Investing

Invest Like Renaissance Technologies Jim Simons With These Two Stocks

Published:

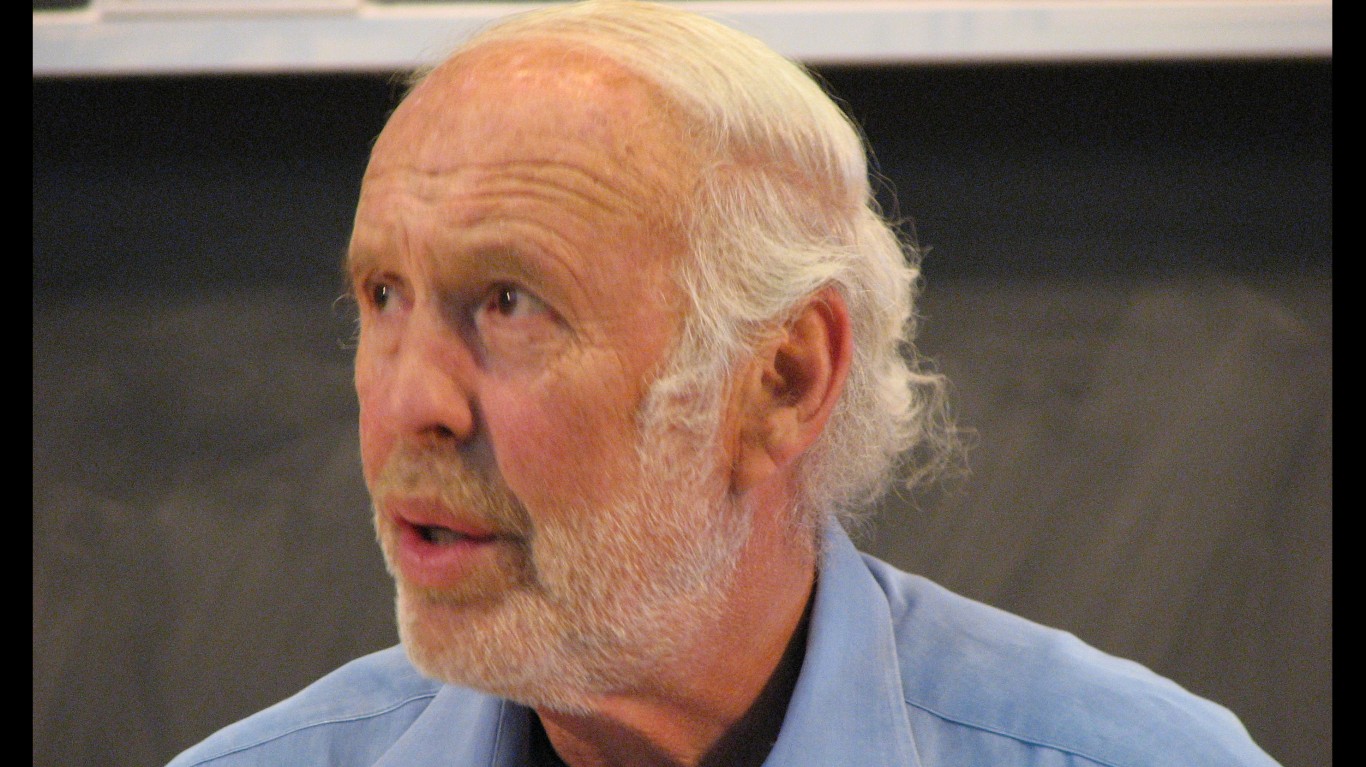

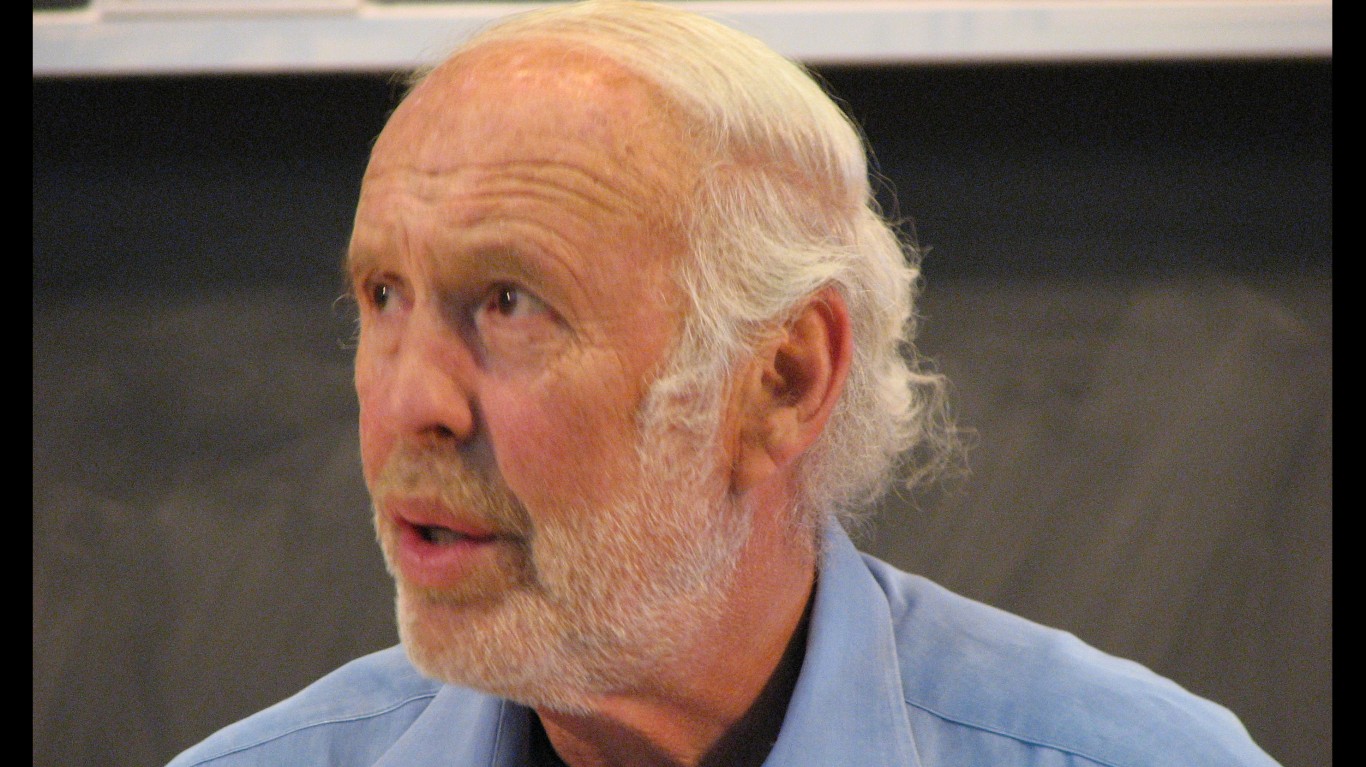

Jim Simons was a mathematician-turned-investor who built Renaissance Technologies into the world’s second-largest hedge fund. Although Simons died earlier this year at age 86, it is still possible to use his legendary investment (and mathematical) skills to build a portfolio that creates substantial wealth.

Over the 30-year period between 1988 when Simons’ flagship Medallion fund was founded and 2018, it produced mind-blowing annualized returns of over 66%. But Simons charged hefty fees for his success.

While he started off as a standard 5-and-20 fund, or one that charged a 5% fixed fee and a 20% performance fee, he upped the latter to 44% in 2002. But even after subtracting out Simons’ cut, Medallion generated returns of 39% annually. That means just $100 invested in the hedge fund in 1988 would have turned into more than $399 million by 2018.

To put that in perspective, Warren Buffett has achieved annual returns of just under 20% at Berkshire Hathaway (NYSE:BRK-A)(NYSE:BRK-B). There is no modern-day investor who comes close to the performance Simons has produced.

Because Simons was secretive about his methods we don’t know what went into his sauce, but we do know where he’s putting his money. By looking at where Renaissance Technologies is placing its bets today we have a head start on stocks we might want to buy.

The two biggest holdings in Renaissance Technologies portfolio are Swedish pharmaceutical giant Novo Nordisk (NYSE:NVO) and Palantir Technologies (NYSE:PLTR), representing 2.2% and 1.7% of the total, respectively (it owns over 3,400 stocks). The following two companies, though, represent the largest percentage increases in holdings, so let’s see whether they are right for us.

The stock with the biggest percentage jump in holdings is tech giant Apple (NASDAQ:AAPL). Renaissance Technologies went from owning about 435,000 shares in the first quarter to owning more than 1.7 million shares at the end of the second, a 316% increase in size.

What’s notable is that the hedge fund had been selling down the stock prior to the second quarter and the current stake is only one-third the size it had been a year ago when 4.9 million shares were owned.

Of course, it was during the second quarter that Apple had a number of big product reveals for the coming year, including the introduction of Apple Intelligence, its artificial intelligence technology. It is also integrating OpenAI‘s latest, most advanced Chat GPT 4o into the iPhone’s iOS 18. Massive sales are expected as the new smartphone hits the shelves on Sept. 20, though a number of AI features won’t be fully available till next month.

The South China Morning Post reported Apple’s biggest manufacturer, Foxconn, hired more than 50,000 workers in anticipation of the launch and raised worker pay, with bonuses offered for certain workers.

Since then, its stock has soared 25% to $288 per share. Simon’s Renaissance Technologies has an average buy-in price of $188, suggesting a near-22% gain on its holdings. And when the fund was selling off its 5 million-share stake last year, AAPL stock was falling. So it seems the hedge fund was able to minimize its losses and capitalize on the gains.

The next stock with the second-biggest boost to its holdings is Coinbase Global (NASDAQ:COIN), the secure online platform for buying, selling, transferring, and storing cryptocurrencies.

I’ll admit to not being a crypto fan. I believe most coins that are bid up have little to no utility and are akin to penny stocks where they are traded on hope, fear, and “feelz.” They are merely used to buy, sell, and pass on to the greater fool. That’s why investors looking to get into crypto should stick with those that have actual, real-world uses like Bitcoin (CRYPTO:BTC), Ethereum (CRYPTO:ETH), and similar coins.

Coinbase, though, is agnostic about the cryptos you buy, including the riskier options on the market. Its site says it supports more than 260 digital assets and 300 different trading pairs. It also offers custody for more than 425 digital assets.

Renaissance Technologies sees the value in a platform that caters to all tastes. It increased its holdings from almost 372,000 shares to over 1 million shares, a 186% increase. But the fund missed out on a lot of Coinbase’s growth. While COIN stock has more than doubled over the past year, shares are down 3% year-to-date and have fallen 37% since the end of the first quarter.

That means Renaissance Technologies $203 per share average buy price suggests a loss of 17%. However, it may agree with investing guru Cathie Wood that Bitcoin could be worth $1.5 million by 2030, a substantial march higher from its current price of $63,500, which ought to also lift COIN stock.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.