Investing

2 Stocks Ray Dalio's Bridgewater Associates Has Been Buying Hand Over Fist

Published:

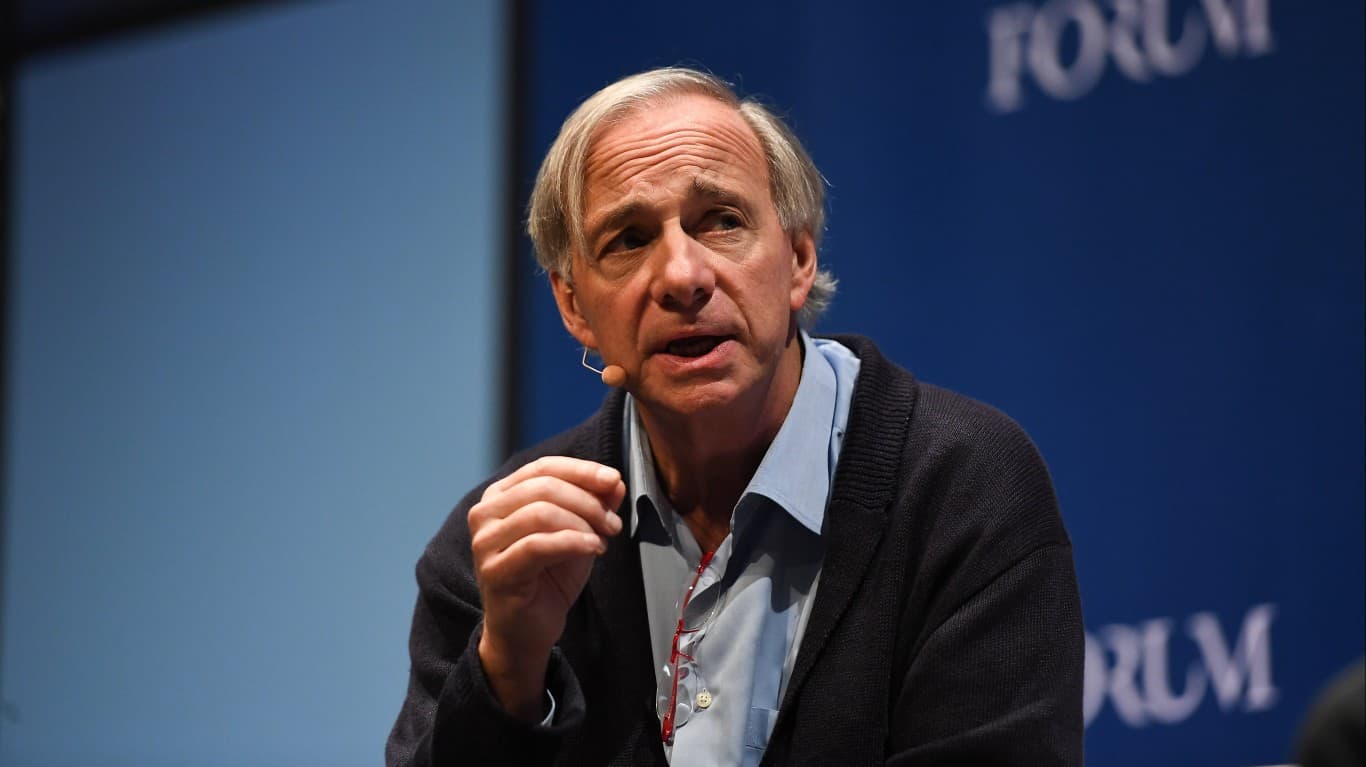

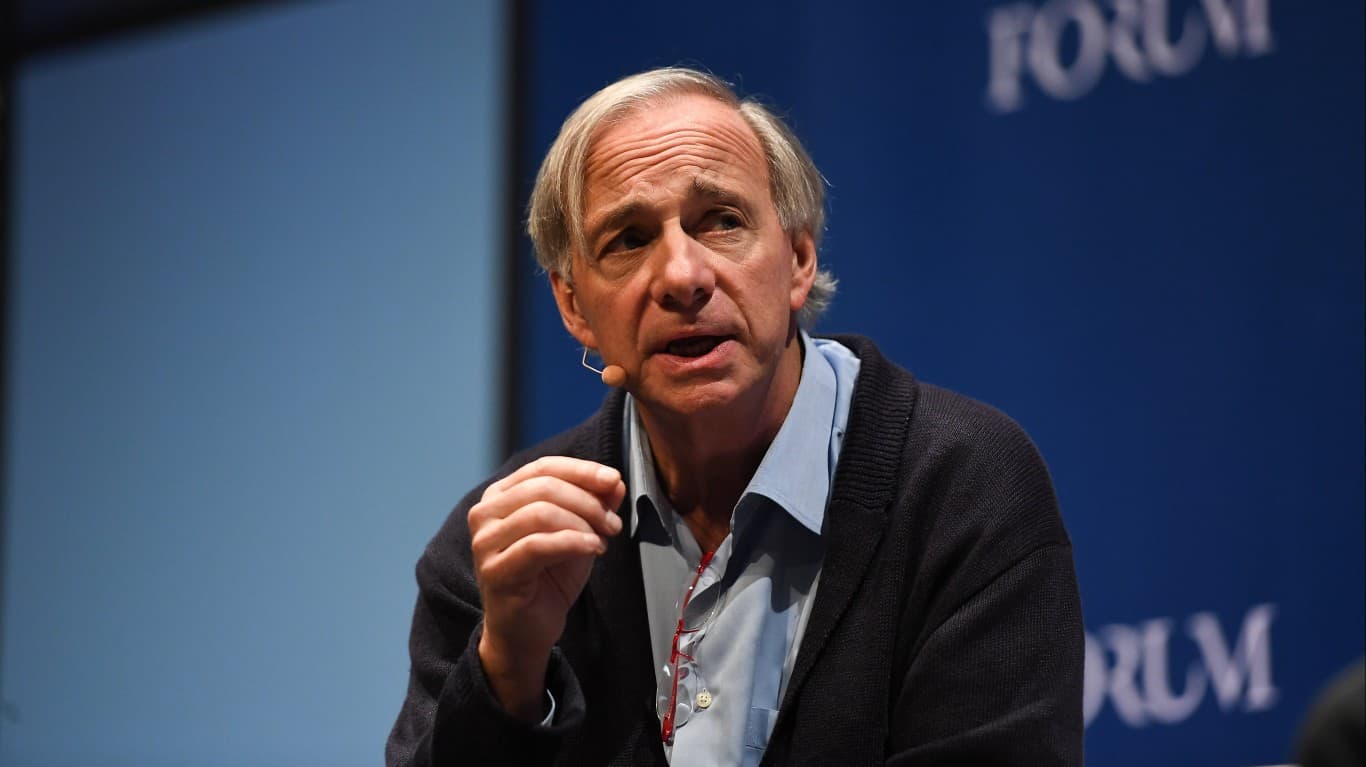

Since Bridgewater Associates founding in 1975, Ray Dalio has grown the investment firm into the world’s largest hedge fund with over $124 billion in assets under management (AUM). With nearly 900 stocks in his portfolio, Dalio has a finger in a lot of pies.

His investment strategy is based on the concept of risk-parity, or diversifying investments across many stocks based on how volatile they are, and he may use leverage to enhance returns. In recent years, though, Bridgewater has lagged the market and saw a withdrawal of money from the fund. Similar funds have also fallen behind with Forbes reporting risk-parity funds have lost to global 60/40 funds — or funds with 60% of their investments in equities and 40% in U.S. treasuries — every year since 2019.

Yet Bridgewater is no longer run by its founder. Dalio stepped back from day-to-day oversight in 2020 and retired in 2022. Yet he has been peering over the current management’s shoulder to ensure it maintains the performance it was noted for. There were rumors he might even return to the hedge fund’s helm last year.

The hedge fund, however, has been keeping pace with the benchmark S&P 500 in 2024 returning more than 14% over the first six months of the year. Dalio’s fund has been pouring a lot of money into a handful of companies lately and the two stocks below represent those that have seen 500% increases in stock bought in the most recent period.

Integrated oil and gas giant Exxon Mobil (NYSE:XOM) has seen the biggest change in shares in the second quarter. Bridgewater Associates went from owning 151,000 at the end of the first quarter to holding over 941,000 shares at the end of the second, a 521% increase.

Exxon’s dominance in the important Permian Basin may be driving the hedge fund’s investment decision. Following the oil stock’s acquisition of Pioneer Natural Resources last year, Exxon surged to the forefront as the biggest player in the space with 1.4 million net acres.

Yet XOM stock has been trading in a fairly narrow band over the past six months, bouncing between $110 per share and $120 per share. Oil prices weakened after OPEC+ nations delayed production and China’s economy continued slowing.

The U.S. benchmark West Texas Intermediate crude oil price fell as low as $65.75 per barrel last week — its lowest price in three years — but has since bounced back to above $71 per barrel.

Because Exxon has not followed its industry peers as deep into the renewables pool, but instead is focusing on its core strength of developing fossil fuels, it can be sensitive to oil’s price. Yet with the Permian one of the most prolific fields in the world, which is how the U.S. became the top oil producer, the long-term demand for oil will see Exxon Mobil keep growing.

Uranium miner Cameco (NYSE:CCJ) is the second-biggest buy of the quarter for Bridgewater Associates. It increased its holdings from 347,000 shares to almost 2.1 million shares, a near 500% jump. The total value of the hedge funds holdings is $101 million. But with an average buy-in price of $44 per share, Bridgewater is sitting on a loss of about 9%. That could very well change.

Although uranium prices have pulled back from their March highs, which had represented a fourfold increase in price since their 12-year low in 2016, uranium is still three times more expensive than it was. The reason is demand for nuclear energy is growing. Over 20 countries have called for tripling nuclear capacity by 2050.

Cameco is one of the world’s largest uranium miners, owning mines in Saskatchewan and the U.S. It also has a 40% stake in a joint venture with Kazatomprom for a mine in Kazakhstan. Its premier supply has annual commitments from 2024 through 2028 that increased in the second quarter to an average of about 29 million pounds per year.

With the U.S. government backing construction of small modular reactors while streamlining licensing requirements, Cameco has a long-term tailwind that should push its stock much higher in the future.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.