Investing in the S&P 500 Index provides exposure to the 500 largest U.S. companies, and is typically viewed as the safest way to invest. Many experts, from stock pickers like Warren Buffett and a slew of other investing gurus suggest that simply diversifying one’s portfolio by buying the index could be the best way to invest.

However, while many experts like Buffett suggest this may be the way to go for the average investor, that doesn’t stop millions from trying to beat the market. At the end of the day, what makes markets is winners and losers. The key is to invest over a sufficiently long time frame to increase one’s chances of being successful, and not losing so much on any particular bet that one gets knocked out of the game completely.

Thus, for those looking to create a world-class portfolio of individual stocks, doing plenty of research is very important. Here are three top stocks I’ve dug into and believe could continue to hold incredible upside over the next 12 months. Who knows what the long-term will hold. But if market dynamics continue for the foreseeable future, these three companies could be the winners investors may want to own over the near-term.

Key Points About This Article:

- For investors who are looking to place bets on companies that may perform over the relative near-term (by the end of next year), there are thousands of options to choose from.

- These three picks certainly look compelling to me as potential momentum plays in this otherwise choppy market.

- If you’re looking for some stocks with huge potential, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

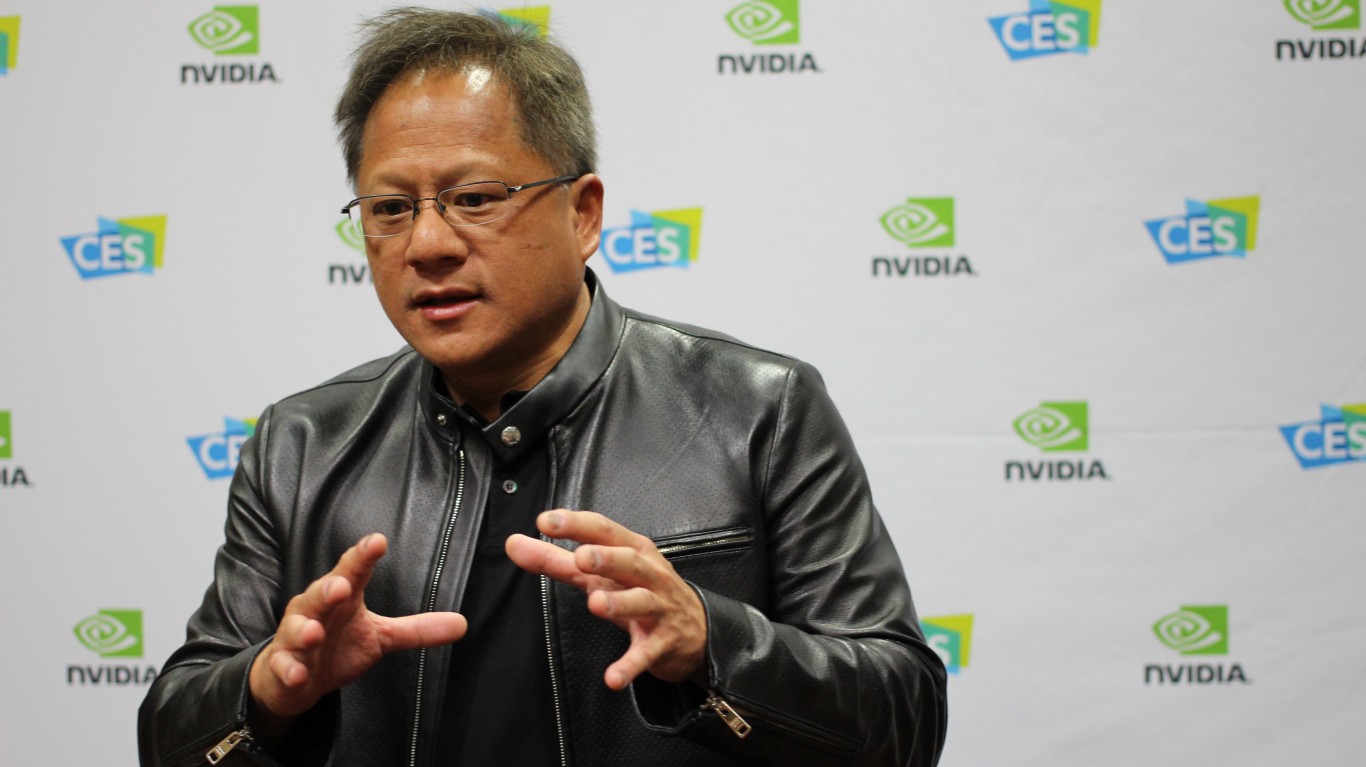

Nvidia (NVDA)

No list of top high-growth stocks that could outperform the market would be complete without discussing the world’s most important chip maker, Nvidia (NASDAQ:NVDA). The company designs GPUs for various markets, including gaming PCs, data centers, and automotive systems. Currently holding more than 90% of the GPU market, Nvidia continues to maintain its impressive competitive edge through decades-long investments in software. The company’s chips power the AI revolution, it’s that simple. This fact alone has led to eye-watering growth for investors who have stuck with this company during its previous high-volatility periods.

I’m not saying that more volatility isn’t on the horizon. In fact, we could be entering a rather choppy period, with various macro indicators suggesting the economy may be weakening faster than the stock market can price in. We’ll see.

But for those looking truly long-term, Nvidia remains a top option I think will continue to outperform over the next year. Unless corporate spending on AI chips slows (which is shows no sign of slowing thus far), this is a company with some of the strongest secular growth catalysts in the world.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) has been on a roll in recent days, surging on news related to OpenAI, a company Microsoft has heavily invested in. OpenAI reportedly is expected to release a reasoning-focused AI product called “Strawberry” within two weeks. Microsoft’s $13 billion investment in OpenAI is certainly among the largest in the mega-cap tech space, and is one of the key reasons why this company has surged in value, becoming the most valuable company in the world on multiple occasions this year.

With plans to integrate AI across its software products, Microsoft stands to disproportionately benefit from these trends. While we’re going to need to see more details on this potential launch, more incredible innovation out of the likes of OpenAI should continue to provide Microsoft with yet another growth engine investors can focus on.

Of course, the company’s core software and cloud businesses continue to outperform. In Microsoft’s most recent earnings, the company reported both revenue and operating income growth of 15% year-over-year. Its earnings per share (EPS) reached $2.95, surpassing analyst expectations and more than doubling in five years. This growth highlighted Microsoft’s increasing profitability, driven largely by improved earnings, as outstanding shares declined only 3% during the same period.

Although the company is not known for dividends, Microsoft offers the highest yield among the “Magnificent Seven” with a modest $0.75 quarterly payout. Regular increases, including a 10% rise in 2023, boosted total returns beyond stock appreciation.

Amazon (AMZN)

The surge in Amazon (NASDAQ:AMZN) stock this year has certainly been welcome by long-term investors. The e-commerce and cloud giant has seen its shares move more than 22% higher in 2024 at the time of writing, as long-term investors continue to pile into this growth-heavy mega-cap name.

Much of this surge in buying activity likely has to do with the company’s strong results. In Q2 2024, Amazon’s revenue grew 10%, adding nearly $50 billion annually. That’s an impressive surge, and equivalent to the market capitalizations of many well-known companies in the market right now. Currently bringing in more than $500 billion in annual sales, Amazon continues to expand rapidly across all its business lines.

On the AI front, there’s also plenty to like when it comes to Amazon. A recent announcement that Amazon-backed Anthropic launched Claude Enterprise is certainly worth noting. This is Anthropic’s most significant product release since its chatbot debut, aimed at capitalizing on the longer-term trend of businesses continuing to integrate AI technology into their business models. Anthropic is certainly one start up that investors are increasingly paying attention to, with its global growth strategy starting to pay off.

For investors looking for an AI beneficiary with a rock-solid core business that continues to grow in a consistent fashion, Amazon remains a great long-term pick.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.