into the specific concerns around Icahn Enterprises, including allegations levied by Hindenburg Research via its recent short report on Icahn Enterprises.

Nearly five months after Hindenburg Research accused Icahn Enterprises (IEP) of overvaluing its assets and using a “Ponzi-like” structure to pay dividends, investors appear to be growing increasingly concerned about recent charges from the SEC over the company’s lack of disclosure for billions in personal loans issued by Carl Icahn that were collateralized by shares of IEP stock. The charges allege that Icahn used 51% to 82% of IEP stock as collateral for margin loans since 2018, but only disclosed these transactions in 2022. And while both Carl Icahn and Icahn Enterprises agreed to pay civil penalties (totaling $2 million) to settle these claims, investors are clearly uncertain as to how IEP stock may perform if a margin call is indeed levied at some point in the future.

That’s partly due to the fact that Hindenburg’s research unveiled that Carl Icahn and his son own approximately 85% of Icahn Enterprises, with institutional investors essentially out of the picture when it comes to pushing for any sort of management changes. This lack of say from market participants may push many investors to seek other close-ended funds that have better governance fundamentals.

Carl Icahn is currently worth around $6 billion, and is among the most prominent billionaires featured in interviews for his takes on how large corporate entities operate, largely due to his status as a top activist investor. That said, the sentiment among many bears appears to be that his firm is more of a corporate raider (a term which used to be used to describe such activities), and that there may be more fire where there’s currently some smoke billowing out from IEP.

Icahn Enterprises focuses on revamping undervalued companies. Known for Icahn’s 2013 Herbalife investment that netted $1.3 billion (mainly as part of his feud with another activist investor Bill Ackman), he’s had some pretty big wins in the past.

However, it’s clear that Icahn’s recent performance hasn’t been as great. As Hindenburg pointed out in its short report, Icahn Enterprises has lost around $9.2 billion over the past nine years, partly due to unsuccessful short-selling and hedging strategies.

Such performance has raised skepticism among investors, many of whom have noted that a straying from the firm’s activist strategies and excessive hedging has hurt returns. Additionally, with Icahn Enterprises filing to sell up to $400 million in units on August 26, some investors appear to be sniffing out additional dilution as a reason to steer clear of this stock.

With a 39% dividend yield at the time of writing (which appears to be totally unsustainable), this is a stock that many investors have reason to be skeptical of.

Icahn Enterprises is a firm that certainly shows some signs of overvaluation, with its dividend being the most obvious signal sent by the market that things aren’t right from a fundamental perspective with this stock. I think the recent rise we’ve seen in IEP stock may be short-lived. And to me, many of the allegations put forward by Hindenburg are worth taking into consideration.

In many cases, where there’s smoke, there is indeed fire. With a high probability this is the case, I’m steering clear of this stock for now.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.