Investing

Lean Into These 3 Dividend Stocks for a "Sleep At Night" Retirement

Published:

Since July, markets have been volatile, and this volatility has provided plenty of opportunities for traders and those with a shorter-term investing time horizon to make some money. For longer-term investors, buying the dips on specific “sleep at night” stocks has been a profitable trade, despite various recessionary signals continuing to flow through to the market. Right now, my take is that there are plenty of mixed signals in the market, making right now one of the more uncertain times to invest I’ve seen in some time.

That said, investors looking to build a “sleep at night” retirement portfolio are likely after stocks that can perform well in any environment. No matter what the VIX is doing, how high tech stocks are flying, and what the latest meme trend might be, many investors are after the more stable and consistent returns. Indeed, those entering or nearing retirement can’t afford to lose a tremendous amount of money – stability may be worth paying a premium for certain stocks.

These three dividend stocks have the sort of staying power I think these investors may be after. For those looking for consistent passive income, here’s why I’d consider these three names right now as part of a slow and steady long-term portfolio.

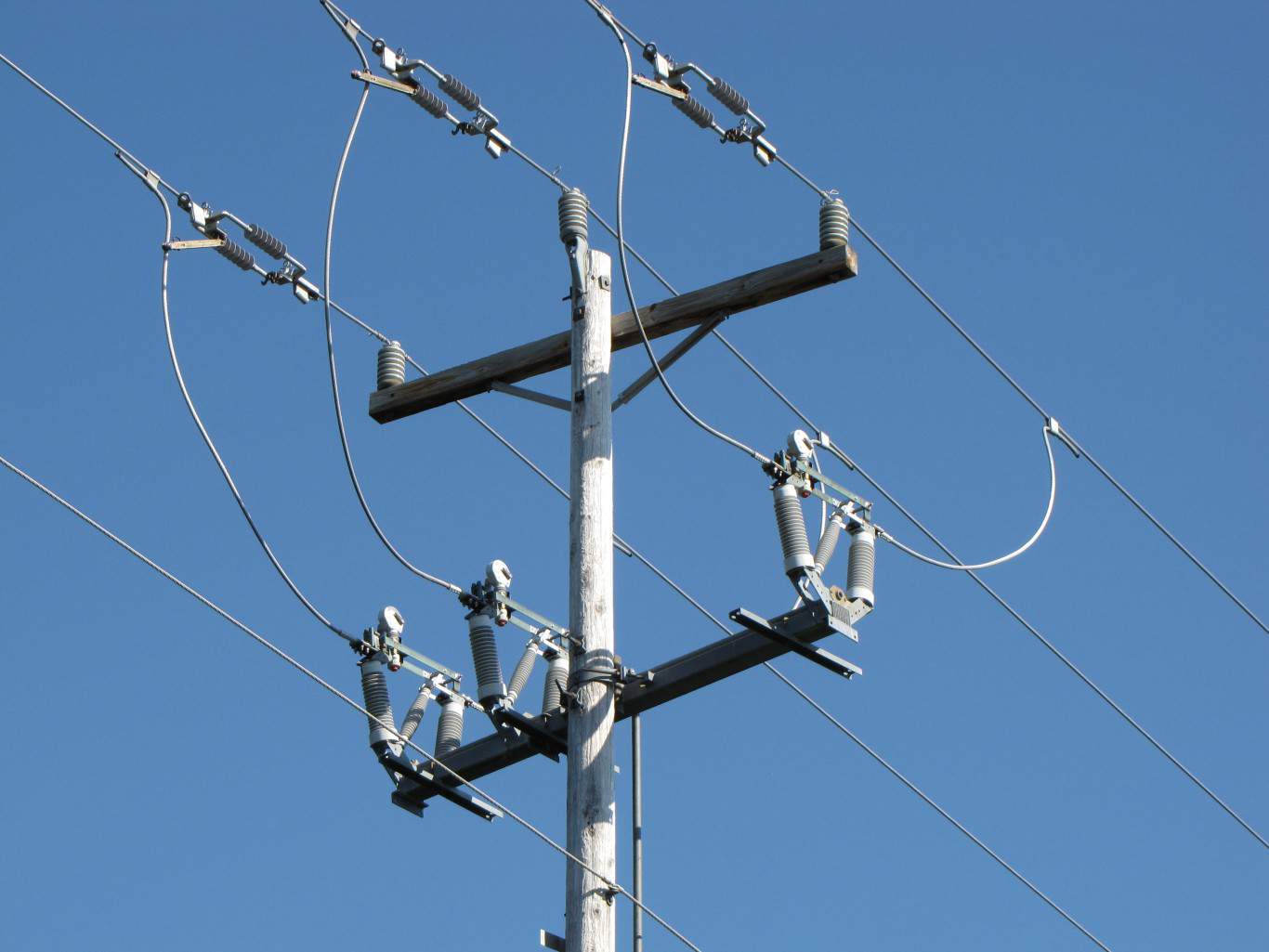

American Tower (NYSE:AMT) is among the top global REITs focused on communications real estate. The company essentially owns the rights to various communications towers, with various telecom providers paying rent to the company in order to latch onto its existing infrastructure around the world.

The company’s status as a top dividend stock is certainly cemented in many institutional investors’ portfolios, for this reason. The company’s business model is about as defensive as they come – until other competitors pop up with the billions necessary to install new infrastructure and gain the right of way to do such massive projects, American Tower is going to be the dominant force in this sector.

Thus, the company’s recent announcement of a quarterly cash distribution of $1.62 per share payable on October 25, 2024 has certainly caught the attention of many investors. This distribution translates into a yield of 2.8% for existing investors. That may not sound like much, but the company has continued to raise its dividend consistently, and looks poised to do so over the long-term.

American Tower’s financial stability is noteworthy, and its rock-solid balance sheet is supported by strong fundamental growth. The company’s adjusted FFO rose 13.5% to $1.3 billion in the second quarter, continuing its growth momentum from Q1. American Tower’s strong cash flow was driven by improved collections in India this past quarter, with the company also reporting 5% organic growth in U.S. and Canadian towers, and robust data center performance. These key growth drivers allowed the company to deliver more than $750 million in dividends to shareholders, all the while reducing the company’s leverage ratio to 4.8-times.

Investors looking for long-term dividend stocks to hold through turbulence may want to consider adding this name. AMT stock isn’t cheap, but it’s one that’s on my watch list now – and I intend to buy it on any significant dips moving forward.

PepsiCo (NASDAQ:PEP) is among the most stable dividend stocks in the market. The company’s iconic beverage brands continue to perform well, with Pepsi’s snack business also seeing outsized growth in recent years. This growth has been driven by impressive pricing power, with Pepsi’s management team able to effectively counter inflationary pressures on input prices by raising prices on the consumer, who appear to be happy to oblige.

While the company’s earnings have flatlined in recent years, the company’s moat around distribution and marketing make this Dividend King worth considering. With more than five consecutive decades of dividend hikes, Pepsi’s 3.2% yield is much more attractive to long-term investors looking to lock in today’s rate.

The company’s recent Q2 results were strong, with Pepsi reporting $22.5 billion in net revenues, up 0.8% year-over-year. Frito-Lay North America saw declines from inflation, and Quaker Foods revenue dropped 18% due to recalls. That said, the company’s Beverages North America segment grew 1%, driven by zero-sugar options. International organic revenue rose 5.5%, boosting gross profit by 3.2% and operating income by 10.6%. With $6.4 billion in cash, PepsiCo expects 4% organic revenue and 8% core EPS growth for FY24. However, the company remains reliant on international growth, and some weakness in key markets (such as China) could be a risk factor to consider over the medium-term.

That said, I still think Pepsi is worth considering at its current levels. Personally, I’d like to buy this stock on the cheap, and I’m waiting patiently for any sort of hiccup to consider adding a psotioin. But with a number of analysts maintaining a bullish stance on this stock, it’s one I think should have plenty of support to rally higher from here over the long-term.

Another REIT to bless this list is Prologis (NYSE:PLD), a global leader in logistics real estate. The company operates more than 5,500 warehouses with 6,700 long-term lease customers. This trust is absolutely massive, with a market capitalization of $117 billion at the time of writing, and has seen increased investor interest as the key player in the world of logistics real estate. Indeed, if our economy is going to transition to a more online/e-commerce based future, Prologis’ locations will become ever more important to the story.

The ability to increase rents, as a result of the company’s core asset portfolio and the locations of its core assets, has been a key driver of its net operating income (NOI). In fact, Prologis’ NOI is expected to grow 7.5% to 8.5% annually over the next few years, driven by surging market demand for its properties which should bleed into higher rents.

Helping the case for these higher rents is the company’s plan to invest nearly $7 billion to develop 46 million square feet of real estate over the next five years. With key expansions of solar projects and data centers (diversifying Prologis’ exposure from mainly warehouse space), the company looks well-positioned to become the REIT of the future.

With a current dividend yield of 3.9%, this is a long-term sleep at night dividend stock I’d consider adding here.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.